Posted on: 1st June 2022 in Investments

Two of the synonyms of risk are uncertainty and opportunity.

Choosing to take the path of uncertainty can be daunting, regardless of what is on offer on the other side.

Most of us feel more comfortable knowing the outcome and when the risks are lower. It’s why we take precautions like waiting for the red light before crossing the street or leaving a little earlier to avoid being late for an important meeting.

However, in the context of investing, we need to look at risk a little differently from what we would in everyday life.

When we talk about the financial markets, it’s that uncertainty that can bring the biggest opportunities.

In this article, we take a look at investment risk, how to determine your risk tolerance and how you can manage it.

The dictionary definition of risk is the possibility of something bad happening. The fact is that there is a degree of risk with everything we do in life, no matter how small.

Think drinking a coffee is risk-free? Think again. One slip and your morning latte could end up all over your laptop, leaving you wishing you had stuck to your new year’s resolution of going caffeine-free in 2022.

For most of the risks we encounter in life, our brain makes a judgement. Sometimes that judgment is instinctual, and other times it’s based on common sense. For example, deciding that putting your coffee next to your brand new laptop on a wobbly table is too risky.

Understanding risk and managing it is not so black and white when it comes to investing. In fact, there is almost a science to it.

On the most basic level, when we talk about risk in terms of investments, we are talking about the risk of losing money. In other words, when you invest capital, it’s the chances you may not achieve the desired returns or experience a loss.

To better understand the concept, let’s look at how risk works practically.

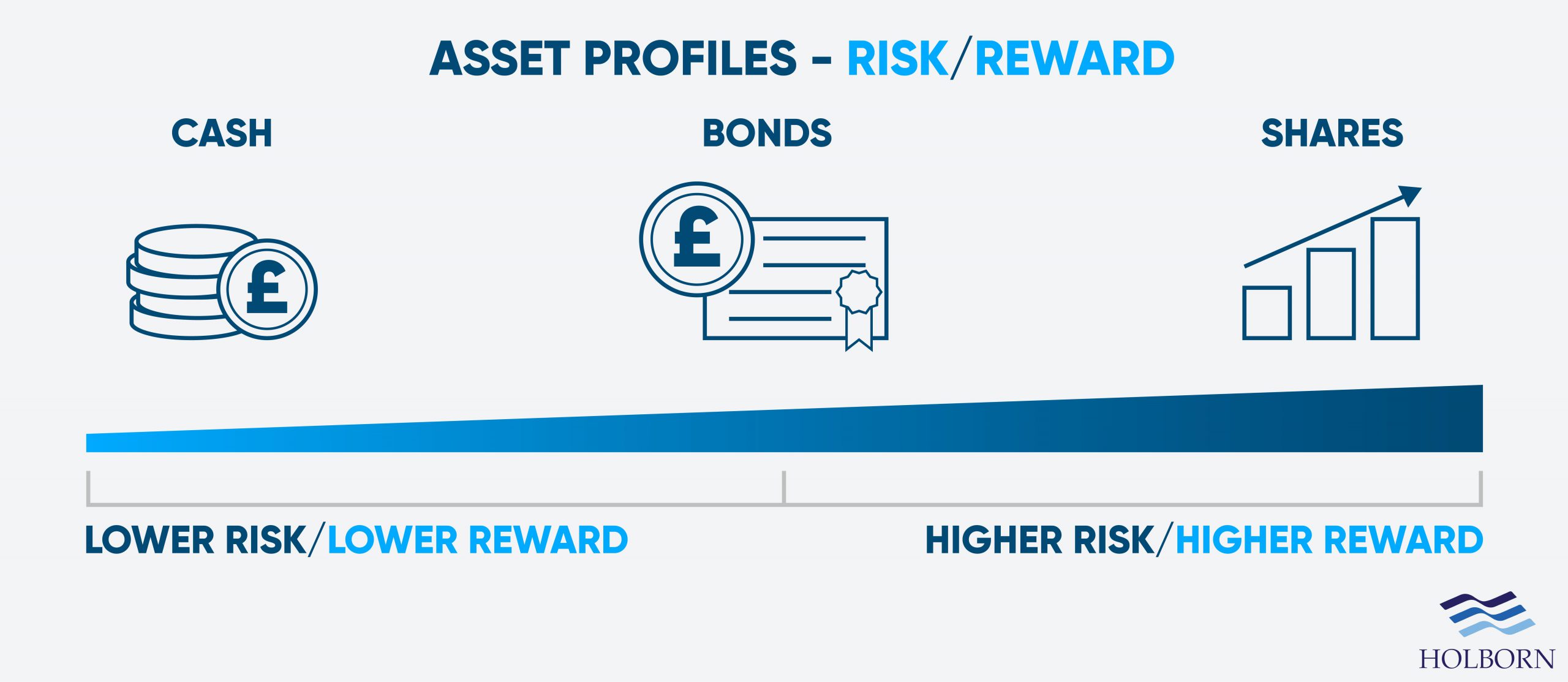

Think of investment risk on a sliding scale. In general, the more risk there is, the greater your potential returns.

To be clear, no asset class is risk-free. However, some asset classes inherently have a higher level of risk attached to them. The graphic below illustrates this by showing the three main areas where people may invest.

Of course, we can’t discuss risk without mentioning cryptocurrencies. These are considered alternative investments and have grown in popularity in recent years.

There are more the 12,000 cryptocurrencies in existence and counting, with Bitcoin being the most well-known and most valuable. Be aware that cryptocurrencies are risky investments due to their extreme volatility.

It’s all well and good to say that equities (shares) are riskier assets, but what creates that risk in the first place?

Almost anything can impact the financial markets, from something as small as a Tweet to something as large scale as a global pandemic. However, every investment is exposed to one or more general types of risk. The table below shows some of the common investment risk types.

Now we understand what investment risk is and what it looks like, let’s look at how to determine how much is too much.

Sometimes known as your risk profile, understanding your risk tolerance is essential for investors. Remember, everyone has a different attitude towards risk and different investment goals.

Here are some of the factors that determine your risk tolerance.

The long-term goal for most will be to build their retirement savings. But how much do you need when you retire? What kind of a lifestyle do you have in mind?

These are questions you need to ask to drill down and establish how much money you need. You don’t have to be precise down to the penny, but try to be as clear and accurate as possible when setting goals. Also, don’t forget to consider shorter-term financial objectives.

Some people are naturally aggressive investors who are more than happy to go all-in on high-risk investments.

On the other end of the spectrum, the thought of investing even a small amount into something as volatile as cryptocurrency is enough to keep some people up at night.

Remember, investments are typically a long-term solution to building wealth. Sometimes they will be up, and other times they will be down. If bad market news and seeing red instead of green on your investments causes you to worry, you need to invest accordingly.

The assets held in investment portfolios should represent the investor’s personal attitude towards risk. Find a balance between your comfort levels and the overall returns needed to reach your financial goals.

Sometimes, it can help to speak with a financial adviser who can help you better understand how to strike a balance between risk and reward.

We have left possibly the most important factor until last.

There will always be dips in the stock market; it’s something you can’t avoid. However, it is something you can plan for as part of your overall investment strategy.

The longer your investment time horizon is, the more risks you can afford to take. As an example, let’s say your long-term goal is focused on your retirement.

It’s not uncommon for people to have their portfolios weighted towards equities with lower bond allocations while they are young. As they get closer to retirement, they will change their asset allocation and weigh it more toward bonds to reduce their risk levels.

Doing this allows you to reap the financial rewards while you are young. Not only that, but you also have enough time to even out any losses along the way.

Of course, someone who is much closer to retirement may not be able to take the same chances as they have less time to account for losses.

There is no getting around it; investments and risk go hand in hand, and there is no such thing as risk-free. And that’s ok because risk itself is not inherently bad.

If the risk is too low, there is a good chance that the rate of return will be low. If your money is not growing quick enough, you may not meet your long-term goals, such as building money for retirement.

Although you can’t eliminate risk, you can take steps to manage it. To start with, let’s look at how proportions matter.

Rather than looking at individual asset risk, we need to look at the portfolio’s overall risk. Just because some assets, such as equities, are higher risk, the proportion of that asset determines your portfolio risk.

For example, if a high-risk asset such as shares made up 10% of your portfolio but the remaining 90% were bonds, the portfolio itself would be considered low risk.

For this reason, it’s important to consider asset allocation; in other words, what percentage of your portfolio is split between the main asset classes. We can take it a step further with a strategy called portfolio diversification.

This strategy involves spreading your investments across different asset classes, industries, sectors, and countries. Ultimately, you want to make sure there is a low correlation between your investments.

By doing this, you spread the risk. So, an asset that is performing well can help offset the underperforming one.

Another way to manage risk is to remain invested. The financial markets naturally have highs and lows, and it can be tempting to take your money out when things are not going well. This is often an overreaction to a short-term problem.

Most experts agree that you should remain invested for at least 5-10 years. That way, you have time to make up for any bumps in the road.

Everyone’s investment journey will look a little different. However, one thing most share in common is the ups and downs, but don’t worry; bumps in the road are normal.

The important thing is to have a strategy that reduces those bumps and ultimately gets you to your destination. That’s where we can help.

Since 1998, Holborn Assets has worked with clients to build and manage portfolios that support and help them reach their financial goals.

With expert advice and award-winning customer service, you can be sure that you and your finances are in safe hands.

Don’t take unnecessary risks to reach your financial goals. Contact us using the form below and find out how we can help you successfully manage your investment journey.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more

When it comes to growing your wealth, choosing the right investment path can make all the difference—especially if you’re an expat managing finances across borders. Two of the most talked-about...

Read more

Building wealth is one thing—but building a legacy that lasts for generations? That’s something else entirely. For families, especially those living and working abroad, creating multi-generational wealth means more than...

Read more