Non-Fungible Tokens: The Future of Investing?

Posted on: 10th March 2021 in

Investments

From artwork to rare trading cards, investors and collectors are trying to get their hands on the latest items, which are selling like hotcakes.

Some are even paying hundreds of thousands, even millions, to secure these coveted items. But there is a catch (kind of).

You can’t hang this art on your wall, and you can’t touch these collectables. In fact, they don’t even exist in our physical world.

Welcome to the bizarre world of non-fungible tokens, otherwise known NFTs or ‘nifties’.

What are NFTs?

Non-fungible tokens are digital assets found on a blockchain, a decentralised digital ledger.

Currently, NFTs typically include digital artwork and trading cards. In reality, they can be anything, even virtual real estate.

Although Bitcoin and NFTs are both blockchain-based assets, it’s important not to get the two confused.

Bitcoin, like traditional currencies, is fungible. What this means is, your Bitcoin is worth the same as someone else’s. Your pound is worth the same as someone else’s pound. You get the idea.

NFTs, as the name suggests, are the opposite or non-fungible. You couldn’t exchange one NFT for another because both will hold a different value.

When it comes to digital items, authenticity could be a concern. After all, what’s to stop someone from cloning a piece of digital artwork and passing it off as an original?

That’s where the blockchain comes in.

A link in the chain

A blockchain is essentially a list that records transactions, with each transaction forming a new link in the chain.

Every NFT contains a unique token that the blockchain uses to authenticate an item and ownership. The movement of this token is what forms the links in the chain.

Think of the token as a seat on a plane. When you book a flight, the ticket is registered in your name, and only you can use that ticket.

However, you can amend the details if you would like to transfer that ticket to someone else. Now only they would be able to use that ticket to travel. Either way, there is one ticket, meaning only one person can use it.

If we apply that analogy to non-fungible tokens, the same logic applies.

When the artist creates the piece, they generate a token which only they have. They sell the artwork to Adam, who then gets the token.

At the same time, Nick tries to sell the same piece to a collector. Identifying Nick’s artwork as counterfeit would be easy because there is no link in the chain between Adam and Nick.

Being able to authenticate NFTs in this way ultimately protects their value.

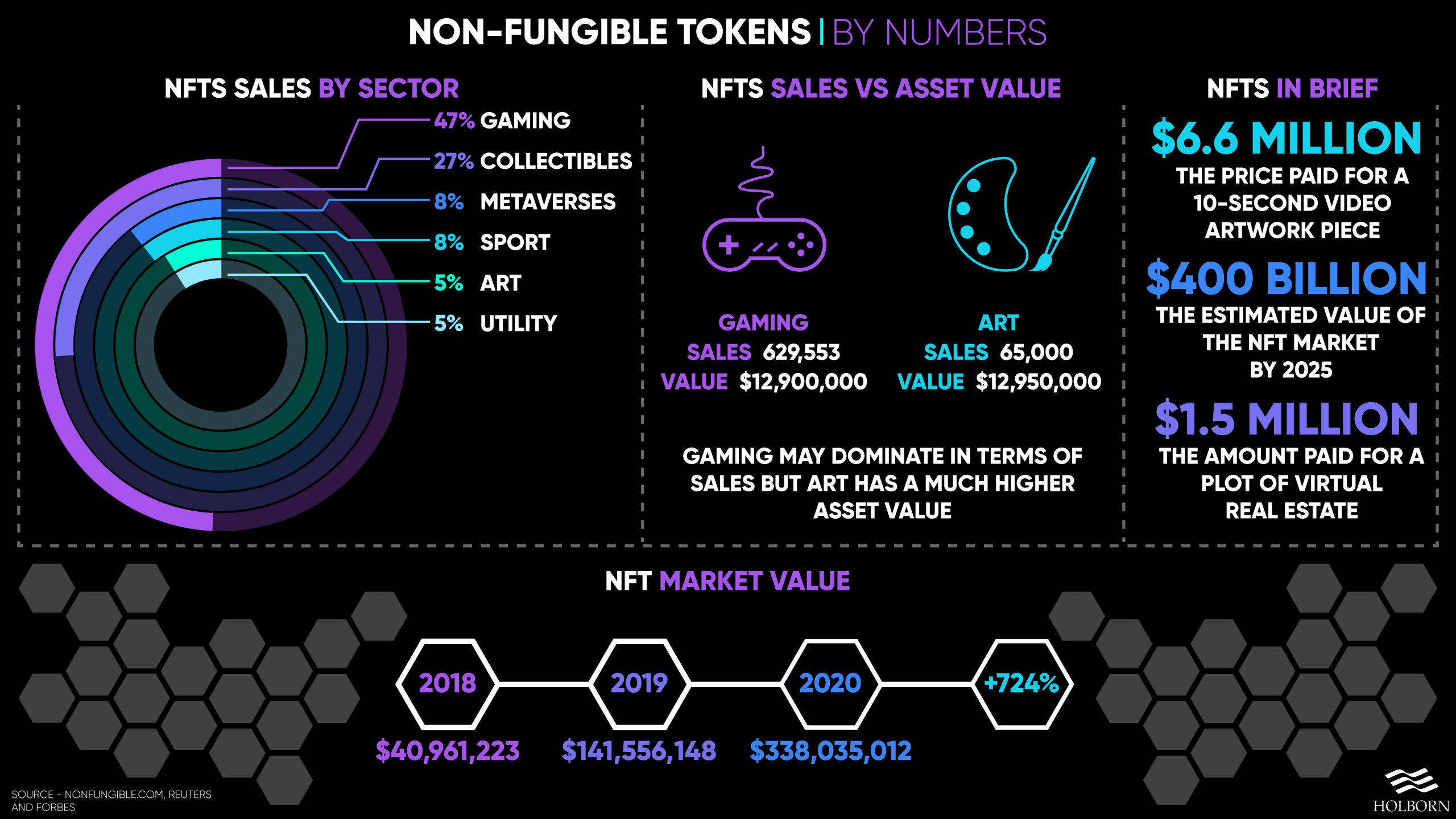

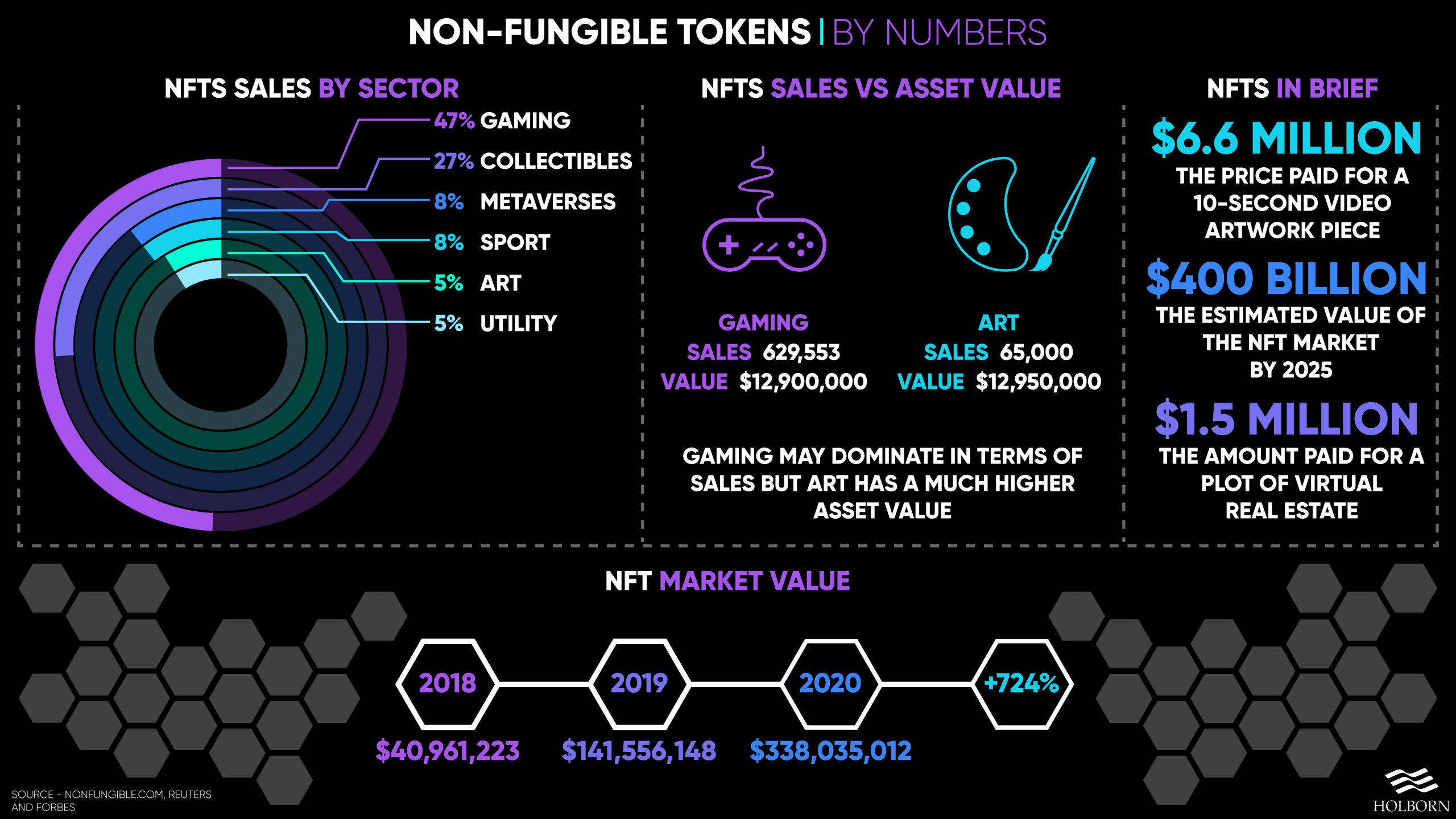

Non-fungible tokens are nothing new. Recently, their popularity has exploded, thanks to some high-value sales. In just seven days, NFTs generated just over $45 million in sales.

So, why are these digital assets trading hands for eye-watering amounts of money? To answer that, we need to understand how value is derived.

Supply and demand

If you are buying stocks and shares, the value is very clear cut.

If Apple’s stock price is $120 per share, then that is the price. Simple. With alternative assets, the value of something is more complex and unpredictable.

Like real-world assets such as classic cars or a bottle of rare whisky, NFTs are valued based on supply and demand. Remember, these are collectables, just like physical artwork.

Another reason why NFTs can be so valuable is their rarity. Each one is unique, meaning you are buying a one-of-a-kind item. Right now, the demand is high, but the supply is limited.

So, how much are individual pieces going for currently? Probably more than you might think.

CryptoKitties, digital works of art featuring cats, often sell for more than $100,000. If you’re looking for somewhere to hang your digital art, how about a virtual property?

In February, a virtual plot of land sold for $1.5 million. The sale represented the largest NFT transaction of all time – a record that didn’t last long. Just weeks later, a 10-second video clip sold for $6.6 million.

We’ve established that individual NFTs can sell for vast sums of money. However, the overall market performance and stability will be a point of interest for investors.

A blistering rate

According to data from Nonfungible.com, the NFT market has grown at a blistering rate over the last few years.

The site, which monitors the NFT marketplace, revealed the NFT market was worth around $40 million in 2018. Fast forward to the end of 2020, and its market value had soared to $338 million – a 724% increase.

Looking at the performance of individual NFTs, and it’s easy to see why big-name investors are starting to take notice.

Cryptopunks, collectable digital avatars, have grown in popularity since 2017 – and value.

In 2017, the 8-bit avatars had a value of around $56. At the time of writing, they were worth just over $85,000 on average, with the most expensive costing around $1 million. Even the cheapest Cryptopunk will set you back roughly $36,000.

And if you thought the sale of digital art was limited to niche, online marketplaces, you would be wrong.

Christie’s recently became the first big-name auction house to sell a digital art collection. The move could be the catalyst that brings NFTs into the mainstream.

Answering the big question

As an investor looking to build a diverse portfolio, you probably have one question. Are NFTs the future for investors, or are they a passing craze?

When it comes to investing in alternative markets, the answer isn’t straightforward.

Whether they are digital or physical, alternative assets usually present a greater risk than mainstream investments. Blockchain-based assets are even more of a risk, and their value can fluctuate wildly.

Take Bitcoin as an example. A year ago, one Bitcoin would cost around $5,000. According to Coindesk, it was worth just over $50,000 at the time of writing.

The NFT market could be a bubble just waiting to burst, or it could be a solid investment option in years to come. For now, it’s certainly fascinating to follow.

If real-world assets and investments are more your thing, we are here to help. With over 20 years of investment experience, our experts are perfectly placed to help you build a strong portfolio.

To find out how we can help you, contact us using the form below.