Posted on: 31st July 2020 in Investments

To say that the events of 2020 have created a headache for investors would be an understatement.

Covid-19, rising tensions between the U.S. and China, as well as other factors, have made it practically impossible to predict the market.

There have been a few outliers which look Covid-proof, but there is one investment which is thriving – gold.

Since humans first discovered gold, we have been fascinated by it.

For early civilisations around the world, gold was associated with wealth and gods.

The ancient Egyptians were the first known civilisation to mine the precious metal. Menes, Egypt’s first pharaoh, is believed to have been the first to give gold a tangible value.

The code of Menes stated that one part of gold is equal to two and one-half parts of silver. The gap in value between the two metals has grown exponentially in the last 5000 years.

In today’s market, gold is worth nearly 80 times that of silver. The value of gold may have changed, but our fascination with it hasn’t.

Today, gold is more than just a symbol of wealth and power. The precious metal is a key component for some investment portfolios, and a great way to diversify a portfolio.

Investing in gold isn’t a new trend. However, the precious metal has gained a lot of traction recently as more investors turn their attention to gold.

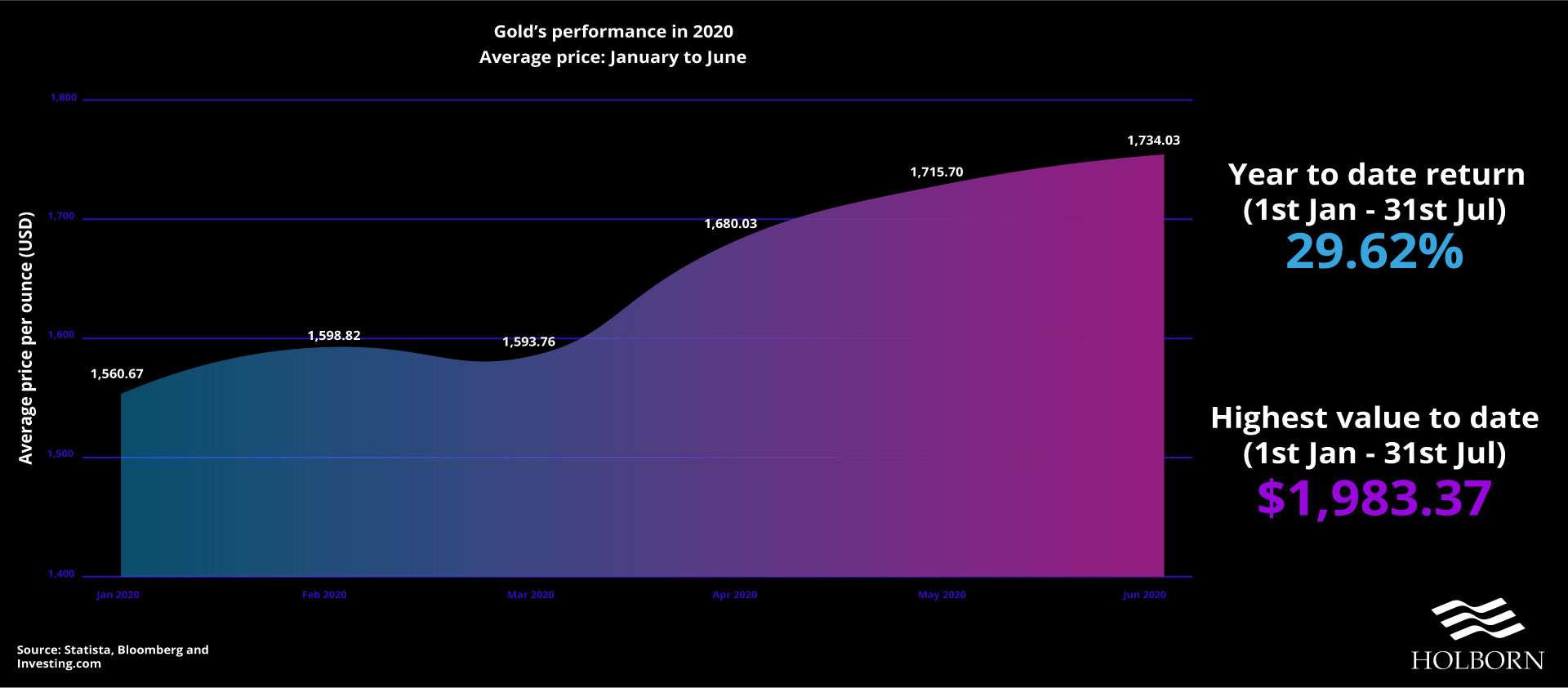

The pandemic, low oil demand and growing tensions between China and the U.S have sent the price of gold soaring.

This year, the value of gold has increased by 28%. At the time of writing, spot gold had briefly hit a record high of $1,983 (£1,510) in some markets.

In the U.K., the Royal Mint has seen a sharp increase in customers opening bullion accounts. Since the start of the lockdown in March, 6,000 new accounts were opened, and sales revenues are up 500% on this time last year.

The Royal Mint reported that younger investors were driving demand. The number of millennials investing in gold has increased by 250% compared to last year.

So, what has led to the recent surge of gold investments?

The answer is quite simple – safety.

Gold may not be an attractive investment when the economy is doing well. Unlike stocks and other investments, gold doesn’t offer interest.

However, it’s during times of crisis or uncertainty that gold shines (excuse the pun).

The coronavirus pandemic currently has gold trading for a record amount. The previous record price for gold was $1,921 (£1481) back in 2011 – the height of the European debt crisis.

What makes gold stand out from other investments is the fact that it works inversely to the economy. Historically, as the economy has grown weaker, the value of gold has increased.

A report by UBS revealed how beneficial gold could be to a portfolio.

The Swiss investment bank found that portfolio risk/reward improved 80% of the time when adding gold to equity investments. In some cases, investing in gold was shown to reduce the volatility of a portfolio by 40%.

It’s because of its performance during economic uncertainty that investors have seen gold as a reliable hedge against inflation. However, the precious metal isn’t completely immune.

Gold does fluctuate in price, but because it is a tangible commodity with intrinsic value, it is much less likely to devalue completely.

Gold is certainly performing well in the current climate, and it looks set to continue due to the ongoing demand.

Analysts believe that gold could surpass $2,000 per ounce in the next 6-12 months.

The million-dollar question – should you invest in gold?

The answer isn’t so straight forward. Investing in gold has pros and cons, and your financial goals will also be a factor.

Gold acts as a safety net in times of uncertainty, and the current market trend could tempt people to invest heavily in gold.

Investing in gold could be a great way to diversify your portfolio and protect it against market downturns.

Like any investment, it’s not wise to put all of your eggs in one basket. To find out how we can help you build a successful portfolio that is profitable in any climate, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more