Why invest in a Portugal Golden Visa now

Posted on: 3rd February 2021 in

Expats

New laws came into effect on January 1st 2022, meaning some of the information in this article may be outdated. To find out more, read our article on the changes to the Portugal Golden Visa in 2022.

Why should you invest in a Portugal Golden Visa now? The recent EU-UK Trade and Cooperation Agreement has had an impact on the lives of UK citizens, especially the ones that would like to live or work in the Old Continent, without getting puzzled by any problem.

If you feel you tick some of the boxes, the range of EU citizenship and residency solutions we can suggest is broad, with the Portugal Golden Visa being one of them.

What is the Portugal Golden Visa?

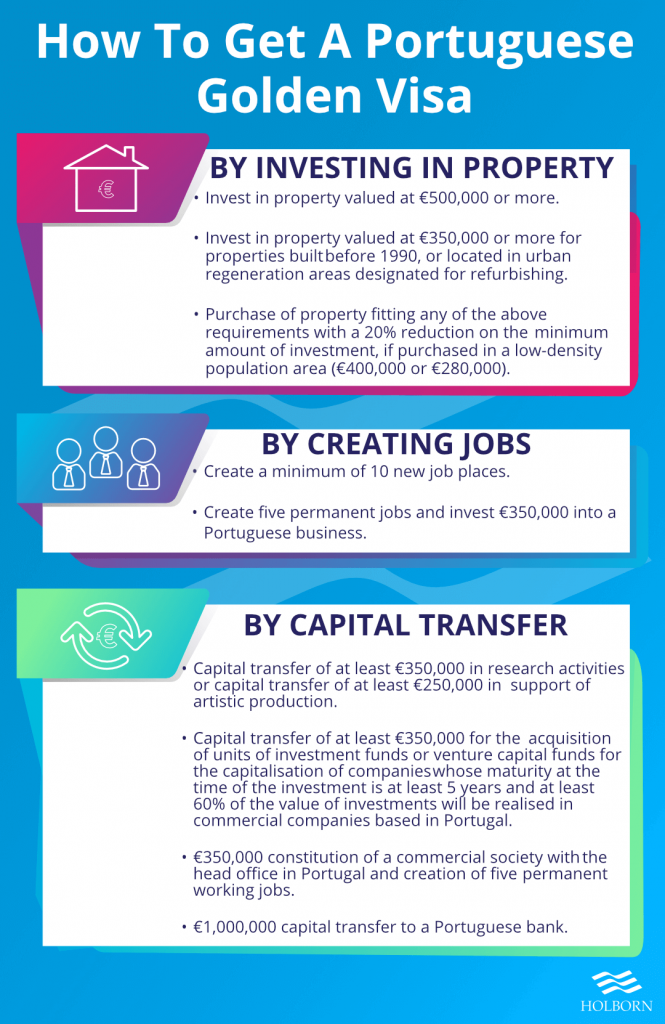

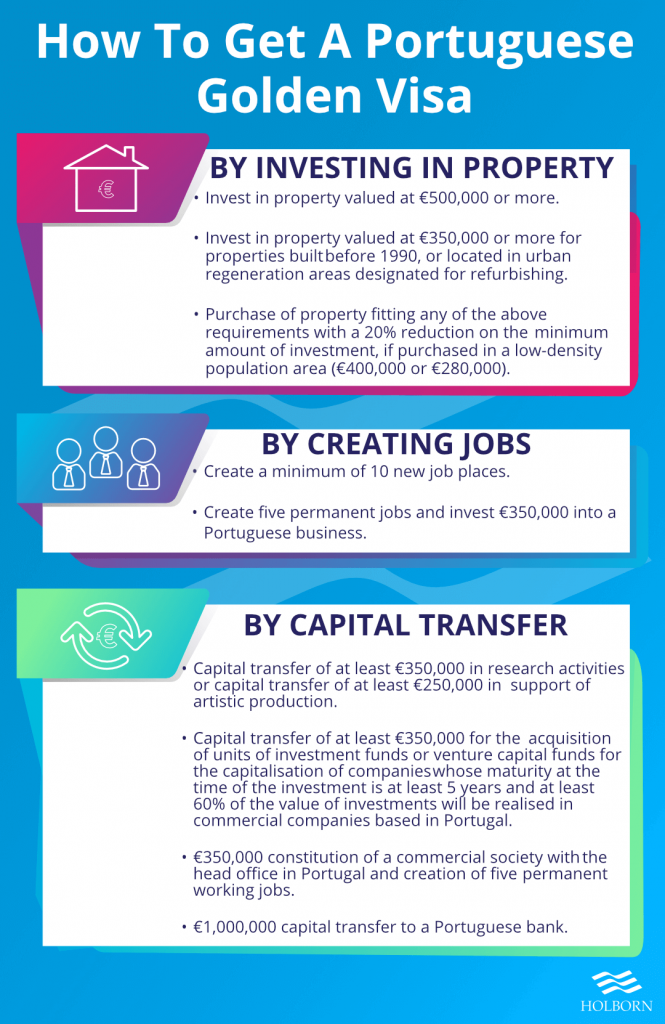

The Portugal Golden Visa is the nickname of the country’s residency by investment programme which allows you to become a permanent resident of the beautiful country located on the Iberian Peninsula.

It is designed to attract foreign investors who want an easy way to obtain the legal right to live in the country and being able to travel in the EU and 150 more countries without any visa limitations.

Why invest in one now?

The answer is simple. The Portuguese government has decided to change the rules and requirements related to its residency by investment programme. Under the new legislation, requirements would become stricter, and investors would see their options getting limited.

Just before Christmas last year, the Portuguese government announced that it would change the residency by investment programme by removing eligibility or increasing costs for investments in metropolitan and coastal areas. This means that people who would be interested in property investment in Lisbon, Porto or in the UK tourist favourite Algarve just to name a few locations, wouldn’t be able to.

The government aims to divert investors to low-density country areas, strengthening local economies as Portugal is one of the poorer countries in the eurozone bloc.

Is it too late to invest in a Portugal Golden Visa?

It is never too late, but the clock is ticking. Portuguese authorities have announced that the new residency by investment programme would become effective on January 1st 2022.

Applications submitted by December 31st 2021 will be accepted and scrutinised, taking into consideration the older programme requirements. Experts suggest that if applicants would like to invest in real estate, they would need to find a suitable property by October to make the application process easier and to avoid any potential problems.

Portuguese authorities can issue the residence permit in three months after you have submitted the necessary application documents.

The initial Golden Visa grants temporary residence for two years. The visa can be renewed for successive periods of two years at a time, providing that the requirements are met.

The process of gaining citizenship in Portugal takes approximately five years.

Are you interested in a Portugal Golden Visa? Ask Holborn.

Citizenship and residency by investment programmes help individuals and families secure their future. Our experts will listen to your needs and suggest a number of investment solutions to help you make the ideal plan for you and your loved ones. Fill in the contact form below to learn more.