UK buy to let investments: the perfect time to invest?

Posted on: 8th September 2021 in

Mortgage & Property

UK buy to let investments have long been viewed as a great addition to a portfolio.

The UK housing market as a whole has shown how resilient it is over the last 18 months, bouncing back stronger than ever following the pandemic.

However, the buy to let market specifically is showing some interesting signs.

With restrictions being lifted, demand for rental accommodation has soared. Buy to let properties have also increased in value, with some regions seeing an increase of up to 11%.

So, is now the right time to add an investment property to your portfolio?

Here, we examine the current state of the buy to let market and what the future holds for the sector.

Rental boom

With the stamp duty holiday coming to an end, the demand for mortgages has dropped.

In June, the month that the tax cut ended, lenders issued around 80,300 mortgages. July saw a 6.4% drop, with 75,200 mortgages handed out.

Buying may have tapered off, but demand for rental homes has soared.

According to the National Residential Landlords Association (NRLA), demand for rental housing is at a five-year high. It would seem that as the Covid restrictions eased across the UK, the market began to pick up.

The data showed that demand for rented accommodation increased by 8% between the first and second quarters of 2021.

Of course, an active market is great news for landlords. However, the value of a buy to let property in the UK has also increased.

An increase in value

A report by Shawbrook Bank revealed that as of December 2020, the private rented sector grew to £1.4trn. The figures represent a 5.8% increase when compared to December 2019.

As a result, the average price of a buy to let property in the UK has also increased. During the same period, the average value of a buy to let property in the UK reached £258,900 – a 5.6% increase.

As you would expect, London remains the most expensive region in the UK. However, the average price of a buy to let property in the capital only saw a 2.5% increase.

It was locations outside of London that saw the best overall growth.

Wales saw the biggest increase in value at 11%, while the North West (10.7%) and Scotland (9.5%) were close behind.

Strong growth in these key areas and across the UK highlights the potential long-term benefit of a UK buy to let investment.

There is another area to consider for those looking at UK buy to let investments – rental yields.

Profits by locations

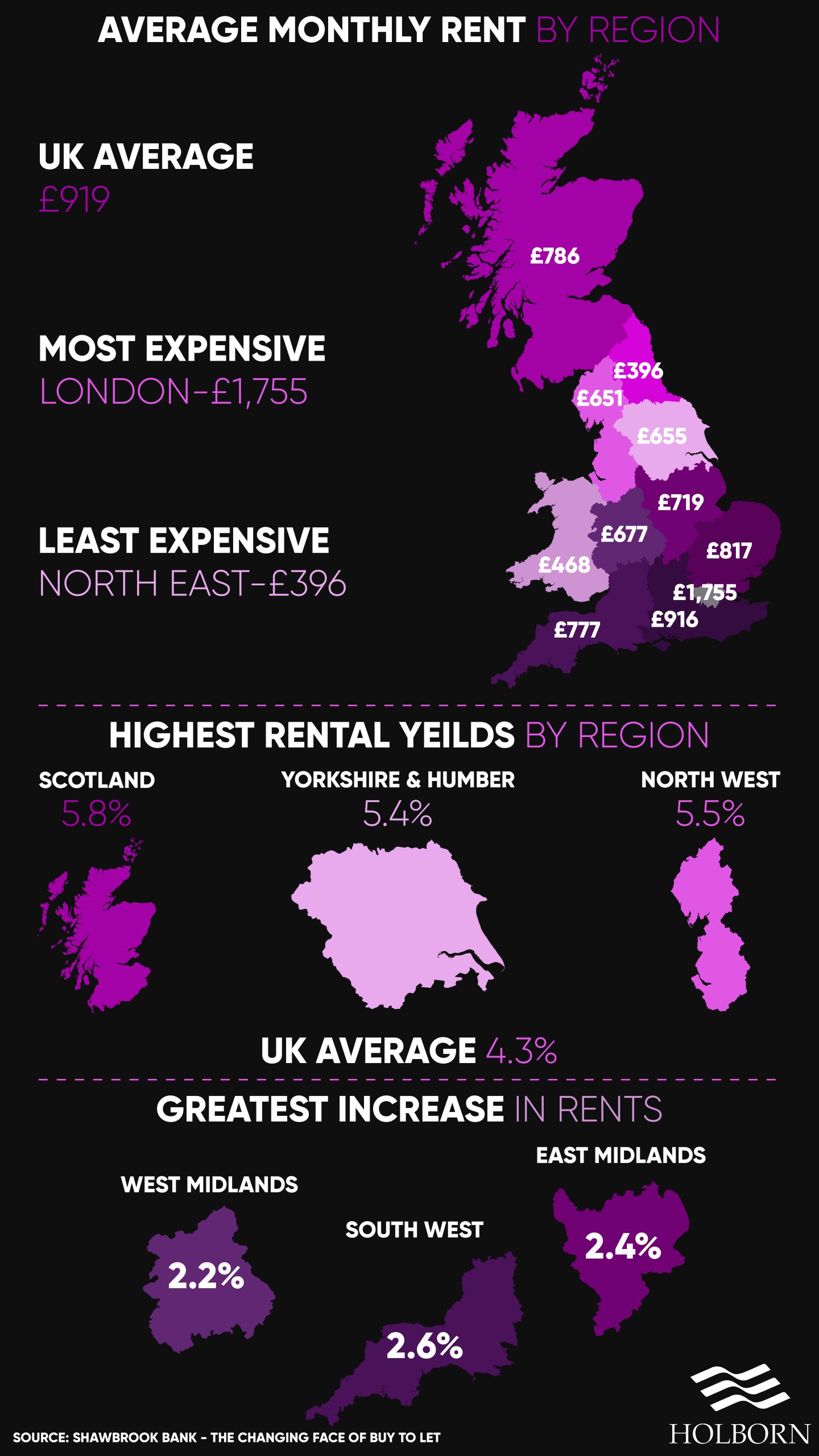

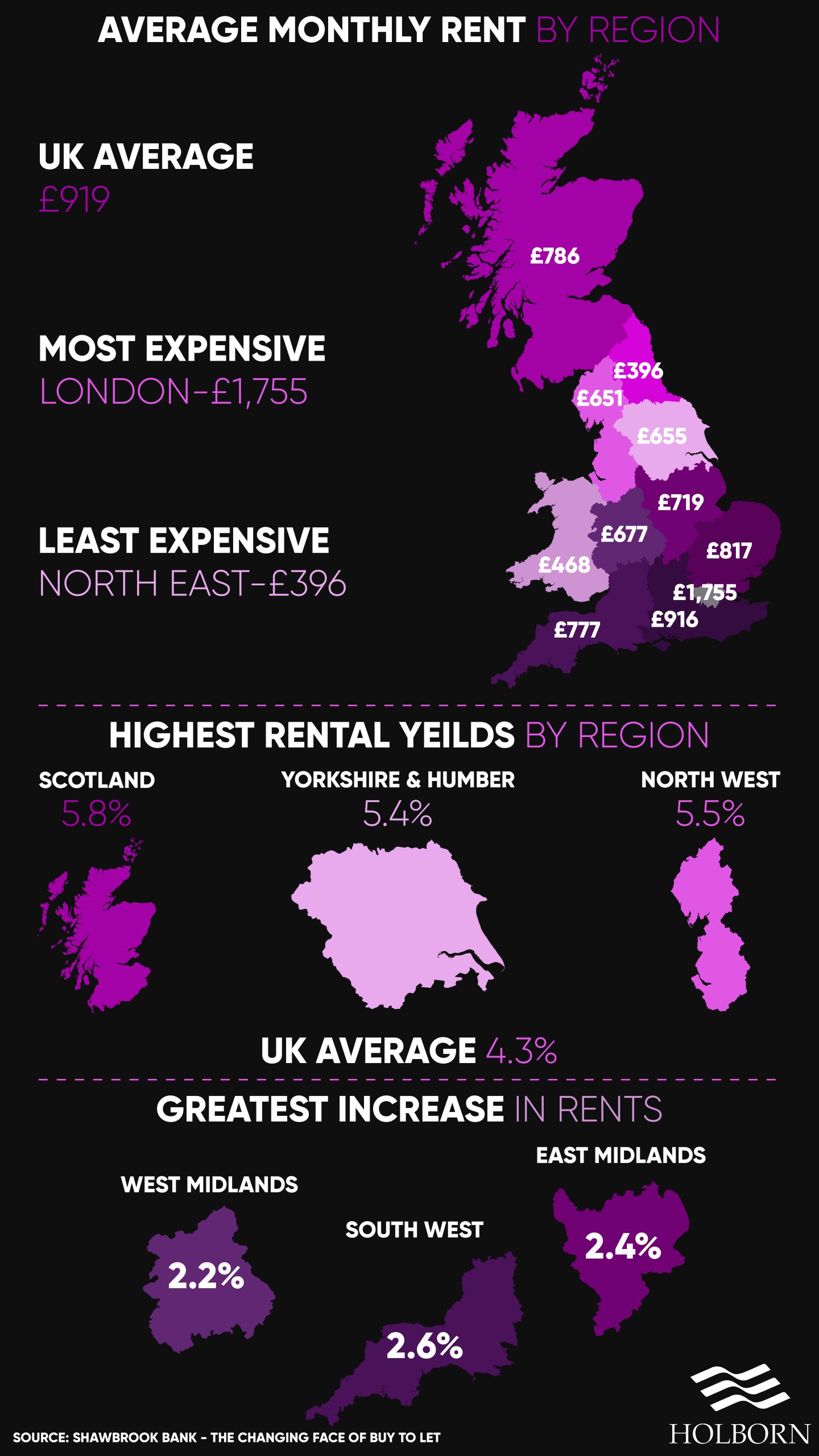

Unsurprisingly, London is home to the highest rent prices.

Rent in the capital costs £1,755 on average, much higher than the UK average of £919.

The cost of renting in London is also considerably higher than in the North East, which is the cheapest place to rent at £396 per month on average.

Here is a look at the average rental prices across the UK, along with the rental yields for each region.

Changing landscape

The property market as a whole has gone through some considerable changes over the last 18 months.

Still, it seems that UK buy to let investments are still a profitable addition to a portfolio, and landlords are confident in the future of the UK property market.

The research carried out by Shawbrook Bank seems to support this theory.

Looking ahead at the next 12 months, two thirds (67%) of landlords said they feel confident about the future of the UK property market. A further 34% of all landlords are also planning to buy a property in that period.

Lenders also seem to share that confidence.

71% of mortgage brokers believe that investors will be adding property to their portfolios in 2021. What’s more, 12% feel that the end of the stamp duty holiday will have no bearing on the market.

So, with things looking bright going forward, now could be the right time to invest. To find out how a UK buy to let investment could benefit your portfolio, speak to one of our experts.

Our property specialists work with some of the world’s leading developers to bring our clients exclusive property investment opportunities.

With a complete end-to-end service, we make the process of securing an investment property stress-free.

To find out how we can help you, please use the contact form and we will be in touch.