Investing in Bitcoin in 2022

Posted on: 23rd February 2022 in

Investments

To compare investing in Bitcoin to a rollercoaster ride might be a bit of an understatement.

It’s certainly been a bumpy ride for investors over the last 12 months. Our article from a year ago perfectly demonstrates how quickly things can change in the world of crypto.

At the time, Bitcoin had reached a then-record high of nearly £31,000. Since then, prices have spiked drastically in both directions.

So, should you include Bitcoin in your investment strategy? In this article, we find out.

We take a look at the current state of Bitcoin and what you need to know about this often unpredictable asset as an investor.

Let’s start with a quick refresher on Bitcoin and how it works.

What is Bitcoin?

Bitcoin is one of many digital currencies, often referred to as a cryptocurrency.

In 2013, there were around 66 different digital coins worldwide, according to data from Statista.

Fast forward to February 2022, there is an estimated 10,397 cryptocurrencies in existence. That may sound like a lot, but the top 20 coins make up roughly 90% of the market.

Bitcoin was the first alternative currency of its kind, launching in 2009. It’s also the one that has become synonymous with the term cryptocurrency.

Unlike a so-called ‘real currency’, Bitcoin is a digital version of cash. Although you often see Bitcoins in photos, they are technically worthless as the currency is purely digital.

Another trait that separates it from physical currencies is that it is decentralised. In other words, it is not controlled by central banks or the government.

When you use a traditional payment method such as a debit card or credit card, the payment is facilitated by banks. A virtual currency such as Bitcoin essentially cuts out the middle man, allowing you to buy and sell with people directly.

There are three ways to get Bitcoin;

- buying some on a cryptocurrency exchange,

- Belling something and receiving payment in Bitcoin

- Creating/mining it

The latter is one of the main things that gives Bitcoin its value.

For new Bitcoin to enter circulation, they first have to be mined. Mining is a complex process that involves solving mathematical puzzles, and in return, the miner receives coins.

Unlike other forms of digital currency, there is only a finite amount of Bitcoin available – 21 million, to be exact.

Like other commodities such as gold, once they are all found, no more will ever enter circulation. This scarcity plays a part in the value of the coin.

How does it work?

Bitcoin is bought on crypto exchanges and then added to a digital wallet.

Payments are essentially P2P exchanges. You transfer funds from your digital wallet to someone else’s. Understanding how it works as a payment option is relatively straightforward. The technology that allows it to work is a little more complex.

Bitcoin payments are made possible through the application of blockchain technology.

The blockchain is essentially a list that records transactions, with each transaction forming a new link in the chain. Think of it as a digital ledger where each entry is added to the chain in chronological order.

It records information such as dates, value, the buyer and the seller. Because anyone can access the blockchain, it makes verifying a transaction simple.

Such an important document that anyone can access and edit may sound risky. However, the process involved to add a block to the chain actually makes it very secure.

Although Bitcoin is a currency that allows you to buy real items, most people see it more as an investment opportunity. With the value of one Bitcoin reaching an eye-watering amount in recent years, it’s easy to see why investors are keen to add a crypto asset to their portfolio.

How much is Bitcoin worth?

The answer to this question ages about as well as milk on a summer’s day.

The current market price at the time of writing is just under £28,000 ($37,000) per coin, according to Coindesk. However, long-term investors in Bitcoin will be well aware of how quickly things can change in the world of crypto.

To illustrate that point, let’s look at Bitcoin price from its infancy to now.

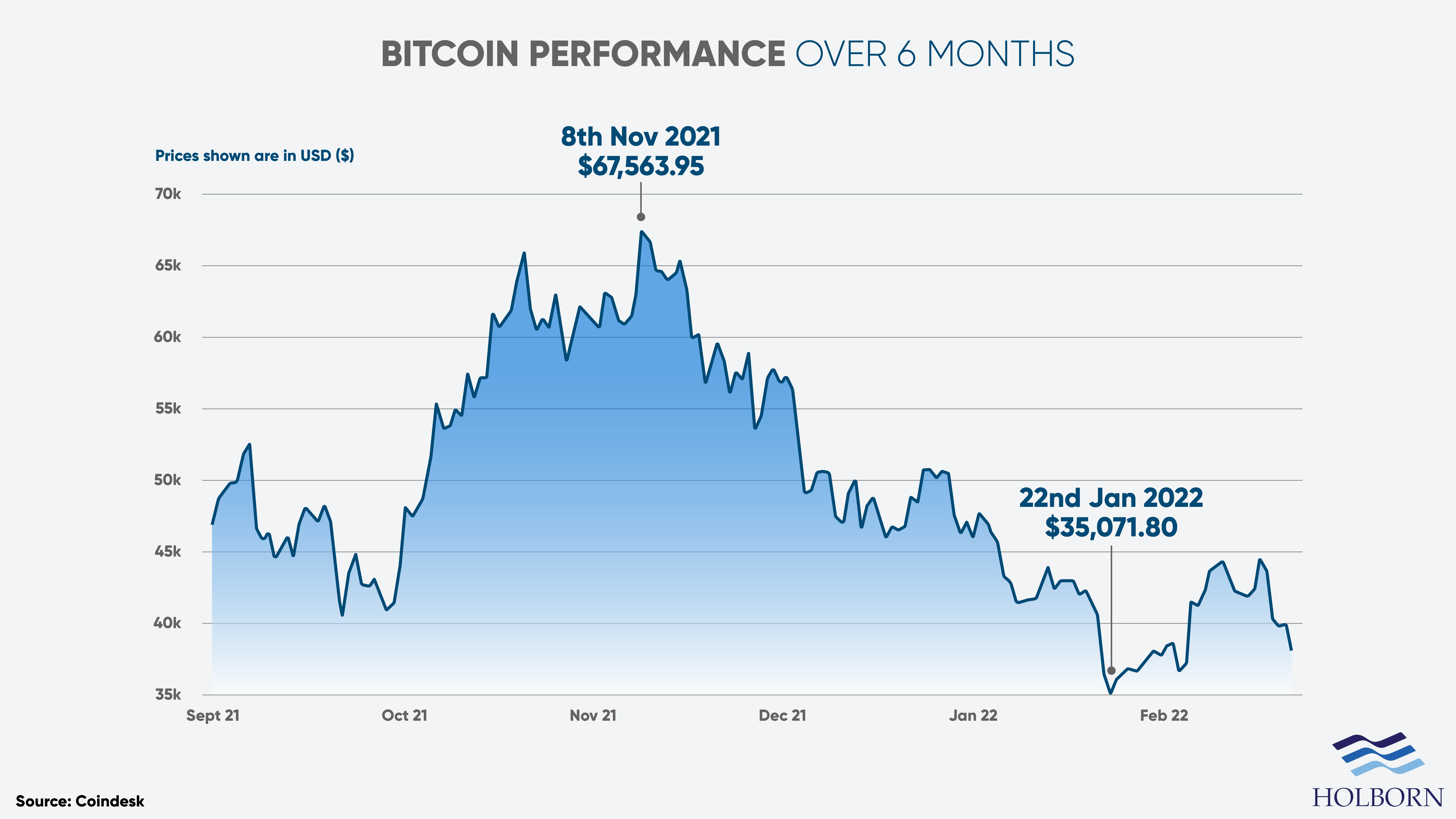

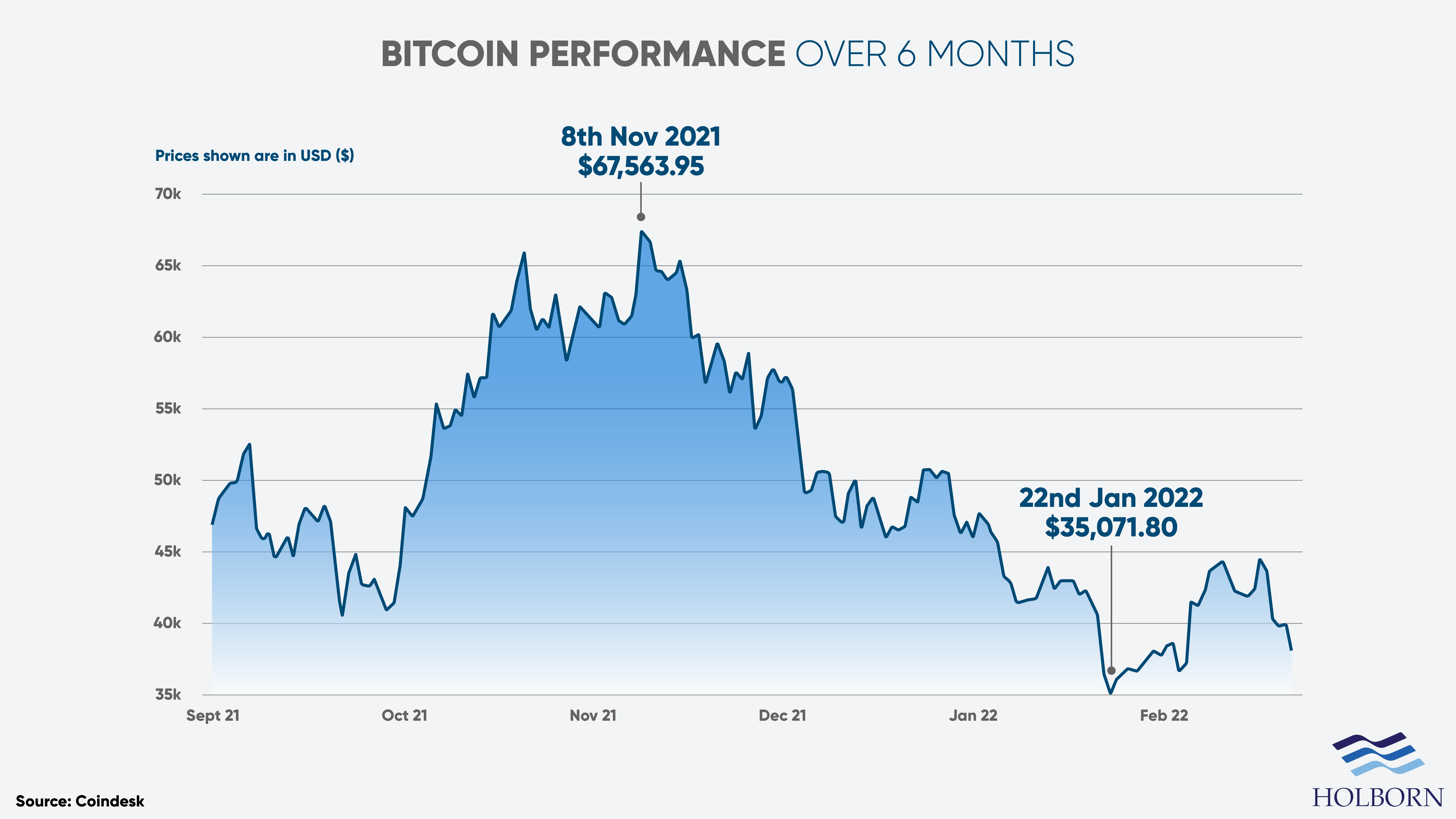

In 2010, a year after it launched, one Bitcoin would set you back around £0.05 ($0.08). Yes, you read that correctly, five pence. By November 2021, it had reached absurd prices, trading for a record high of nearly £51,000 ($67,000) per coin.

The excitement for investors didn’t last long. By February 2022, the price plummeted to just under £26,000 ($35,000). In the space of three months, investors in the coin saw the value of their digital assets drop by 50%.

The chart below shows just how erratic the price of Bitcoin is.

Why has the Bitcoin price dropped?

There are a lot of factors that can affect cryptocurrency investments and their value. A simple tweet by Elon Musk can either send the price soaring or cause it to tumble.

One of the main things linked to the recent decline is a move by the U.S. to regulate digital assets. Remember, crypto is just like any other asset of the stock market. If there is new regulation and uncertainty, the markets react to it in the short term.

It’s also worth noting that Bitcoin and the broader crypto market tend to follow similar trends we see in the stock market. So, when there is a fall in the financial markets, crypto also drops.

The Dow Jones, S&P 500 and Nasdaq all took a hit at the start of the year before rebounding. We are now seeing a similar trend with Bitcoin.

While it plummeted to just under £26,000 a coin in January, it had picked up by February, peaking at nearly £33,000.

Cryptocurrency risks: what you need to know before you invest

If it wasn’t clear already, the biggest risk to be aware of is just how volatile crypto is.

Another concern is the potential for hacks. A report by Chainalysis found that roughly $3.2 billion (£2.35 billion) of cryptocurrency was stolen in 2021, an increase of 516% from 2020.

There are measures people use to protect their coins, such as using a cold wallet. Otherwise known as a hardware wallet or cold storage, a cold wallet allows you to take your coins offline.

They are similar to using a USB stick and can help protect your crypto from online attacks. However, there are also drawbacks to using this method.

Is there an alternative currency?

As we mentioned at the top of this article, thousands of coins exist on the crypto market.

When it comes to crypto investing, research is essential. Some coins are here one minute and gone the next.

According to Forbes, Bitcoin is by far the biggest based on the total value of the coins in circulation. Still, there are alternatives to consider, such as:

- Bitcoin (BTC) – Market cap: Over $730 billion

- Ethereum (ETH) – Market cap: Over $327 billion

- Tether (USDT) – Market cap: Over $78 billion

- Binance Coin (BNB) – Market cap: Over $63 billion

- U.S. Dollar Coin (USDC) – Market cap: Over $50 billion

Building a diverse investment portfolio

There is a level of risk tied to any investment, and crypto is no different. However, cryptocurrency-related investments may not be for everyone depending on their risk tolerance.

Whatever your investment strategy, building a diverse investment portfolio is essential. With the right mix of assets, crypto can certainly help to form part of a profitable portfolio.

Speaking with an expert can help you put together a plan that gives you the best possible chance of reaching your financial goals.

Holborn Assets has worked with clients to build successful portfolios tailored to their needs and goals for more than two decades.

To find out how we can help you, contact us using the form below.