If you have recently looked at houses for sale in the UK, you will have noticed one thing – the price.

Once again, the property market has shown its resilience.

Following the pandemic, properties across the UK have soared in value. While the south used to reign supreme when it came to house price growth, it seems the north has stolen the crown.

In this article, we look at the shrinking north-south property divide and why it could be good news for investors.

Houses for sale – at a price

The value of assets such as stocks and shares took a hit during the pandemic. Property, on the other hand, held its value.

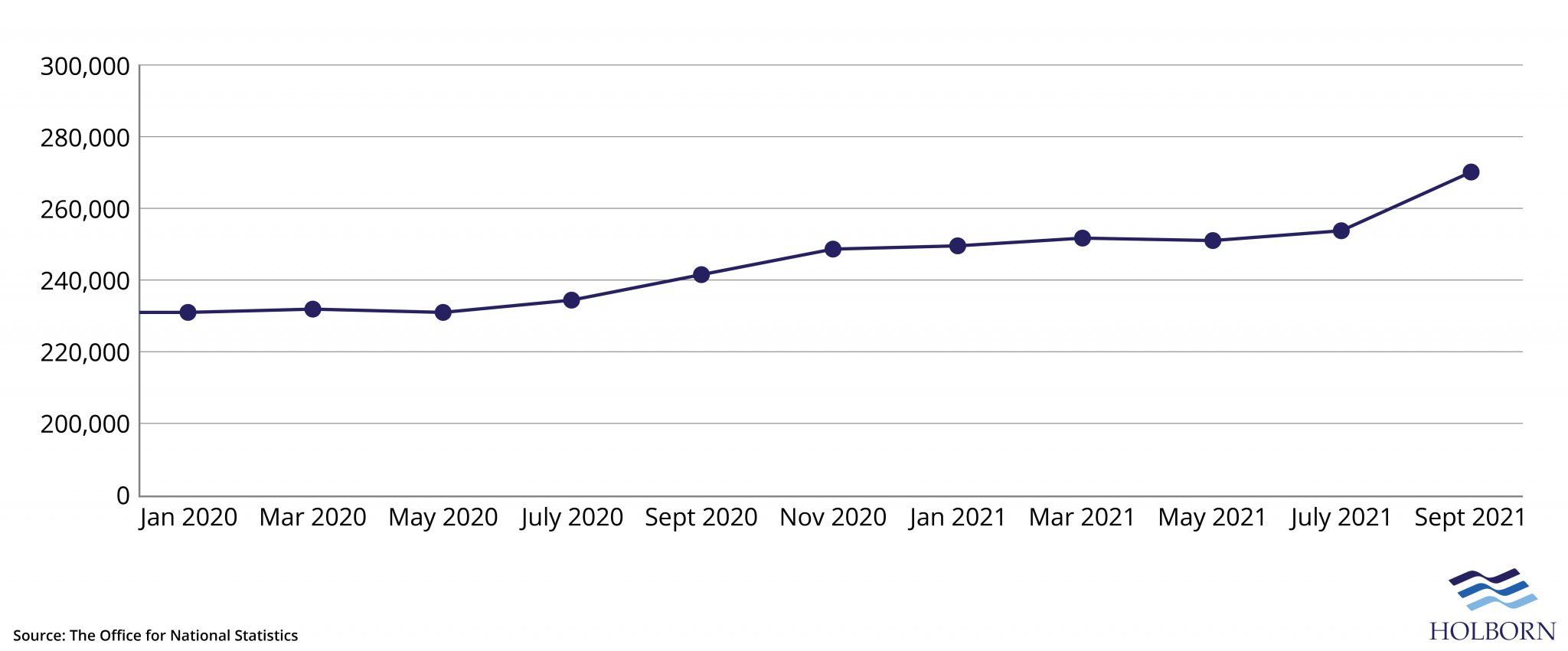

Data from the ONS shows the average property price when the UK entered lockdown in March 2020 was nearly £233,000. Despite a few minor dips and increases, prices held steady over the next few months.

However, it was around June when the UK prepared to lift restrictions that prices soared.

The latest figures for September 2021 reveal that the average UK house price is now at a record high of £270,000.

The figures represent a 14.7% increase in 18 months, and experts predict that the upward trend will continue.

Future forecast

The strong growth we have seen in 2021 is expected to continue into 2022, according to Savills.

The property group predict that prices will grow by 3.5% next year. Long-term, it seems to be the same story, with total growth by 2025 is expected to reach 21.5%.

High demand but fewer houses for sale is one of the contributing factors for the predicted increase.

What is interesting is how quickly the north is closing the gap on the south. If we look at the data, it’s easy to see why investors are moving away from the capital and looking at property in other regions.

The north-south divide

While houses for sale in London are some of the most expensive in the country, the capital actually has the lowest annual growth.

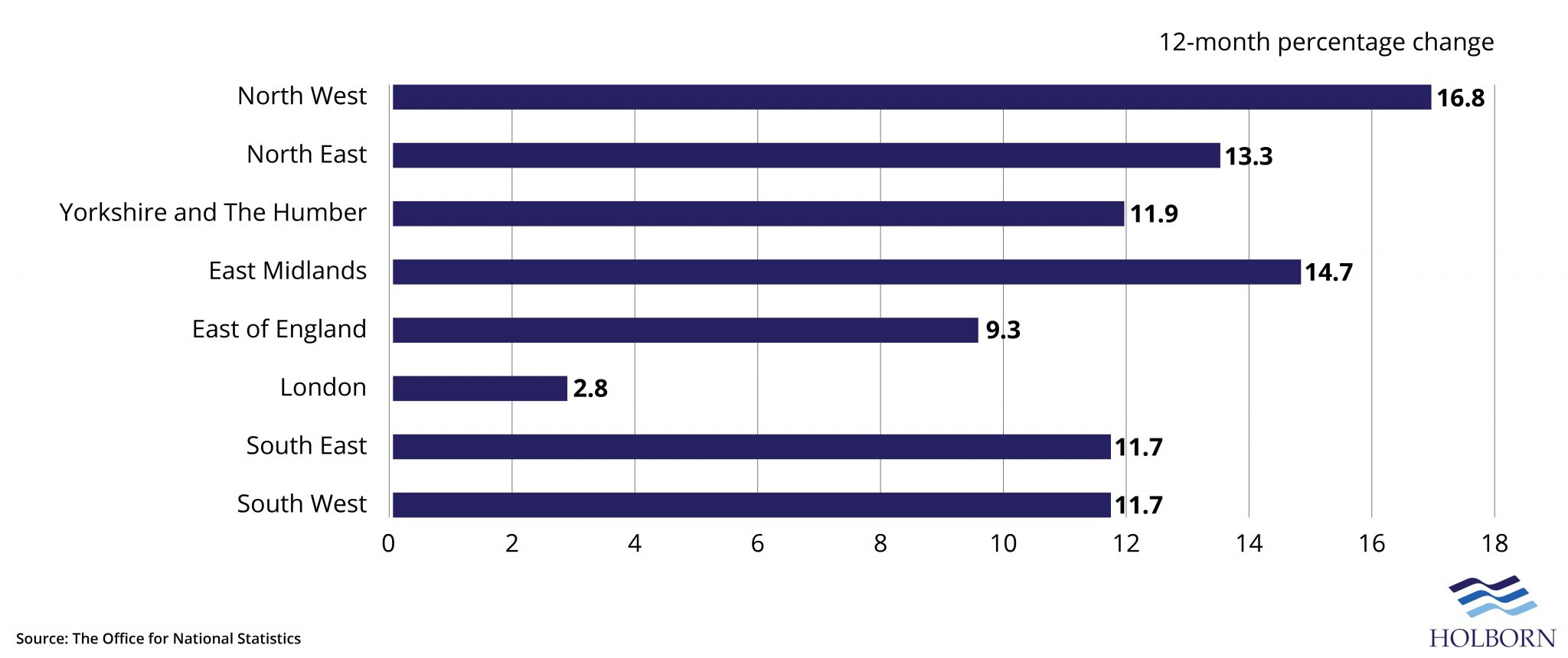

The latest ONS UK House Price Index shows just how far behind the capital is in terms of annual growth.

In the year to September 2021, London saw house prices increase by 2.8%. On the other end of the scale, the North West saw average prices rise by 16.8%.

While the gap may be closing in terms of annual growth, there is still a considerable gap in property prices between London and other regions.

The average property price in the North West, the region with the highest annual growth, is around £233,000. Although London saw significantly less annual growth, the average property price in the capital is just over £675,000.

However, Savills expects regions in the north of England to continue outperforming London and the south in terms of annual growth.

Over the next five years, prices in the North West and Yorkshire are expected to rise by 18.8%. In London, an increase of 5.6% is expected over the same period.

Ultimately, this will see the gap in prices between the north and the south continue to decrease.

What this means for investors

As we mentioned, while property prices are lower in the north than in the south, regions in the north are seeing better annual growth.

For investors, this is an important metric as is it will determine their capital growth. In other words, the long-term return on your asset based on its increase in market value over time.

Of course, there are several factors to consider before investing. Still, if we look at capital growth alone, it’s hard to argue with the data.

Houses for sale in the north are increasing in cost, but they are still nowhere near the level of property prices in London and the south. For investors, this makes buying in those regions far more accessible without sacrificing returns.

For those looking to invest, now might be the right time.

In the UK, now is the prime time to borrow. The Bank of England (BoE) base rate is at a historic low of 0.1% in response to the pandemic. With the base rate near zero, interest rates on mortgages are incredibly favourable.

However, things are starting to change.

Forecasts suggest that the BoE will increase the base rate twice in 2022, ending the year at 0.5%. By the end of 2026, the base rate is expected to reach 1.5%. As a result, the cost of borrowing will increase.

Invest with confidence

The gap between the north and south in terms of property prices is shrinking. If we look at the five-year predictions, the trend looks set to continue.

Of course, this doesn’t make London and the south poor locations to invest. It just means that investors now have far more options, which is good news.

If you are considering adding property to your portfolio, speak to a professional.

At Holborn, we work with clients to secure property investments through a complete end-to-end service. We offer investment opportunities across the UK and internationally.

Because we work closely with some of the leading property developers, we can offer clients exclusive investment opportunities at competitive rates.

To find out how we can help you, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences