A guide to moving from the UK to the UAE

Posted on: 9th May 2022 in

Expats

If you are looking to become one of the hundreds of British expats who relocate to the UAE each year, there are some things you need to know.

Packing up your life in the UK and heading for sunnier climes requires careful thought and planning.

In this article, we look at what prospective British expats need to know before moving to the UAE.

Living and working in the UAE

UK passport holders are granted a visa on arrival in the UAE, so there is no need to submit a visa application before flying.

Your passport is stamped with a 30-day visit visa that you can apply to have extended for an additional 30 days. You can find more information about short-stay visas by visiting the Emirates Airline website.

Short-stay visas are perfect for those looking to get a feel for the country before making their stay more permanent. British expats who intend to live and work in the UAE will need a different type of visa.

Foreign workers in the UAE require a valid employment visa and a labour card. It’s usually your employer who arranges this, and the duration is typically subject to the terms of your work contract.

For more information, it’s best to speak with your employer. Alternatively, visit the Dubai government portal.

Be aware that the way visa system in the UAE is changing from September 2022, following a massive overhaul. The changes will affect everything from residency visas to the standard tourist visa.

The visa requirements will also be updated to make the system more accessible and attract more skilled workers to the region.

Our article on the UAE visa changes in 2022 has more information.

Tax and financial tips for UK expats

A tax-free salary is maybe one of the biggest draws for British expats who come to the UAE for work.

Income tax in the UK starts at 20% but can go as high as 45%. In the UAE, there is no income tax to pay, which means expat workers get to keep 100% of their monthly salary.

British expats also avoid paying National Insurance on their monthly salary.

Your National Insurance contributions (NICs) are directly linked to certain UK benefits, including your state pension. The number of qualifying years will determine if and how much State Pension you receive.

You can check how many qualifying years you have by checking your National Insurance record. Our article tells you everything you need to know about NICs and how to check your record. Alternatively, you can log in via the UK government website.

It’s not uncommon for expats who have worked overseas for a long time to have gaps in their record.

If you do have any gaps, you can make voluntary contributions. It’s something to consider to ensure you receive a full State Pension once you reach retirement age.

Finding a place to live in the UAE

Although salaries are higher in the UAE, so is the cost of living. Rent alone is one of the biggest expenses for expats.

Twelve months is the typical length of rental contracts in the UAE with a three-month deposit. Most landlords also ask for 12 months’ worth of pre-dated cheques.

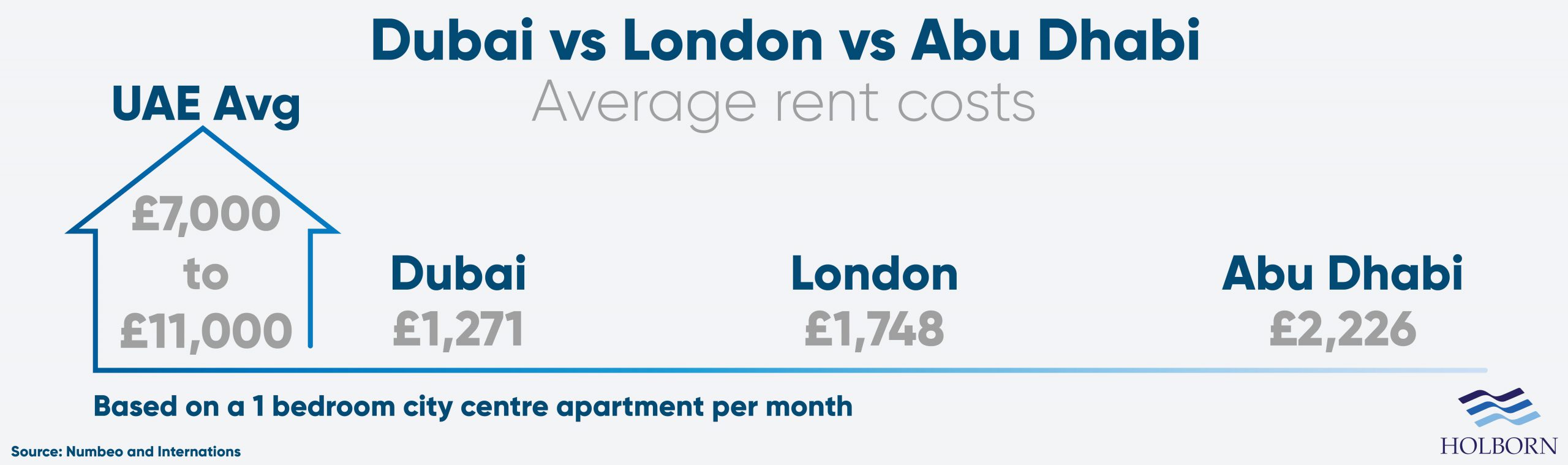

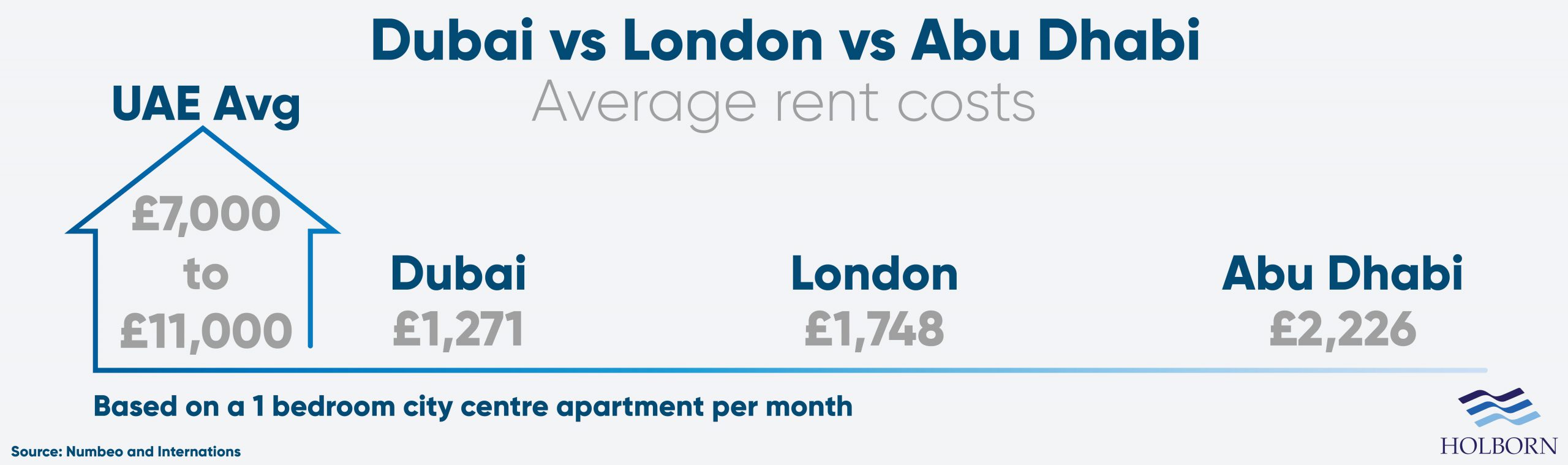

The average rent for studio apartments in the UAE ranges between 30,000 and 50,000 AED (£7,000 and £11,000) per year. Of course, the type of accommodation and the area you want to live in can see prices fluctuate considerably.

Dubai and Abu Dhabi are two of the most expensive cities for rent. A city centre one-bedroom apartment in Dubai costs around 5,700 AED (£1,253) according to Numbeo, a global database for living costs. The same property in Abu Dhabi costs roughly 11,500 AED (£2,500) each month.

While this may seem high depending on where you are coming from in the UK, it won’t be too much of a shock to those coming from London.

The UK capital sits in the middle when it comes to rental costs, coming in more expensive than Dubai but cheaper than Abu Dhabi.

You can find cheaper accommodation outside of these two cities. Areas such as Sharjah and Fujairah will typically offer less expensive options.

Be aware that all rental contracts in the UAE need to be registered in the Ejari system.

British communities in the UAE

The United Arab Emirates is a multi-cultural place. Expats from all over the world come to the region to live and work.

Experiencing other cultures is one of the things that makes the expat lifestyle so unique and rewarding. Still, sometimes it’s nice to meet with people in the same boat as you that remind you of home.

The UAE has a large community of British expats. An estimated 240,000 Britons live in Dubai, so you’ll likely meet people out and about.

Alternatively, you can find other expats through an online community. There are plenty of British expat groups on social media platforms like Facebook. Websites such as Expatica and Expat.com also provide a great way to connect with others from the UK.

How we can help

The United Arab Emirates has so much to offer British expats willing to take the leap.

Despite the higher cost of living, British expats often find themselves better off financially than in the UK. With the right strategy and expert advice, you can take advantage of your newfound financial situation.

Whether it’s investing in the stock market, the property market, or planning for retirement, Holborn can help.

Holborn Assets was founded in Dubai more than 20 years ago. Since then, we have established a global presence, working with expats all over the world.

With award-winning customer service and a team of leading financial experts, you can be sure that you are in safe hands.

Contact us using the form below to find out how we can help you.