5 golden rules for investing during a recession

Posted on: 26th July 2022 in

Investments

With inflation continuing to soar and the spiralling cost of living, there are fears that another recession is just around the corner.

In this article, we examine what a recession means for investors and how they impact global markets. We’ll also look at the golden rules when investing during a recession.

What is a recession?

A country’s economic growth is measured by its Gross Domestic Product (GDP).

GDP is the overall value of all goods and services in the country. The Office for National Statistics (ONS) calculates the monthly GDP figures in the UK. But, it’s the quarterly figures that paint a better picture of the economic performance.

In an ideal world, GDP growth is always higher than in the previous quarter. Of course, that is not always the case. And, when the GDP growth is lower from one quarter to the next, the word ‘recession’ starts popping up.

A recession is a term used to describe a decline in economic activity. Technically, a recession is when the GDP value drops for two consecutive quarters (six months).

In reality, GDP is more of an indicator than a cause of a recession. By the time the figures are reported, the country is already likely in a recession.

Remember, the figures are reported at the end of each quarter. If the country were already in a recession in May, we wouldn’t know about it until the ONS released their figures in June.

How have stock markets performed during past recessions?

The word ‘recession’ often causes panic, especially among investors. Even experienced investors can have a knee-jerk reaction at the mention of the word.

The question is, what kind of a toll does a recession take on the markets?

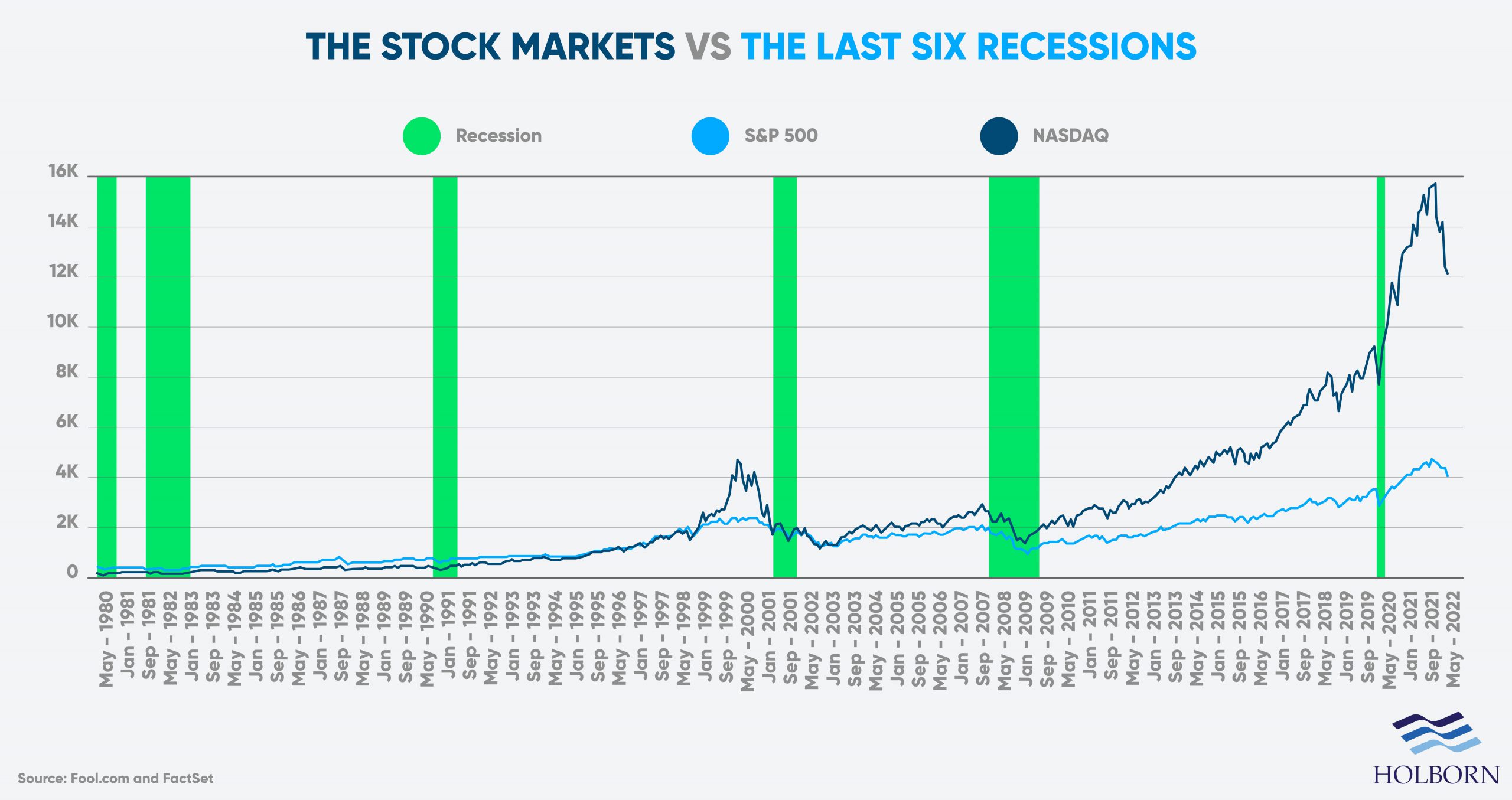

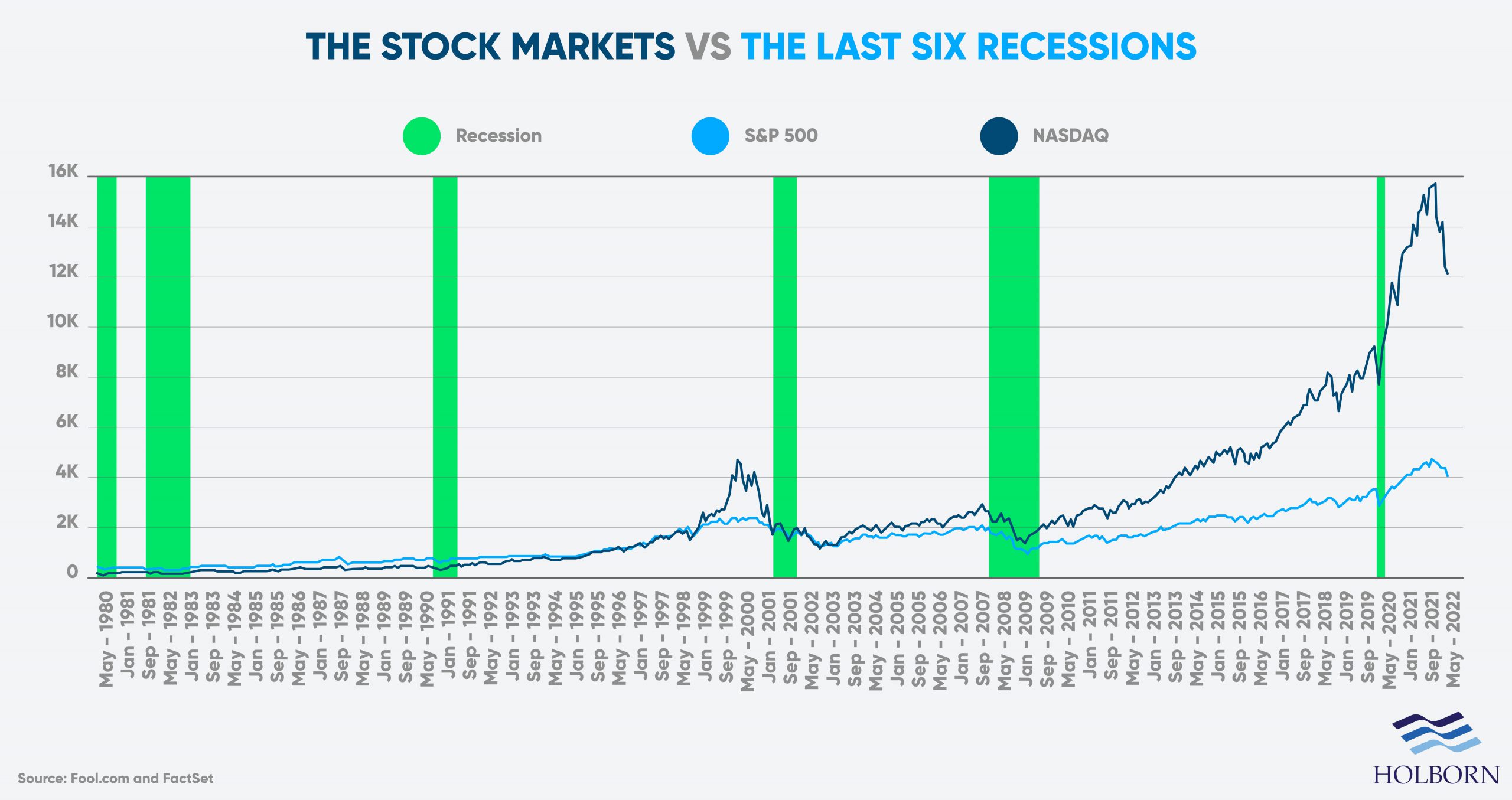

The S&P 500 and NASDAQ are two of the biggest exchanges in the world in terms of their market cap. Looking at both of these gives us a good idea of how markets have fared against previous recessions.

According to findings by Fool.com, recovery of the stock markets following a recession seems inevitable.

The table below shows just how resilient the market is. Not only do stocks recover, they actually go on to exceed their pre-recession levels.

Following the six previous recessions, the S&P 500 and the NASDAQ have always returned to their pre-recession levels. Not only that, they have done so relatively quickly.

Since 2000, the S&P 500 took 647 trading days on average to return to its pre-recession levels, while the NASDAQ took 330. Of course, past performance does not guarantee future results. Still, it does highlight one thing.

Historically, the best strategy has been to play the long game. In other words, it shows us that remaining calm and weathering the storm is the best approach.

Are we heading for a recession?

With the current cost of living crisis and soaring inflation, it may already feel like we are in a recession for some. But are we heading for an official recession? This is a tough one to answer, and even the experts are split.

The Bank of England recently warned of a recession at the end of the year. The central bank expects the UK economy to contract by roughly 1% between October and December. The driving factor is energy prices, which are set to increase further from October.

However, not all the experts agree. The Office for Budget Responsibility (ORB) predicted the UK economy would grow by 3.8% in 2022.

Another recession is not a sure thing. But, like anything in life, it’s best to be prepared. With that in mind, let’s look at the five golden rules for investing during a recession.

Investing during a recession – 5 golden rules

1- Spread the risk

Remember, there is no such thing as a zero-risk investment. But there are ways to lower the risk.

Building a well-diversified portfolio is an essential investment strategy in any climate. Doing so helps you spread and reduce the overall portfolio risk.

So, how do you create a diversified portfolio? It simply requires you to spread your asset allocation across not only different assets but also different sectors and geographical locations.

Of course, it’s not actually a simple process; a lot of thought goes into picking the risk investments.

Each investment should have a low correlation with one another. If one asset performs poorly, another may show strong performance, offsetting potential losses.

How you diversify will all depend on your goals and your risk tolerance. Our article on risk gives a full breakdown of investment risk and how you can determine your risk profile.

2- Shop for bargains

You may not realise it, but investing during a recession can open the door to buying opportunities that were otherwise outside of your financial reach.

Share prices for big companies often trade for a premium. For average investors, the only way to access these companies is if they split their stock.

However, economic downturns can result in company stock prices falling. This allows investors to take advantage of bargain prices. The idea is to buy while the price is low, assuming that the price will increase again, increasing your rate of return.

3- Harness the power of precious metals

Precious metals such as gold and silver have long been considered ‘safe havens’.

One of the reasons for this is that their performance is not directly tied to the stock market. In fact, their value typically increases as stock prices fall. This means they can help reduce the overall risk of your portfolio.

4- Beware of bonds

Investors often turn to the bond market, looking for safer options. While bonds are a lower-risk option and offer a great way to diversify your portfolio, timing is essential.

Bonds are basically a loan to a company of government. In return, you receive interest on that loan. A change in interest rates can have an impact on your return.

As interest rates go up, the bond price drops. A decline in interest rates will do the opposite, pushing up the price of the bond.

One of the side effects of a recession is rising interest rates. In an environment where rates are set to increase in the near future, buying bonds is often not the best choice.

As we said, timing is essential. So, buying bonds before a recession tends to be the better option.

5- Don’t make rash decisions

When the stock market is volatile, it can cause some to make bad investment decisions. A knee-jerk reaction is often to sell and get out before things get any worse.

Remember, investing is a long-term strategy, and there will be bumps along the way – some bigger than others. It’s important to trust in the resilience of the financial markets.

According to Forbes, the S&P 500 actually increased by 1% on average during all recision periods since 1945. As long as your portfolio is diversified, the best option is often to do nothing.

Selling could mean not only hefty losses, but you could also miss out on future returns when the markets stabilise.

What are the safest investments?

There are no truly recession-proof investments. All investments carry some level of risk, regardless of the current economic climate.

However, some options are better than others when it comes to investing during a recession. Investment funds that track the market are a popular choice, especially during an economic downturn.

These are often referred to as index funds, as they track a specific index—for example, the S&P 500 or the FTSE 100. So, what makes them so special?

With an index fund, you’re not betting on one company. Instead, you’re betting on the overall long-term success of business in a particular country.

Let’s say you invest in an index that tracks the FTSE 100. Instead of you betting on the success of a FTSE 100 company, you’re betting on the long-term success of UK business as a whole.

While there are no guarantees, the markets bounce back after a recession, as we have already seen.

Other types of funds, such as exchange-traded funds (ETFs), are also worth considering. These give you access to a ready-made basket of investments, helping you to spread the risk.

How Holborn can help

Remember, like tough times, economic downturns do not last forever. Some experts even suggest that economic recessions are a normal part of doing business.

Of course, that doesn’t take away from the fact that going through a recession is far from ideal. Still, it doesn’t have to mean the proverbial death of your investment portfolio.

Investing during a recession and building a profitable portfolio is still possible with the right strategy. That’s where we can help.

At Holborn Assets, we take a client-first approach at all times. We provide you with the honest, transparent advice needed to put your money in the right place at the right time.

Since our inception in 1998, we’ve had to contest multiple recessions. That is why we know what it takes to help our clients succeed, even during harsh economic conditions.

With our tailored, expert advice and award-winning customer service, you can be sure that you are in safe hands.

Contact using the form below and find out how we can help you make the right investment choices to meet your goals.