Posted on: 27th June 2022 in Finance

The news of rising interest rates seems to be making headlines almost on a weekly basis.

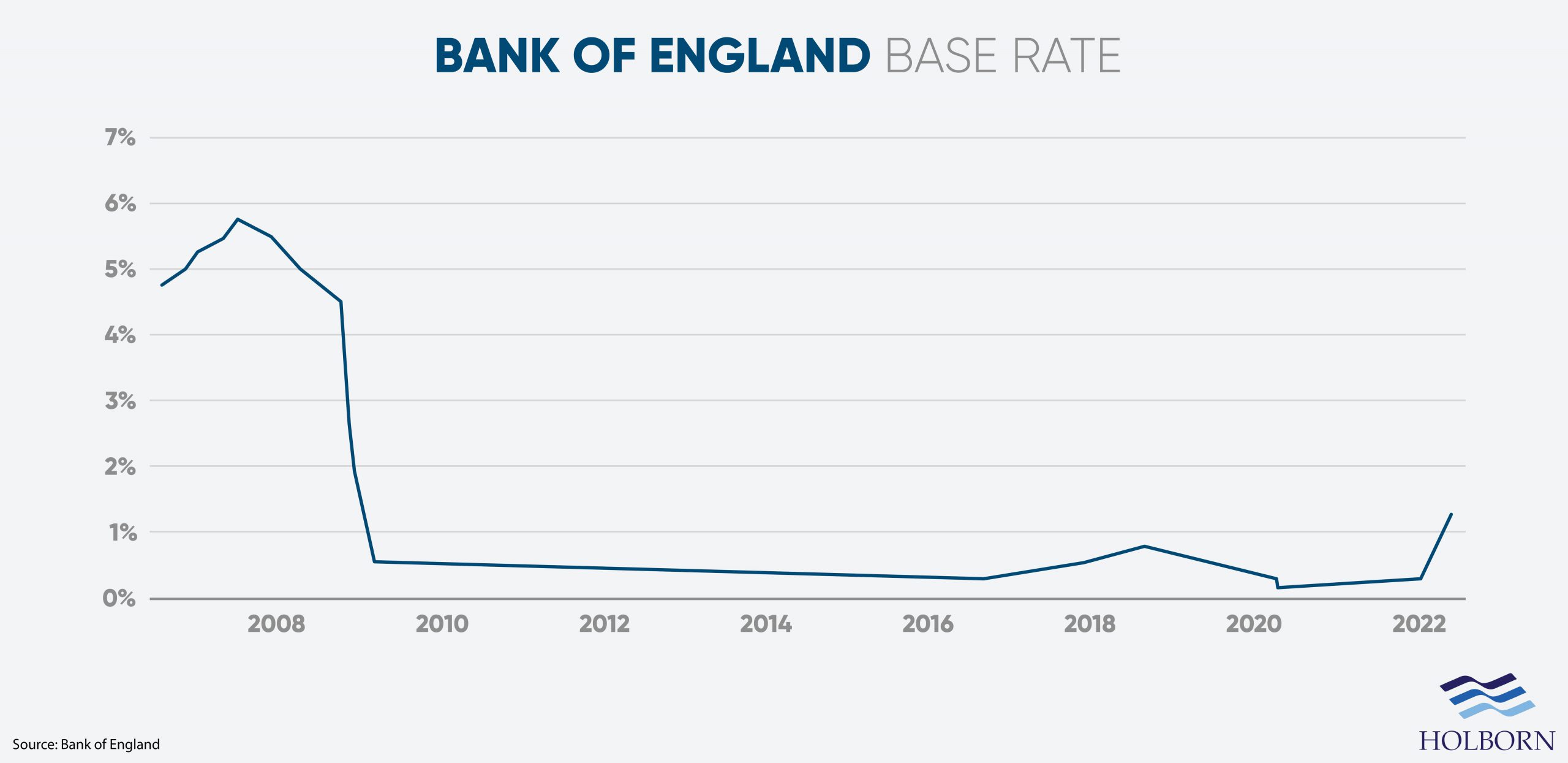

Only a year ago, all the talk was about the possibility of negative rates. Fast forward to today, and the Bank of England just announced that interest rates are increasing from 1% to 1.25% – a 13-year high.

So, what do rising interest rates mean for you and your money?

In this article, we look at the cause of rising interest rates and what it means for borrowers, savers and investors.

When it comes to the economy, a lot can change in a short space of time.

In April 2021, we looked at what negative interest rates could mean for your finances. At that time, the Bank of England (BoE) base rate was at 0.1%, and there was talk of the central bank lowering the base rate below zero. It’s also worth noting that when we published that article, inflation in the UK stood at 1.5%.

Here we are, halfway through 2022, and the rate of inflation is moving upwards at a blistering pace. The latest Consumer Price Index (CPI) shows that inflation is rising at 9.1% – the fastest rate in 40 years. There are further concerns that inflation could go as high as 11%.

So, how did we get to this point?

First, we need to understand that when we talk about inflation, we are talking about the speed at which prices increase.

As Covid restrictions eased, spending went up. While spending went up, production failed to keep up with demand, increasing prices. Oil and gas prices have also spiked, partly due to the invasion of Ukraine by the Russians.

All of this has contributed to one of the worst cost of living crises in recent times.

A little inflation is normal. Some experts believe that small amounts of inflation can even help with economic growth. However, the current levels of inflation we are seeing are bad news for the economy.

One way to help control inflation is for central banks to increase the bank rate, otherwise known as the base rate. Ultimately, this encourages people to save money rather than spending or borrowing.

The idea here is to reduce the demand for goods and services, which should lower the prices. As prices fall, inflation should also ease.

When it comes to increasing rates, a balanced approach is essential. Too sharp of an increase, and there is the risk of slowing the economy too much. That could explain why the BoE is being more cautious, opting for gradual changes more frequently.

The BoE’s most recent rate hike of 0.25% was the fifth successive increase since December 2021. That brought the base rate to 1.25% – the highest since 2009.

It wasn’t only the UK that has seen rate rises; the United States also saw a jump. The BoE’s counterpart, the Federal Reserve, took a more drastic approach when it increased its rate by 0.75%.

Let’s look at how all of this impacts your day-to-day finances.

Nothing will change for those with a fixed-rate mortgage, as the rate you have is locked in until your deal expires.

However, those with a variable rate or tracker mortgage will see their monthly repayments increase. In the UK, that is around a quarter of all homeowners.

The mortgage rates charged by commercial banks on these types of mortgages are often tied directly to the base rate. So, with the latest increase, mortgage repayments will increase by 0.25%.

For those with a £400,000 mortgage over 25 years, this amounts to an increase of £480 a year. This amounts to an extra £48 leaving their bank accounts each month.

It’s not just mortgages affected by rising interest rates. Other types of borrowing can also increase in cost.

For example, the rates on credit cards are typically variable. Unlike mortgages, credit cards are not explicitly tied to the base rate. You should still be aware that the base rate can influence the amount of interest you pay.

Typically, rising interest rates are good news for savers. Remember, the idea of increasing rates is to encourage people to spend less and save more. But, there is a problem.

If we look at data across a range of savings accounts, we can see that banks are not passing these rate increases on to savers.

In December 2021, when the BoE base rate stood at 0.1%, the average interest rate offered on a savings account was 0.45%. Since then, the base rate has increased by 1.15%, but the interest rate for savings accounts has only risen by 0.35% to 0.80% on average.

Different types of savings accounts may pay more than the average. Still, even the best current rates offered by banks are well below that of inflation. Any savings rate below the rate of inflation (9.1%) results in your money losing value over time.

A savings account may not beat inflation. But they could still be a good option for essential funds that you might need quick access to, such as your emergency fund.

Typically, as rates increase, some people find it harder to justify risky assets such as investments. After all, why would you take risks investing when banks offer attractive rates on savings accounts?

But as we have seen, the average rates offered on savings accounts are not exactly attractive to would-be savers. Of course, investments are not entirely immune to rate rises.

Although rising interest rates do not directly affect the stock market or stock prices, they can have a knock-on effect.

As interest rates on credit cards and mortgages increase, people have less money to spend. When spending drops, it can directly impact a company’s profits and revenue. This and other factors could, in theory, lead to lower average returns.

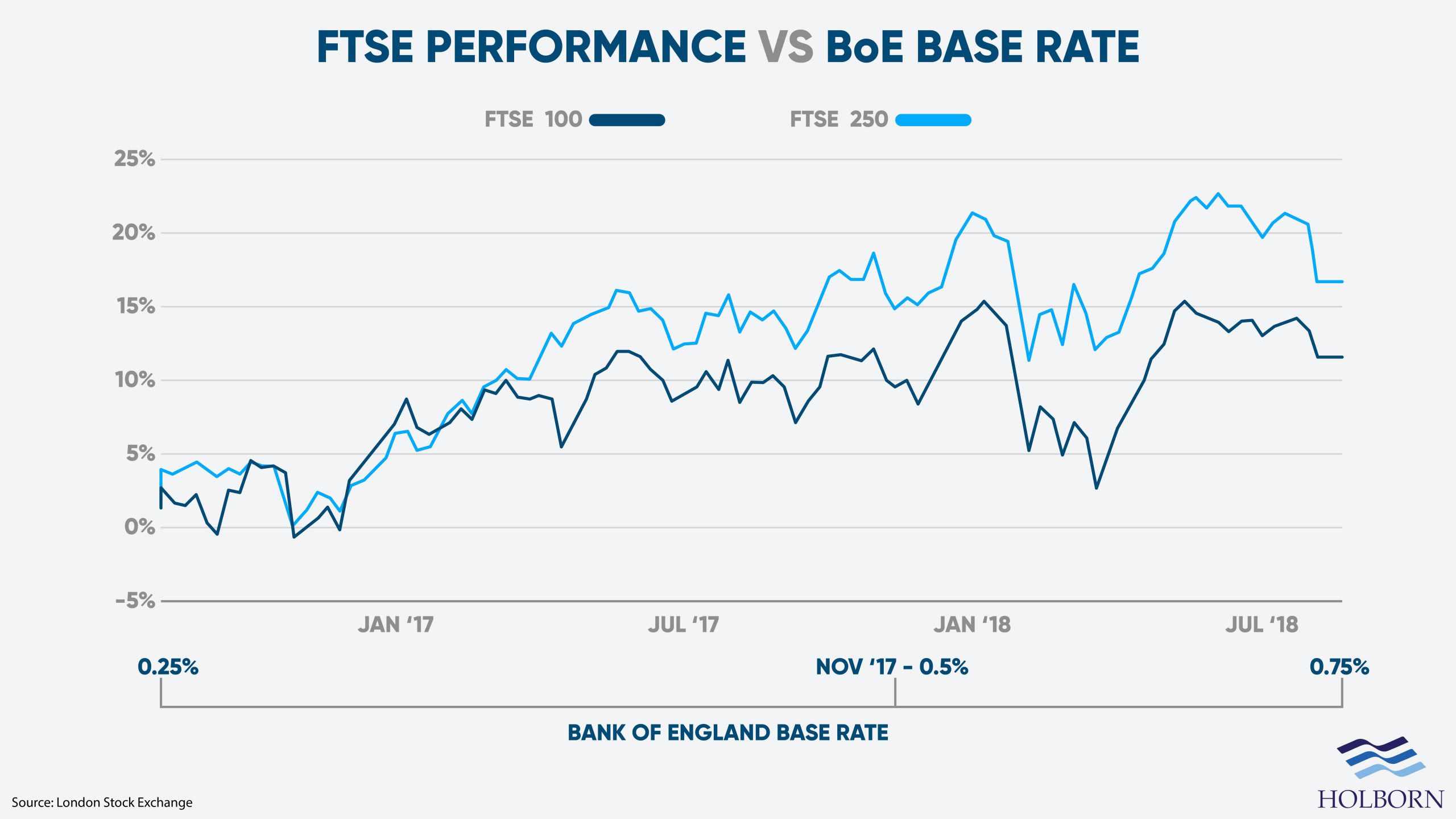

Historically, the markets have coped well with rate rises and continued to produce strong returns.

Be aware that the past is not an indication of future performance. Still, it does give us an indication of how the stock market has fared before.

Our article on how rising interest rates affect the stock market covers all of this in more depth.

Remember, there is no such thing as a risk-free asset, but there are steps you can take to help reduce the overall risk of your portfolio. For example, making sure you have the optimal allocation of assets.

The Bank of England will meet again on 4 August 2022 to decide if further increases are needed to combat growing inflation. There will be three more meetings in 2022, which could result in an unprecedented eight increases in a calendar year.

As we have seen, the economic landscape can change quickly, so it’s essential to have the right strategy that adapts to those changes. That’s where we can help.

For over 20 years, clients have trusted Holborn Assets to manage their finances and build successful investment portfolios to withstand any climate.

We offer our clients bespoke, transparent advice and award-winning customer service. Our commitment to excellence has made us one of the leading names in the financial services space.

Contact us using the form below to find out how we can help you.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more

When it comes to growing your wealth, choosing the right investment path can make all the difference—especially if you’re an expat managing finances across borders. Two of the most talked-about...

Read more

Building wealth is one thing—but building a legacy that lasts for generations? That’s something else entirely. For families, especially those living and working abroad, creating multi-generational wealth means more than...

Read more

Living abroad as an expat can be one of life’s most rewarding adventures—but it also comes with its fair share of financial surprises. Whether you’ve relocated for work, lifestyle, or...

Read more