Posted on: 12th April 2021 in Mortgage & Property

Great Britain’s railway system is one of the oldest in the world. The number of passengers has increased

significantly in the last few years as more people use the train to commute to their work and save time avoiding

traffic jams. The next big railway project is the HS2 train which is expected to make commuting easier and faster

while boosting property prices in its main city stations.

According to the HS2 website, “the High Speed 2 is a state-of-the-art, high-speed line critical for the UK’s low carbon transport future. It will provide much-needed rail capacity across the country, and is integral to rail projects in the North and Midlands – helping rebalance the UK economy.”

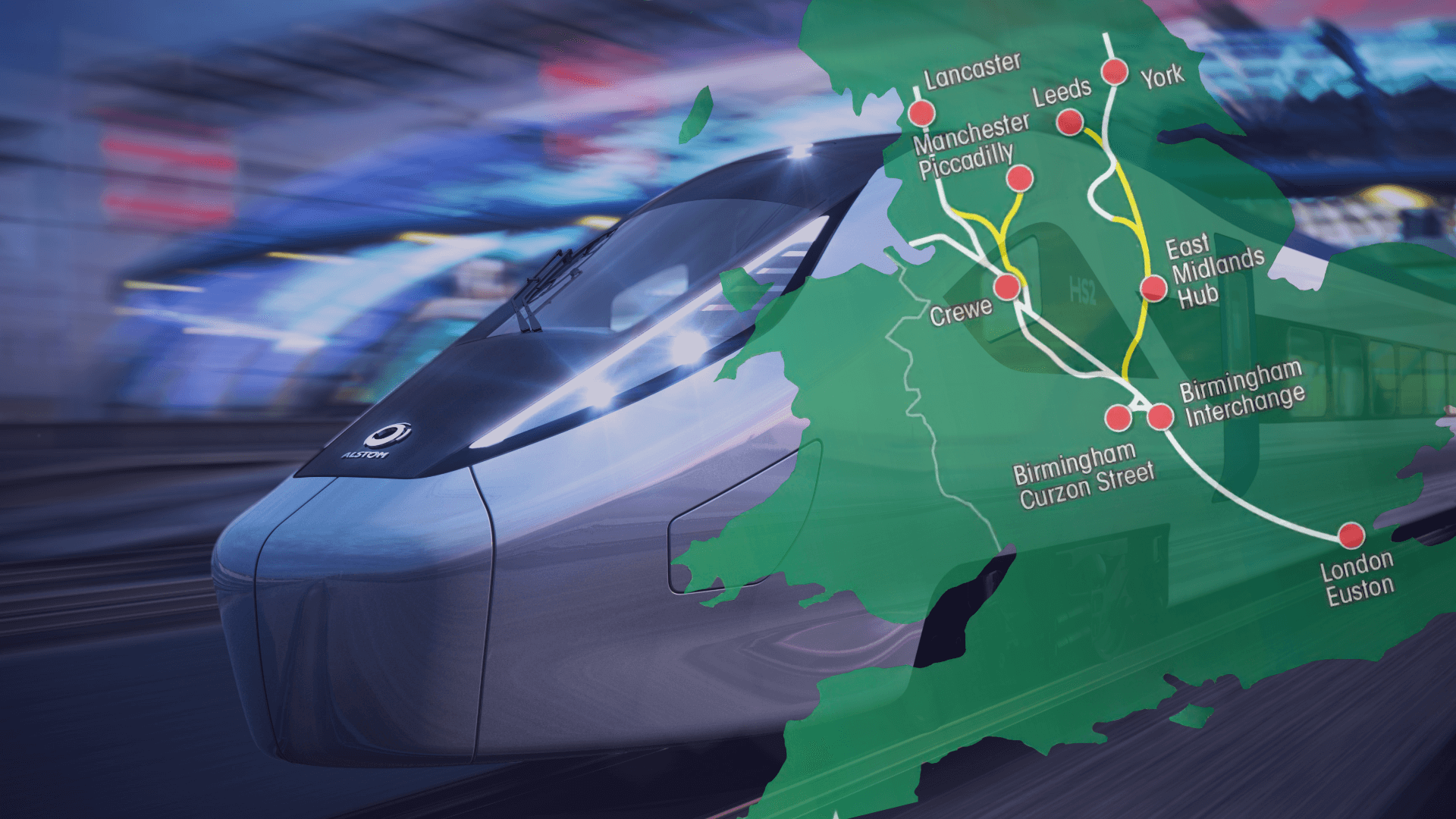

The new high-speed rail will connect London, Birmingham, Manchester, Leeds etc. The plan is to build a “Y-shaped” network that would connect the cities, transporting more than 25,000 passengers every hour, reaching speeds of up to 250 miles per hour.

The project is split into two phases, “Phase I” and “Phase II”. In Phase I, it is expected that trains would travel from London to Birmingham on a dedicated track of 140 miles. The approximate cost for Phase I would be between 35 and 45 million pounds and completion is expected between 2029 and 2033.

Information published on the HS2 website suggests that “the Phase II line forms a Y shape, split into an eastern and a western leg. The western leg will connect to the high-speed lines at Crewe and run through to Manchester. The eastern leg will connect to high-speed lines in the West Midlands and run through to Leeds.”

As infrastructure projects such as railways etc. tend to boost housing prices, it would be interesting to review some interesting housing market data regarding the HS2 city stations.

The Office for National Statistics (ONS) has reported that average prices in London grew 3.5% in 2020. The rate has been slower than in any other region in the UK, but still above the average rate recorded in the last few years.

A report by Rightmove noted that average asking prices in the city dropped 1.1% in February on an annualised basis. However, market analysts suggested that, as the Stamp Duty holiday has been extended to the end of June 2021 by Chancellor Rishi Sunak, sales are likely to receive a further boost.

Birmingham’s population has increased by almost 10% in the last ten years. A survey published by Oxford Economics suggests that each year until 2030, more than 3,300 households would be created. The demand for houses and apartments is getting stronger as four out of ten university graduates in Birmingham intend to continue to live and work in the city.

Analysts at Knight Frank wrote in a report that “around 60% of those living there are under the age of 35 reflecting the growth in a young, professional population attracted by the improving jobs market and career opportunities. The overall development picture has changed substantially over the past five years. The new-build market is maturing, with schemes being developed across the spectrum in price and tenure.”

Liverpool is known as one of the most affordable cities to buy a house or an apartment in the UK. Although 2020 was a difficult year due to the coronavirus pandemic, real estate prices in the Liverpool area hit new highs as the influx of investors and buyers boosted demand. This has turned Liverpool into one of the fastest-growing markets in the UK.

Data published by the online estate agent Strike showed that the number of offers accepted on properties was eight times larger in February 2021 versus the same month last year. Local real estate agents report that Liverpool housing prices have soared beyond any expectations on the back of the Stamp Duty holiday and low mortgage interest rates.

Zoopla’s market analysts note that Liverpool is currently outperforming the

capital in house price growth. Their survey showed that annual house price growth hit 6.4%, with houses being the

top priority for buyers who want more available space as a result of the lockdown.

The lack of house supply in the city centre and the growing population have pushed Manchester house prices higher in the last two years. Zoopla’s UK House Price Index published in February 2021 revealed that the average asking price stood at £185,000, with price growth coming in at 6.6% on an annualised basis. The price growth percentage figure is the highest recorded in the UK in February.

Young professionals and graduates form a unique talent pool that has attracted businesses, making them relocate to

the area of Greater Manchester and helping drive property prices higher. Some market analysts suggest that investors

who focus on the buy-to-let (BTL) market would find Manchester to be the ideal ground to implement their portfolio

diversification strategies. It should be noted that, according to a Financial Times report, the city of Manchester came in

first position in the European business-friendliness category.

Investing in property is one of the best ways to diversify your investment portfolio. Despite recent political developments with the EU and the coronavirus pandemic consequences, the UK property has shown its strength with prices jumping on the back of limited supply and tax reductions such as the stamp duty holiday.

If you would like to seize the opportunity to invest in property along the upcoming HS2 railway project, Holborn’s qualified advisers can help you make the right decision and be with you every step of the way.

Whether you would like to invest in property in London, Birmingham, Manchester or Liverpool, Holborn’s variety of investment options is able to satisfy even the most demanding investor. Get in touch with us and let us design an investment plan for you.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more