Buy-to-let investments: the outlook for 2022

Posted on: 7th September 2022 in

Mortgage & Property

The housing market in the UK has been booming, with average property values at an all-time high.

For years, rental property has been the go-to option for investors looking to put their money into bricks and mortar. However, tax changes in recent years have impacted returns.

So, with these changes, are buy-to-let investments still the best option?

In this article, we look at the pros and cons of buy-to-let in 2022. Let’s start by looking at how the UK property landscape currently looks.

At a glance: the UK housing market in 2022

Property has long been a staple asset in investment portfolios, and it’s easy to see why.

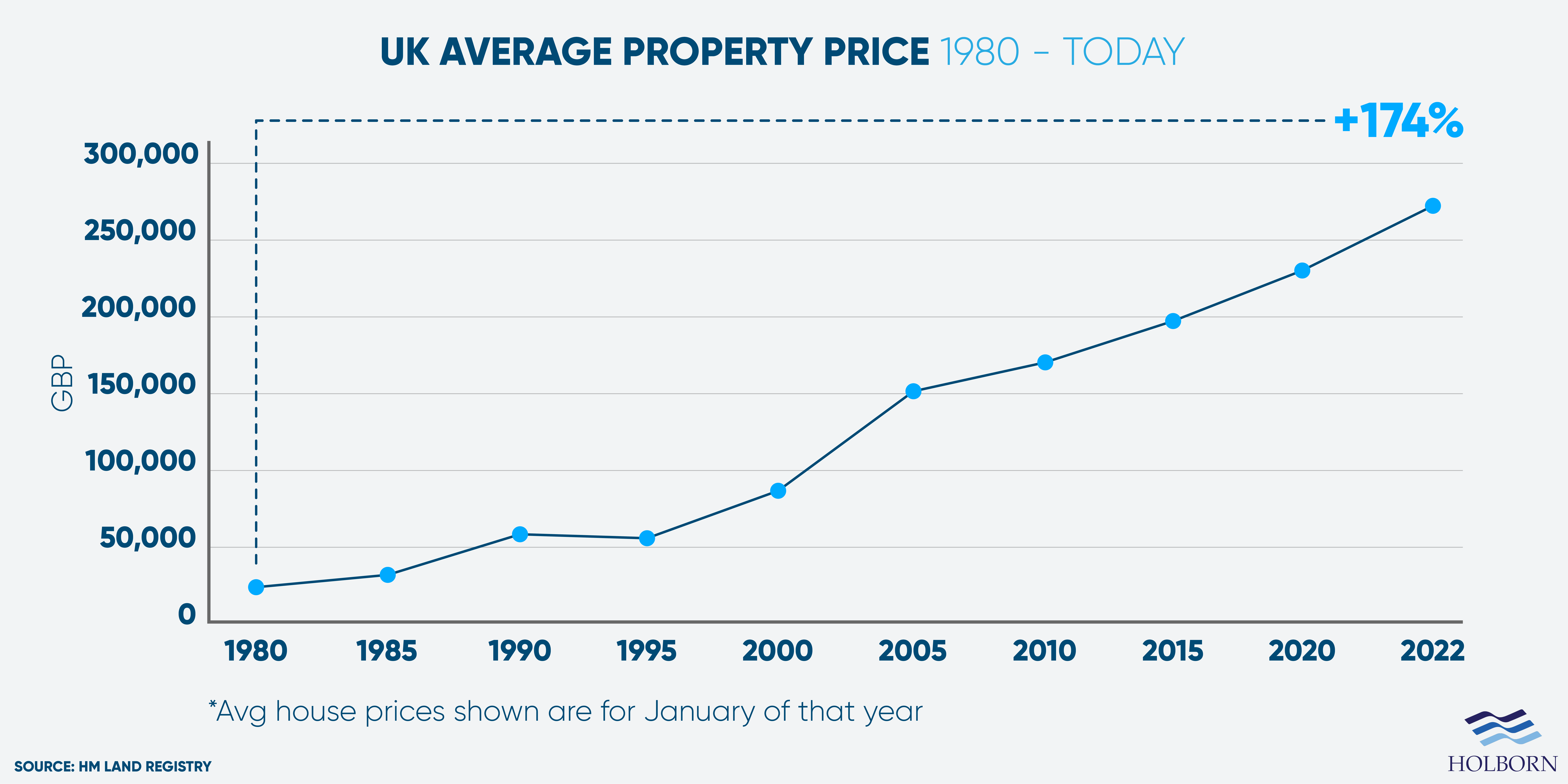

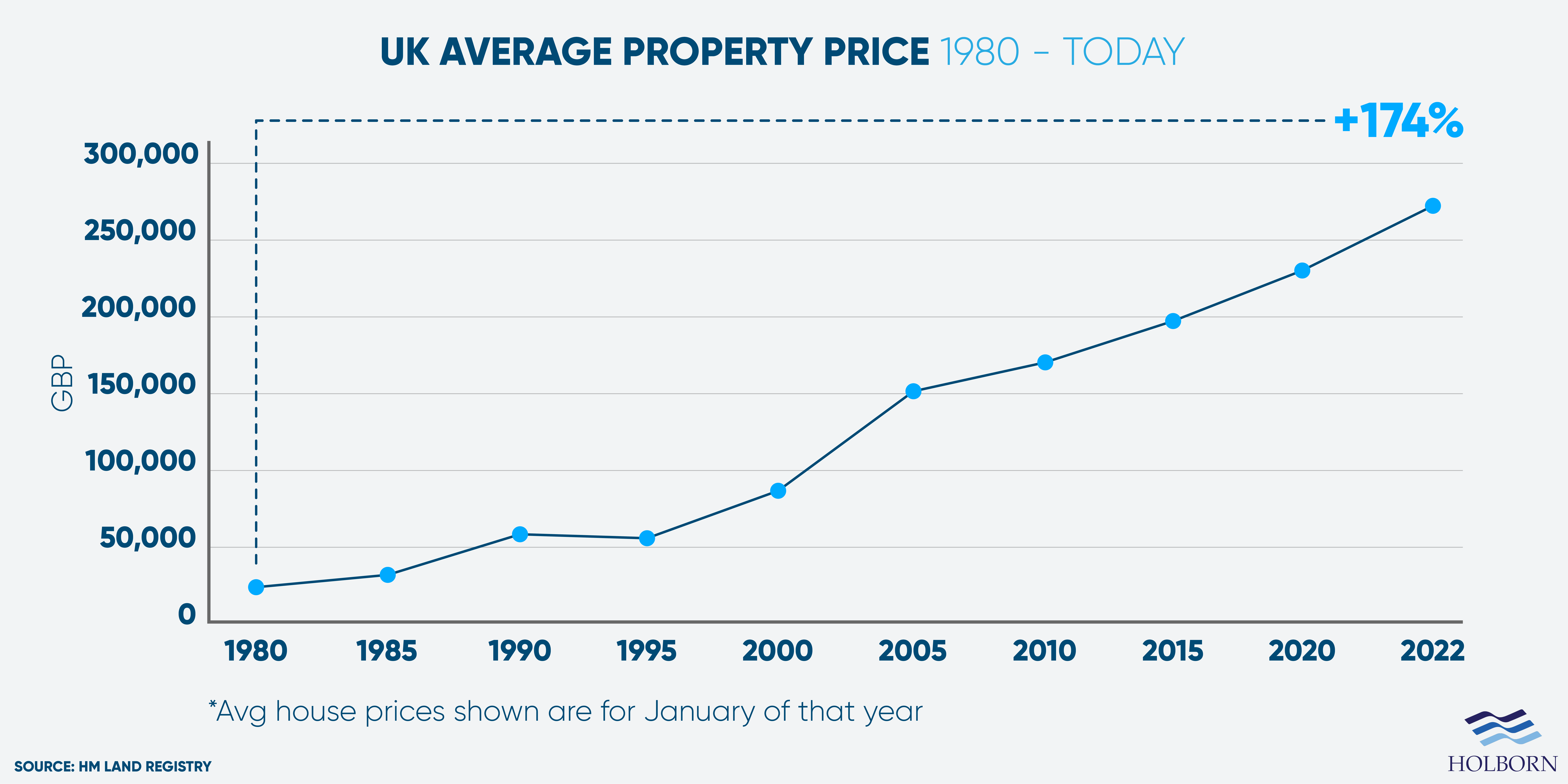

Data from the HM Land Registry reveals that UK property prices have soared over the last few decades.

In 1980, the average property price was a little under £20,000. In just 10 years, the average house price had almost tripled to £58,000. Since then, property price growth has exploded.

As of June 2022, the average house price across the UK is £286,397. The figures represent an increase of 7.8% compared to the previous year.

To put things into perspective, the deposits alone are higher now than the average house prices were in 1990. A report by Barclays found the average deposit for first-time buyers in 2021 was £61,000.

Although prices are expected to stabilise compared to recent times, the upward trend looks set to continue.

Savills Mainstream Residential Property Forecast expects growth to reach 7.5% by the end of 2022. The property experts forecast growth of 12.9% nationally over the next five years.

This gives us a good indication of where the UK property market is as a whole and where it is heading. However, the buy-to-let market is where most investors turn to when they want to put their money into real estate.

Buy-to-let demand

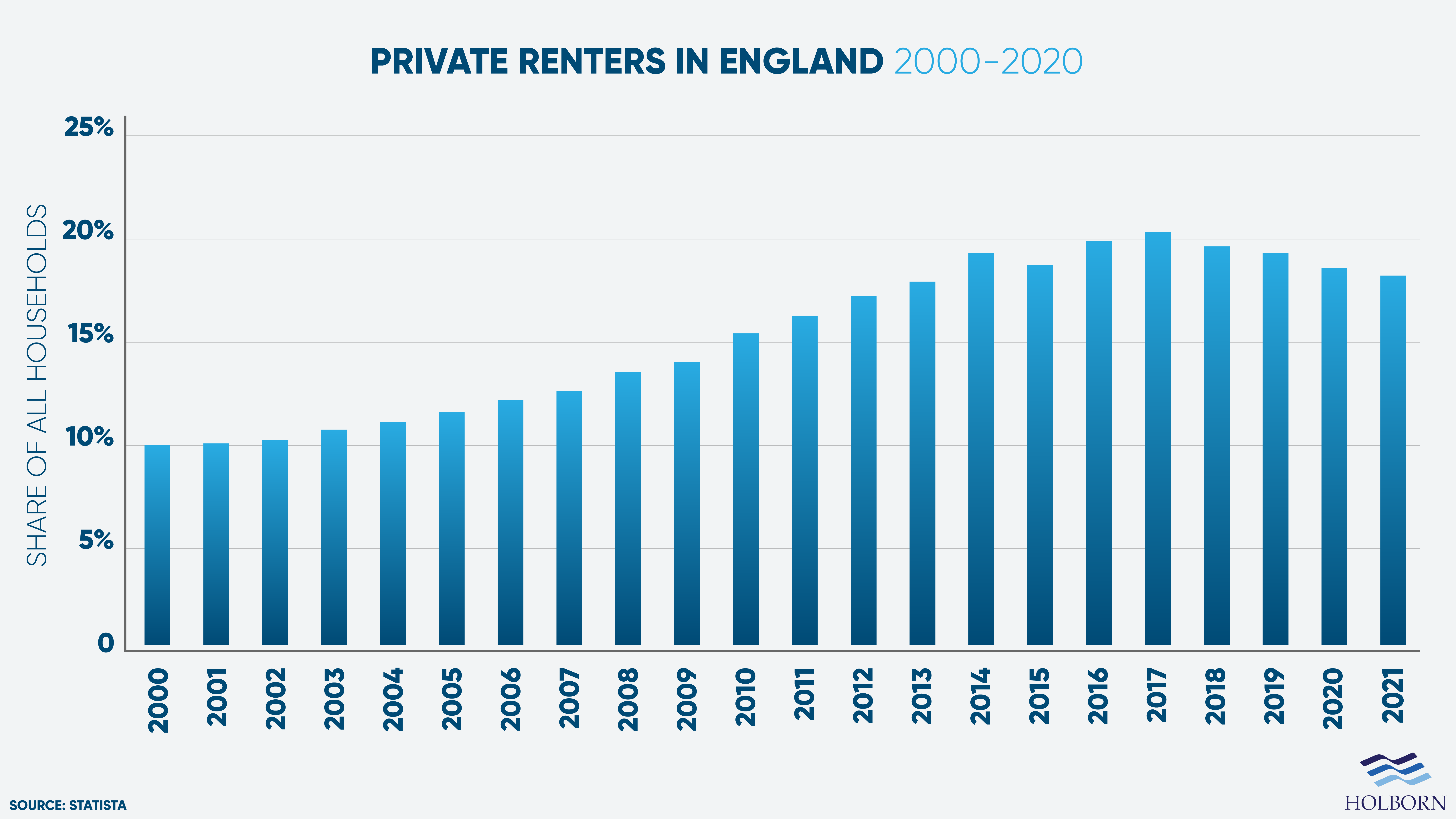

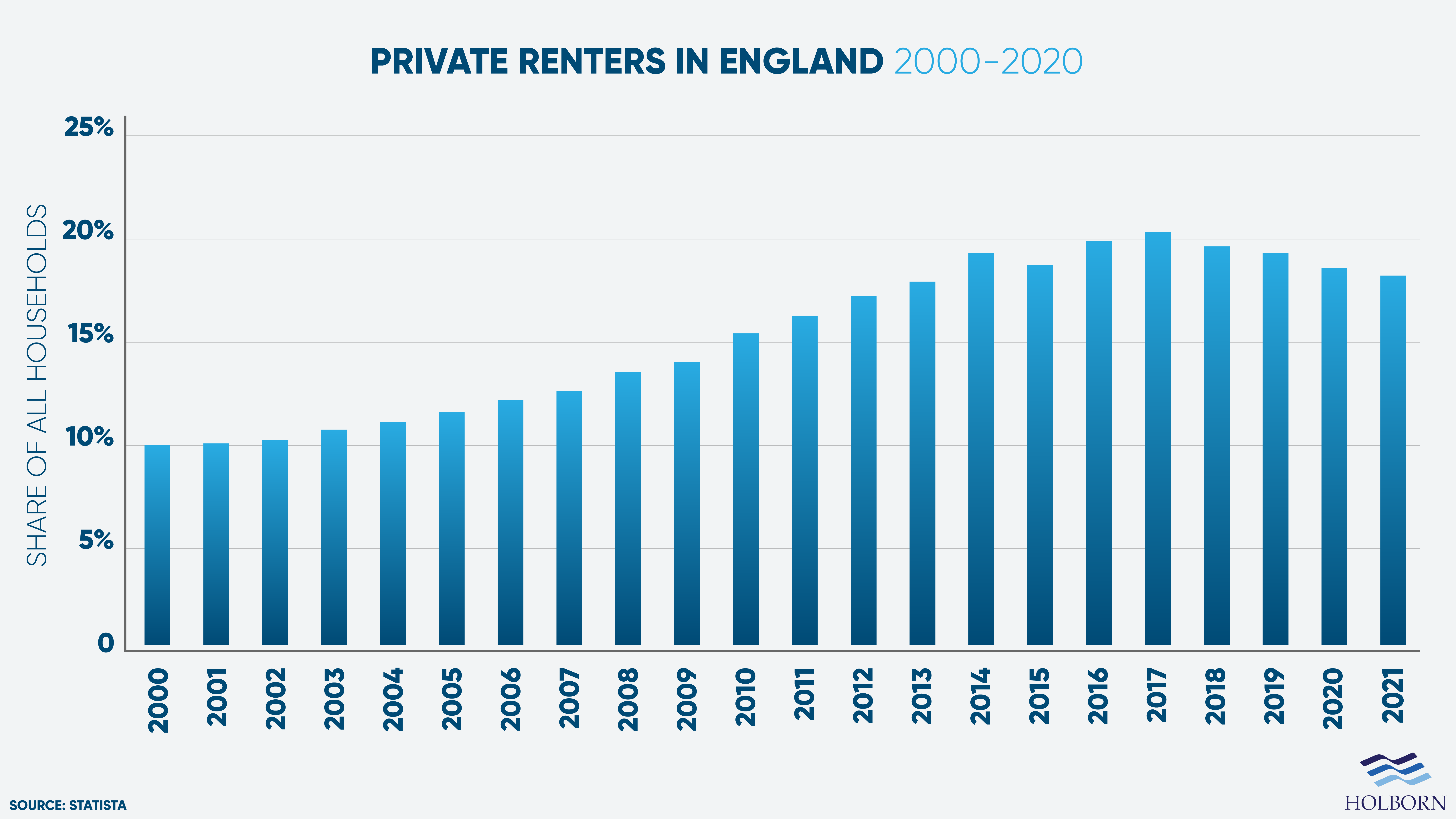

House prices in the UK have increased rapidly since the late 90s/early 2000s. With buying becoming increasingly unaffordable, the demand for rented homes has increased.

In 2000, 10% of all homes in England were privately rented. By 2017, the number of people privately renting over doubled to 20.3%. According to the latest figures, around 18.5% of all households in England are privately rented.

Despite a slight drop over the last few years, the demand remains.

Forecasts suggest that if the current growth rate continues, more homes will be needed to keep up with demand.

Findings by Capital Economics suggest that 1.8 million new homes are needed over the next decade to meet demand. That works out to 227,000 new homes per year.

With high demand and a strong rental market, it would seem that buy-to-let landlords are looking to capitalise.

The latest figures from Savills found that 36% more loans were granted for buy-to-let mortgages in May 2022 than the pre-pandemic monthly average.

What makes property a good investment?

Before investing in a buy-to-let property, it’s essential to under what makes it an attractive investment in the first place.

When it comes to generating a profit, there are two things to consider; rental returns and capital appreciation.

Rental yield percentage

The rental yield is the percentage of return you can make each year against the purchase price.

You can calculate rental yields in the following way:

- Add up the total amount you will receive in rental payments for the year

- Divide your yearly rental income figure by the amount you paid for the property

- Multiply that number by 100 to find out the yield percentage

Data from the Office for National Statistics (ONS) shows that rental prices increased by 3.2% across the UK in the 12 months to July 2022.

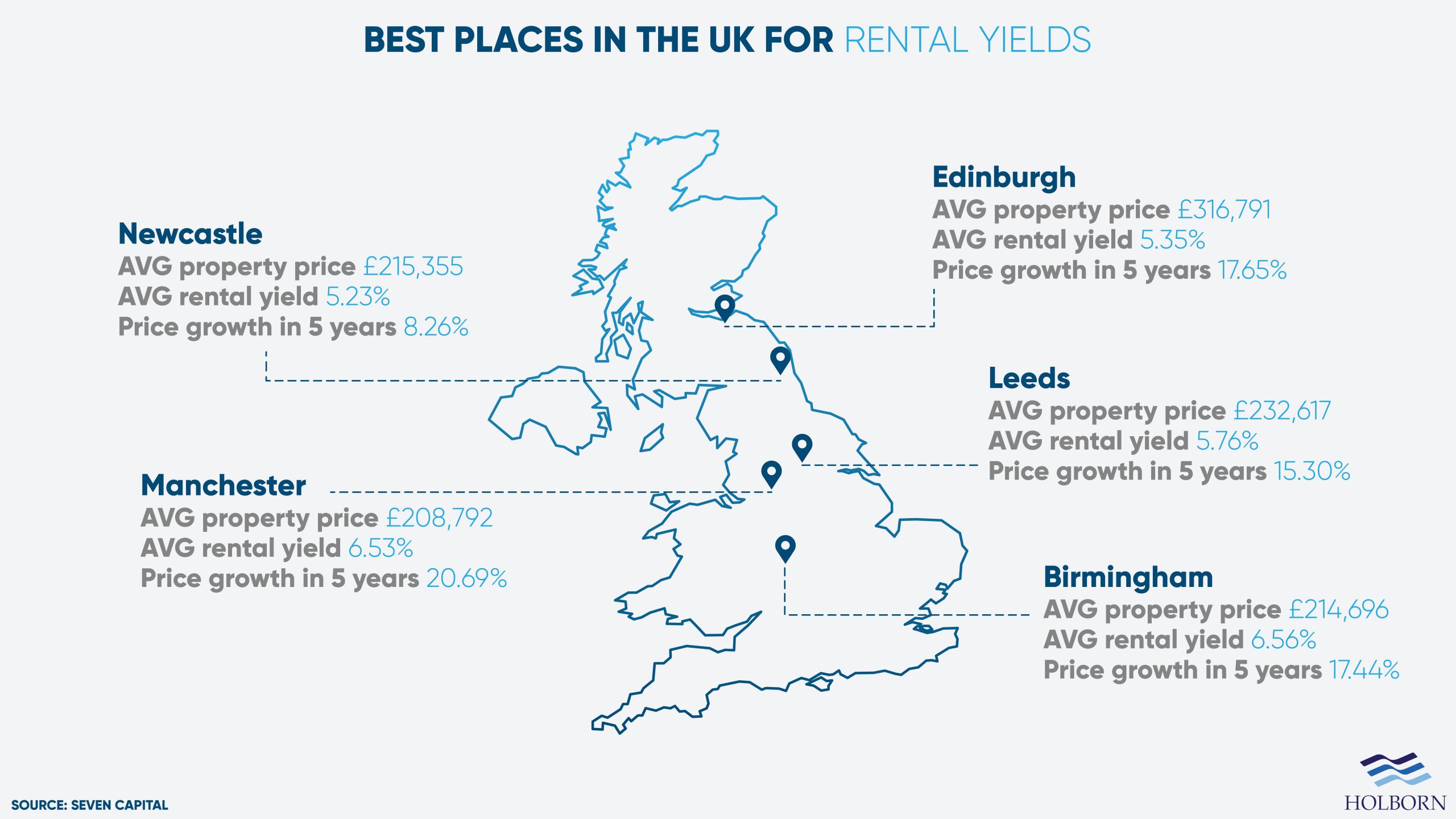

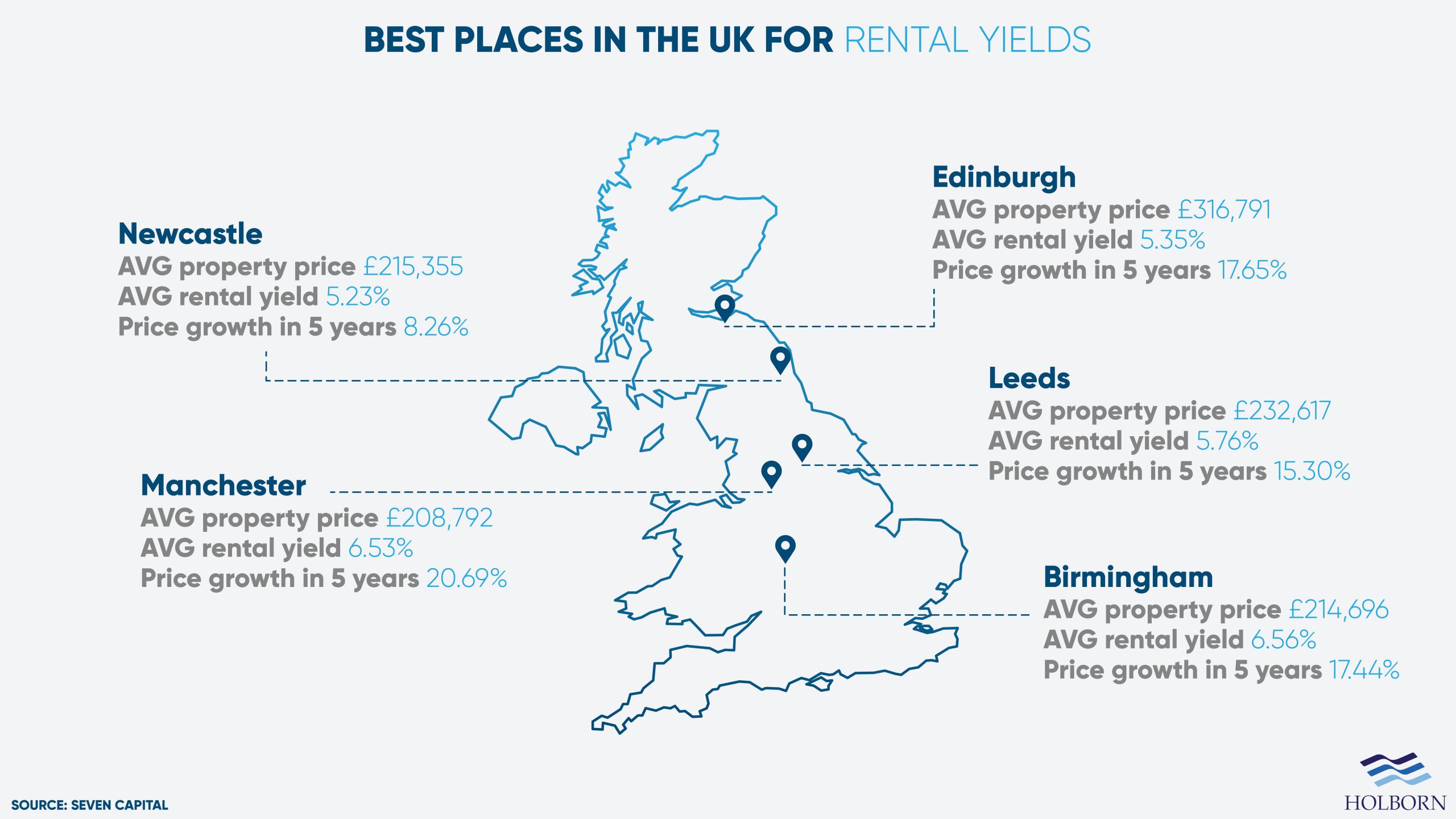

When it comes to rental yields, location is a significant factor.

A report by Seven Capital found that Birmingham had the highest average rental yields at 6.56%. This was closely followed by Manchester, where the average rental yields were 6.53%.

Not only do property investors need to factor in mortgage costs, but they also need to consider additional costs such as repairs and maintenance.

Be aware that rental income is subject to UK income tax. The tax rate is 20% for basic rate taxpayers and 40% for those on the higher rate.

Capital appreciation

Capital appreciation, otherwise known as capital gain, refers to the money you make on an asset as it increases in value over time.

For buy-to-let investors, it’s the property’s future value compared to the amount the investor paid.

When buying an investment property in the UK, you must understand the taxes that come with it. After all, these will offset any profits you make.

In 2016, the UK government introduced a stamp duty surcharge for anyone buying a second property. This directly had an impact on buy-to-let investment properties.

The stamp duty rate is tied to the property price and can range from 3% to 15%.

Property sales are also subject to capital gains tax at the following rates:

- 18% for basic rate taxpayers

- 28% for higher rate taxpayers

Landlords now have 60 days to report and pay any capital gains tax due on the sale of a property.

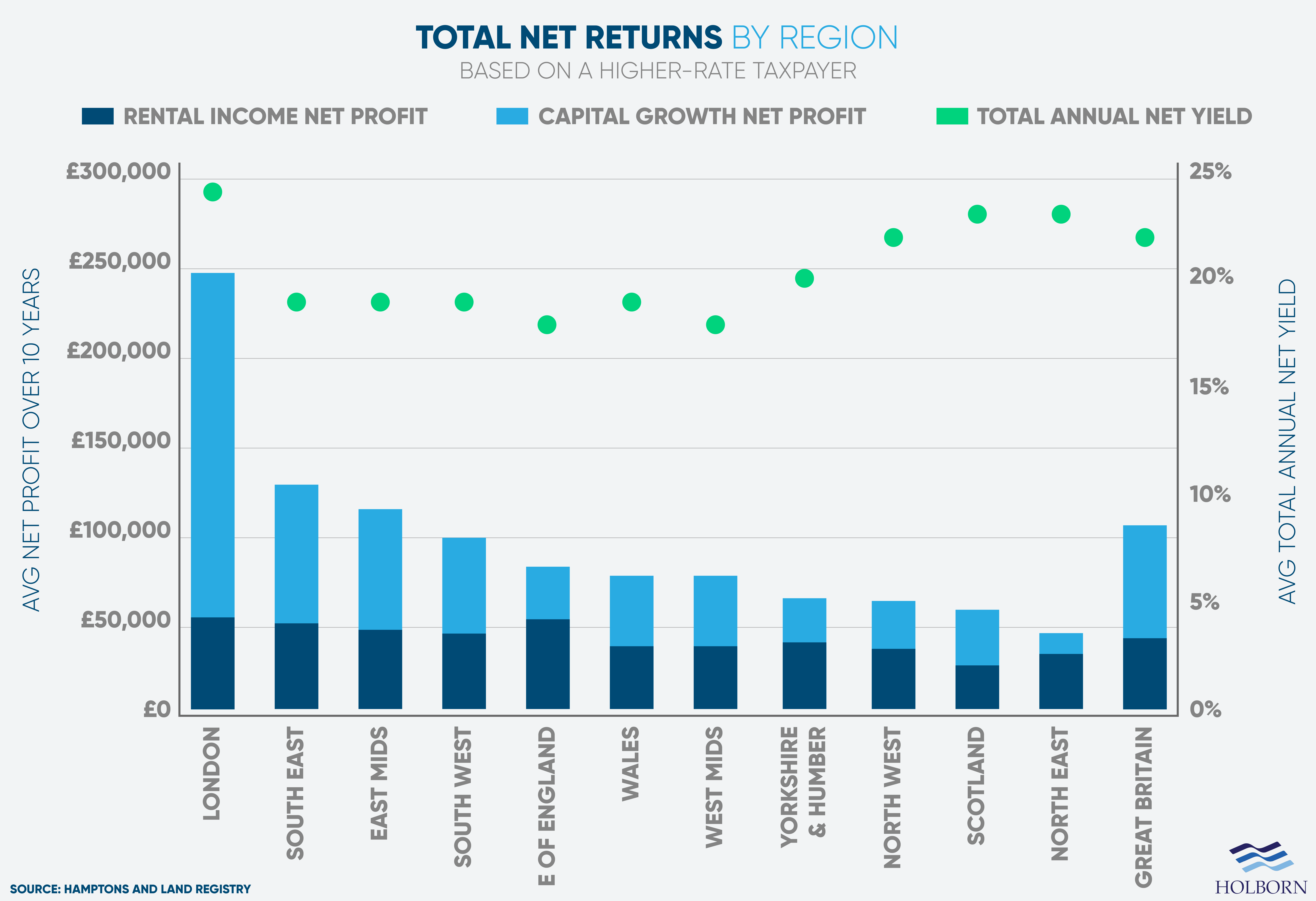

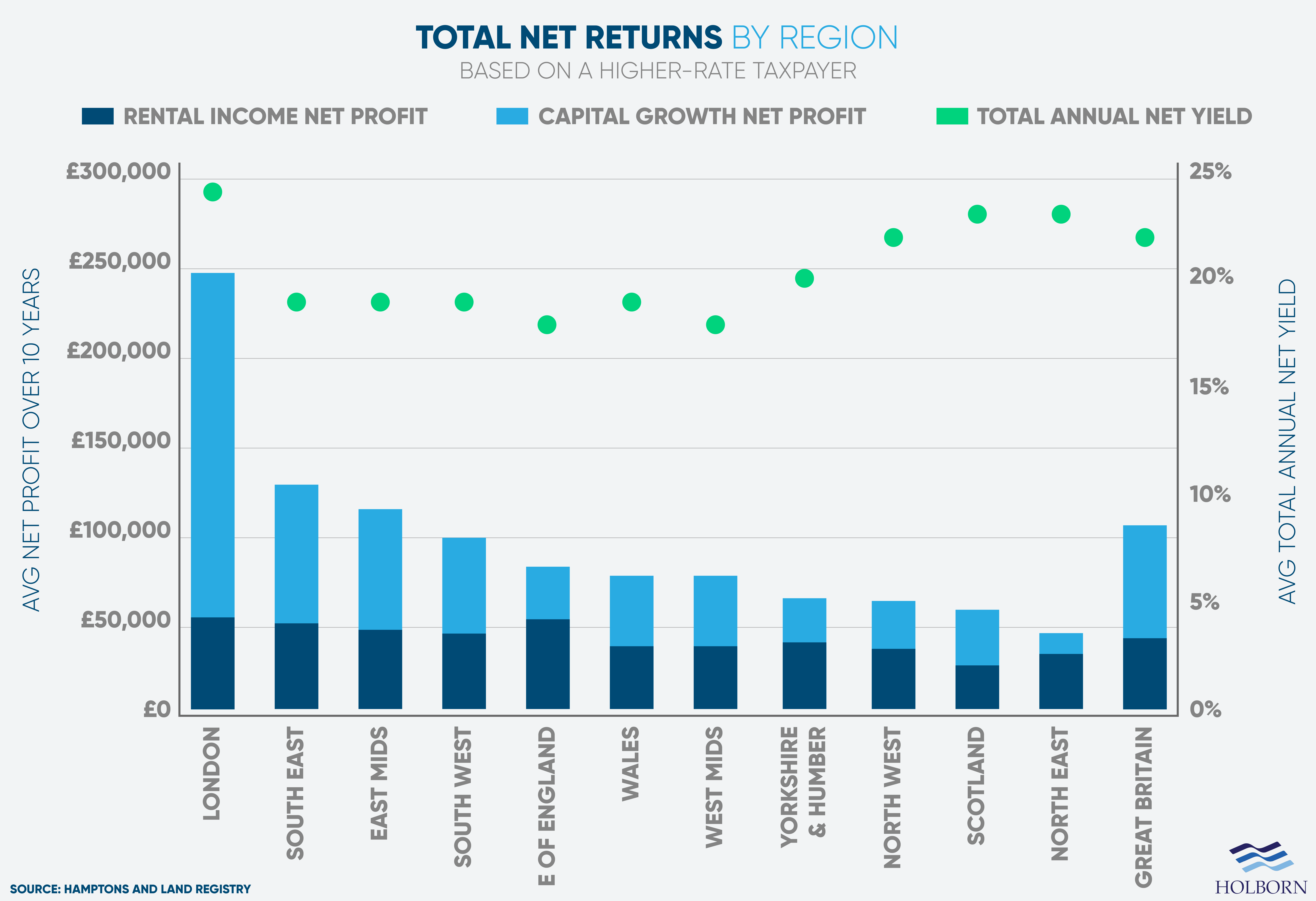

Despite the taxes associated with a buy-to-let property, landlords are still seeing good returns, according to research carried out by Hamptons.

Over 10 years, the average landlord paying the higher rate of tax saw a total net return of £105,500 – a 56% return. The figures represent a 225% return on the initial investment.

We can also see just how big of a factor capital growth is for overall returns. Rental income comprised 39% of the total gain, while 61% was due to capital growth.

Like rental yields, the way profits are generated is very much location-dependent.

London landlords saw the highest returns, with an average profit of £245,900. This amounts to a 244% return on investment over 10 years or 24% each year after costs and taxes.

However, rental yields in the capital are much weaker than in other parts of the UK. Only 23% of the profit came from rental income, while the rest was from capital growth.

Consider your options

In the current climate with soaring interest rates, people have needed to rethink their investment strategies.

Based on expert projections, there is no doubt that buy-to-let property investments are still a viable option in 2022 and beyond. The landscape may have changed, but property as an asset can still provide excellent long-term growth for investors.

Property as an asset is one way to diversify your portfolio. However, other options, such as investment funds, can also help to form your overall investment strategy.

If you are unsure what the best strategy is for you, speak to a professional.

Holborn Assets is a leading, award-winning financial service company. For over 20 years, we have provided wealth management solutions to clients, helping them reach their financial goals.

Contact us using the form below to find out how we can help you.