A weak pound and cuts to stamp duty may have created a unique opportunity for property investors.

Several factors have resulted in the pound tumbling in value against the dollar.

While it’s bad news for the pound, it has given the dollar significantly more buying power.

For overseas investors looking to take advantage of the strong UK property market, now could be the prime time.

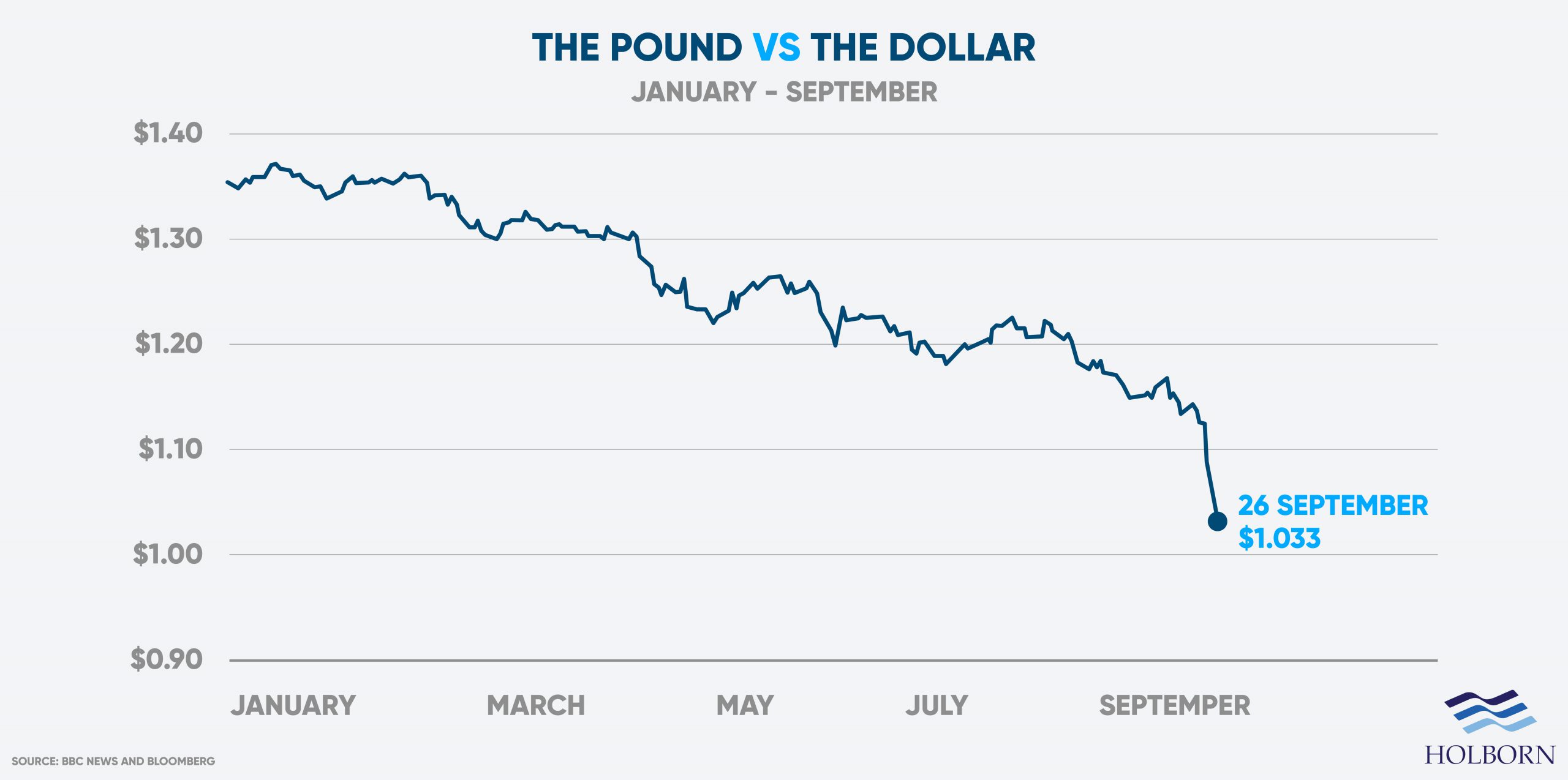

The pound vs the dollar

The recent mini-budget, increased borrowing by the UK government, and other factors have taken their toll.

The British pound recently slumped to a 37-year low against the U.S. dollar. The previous low came in 1985, with the pound worth around $1.05.

At the start of the year, the pound was trading at just over $1.35. By September 26th, three days after the mini-budget, the pound fell to a historic low against the dollar, trading at $1.033.

What this means for overseas investors

Brick and mortar have long been considered a stable investment option for long-term growth.

The issue for some has been the barrier to entry, with property prices soaring since the country opened up following the pandemic.

According to the latest data from the ONS , the average house price across the UK was £292,000 in July 2022. In England, the average house price was £312,000, a 16.4% increase over the year to July 2022.

However, the pound’s current slump against the dollar has presented a unique opportunity for overseas investors.

Those in a USD economy, such as the UAE, now have more buying power. This means that UK assets have effectively gone on sale for those investing in USD.

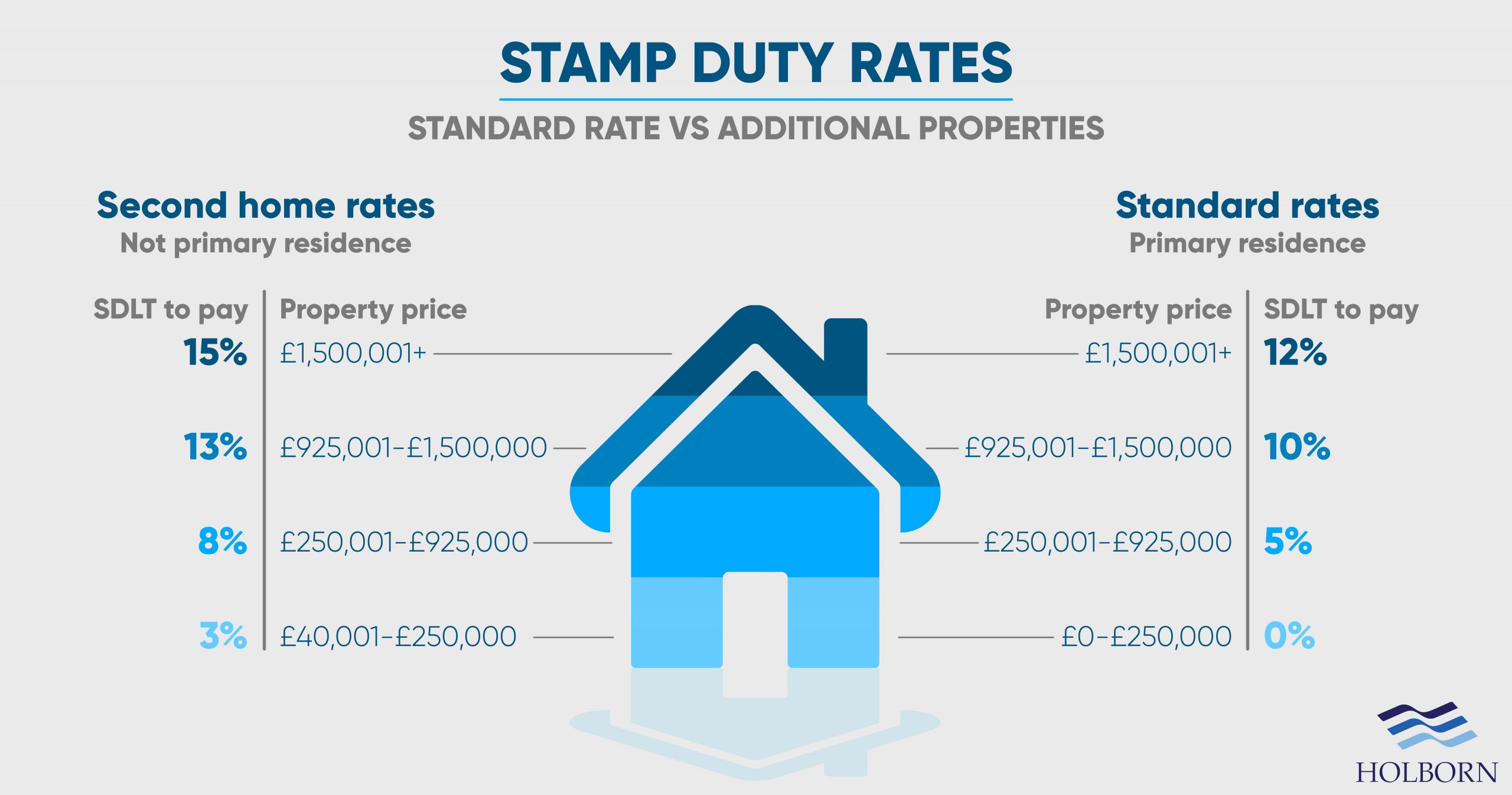

To make things even more appealing, buying a UK property has also been made cheaper due to the recent stamp duty cuts .

With the threshold for stamp duty increased to £250,000, it could result in substantial savings. The cuts will also come as welcome news for overseas buyers who already face an additional 2% surcharge.

So, why should investors look to take advantage of this small window and invest in the UK property market?

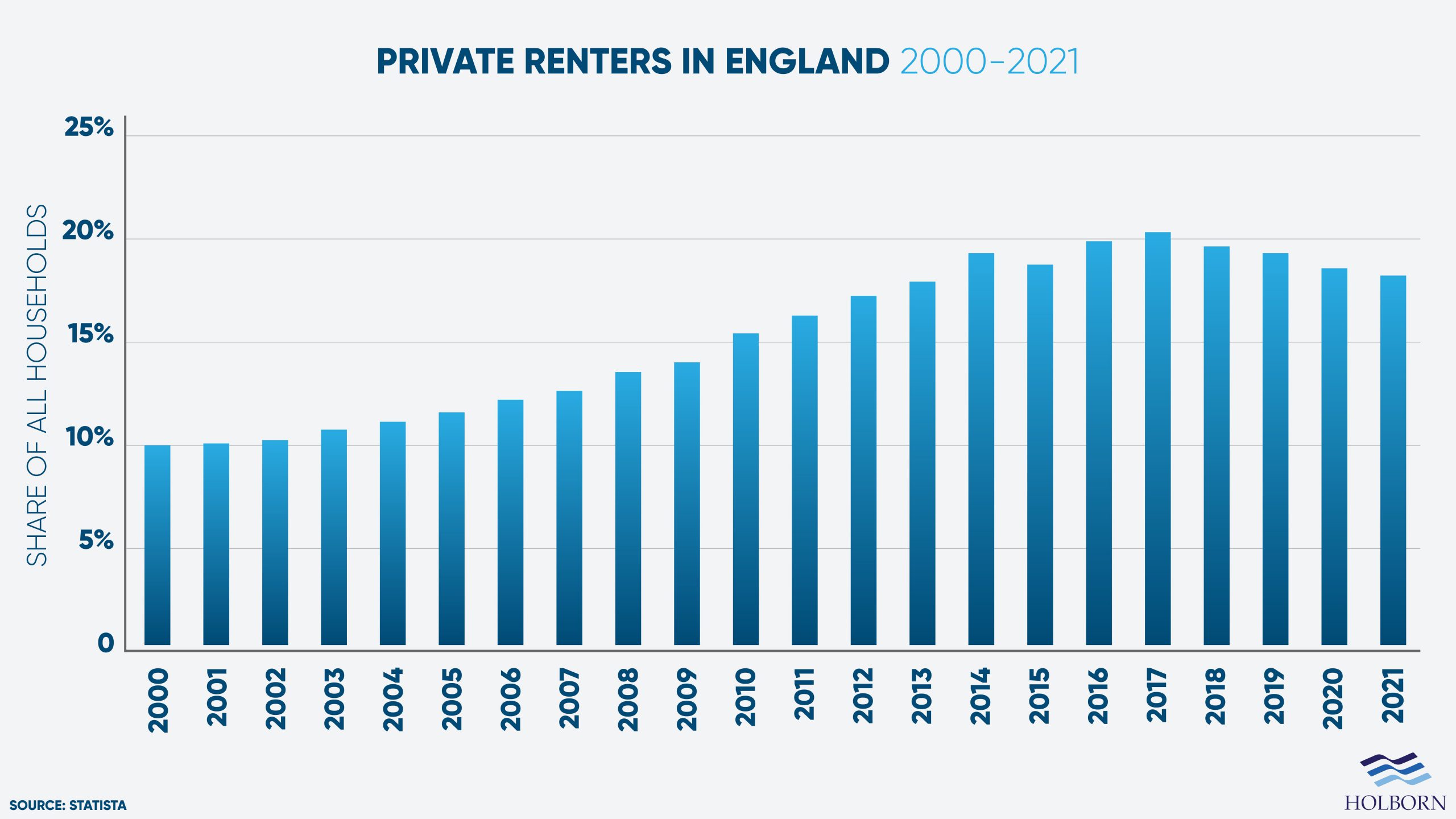

Rising rental demand

In England, 18.5% of all households are privately rented. With such a strong demand for rental accommodation, production is struggling to keep up.

Findings by Capital Economics suggest that 1.8 million new homes are needed over the next decade to meet demand. That works out to 227,000 new homes per year.

Strong demand and a shortfall in premium developments have resulted in increased profits for investors.

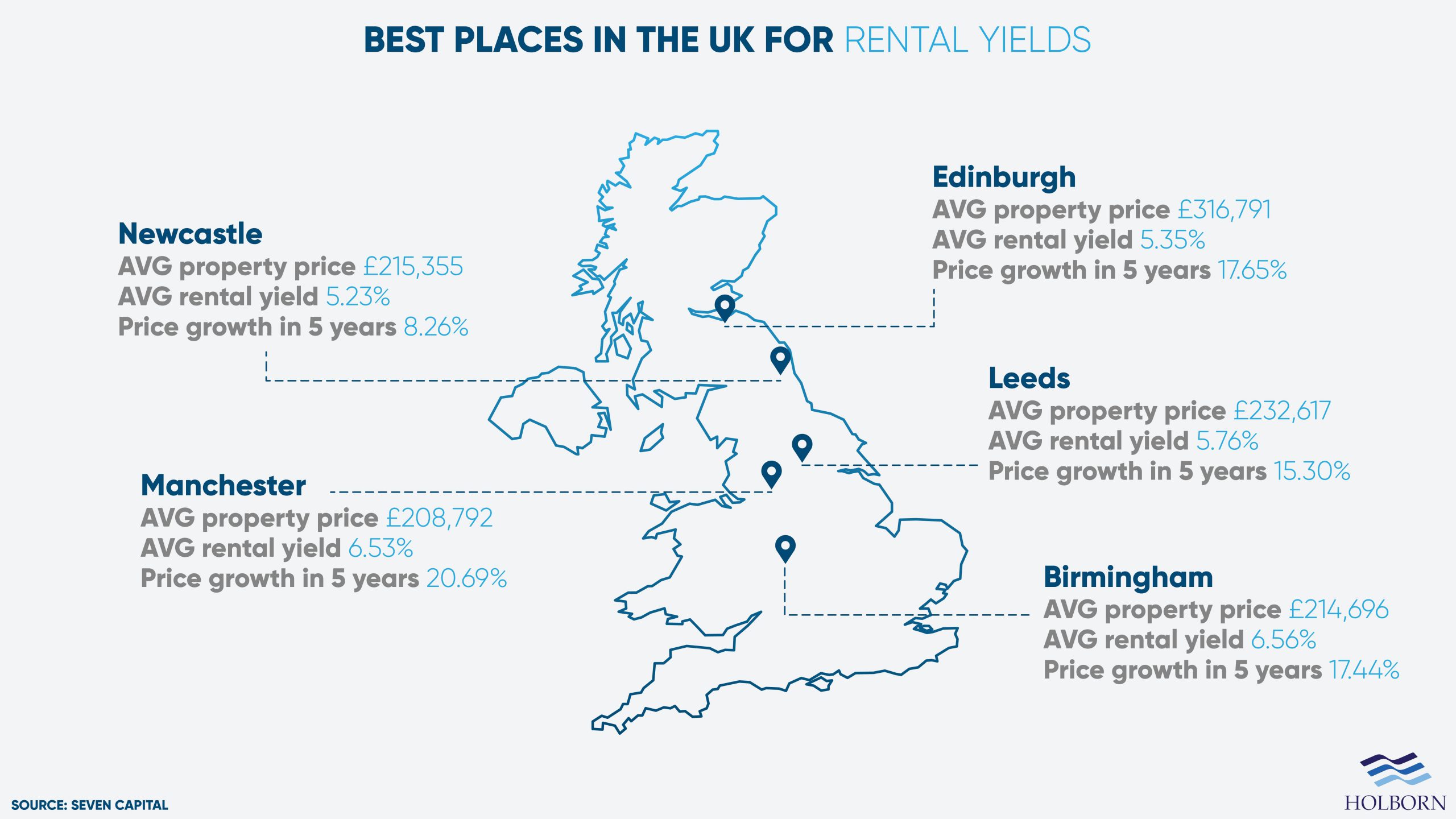

Strong rental yields and capital growth

ONS data shows that rental prices are increasing across the UK.

In the 12 months to July 2022, the average rental costs increased by 3.2%. This has led to higher rental yields for real estate investors in the buy-to-let market.

Birmingham currently has the highest average rental growth at 6.56%. Meanwhile, Manchester’s estimated five-year price growth is nearly 20.7%.

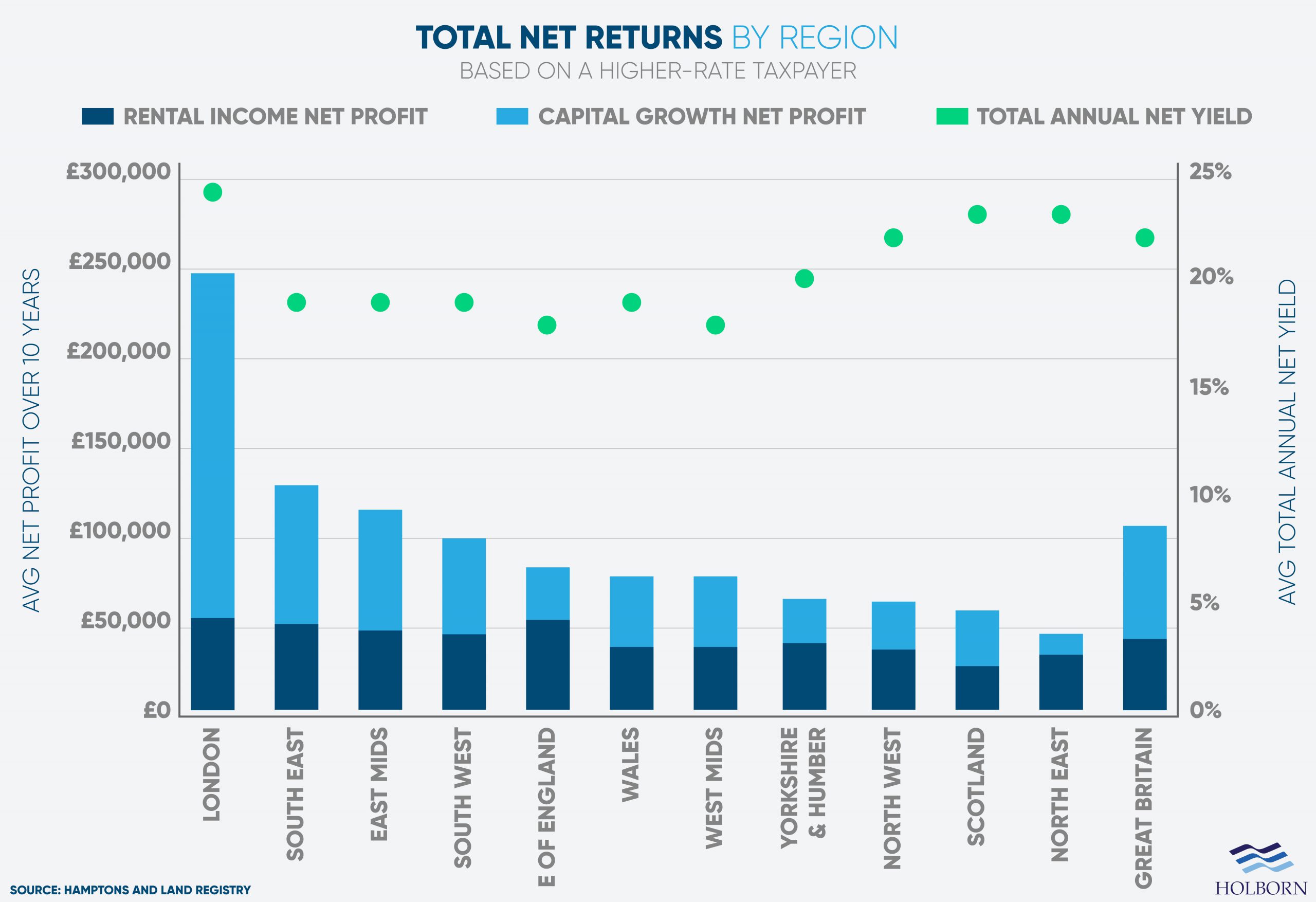

When it comes to capital gain on a property, landlords in London see the most significant return on their investment.

Those with property in the capital saw an average return of £245,900 over 10 years. This amounted to a 244% return on their investment, or 24% each year, after accounting for taxes and other costs.

How Holborn can help

Those in a USD economy buying into the UK property market are effectively getting more for their money in the current climate. Taking advantage of the current situation could result in better returns.

However, intervention from the Bank of England is expected in the form of a bond-buying programme. This aims to push the pound’s value back up, meaning overseas investors only have a limited window to take advantage of the current situation.

At Holborn, we are partnered with some of the UK’s leading property developers. We offer clients an exclusive range of investment properties in some of the country’s most sought-after locations.

We also offer a range of investment options. So, we can help you secure a property that meets your needs and goals.

To find out how we can help you, contact us using the form and speak to one of our property experts.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences