Returning UK citizens – what you need to know

Posted on: 18th October 2021 in

Expats

There is a lot to consider for returning UK citizens. If you plan to return to the UK, you’ll want to be fully prepared.

Tax rules will be one of the biggest obstacles to overcome for British expats returning to the UK. Tax is a complex topic at the best of times. However, it can be even more complicated for expats.

Here, we look at what returning UK citizens need to know about their tax status before repatriating.

One of the main things to understand (and probably the most confusing) is your tax residency status. With that in mind, let’s start there.

Residency

As an expat, you’re no doubt familiar with tax residency. You’re probably also aware of how confusing it can be in some cases.

Your tax residency is used to determine if you pay UK tax on:

- UK income and gains

- Foreign income or gains (in some cases)

The UK government website explains that returning UK citizens will usually be classed as UK residents for tax purposes again.

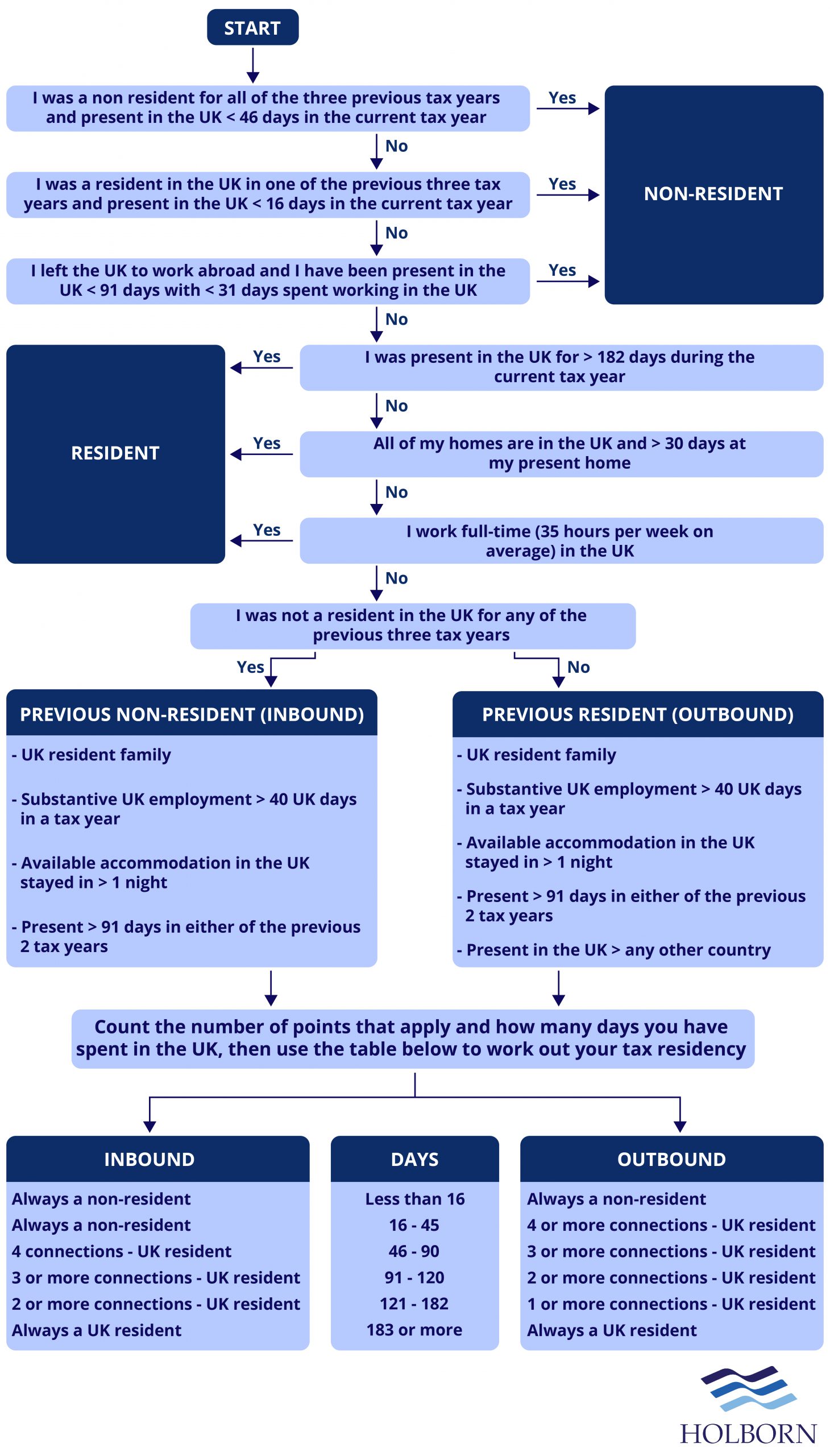

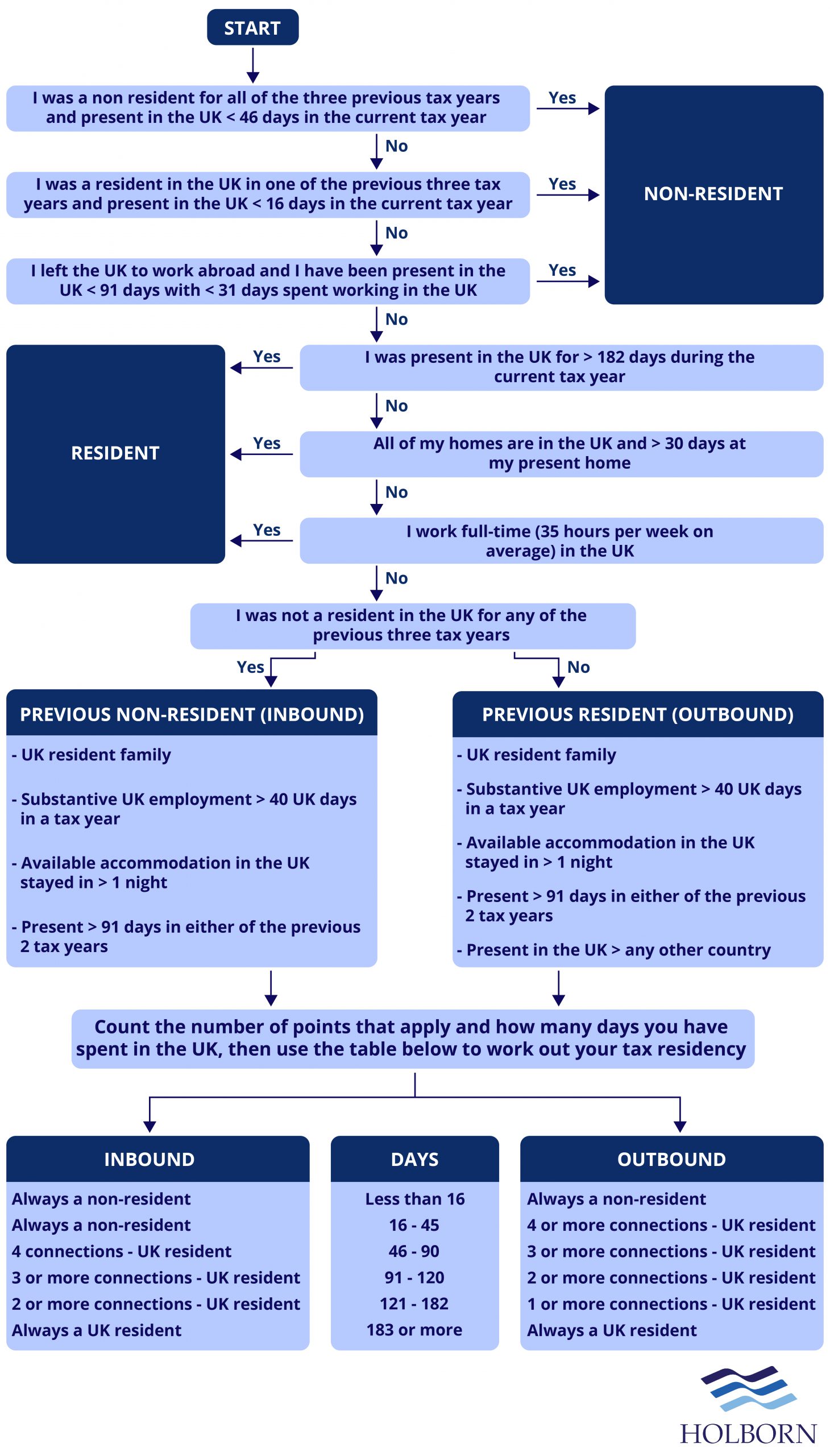

The Statutory Residence Test (SRT) is the method used to work out your residency status. The flowchart below breaks down the SRT.

You can find a detailed breakdown of the SRT here.

However, if you are unsure, it’s best to speak to an expert to help you ensure that you are paying tax in the right place.

Tax for returning UK citizens

If you have lived abroad for less than a full tax year, your status won’t have changed. For reference, the tax year in the UK runs from 6th April to 5th April of the following year.

For British expats returning to the UK within five years, there are some things you need to be aware of before you arrive.

When you arrive back in the UK, you’ll have a ‘temporary non-residence’ status if:

- You return to the UK within five years of moving abroad – if you left before 6th April 2013, this would be five complete tax years

- You were a UK resident in at least four of the seven previous tax years before you moved.

If both of the rules stated above apply to you, certain income could be liable for tax.

For example, certain income or gains you acquired as a non-resident may be taxed in the UK. You should note that your employment income is not included here.

Speaking to a financial adviser specialising in tax is recommended for those concerned about how tax may affect them once they arrive back in the UK. Doing so can help you better prepare your finances before returning.

Check your National Insurance record

Your National Insurance contributions (NICs) are what make you eligible for certain benefits, including the State Pension.

For returning UK citizens, it’s not uncommon for them to have gaps in the NICs unless they made voluntary contributions.

You can check your NICs online via the UK government website. Doing so is the best way to check for any gaps in your record and make voluntary contributions if needed.

For a more detailed guide on National Insurance and how to check your record, take a look at our dedicated guide.

Your UK pension

Your UK State Pension will most likely be the thing most affected by gaps in your NICs.

Currently, you need a minimum of 10 qualifying years of NICs to get any State Pension. To qualify for the maximum amount, you will need 35 years.

Before returning to the UK, it’s essential that you check your record online, especially if you have been out of the country for an extended period.

If you have any overseas pensions or investments, it is strongly advised that you speak with an expert before returning to the UK.

Double tax treaties and other factors determine how these products are taxed in the UK, and they must be managed correctly.

Here to help

Just like starting a new life abroad, UK repatriation is a big step and one that you shouldn’t take lightly. Preparing for the move ahead of time will help ensure your finances are protected from unexpected tax liabilities.

For general guidance, the UK government website has a section specifically for British expats returning to the UK.

However, if you are looking for more detailed guidance related to your financial situation, Holborn Assets can help.

We have over 20 years of experience in the expat market, so we know the difficulties returning UK citizens can face. Our clients benefit from award-winning client care and bespoke expert advice to optimise their finances.

To find out how we can help you, contact us using the form below.