Posted on: 10th September 2021 in Mortgage & Property

We all know the benefits of investing in your education. But could investing in student accommodation benefit your portfolio?

According to the Higher Education Statistics Agency (HESA), in 2020, the UK had just over 2.5 million university students. The figures represent a 3% increase from the previous year.

With university numbers increasing, so is the demand for student housing.

Data from HESA found that more students chose privately rented accommodation than other options.

In 2019/20, just over 569,000 students were renting, compared to 175,000 staying in halls. This has led to landlords generating solid returns thanks to high rental yields – up to 9.56% in some places.

In this article, we look at why investing in student accommodation could be a wise financial move and some of the factors at play.

Let’s start by taking a closer look at the type of student housing we will focus on – HMOs.

There are some situations where two people rent a property. For landlords, this works similar to a standard buy to let investment.

However, most privately rented student housing will be classed as a HMO – houses in multiple occupation.

A property is classed as a HMO if:

The property is classed as a large HMO if five or more tenants live there.

Landlords need to follow extra regulations if they are letting a HMO, including licensing every five years.

Despite the extra work needed to let out a HMO, landlords letting to students are seeing significant returns through rental yield.

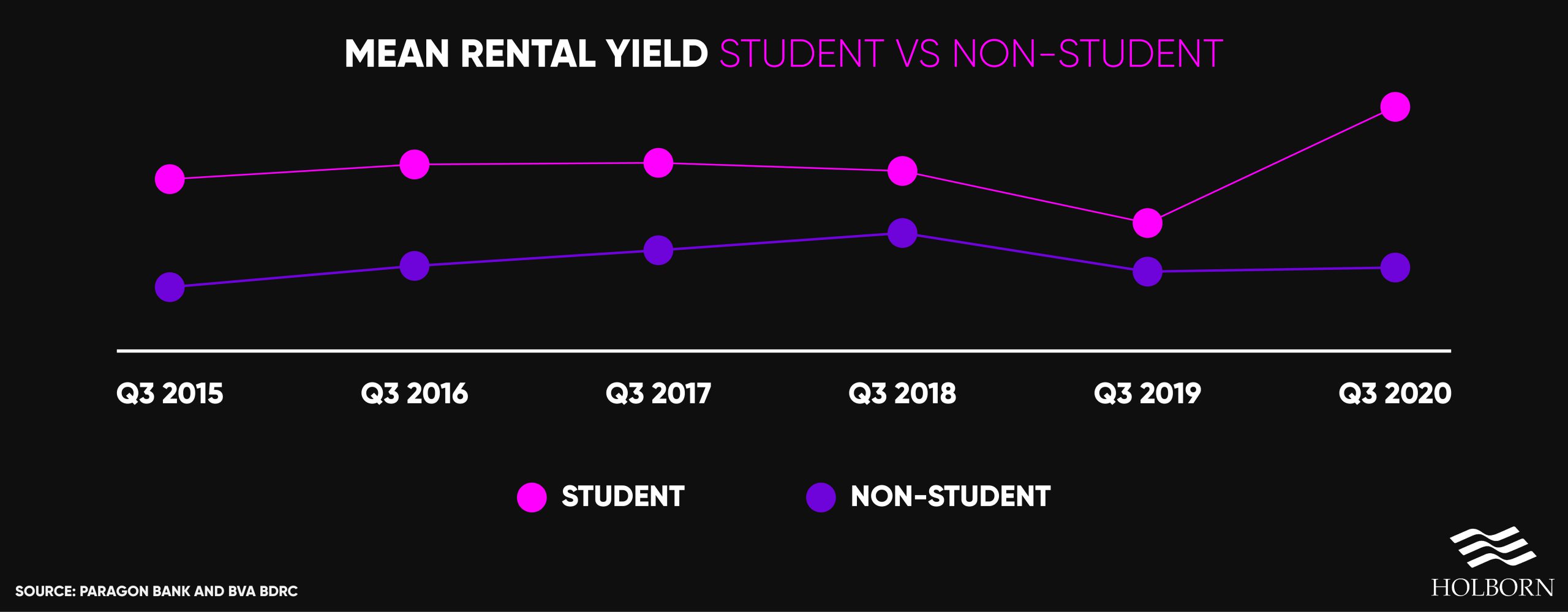

A report by Paragon Bank revealed that landlords who let to students see consistently higher rental yields than those who don’t.

Data from the specialist buy to let lender found that in 2020, the overall mean rental yield was 1% higher for those letting to students.

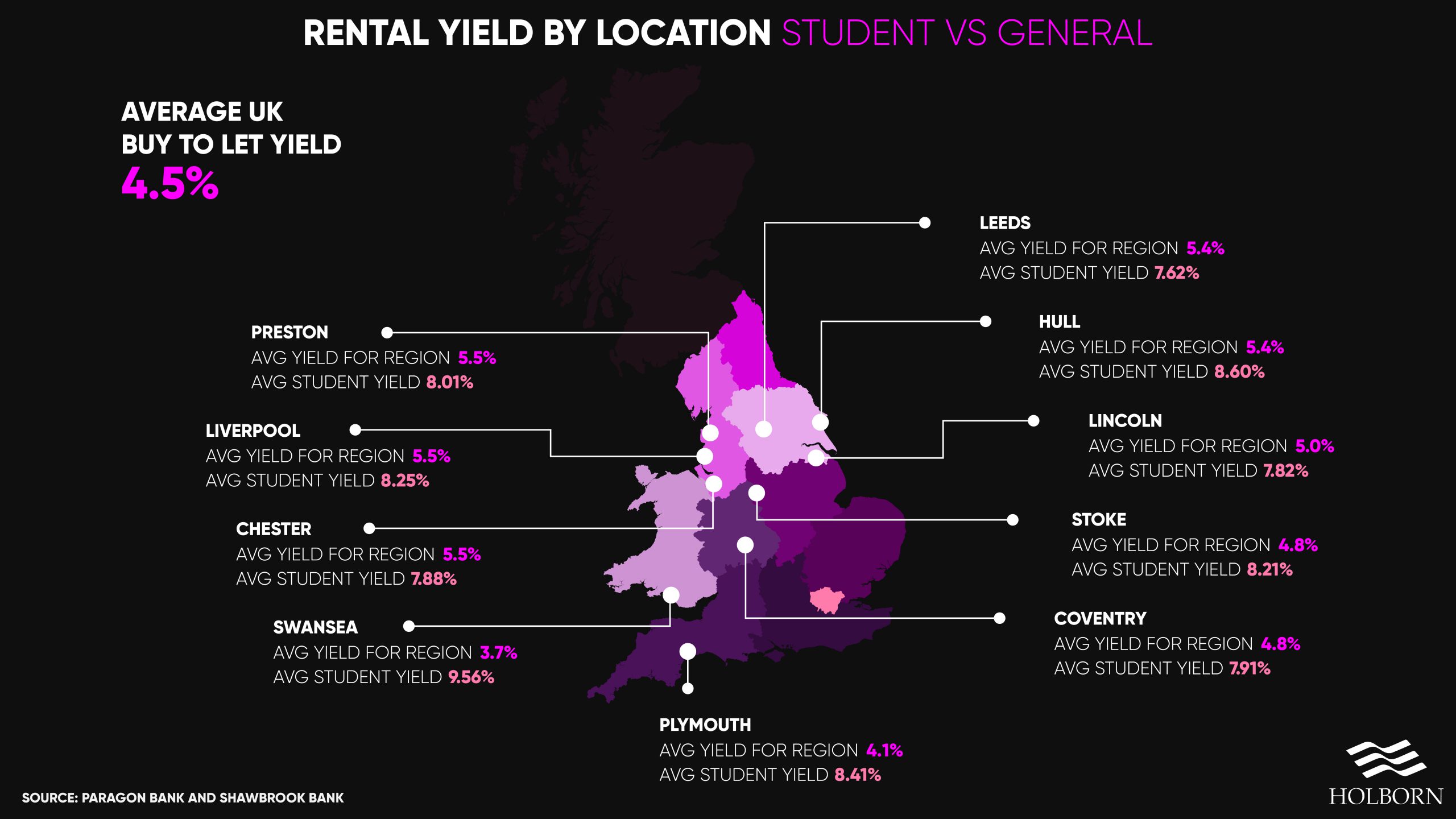

79% of landlords letting to students said that rental yields were the biggest appeal. When we look at the average yield by location, it’s easy to see why.

When we look at the university locations with the best yields, we can see that they far outpace the average for the region.

For example, Swansea saw the highest rental yield at 9.56%. That is nearly three times higher than the average yield for Wales at 3.7%.

As you can see, unlike other buy to let investments, the best returns are not always found in major cities.

Analysis by Paragon found that the best yields tend to be found in small cities or towns.

Those areas with just a single university and less than 25,000 students saw some of the best yields. Only three of the top ten locations contained more than one university.

So, why are these areas so lucrative? Paragon’s report points out that competition may be the main factor.

Smaller towns and cities tend to have less purpose-built student accommodation. As a result, there is less competition for those letting out rental properties to students.

Of course, there are some points to consider for those considering investing in student accommodation.

As we discussed, where there is less purpose-built student accommodation (PBSA), landlords seem to be reaping the rewards thanks to less competition.

However, PBSA is still a top concern for those who own student property.

In the data collected by Paragon Bank, 40% of active student landlords said that PBSA was their biggest concern due to the competition.

According to a report by Savills, their concerns could be justified.

A record number of overseas students are opting to study in the UK. Applications from Chinese students increased by 24% between 2019 and 2020, while applications from Indian students rose by 23%.

Research suggests that students from these two countries were far more likely to opt for PBSA than students from the UK.

In fact, the data from Savills found that those from China were 124% more likely to choose PBSA than domestic students. Students from India are also 106% more likely to choose PBSA over private rental houses when compared to their UK counterparts.

With the number of overseas students increasing and the demand clearly there, we could see more developers turning to PBSA. Ultimately, this will drive up the competition for landlords.

31% also highlighted property damage as a concern. However, there are other issues to consider.

For example, there can be long periods over the summer months where the property is sat empty. This is not an ideal situation for landlords as it means they will not be earning an income from rental payments.

Investing in student accommodation certainly has its benefits, especially from a rental yield perspective.

However, this type of investment won’t work for everyone. To find an investment option that works for you and aligns with your goals, speak to a specialist.

Our team of property experts work with some of the leading developers, bringing our clients a range of exclusive investment opportunities.

We also offer a complete end-to-end service, making the process stress-free.

To find out how we can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more