How rising interest rates affect the stock market

Posted on: 18th May 2022 in

Investments

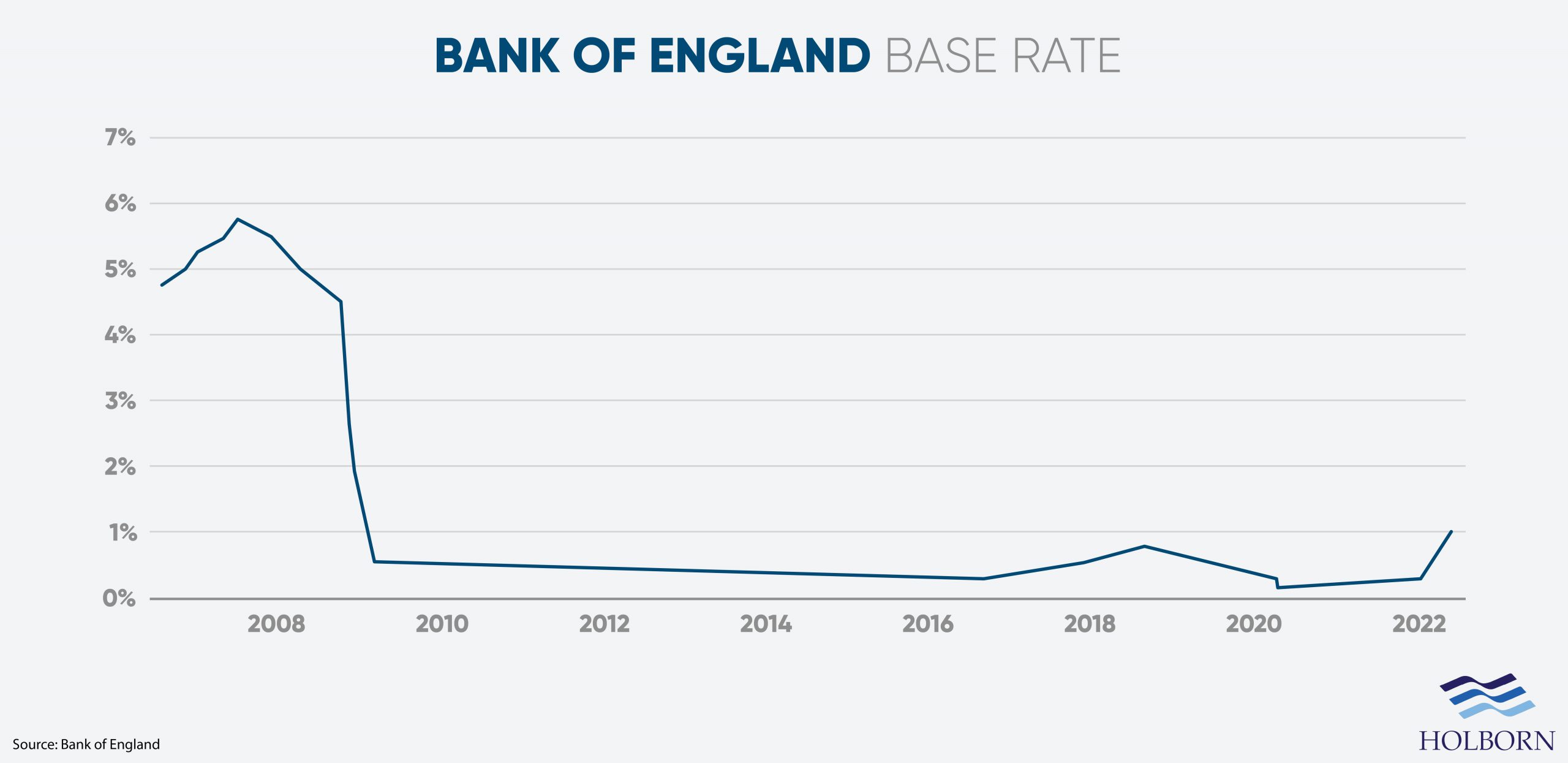

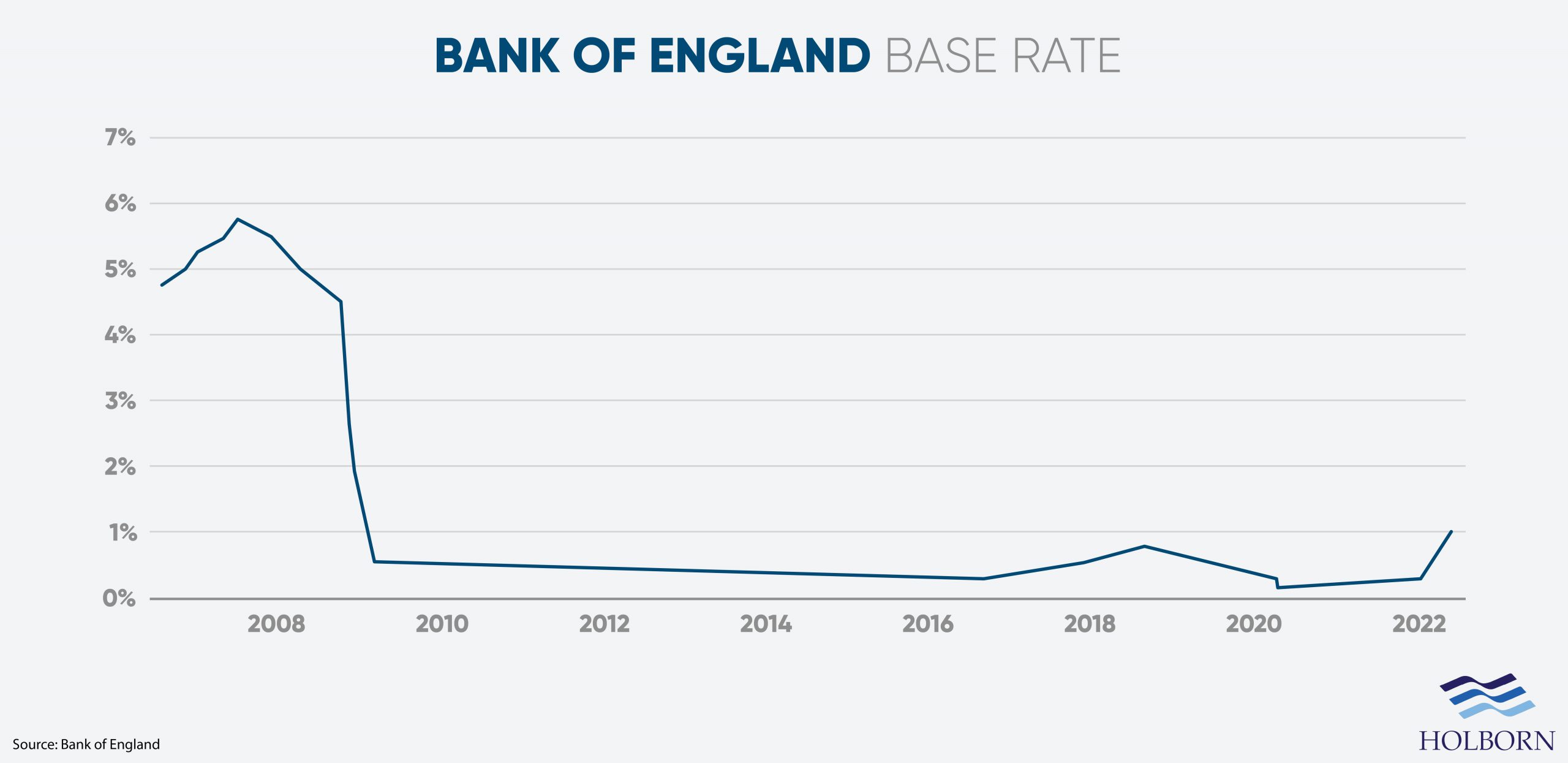

The Bank of England (BoE) recently increased the base rate to 1% in a bid to curb growing inflation.

After four successive rate hikes by the central bank, it is now the highest it has been since early 2009. So, why is the news important?

Anyone who has ever invested will know that stock prices are volatile. A range of factors can positively or negatively affect their value, including interest rate changes.

In this article, we look at how rising interest rates affect the stock market and what it means for your finances.

Understanding the base rate

Interest rates are simply the cost you pay to use someone else’s money.

While commercial banks are free to set their own rates, they often base them on rates set out by central banks.

Central banks like the Bank of England (BoE) are responsible for the monetary policy of their respective countries. Their job is to safeguard and strengthen the economy. In this case, raising the base rate is the BoE’s way of combating growing inflation.

The base rate refers to the interest rate a central bank will pay a commercial bank to hold money or how much they will charge them to borrow money.

Generally speaking, the cost of borrowing goes down when the base rate is low, and getting a loan is often easier. The flip side of this is that you usually get a lower interest rate on your savings.

When the base rate increases, mortgage rates go up, and borrowing becomes more expensive. However, the interest offered on savings accounts should increase.

So, we know how rising interest rates affect borrowing and saving, but how does it impact the stock market?

How do interest rates affect the stock market?

To understand how rising interest rates affect overall market conditions, we need to look at their impact on individual companies. Like the wider economy, businesses are not immune to base rate changes.

As interest rates on credit cards and mortgages increase, people have less money to spend. When spending drops, it can directly impact a company’s profits and revenue.

There is also another aspect to consider. As the borrowing costs increase, it can be harder for businesses to raise the funds needed to achieve the desired growth. Both of these factors can affect the stock price.

Stock prices are based on future performance. In other words, the price you are willing to pay today for money you hope to receive in the future.

If a company is seen as less profitable or scaling back on its growth, predicted future cash flows will decrease. As a result, the value of the company’s stock could fall.

This is bad news for those invested in the company, but it can have a knock-on effect on the broader market.

A drop in stock prices for enough companies, especially the key players, can result in indexes or even the whole market dropping in value.

It’s important to understand that some sectors or industries are less affected by increased rates than others. In fact, some even benefit from rate hikes.

One example is those that focus on lending. This is because mortgage brokers and banks can charge more for lending as rates increase.

For this reason, it’s essential to consider your investment options. Having a diverse portfolio can help spread the risk and balance out some losses if the share price should fall on other investments you hold.

Save or invest?

For some people, an interest rate rise makes investments harder to justify. After all, why would you take risks investing when banks offer attractive rates on savings accounts?

Here’s the issue. In theory, when the BoE increases the base rate, that should be passed on to customers. The reality is, for now at least, most banks seem reluctant to offer rates attractive enough to make saving an obvious choice. Of course, some are better than others.

Data collected by This is Money found that the best fixed-rate account at the time of writing offered a rate of 2.6%. While this is a sign of things improving from a savings perspective, it will not protect your money from inflation.

Inflation currently stands at 7% in the UK, the highest in 30 years. So, you would need an interest rate of 7.1% for your money to grow. This makes a strong argument for considering investments.

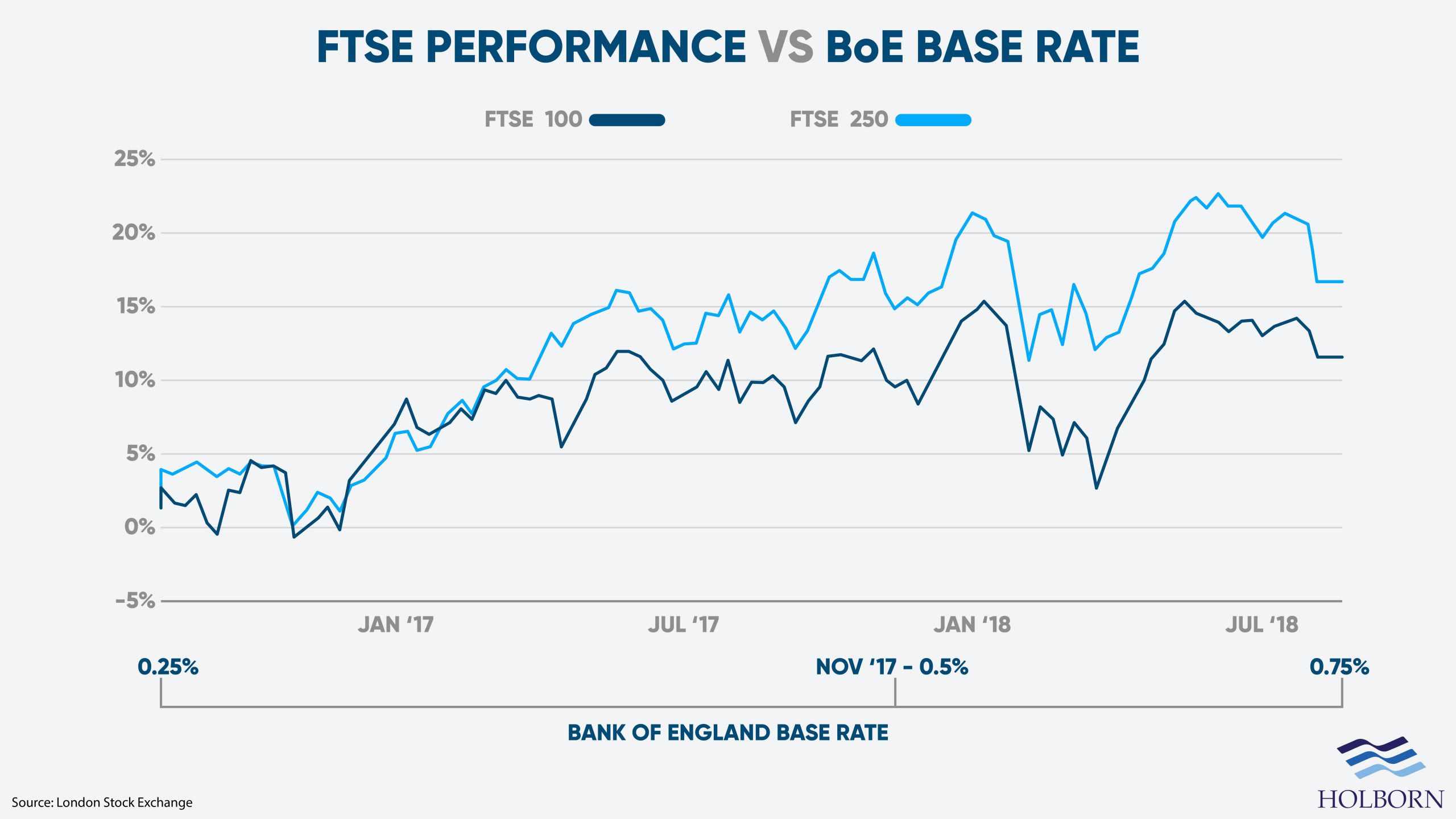

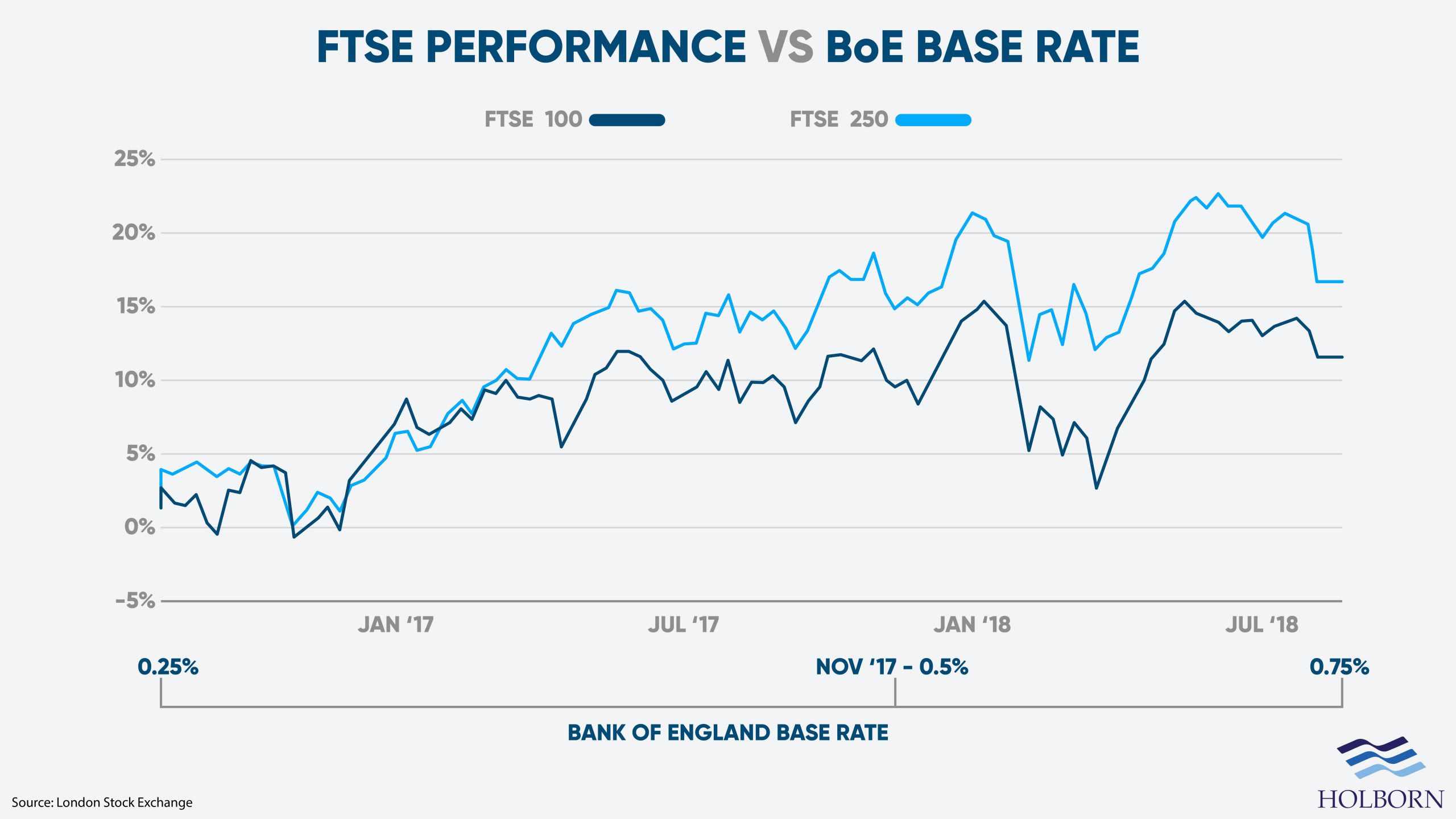

Even when the BoE increased the base rate previously, the market has performed well.

The last time the Bank of England increased the base rate was between August 2016 and August 2018, going from 0.25% to 0.75%. During that same period, both the FTSE 100 and FTSE 250 saw a maximum growth of roughly 14% and 22%, respectively.

We can’t say definitively what the future holds based on past performance. However, it does give us an idea of how the markets have responded when central banks have increased rates before.

The TLDR

Although rising interest rates can cause concern, the stock market has performed well when rates have increased before. Some companies feel the effects of rising rates more than others, highlighting the need to consider your asset allocation.

Remember, you are playing the long game with investments. Any volatility now should iron out in the long term. Time is one of the key ingredients to any successful investment strategy. Of course, there is a lot more to consider, and that’s where we can help.

For more than 20 years, clients have trusted Holborn Assets to manage their finances and build successful investment portfolios to withstand any climate.

With our award-winning customer service and expert financial advice, you can be sure that you are in safe hands.

To find out how we can help you, contact us using the form below.