Posted on: 15th April 2019 in Pensions

The new UK tax year began a fortnight ago on 6th April 2019. So how will the new tax year affect your pension? Well it’s good news. If you receive a state pension or pension credits, you will get more. And, if you are auto-enrolled with a work pension in the UK, you and your employee will be making bigger contributions every month to swell your pension pot.

As of April 6th 2019, the UK state pension went up by 2.6%. If you receive the new State Pension, you will now receive £168.60 a week. That’s a weekly increase of £4.25. Annually you will be £221 better off. If you receive the Basic State Pension, you will now receive £129.20 a week. That’s a weekly increase of £3.25. Annually you will be £169 better off. Pension credits – for those pensioners on lower incomes – also rose by 2.6% in the new 2019 tax year.

Every year the UK government is obliged to adjust the payout of the UK state pension. How does it decide what to do? There is a system in place called “the triple lock system”. The triple lock guarantees that the state pension rises – whatever happens! So that’s good news for Brits. Three figures are used to make the calculation: earnings growth, Consumer Price Index (CPI) and 2.5%. Whichever of these three percentages is the highest is applied to the state pension. Until 2019, the UK state pension has risen at the beginning of each new tax year by an average of 3.2% since 2011. April 2011: 4.6% April 2012: 5.2% April 2013: 2.5% April 2014: 2.7% April 2015: 2.5% April 2016: 2.9% April 2017: 2.5% April 2018: 3.0%

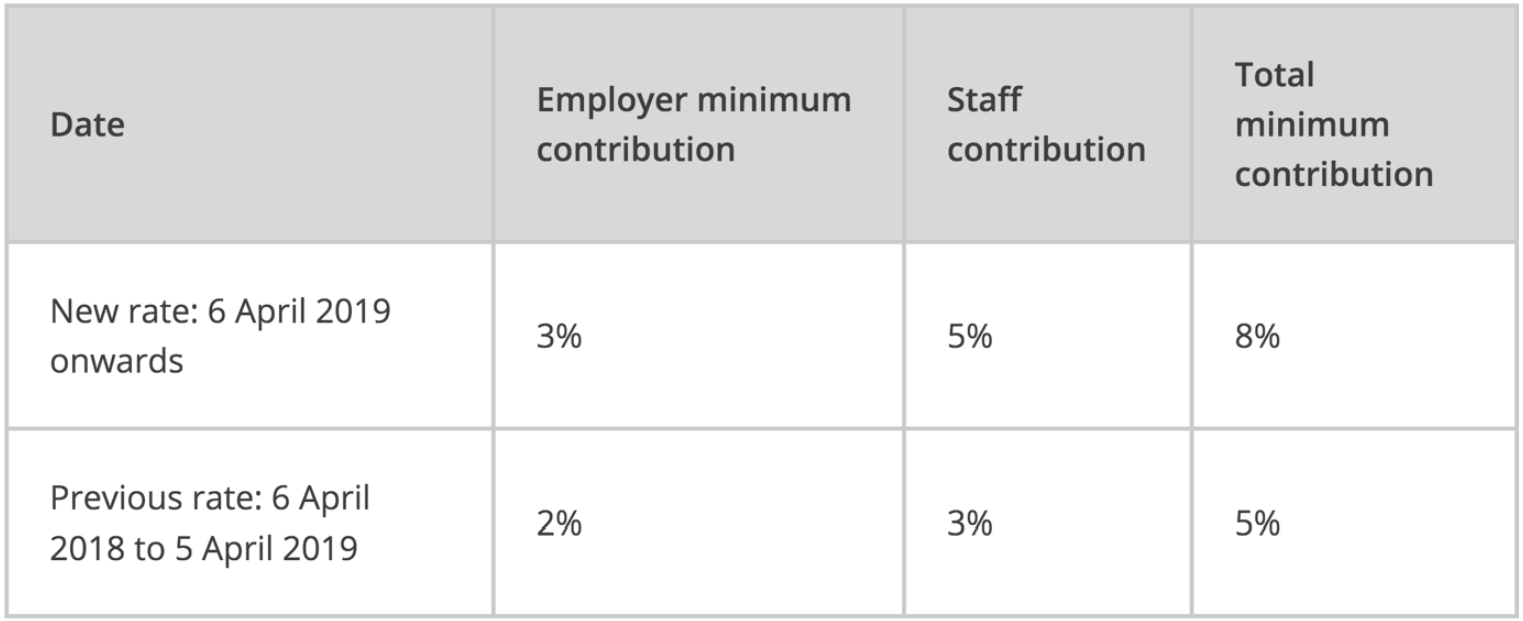

The UK’s automatic enrolment scheme for pensions mean that you and your employer must make a minimum contribution to your workplace pension each month. Together, the two contributions make up a total minimum contribution. And this figure has risen, as of April 6 th 2019, from 5% to 8%. As an employee, the minimum amount you must contribute to your workplace pension went up from 3% to 5%. So that’s a dent on your monthly income of 2%. Not ideal – but it is good news for you in the long-run as your pension pot will swell. (And it’s now the law, so there’s nothing to be done about it). The other good news is that the minimum contribution your employer must make has also risen – from 2% to 3%. These changes are implemented automatically. As an employee, you do not have to take action.  (Table from thepensionsregulator.gov.uk)

(Table from thepensionsregulator.gov.uk)

For more information on changes to auto-enrolment in 2019, read this guide for employers from the UK pensions regulator.

Managing pensions can be confusing, especially for expats who must tackle cross-border complexities in regulation. If you are feeling at a bit of loss over where you stand with your pensions, take action! Your eligibility for a UK state pension depends on how many National Insurance Contributions (NICs) you have made. Check your NIC situation online at the UK government NICs website – and use our guide here to navigate the site. Take advantage of the UK Pensions Dashboard when it comes in. There’s over £400m in lost pensions lying around the UK financial system. And, with an average of 11 jobs in a lifetime, Brits often have many pensions to keep track of. So the UK government is putting in place a scheme to provide every Brit with an online pensions app that shows them all their pensions together. (However, in the first rollout of the dashboard, planned for this year, the state pension will not be shown.) Unclear at what age you will receive your UK state pension? Currently, the UK state pension age for both men and women is 65 years old. Use the HMRC’s State Pension Age Calculator to confirm your eligibility. Also note that the state pension age is set to rise over coming years.

It is great that there are more resources online to check your pension yourself. But loads of data does not help much if you do not know how it all fits together. And that’s where your IFA can help. Your IFA can show you how your work and state pensions link up with the rest of your financial picture. Your pensions are the centrepiece of a decent retirement strategy, so it is important to manage them with care.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more