As the dust settles on the pandemic, there has been an increase in people buying life insurance.

Despite the increase, around 63% of UK adults have no cover in place. Not only that, but uptake is much slower than we have seen in the past.

So, why are people still reluctant to out a policy? There could be several reasons why. However, with the internet full of life insurance myths and misconceptions, it can be hard to understand how a policy works.

In this article, we debunk some of the biggest myths around life insurance and look at how global events have influenced our views on it.

Pandemics: past vs present

One thing a global pandemic does is make us face our own mortality.

When the news headlines and social media all centre around one thing, it can be hard to think about much else. So, it’s no wonder that we look to things that help when confronted with death.

Maybe we start exercising more and eating better to improve our health. The data also suggests that life insurance is more of a priority. This has certainly been the case following the two most recent pandemics.

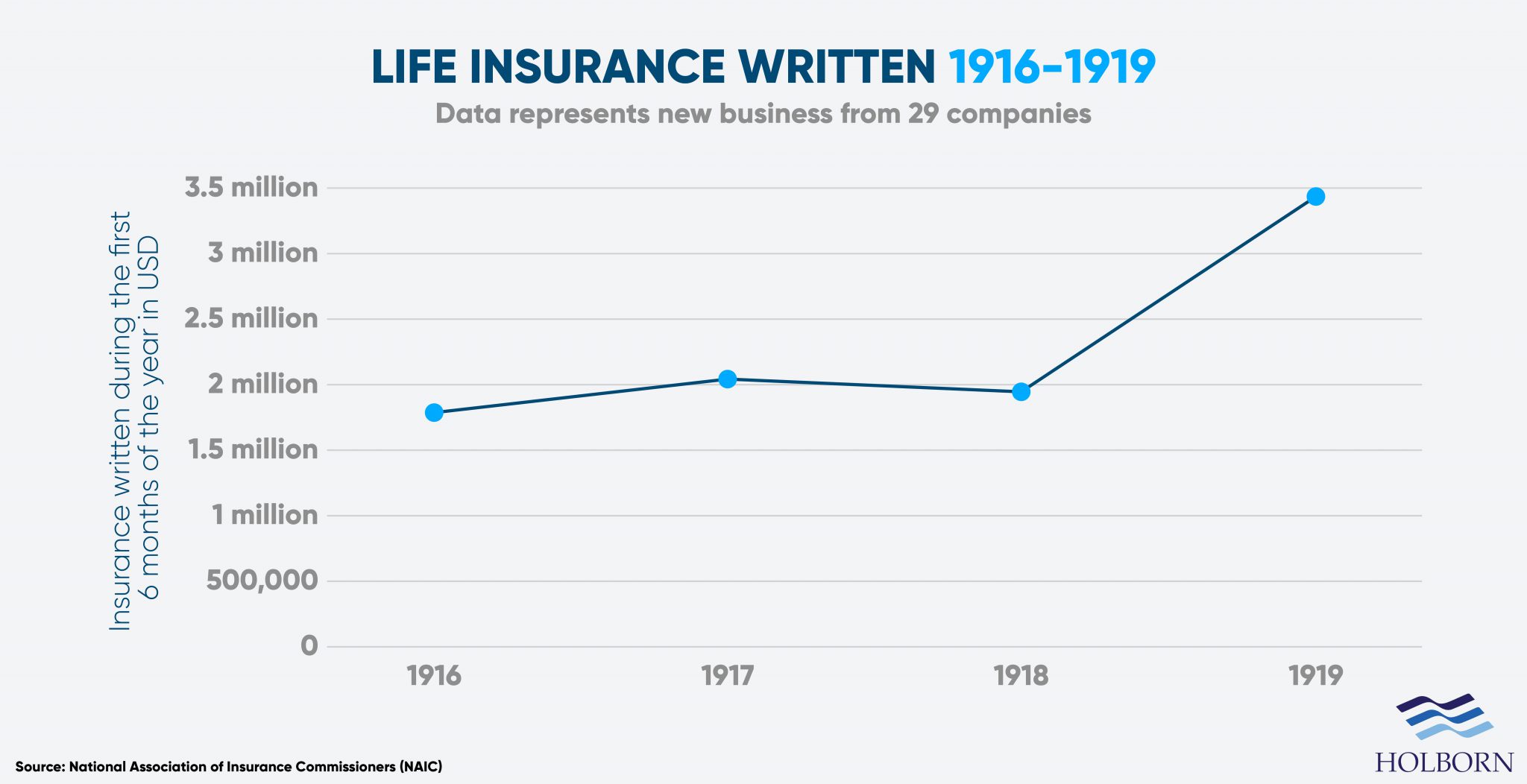

According to data from the National Association of Insurance Commissioners (NAIC), there was a sharp increase in life insurance uptake following the Spanish flu outbreak.

In 1919, new business for life insurance companies in the U.S. jumped by nearly 79%. In 1917, the year before the outbreak, new business stood at 23.5%.

During the Covid-19 pandemic, we saw a similar trend.

Research by Canada Life found that 11% of UK adults have either thought about or taken out life insurance policies since the start of the pandemic.

There has been a clearer increase on the other side of the pond. Research group LIMRA found that life insurance policy sales have reached record highs.

During the first quarter of 2021, sales increased by 11% compared to the same period in 2020. The increase represents the highest quarterly growth since 1983.

Still, 11% is nowhere near the 79% increase we saw following the Spanish flu outbreak. Of course, there are other factors at play that affect the numbers, but what is holding people back?

Some may say they can’t afford it, and others may think they don’t need it. Either way, what holds people back seems to be tied to a lack of understanding and a misconception about life insurance.

Debunking myths about life insurance

If you are considering a life insurance policy, it’s always a good idea to do some research first.

The trouble is, you are bound to come across information that is either not entirely true or, in some cases, completed wrong.

This can lead to confusion around the topic and leave you questioning whether life insurance is even worth it. But don’t fear; below, we look at some common myths and misconceptions to help you better understand the often misunderstood world of life insurance.

I’m too young to worry about life insurance

This is one of the common life insurance myths you often hear.

If you are young, the chances are you won’t have anyone who depends on you financially, and you likely don’t have any large financial commitments.

However, studies show that 35 or under is the optimal age for buying life insurance. There are also benefits to taking out a policy while you are young. One of the main benefits is that it’s often much cheaper.

Life insurance companies often view young people as low-risk because they tend to have fewer health conditions. As a result, an insurance company generally charge lower premium payments. Not only that, but depending on the type of cover, your premiums won’t increase as you get older.

Term life insurance covers you for a fixed amount over a set number of years. So, if you take out a policy at 35 that covers you for 30 years, you will continue to pay the same premiums throughout the policy’s life.

Life insurance is expensive

People are often under the impression that the cost of life insurance is high, which puts them off. This is especially true for younger people.

A report by Legal & General found that 92% of millennials overestimated the cost of life insurance. Of course, your monthly premium costs will depend on the type of cover and policy type. However, the overall costs may be lower than you think.

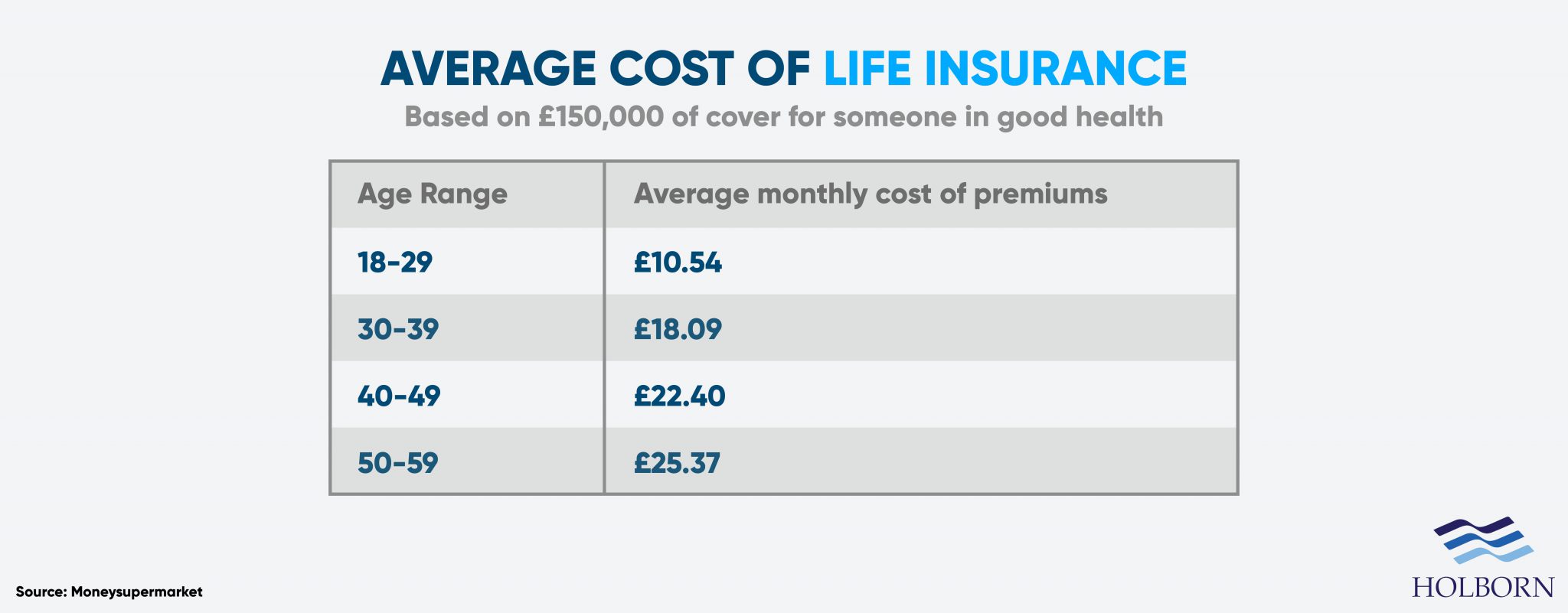

Based on someone in good health, here is the average monthly cost for £150,000 of life insurance coverage.

Remember, cover doesn’t need to be expensive. With so many life insurance products on the market, you are sure to find the right coverage that fits your budget and needs.

Some of the factors that typically define the cost of your life insurance premium include:

Your age

Medical history

Whether or not your smoke

Your weight/BMI

The amount of cover you want

The length of the policy

I need life insurance to get a mortgage

Having life insurance isn’t a requirement to get a mortgage in some jurisdictions (speak to your mortgage or financial adviser to be sure). However, it can affect your chances of getting a mortgage.

Some mortgage providers may be more willing to lend to you if you have cover in place. Lenders will often view you as a lower risk because a life insurance payout can be used to clear the outstanding mortgage.

Not only that, but it also provides your family with the financial support needed to get up with the monthly payments. Life insurance should not be confused with mortgage protection insurance.

Unlike life insurance, mortgage protection insurance only covers the mortgage itself. Because your loan will become lower as you pay it back, your payout will reflect that. As a result, mortgage protection insurance is typically cheaper than life insurance.

Life insurance companies don’t pay out

A common misconception is that life insurance providers don’t pay out on claims. This one has gained a lot of traction over the years. In fact, 4 out of 5 people in the UK believe it to be true.

However, there is solid data to disprove this theory. Figures from the Association of British Insurers (ABI) show that 98% of life insurance claims in the UK result in a payout.

To break this down further, the payout rate for term life insurance was 97.4% and 99.99% for whole of life cover.

One of the UK’s largest insurers, Aviva, publishes its figures every year. In 2021, they accepted 99.4% of all life insurance claims, paying out more than £731.6 million.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Life insurance payouts are taxed

This is a complicated one, and there is an element of truth.

Life insurance payouts are free from both income tax and capital gains tax in the UK. However, payouts may be subject to 40% inheritance tax (IHT).

IHT applies to any estate valued at £350,000 or more (£500,000 if you own a home that you intend to pass on). Your estate includes things such as:

Money

Investments

Pensions

Assets

Property

You can avoid having your life insurance policy included as part of your estate by writing it into a trust. IHT and trusts are both complex areas. For more information, you should consult an experienced financial adviser.

What to do next

The benefits of life insurance go beyond just covering funeral bills. The cash payout can provide vital support to those who depend on you financially.

As we discussed, life insurance is probably cheaper than you think, so it’s worth working into your budget. Although it won’t benefit you directly, you will have the comfort of knowing that your loved ones will be taken care of financially.

Remember, life insurance can also benefit younger people as they typically pay lower premiums. So, avoid procrastinating over a policy as you don’t want to risk spending more each month just because you put it off. You can get the optional cover by taking out a policy while younger and paying a much lower average cost.

With so many types of life insurance on the market, knowing what the right product is for you and the level of cover needed can be a challenge. That’s where we can help.

Holborn Assets is a leading global financial services company. We pride ourselves on our client-first approach at all times. This means providing bespoke, transparent advice based on your circumstances and goals.

With our expert advice and award-winning customer service, you can be sure that you are in safe hands.

To find out how we can help you, simply fill out our enquiry form and we’ll call you to discuss your requirements.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences