Guide to financial freedom

Posted on: 11th September 2020 in

Financial Planning

Could you quit your job tomorrow and be financially stable without any income?

If the answer is no, you’re not alone.

According to the Royal Society of Arts (RSA), 25 million people in the UK are living paycheck to paycheck – that’s over a third of the population.

Being financially free, where money is no longer a source of stress, is an attainable goal for everyone. However, the figures suggest that saving is an issue for Brits, especially in the current climate.

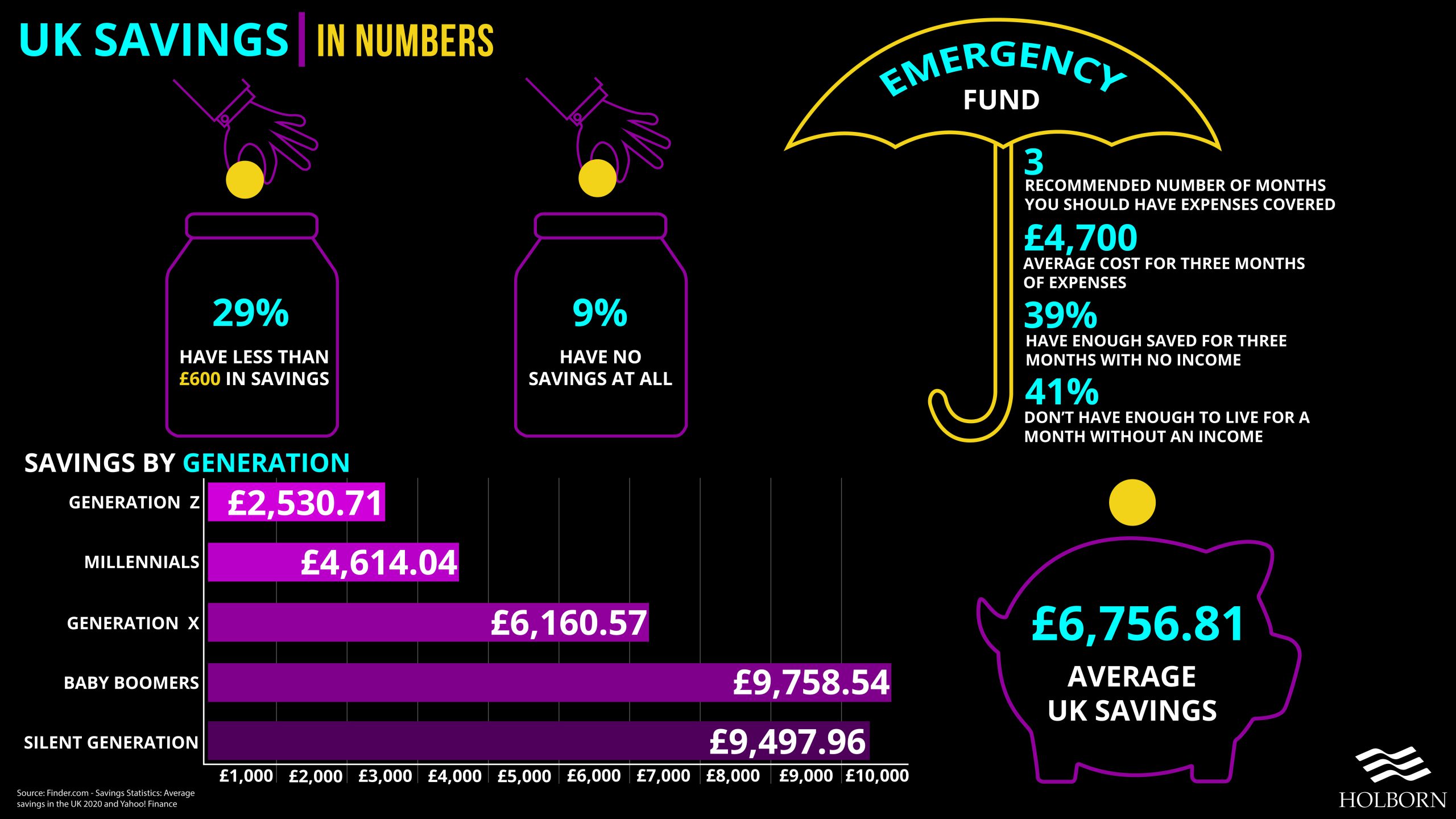

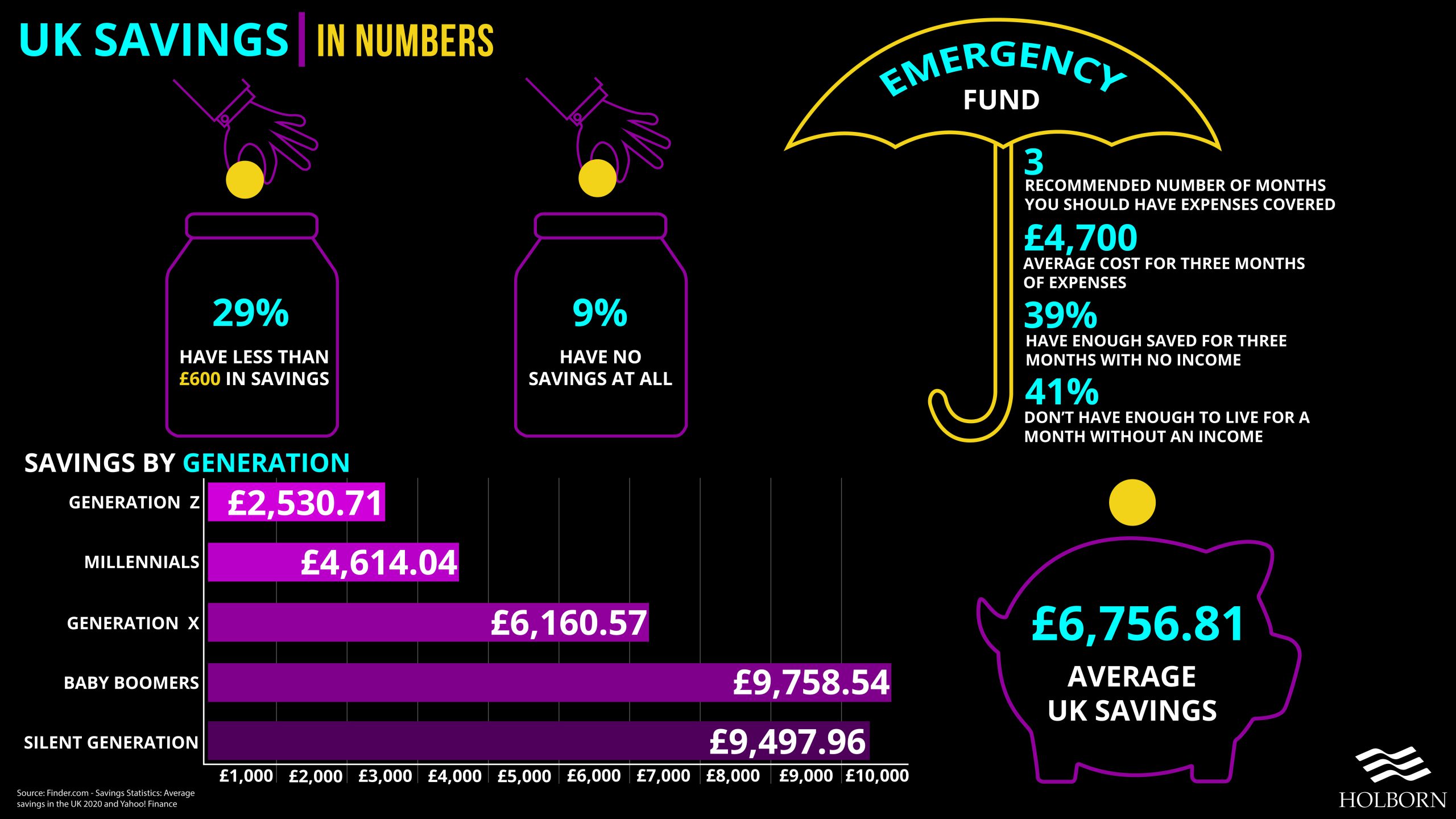

What the numbers say

Savings are one of the key components to achieving financial freedom. They can help you in an emergency and even help to secure your dream retirement.

Research by Finder suggests that when it comes to putting money aside, Brits are having trouble. One in ten have no savings at all.

The pandemic seems to have made the problem worse. The comparison site found that over a third of people (36%) dipped into their savings to support themselves during the lockdown.

A separate survey by Which? found retirees spend around £25,000 per year, per household on average. Looking at the numbers, many of us are ill-prepared for a financial emergency, let alone bigger financial milestones such as retirement.

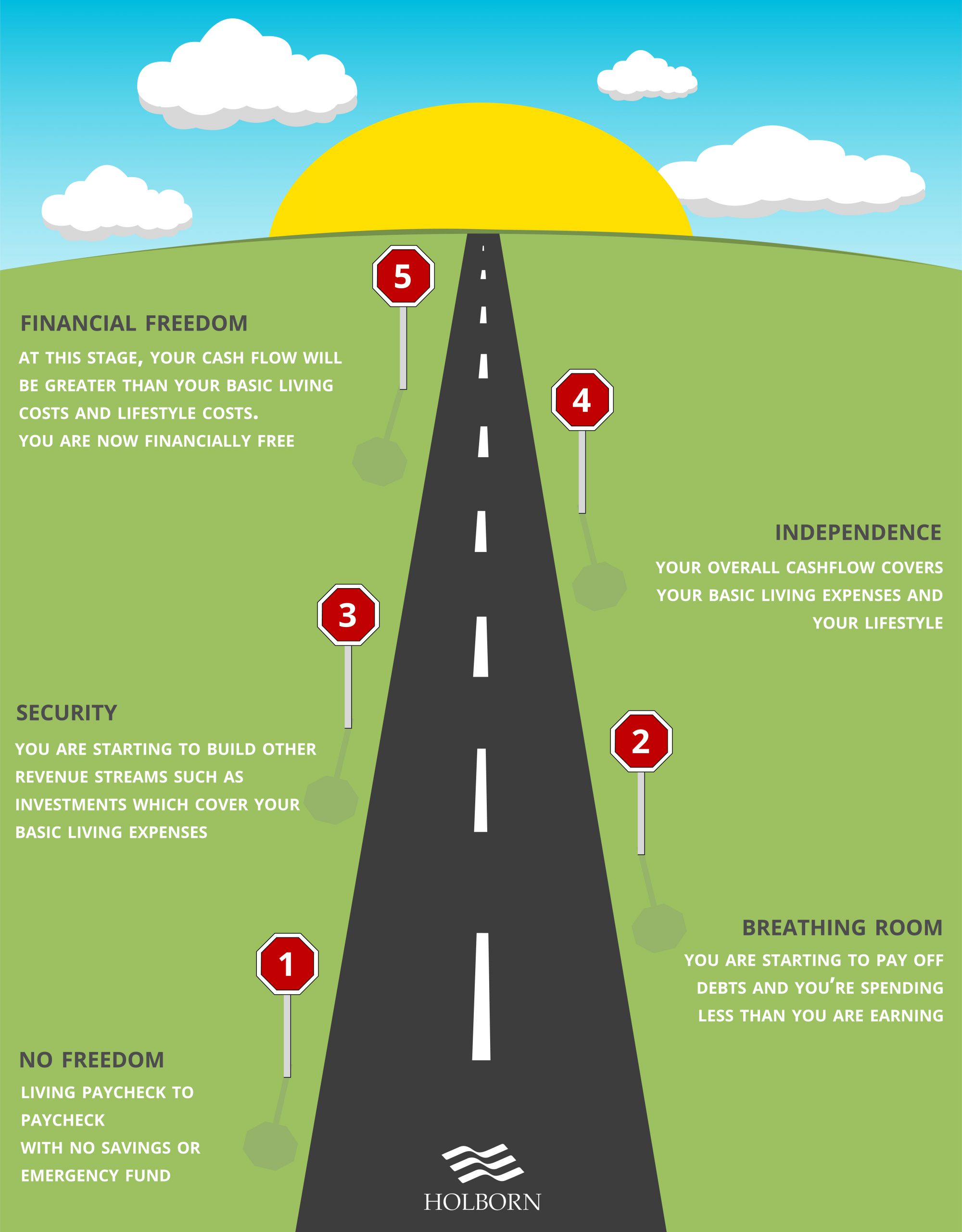

Being financially free isn’t as straightforward and clear cut as you are or you’re not. There are different stages along the road. Before you can get started, you need to know where you are right now.

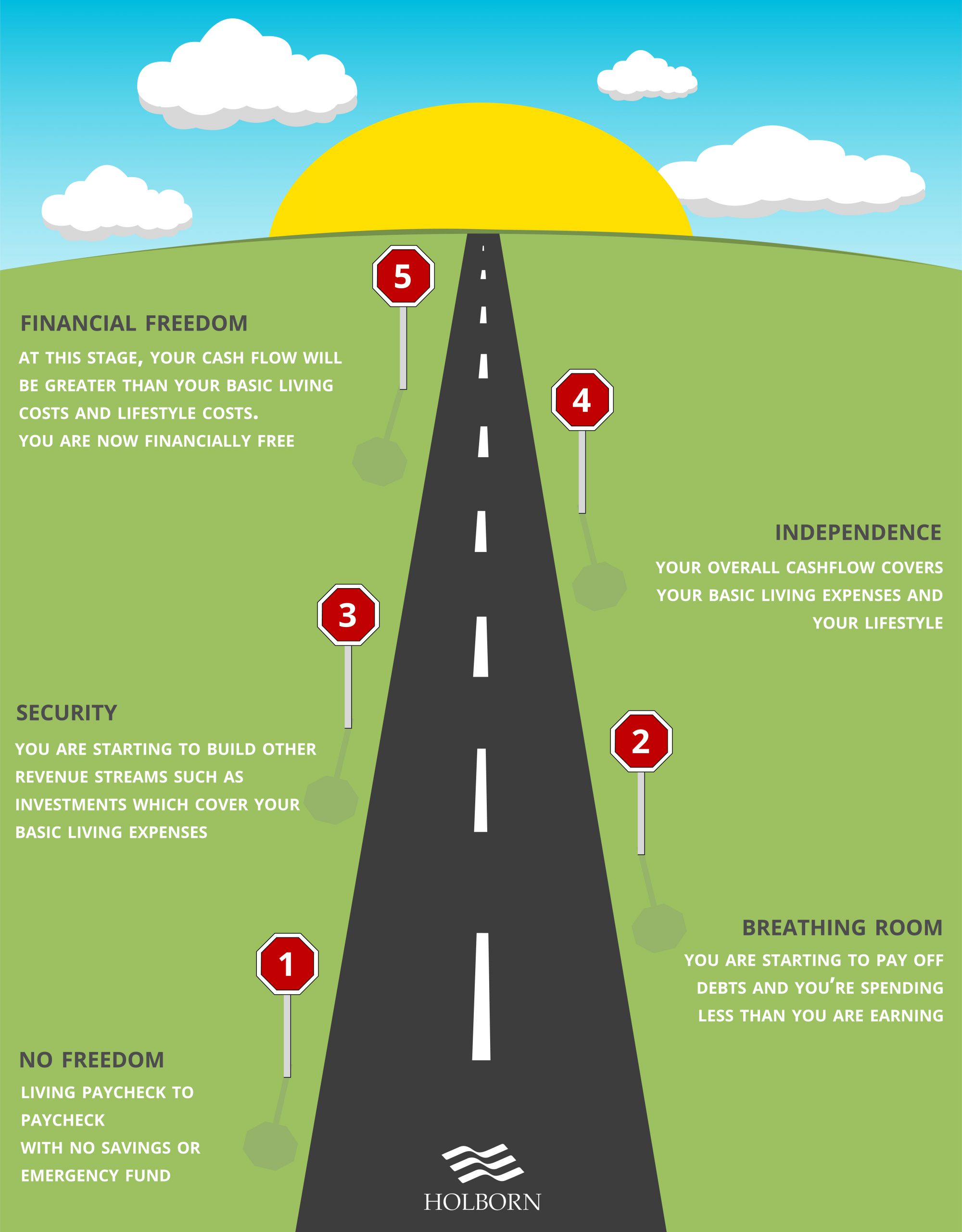

Stops on the road to freedom

Financial freedom doesn’t have to mean retiring early. It just means you have the independence to lead the life you want to without being burdened by money.

Ultimately, it’s about controlling your finances rather than them controlling you.

How much control you have based on your goals and current situation all determine how financially free you are.

Here are some of the stops on the road to financial freedom.

Steps towards financial freedom

The steps you take towards financial freedom all depend on where you are now, and where you want to be.

Besides winning the lottery jackpot or some other stroke of luck, there are no shortcuts to being financially free.

Here are our five steps to get you started on the road towards financial freedom.

Have a clear goal

Ask yourself a few questions.

What does it mean to you to be financially free? What are the long-term and short-term goals? The more specific you are with your goals, the better.

Now you know what you want to achieve, it’s time to get to work.

Strategy

It isn’t easy to save when you don’t know where your money is going.

Creating a budget paints a picture of how much money you have coming in each month versus how much is going out. A budget also helps to develop a routine of good spending/saving habits.

There are countless budgeting strategies; it’s about finding the right one for you. You could try bullet journals or using the 50/30/20. The 50/30/20 rule is straightforward. You use half of your income for bills and essentials, 30% of your salary goes to non-essentials, and you save 20%. Feel free to switch the ratios around to meet your goals.

Eliminate debt

Debt can be the biggest obstacle when it comes to saving or freeing up money.

Just like budgeting, there are several strategies to help eliminate debt. One that has proven to be effective is the snowball method. High-interest credit cards and loans should be a priority as they are the biggest drain on your finances.

Find the right strategy for you and aim to get yourself debt-free.

Save, invest and all the rest

Making your money work for you is fundamental to achieving financial freedom.

There are a seemingly endless number of savings products available in the market, so there is something for everyone. Make sure you do your research and make the most of products which support your goals and are the right fit based on your circumstances.

Investing is a great way to create an additional revenue stream and grow your money. Just remember, investing is a long-term strategy for building wealth.

Make sure you take full advantage of the power of compound interest. Compound interest can increase your wealth over time exponentially.

Go pro

We all need a helping hand sometimes. Having the right strategy in place can make all the difference, especially when it comes to investing and maximising your savings potential.

A financial adviser can help you with complex financial products and provide that extra help you need on your journey towards financial freedom.

Fulfilment

The road to financial freedom and what it means to be financially free is a very personal thing. Whether it’s retiring early or pursuing a career which you are truly passionate for, it’s about being fulfilled.

Achieving financial freedom is a realistic goal for anyone. For over 20 years, we have been helping people take control of their financial situation.

To find out how we can help you, contact us using the form below.

Your journey towards financial freedom starts here.