At the start of February, another high-profile company revealed its plans to split its stocks.

Alphabet, the parent company of Google, followed in the footsteps of Apple and Tesla, who both made similar moves back in 2020.

The company’s 20-for-1 stock split announcement made headlines worldwide, with Forbes describing the move as ‘historic’.

Despite the magnitude of the news, it may not be clear to the average investor what all of this means.

In this article, we take a closer look at stock splits, what they are and what they mean for new and current investors.

Stock splits explained

A stock split is when a company takes a single share with a high value and splits it into a larger number of additional shares with a lower value.

While the number of outstanding shares goes up and the price per share decreases, the value of your stake in the company doesn’t change.

For current shareholders, All that happens is their shares become diluted. How diluted depends on the type of split. Let’s use a 4-for-1 split as an example.

So, you own one share in a company worth $100, and they decide on a 4-for-1 stock split. What this means is your one share becomes four. The value remains at $100, but now you have four shares valued at $25 each.

Just as a board of directors can decide to increase the number of shares, they can also decrease them. This is known as a reverse split.

What is a reverse stock split?

A stock split is also known as a forward split. As you might expect, a reverse split is the opposite of this.

Usually, if a company announces a stock split, it’s a sign that they are doing well. However, a reverse split typically indicates that a company is in trouble.

A company will usually approve a reverse split when there is a major drop in its stock price. This dip in price can lead to a company being thrown off a stock exchange.

By enacting a reverse split, they reduce the number of stocks, but their price increases.

For those already invested, the overall value of their shares doesn’t change. Let’s use a 2-for-1 reverse stock split as an example to keep things simple.

If you had one share in a company worth $100, you would now have two shares worth $50 each. Still, if a company announces a reverse split, it should act as a red flag for investors.

Why do companies stock split?

There are several reasons why a company might choose to split stocks. However, the two main reasons are accessibility and liquidity.

In the case of big companies such as Alphabet and Apple, share prices can increase to the point where most people simply can’t afford them. Alphabet’s surprising 20-for-1 split announcement serves as a great example.

At the time of writing, one share in Alphabet will set investors back around $3,000. Following the split, the share price will drop to roughly $140 – a difference of 182%.

With the entry price lower, investing in a company becomes more accessible and appealing for individual investors.

Remember, with a company splits a stock, it’s not just the price that is affected; the number of individual shares also increases.

With more shares outstanding, their liquidity can increase as it is easier to trade. Buying and selling high-priced stocks is more of a challenge and can take longer.

How they affect new and existing investors

As an existing investor, nothing really changes. You may now have more shares, but their overall value remains the same.

Of course, the increased liquidity can make it easier if you either decide to sell or buy more shares.

For new investors, the benefit of stock splits is clear. A lower price per share makes investing in a company more accessible.

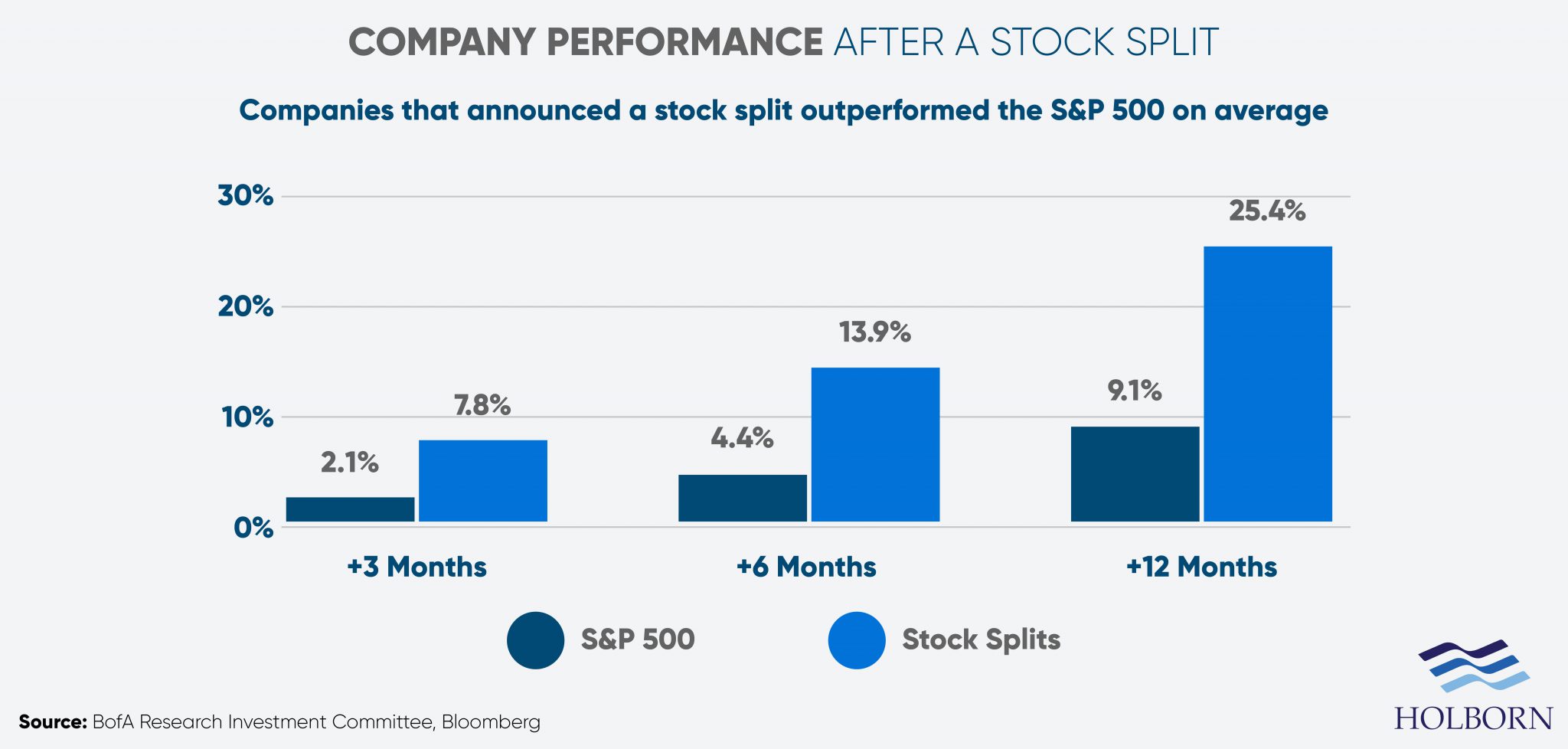

The party that stands to benefit the most is the company itself. According to data from Bank of America, companies that have announced stock splits have outperformed the market.

You could argue that as long as a company is growing and outperforming the market, it’s good news for those invested.

Investing with confidence

Investments are one of the core components for achieving financial freedom.

Whether you want to invest in property or company stocks, creating a diverse portfolio is essential. That means having the right strategy in place and picking assets that align with your goals, risk profile and personal circumstances.

For more than 20 years, we have successfully worked with clients to build robust portfolios. Our team of experts create tailored investment strategies designed around your needs and goals.

So, with Holborn Assets, you can be sure that your money is in safe hands.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences