Analysing investment strategies: the 60/40 rule

Posted on: 20th October 2021 in

Investments

The 60/40 rule is a classic method used by investors for decades.

The trouble with classics is, they don’t always stand the test of time. Take tech as an example. Sure, the Walkman is remembered fondly by those who grew up in the 80s and 90s. Still, I don’t think many of us would take one over our Spotify accounts if we were honest.

However, investing is a different game. With that in mind, is the 60/40 doomed to the same fate of the Walkman?

In this article, we look at the concepts of the 60/40 rule and whether it is still a viable method for successful investing.

60/40 rule explained

On a basic level, investing is about generating high returns and keeping losses to a minimum.

Of course, anyone who invests knows that the process is anything but plain sailing. There will be rough waters, but that is just part of the process.

The trick is finding a strategy that balances risk and reward; this is where the 60/40 rule comes into play.

There are variations of this strategy, but at its core, 60% of your portfolio will consist of higher risk, higher return assets, while 40% will be lower risk, lower reward assets.

So, what type of assets typically fall into these two categories?

- Equities – high risk/high return

- Government bonds – low risk/low return

The idea is, your equity assets provide solid returns, while the bonds help to compensate for the volatility associated with equities.

Historical performance

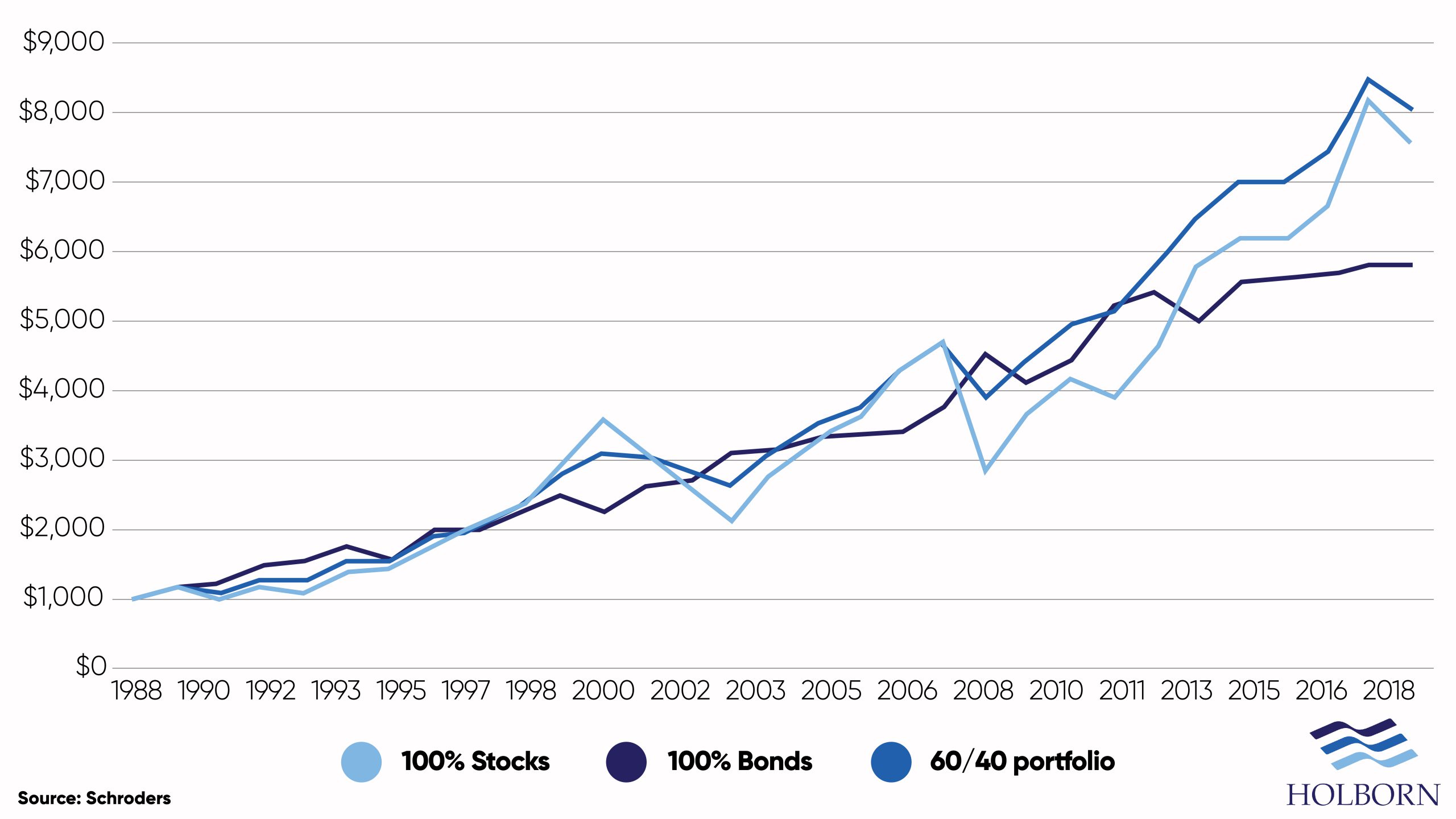

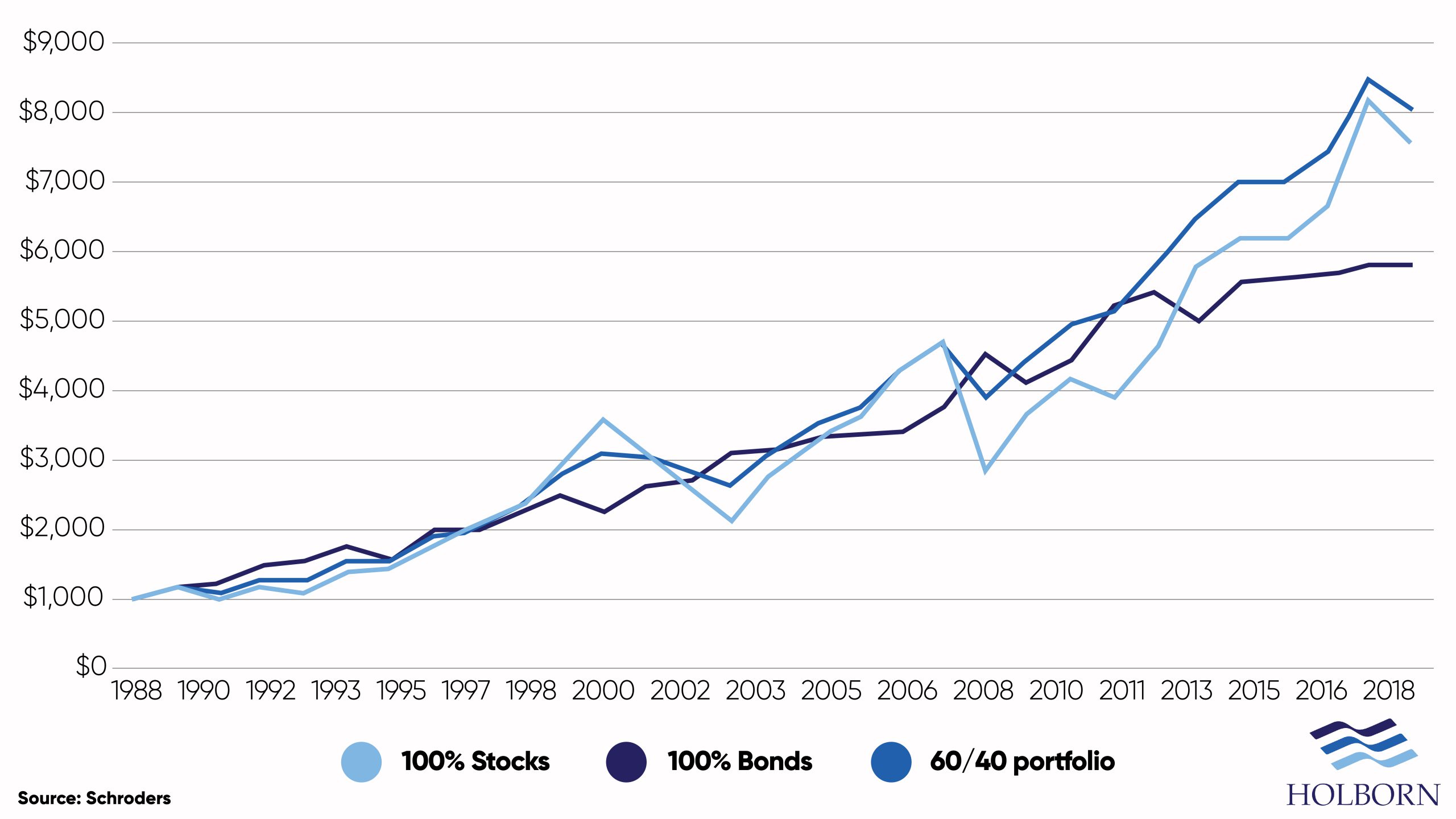

Calculations by Schroders demonstrate the effectiveness of the 60/40 rule.

The asset management firm looked at the historical performance over 30 years. Three portfolios, each with a $1,000 investment, were pitted against one another.

The three portfolios had $1,000 invested and consisted of 100% stocks, 100% bonds and a 60/40 split between the two. Here is what they found:

- 60% invested in stocks, 40% invested in bonds now = $8,091 – an annual return of 7.5%

- 100% invested in stocks now = $7,554 – an annual return of 7.2%

- 100% invested in bonds now = $5,806 – an annual return of 6.2%

Past performance is one thing, but that doesn’t mean the 60/40 approach is still a viable option. Times have changed since 2018 – a lot.

60/40 rule: a dated strategy or ageless approach?

Research from Vanguard confirmed that bonds play an increasing role in stabilising a portfolio the longer equities decline.

However, their findings revealed there are times when the inverse nature of bonds and equities changes.

During the pandemic, we saw a period where bonds and equities both fell together. It should be noted that Vanguard’s research found that this type of situation only happens around 30% of the time.

Despite these types of occurrences, the impact is only short-term. Once the markets recover, the inharmonious relationship between the two assets is restored.

However, times are changing, and some experts believe that the 60/40 rule has had its day.

According to BlackRock strategists, the 60/40 approach could increase risk. BlackRock also warned that a 60/40 portfolio would likely see lower returns than it had in the previous decade.

Branching out with Holborn

Back to our original question; is the 60/40 rule still a viable option for those looking to invest? The answer is, it depends.

The concepts that underpin the strategy are undoubtedly sound. Asset allocation is a crucial part of building a successful portfolio. The way you allocate those assets, however, is what will differ between investors.

Your appetite for risk, financial goals and a whole host of other factors play a part in finding the right strategy. Reviewing and rebalancing your portfolio is also a crucial part of a sound investment strategy.

Whether you are looking to use the 60/40 rule (or a modified version of it) or explore other strategies, speaking with an expert is a great place to start.

At Holborn Assets, we have more than two decades worth of experience managing profitable portfolios for our clients. We build bespoke strategies designed around you and your goals.

Contact us using the form below and find out how we can help you build a better financial future.