Protecting your wealth: hedging against inflation

Posted on: 5th August 2021 in

Financial Planning

After 18 months of lockdowns and uncertainty, efforts have now turned to the post-pandemic recovery—specifically the economy.

With the Bank of England base rate still sitting at a record low of 0.1%, things are not looking good for savers in the short term.

So, when it comes to growing or protecting your wealth during tough economic times, is hedging against inflation possible?

In this article, we look at inflation and the strategies you can use to protect your finances.

What is inflation?

Inflation is the term we use to measure the rate at which prices are rising for both goods and services. Essentially, the higher the rate of inflation, the quicker things become more expensive.

For the most part, it’s unlikely that you will notice normal inflation levels in the short term. However, inflation is more noticeable in the long term.

If you have spoken with an older relative, you will no doubt have heard how far a pound went when they were younger.

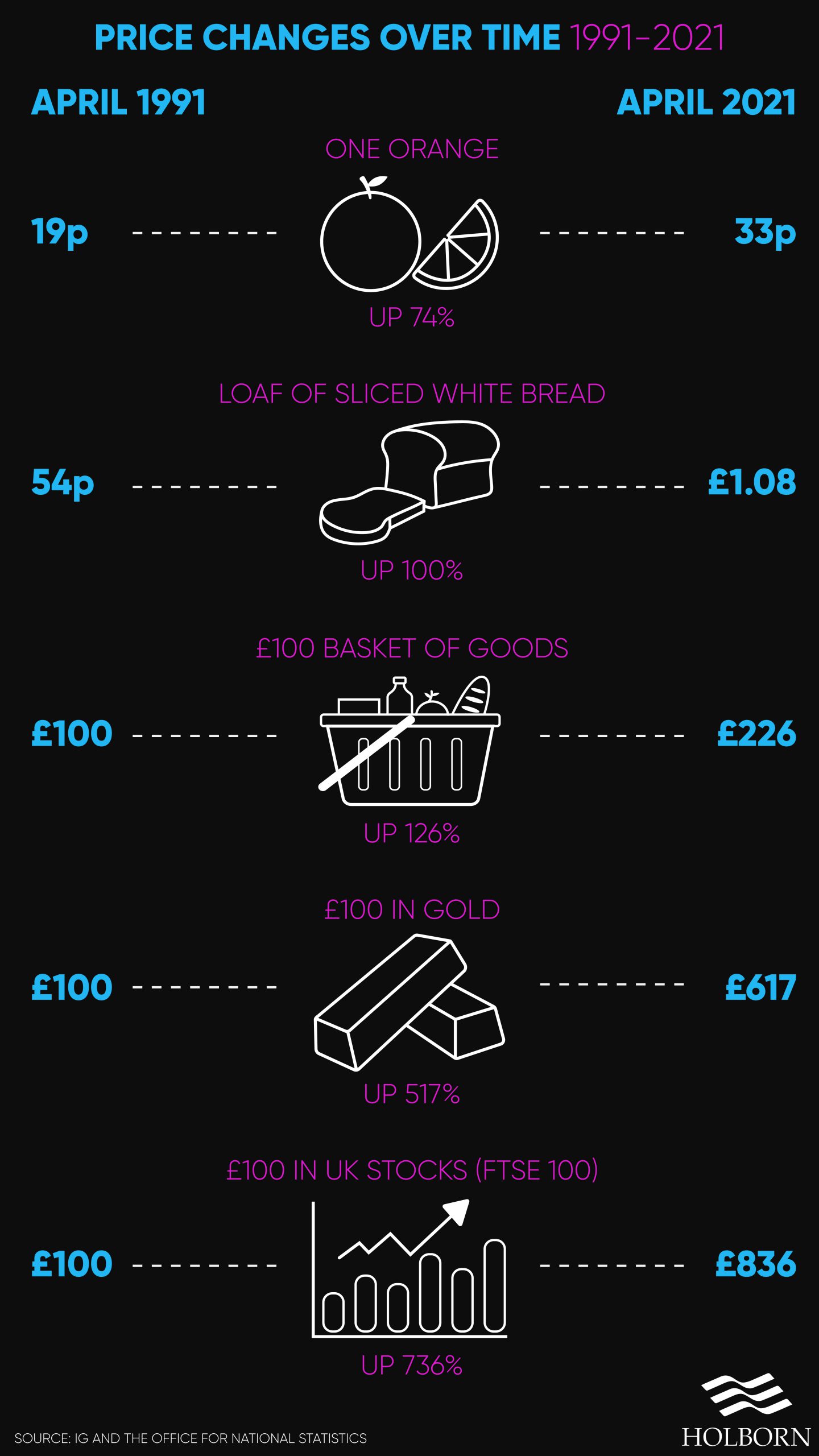

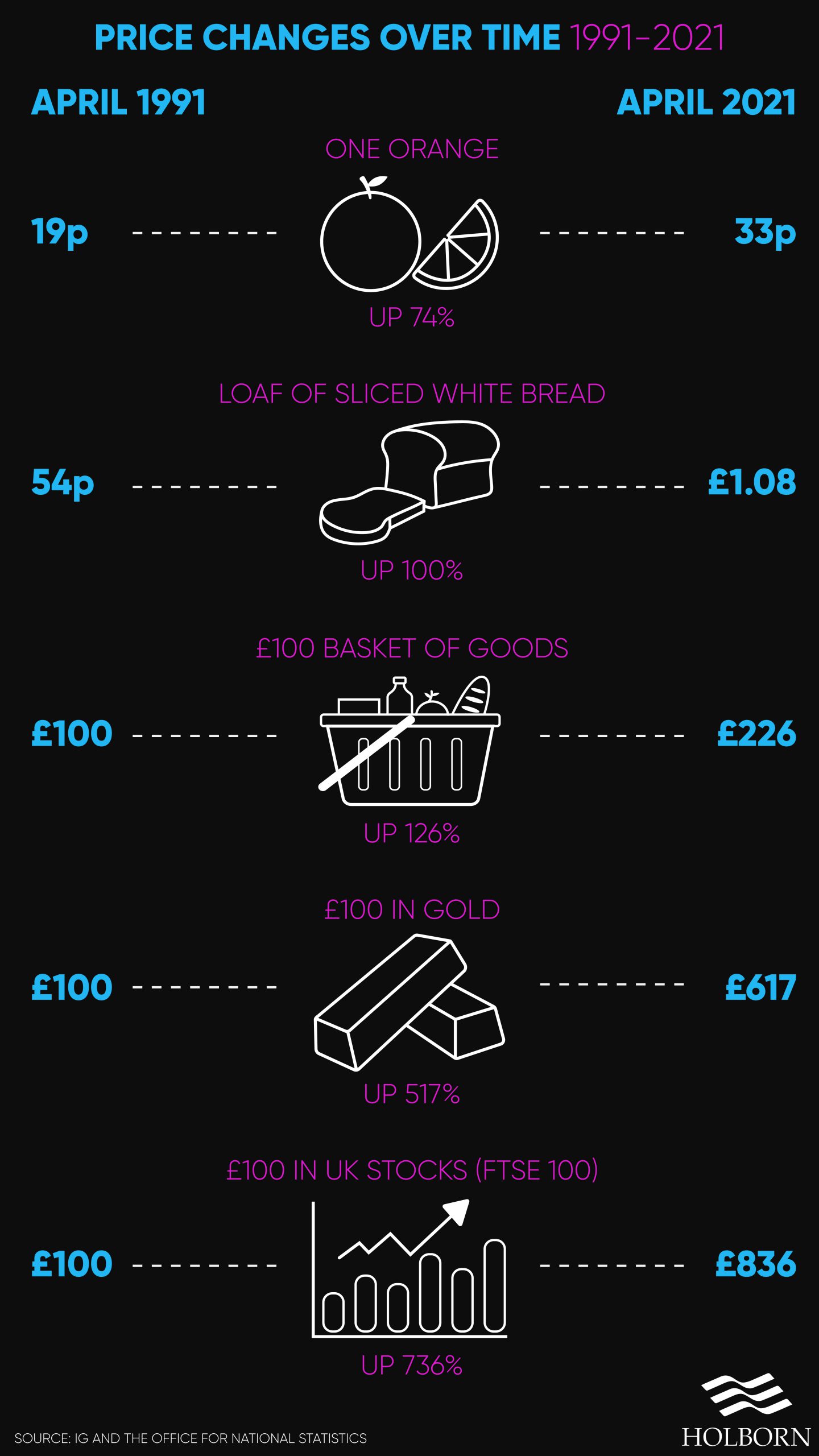

Well, this is true; a pound was more valuable in the past. We only have to look at how prices have changed over time to see inflation at work.

Data collected by IG and the ONS shows how drastically prices have changed over the past 30 years. Even the price of a loaf of sliced white bread has increased 100%.

The Office for National Statistics (ONS) tracks the price of a whole host of products and services to measure inflation.

The ONS then uses that data to publish the Consumer Price Index (CPI). The CPI is a monthly measure of inflation that compares prices to the same point the previous year.

So, why is all of this important, and how could it impact you financially? First, let’s look at savings accounts.

Rates vs rates vs rates

Remember, if money sits still, its value drops over time due to inflation.

Let’s say you put £100 in a safe and intend to take it out of the safe in 10 years. By the time you take it out, your original £100 technically has less value because its purchasing power has fallen.

In other words, what that £100 would have bought you when you put it in the safe is more than what it will now. You can apply the same analogy to a savings account.

Interest rates offered by banks are determined by the Bank of England base rate. The current base rate is at an all-time low of 0.1%, which means banks struggle to offer high-interest rate savings accounts.

For the value of your money to climb, you need a savings account that beats the current rate of inflation. At the very least, it needs to match the rate of inflation.

If your money is not matching or beating the inflation rate, it is ultimately devaluing over time.

Until the Bank of England increases interest rates, savers will find themselves hit the hardest by inflation. There is speculation that the central bank will raise interest rates earlier than expected.

Even if these predictions do materialise, it may not be until mid-2022 at the earliest.

So, what is the solution? Well, investing could be an effective way of hedging against inflation.

Hedging against inflation

Investments are not immune from inflation. However, with the right strategy, you can hedge against inflation.

Equities/stocks

Equity investments are generally considered higher risk/higher reward investments.

There are no guarantees when buying shares in a company. However, the stock market is resilient and generally provides inflation-beating returns.

As we said, these types of investments carry greater risks. You will want to invest in companies/sectors that outperform the market and align with your risk appetite.

Talking to an expert about investments is advised, especially if you are new to the world of investing.

Commodities

Commodities are tangible assets. Think of materials such as steel or natural resources like oil.

Because other industries use commodities, they tend to be in demand. Also, certain types of commodities have historically proven to be a reliable option for hedging against inflation.

Precious metals such as gold and silver, in particular, have performed well during difficult financial climates. These investments may not provide the same returns as equities, but they are a safer bet.

Real estate

Real estate can provide a steady income through rental yield. As an asset, its value also increases over time.

Since lockdown restrictions have eased, house prices in the UK have soared.

Data from the Land Registry revealed that in May 2021, the average house price in the UK was £254,624. Despite a global pandemic a little over 12 months prior, the average property price had risen by 10% compared to the previous year.

Earlier in this article, we explained why savings accounts were less attractive due to poor interest rates. While this is bad news for savers, it’s good news for borrowers.

Lower interest rates make borrowing more favourable. Mortgage rates have plummeted recently, but expect them to rise when the BoE increases interest rates in the future.

If you do not have the capital to invest in property, there are other options. Real estate investment trusts (REIT) allow you to invest in publicly traded property portfolios.

Alternatives

Like real estate, there are other tangible assets to consider.

Alternative assets such as rare whisky or trading cards can be an effective way of hedging against inflation.

However, you should be aware that alternative assets have their cons. The prices can be hard to predict as their value is dictated by several factors such as supply and demand.

Also, you will need to know the area you are investing in, which is why investors tend to have a passion for these types of assets. If you know what you are looking for, alternative assets can beat inflation over time.

How Holborn can help

During any climate, having the right strategy is essential to make your money grow.

Investing can be an effective way of hedging against inflation. Having the right investment strategy can not only help you maintain the value of your money, but it can also help it increase.

At Holborn, we are experts in wealth management. We have worked with clients to successfully build wealth and improve their financial situation for over 20 years.

Don’t let your wealth devalue. Speak with one of our specialists and learn how to protect your savings from inflation.

To find out how we can help you, contact us using the form below.