Posted on: 29th April 2021 in Mortgage & Property

The housing market in the UK has been booming, with average property values at an all-time high.

For years, investors have seen buy-to-let properties as the best way to put their money into bricks and mortar. However, tax changes in recent years have impacted returns.

So, with these changes, is a buy-to-let investment the best option? This article looks at the pros and cons of buy-to-let in 2021 for those looking to invest in property.

Let’s start by looking at how the UK property landscape currently looks.

Property has long been a staple asset in investment portfolios, and it’s easy to see why.

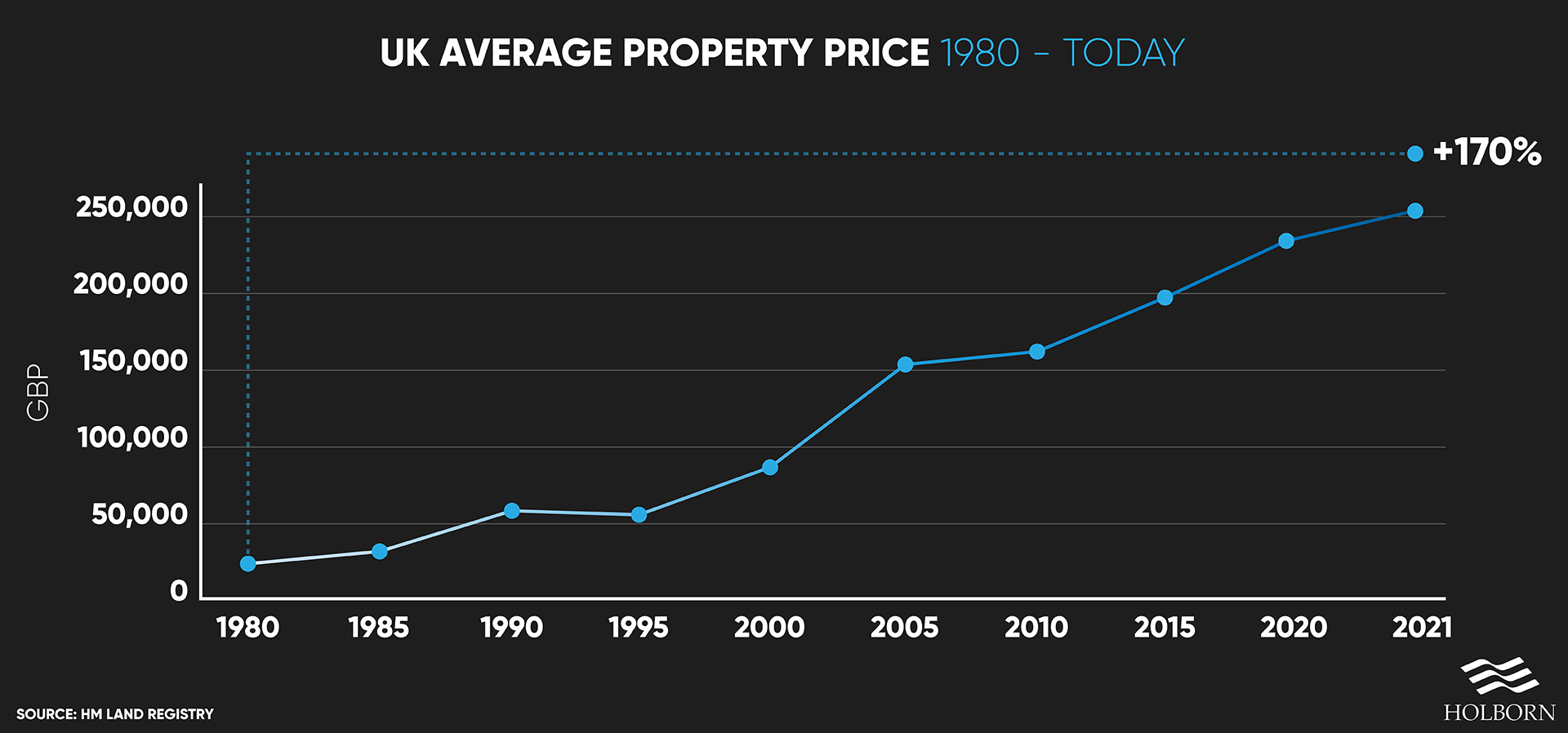

Data from the HM Land Registry reveals that UK property prices have soared.

In 1980, the average property cost was around £20,000. Just 10 years later and that value jumped to £58,000. Fast forward to the present day, and the average property is valued at just over £250,000 – that’s a 170% increase since 1980.

Although house prices are not expected to grow as much as they have in recent decades, the upward trend looks set to continue, according to experts.

Although house prices are not expected to grow as much as they have in recent decades, the upward trend looks set to continue, according to experts.

Savills UK housing market forecast predicts a 4% increase in the average property value in 2021. The real estate experts expect the average UK property value to grow by 21% from 2021-2025.

When it comes to property investment, buy-to-let is one of the most common methods.

Being able to cover the cost of your mortgage and turn a profit through rental income is an attractive option. So, how does the rental market look in 2021?

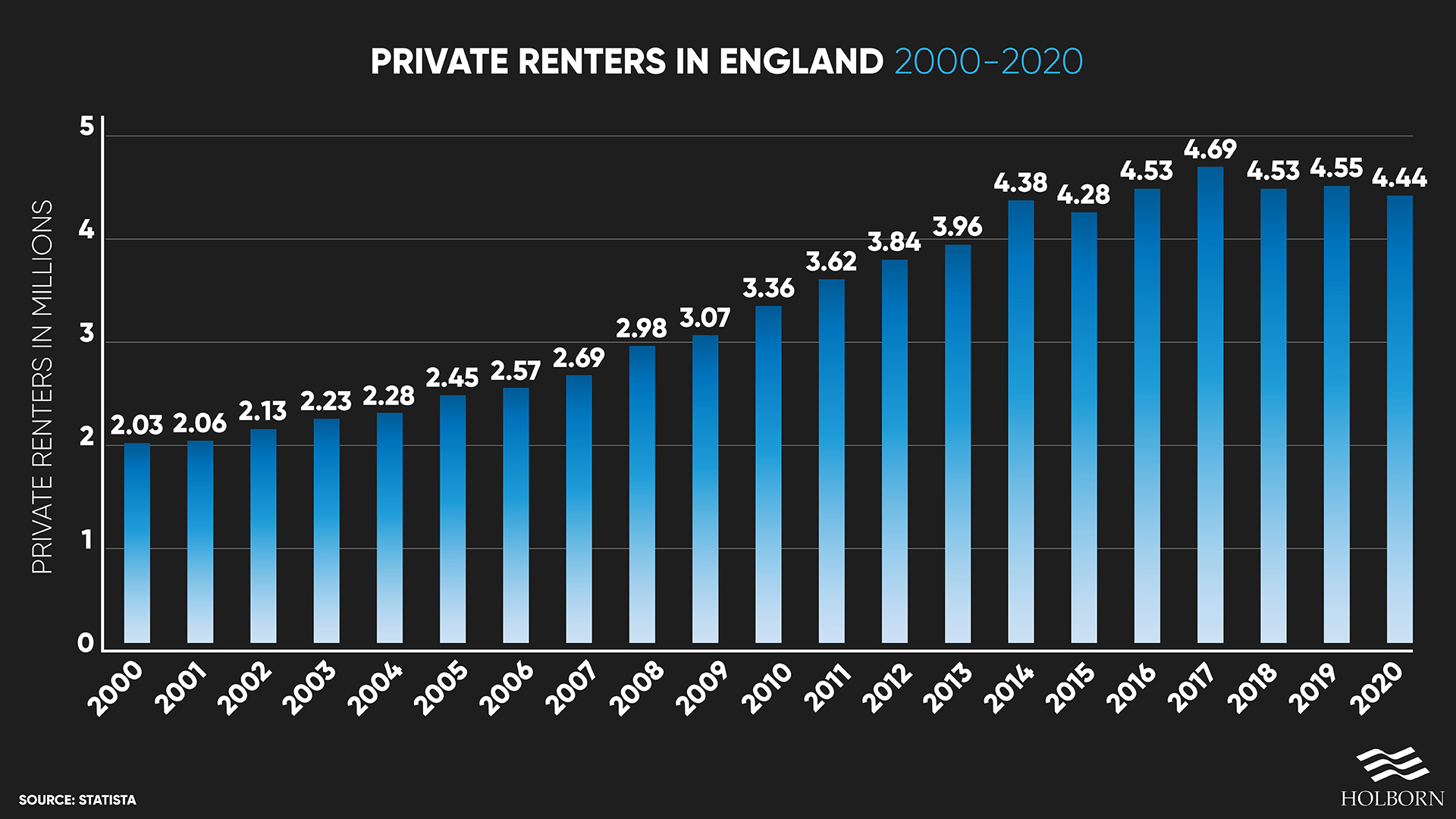

The number of people renting has dropped slightly in recent years. Still, private renting makes up a large portion of the housing market.

Data from Statista found that private renters occupied just over 4.4 million households in England in 2020. In contrast, there were nearly 4.7 million privately rented households in 2017 – the highest number in the last two decades.

Although numbers have fallen since 2017, they are still significantly higher than they were at the start of the millennium. In 2000, just over 2 million people were living in privately rented homes.

High demand is one thing, but the appeal for investors comes from the rental income.

High demand is one thing, but the appeal for investors comes from the rental income.

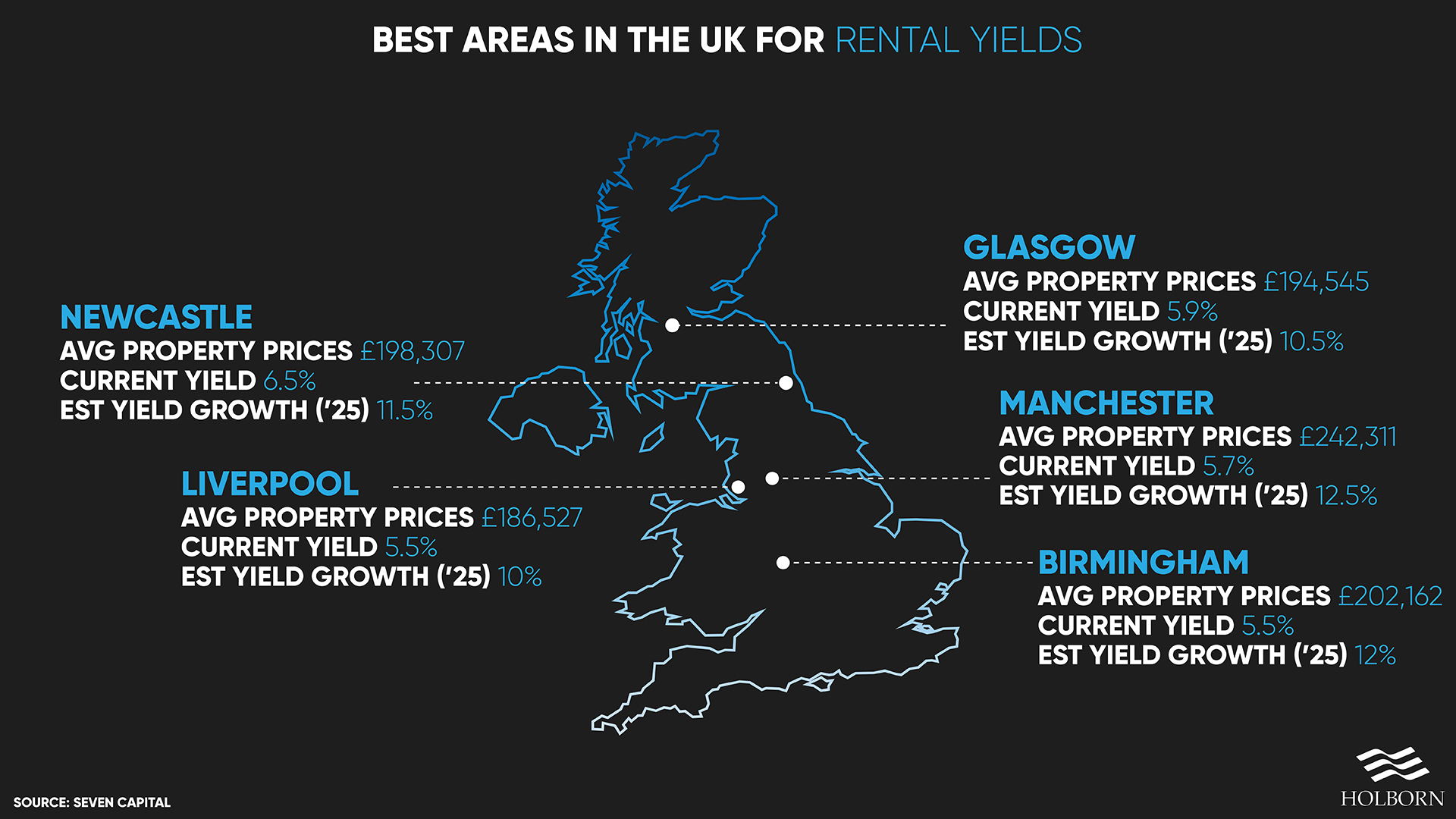

The rental yield is the percentage of return you can make each year against the purchase price.

When it comes to rental yields, location is a big factor. Research carried out by Seven Capital found that properties in Newcastle had the best yields. The city in the North East has a current yield of 6.5%, with average property prices just below £200,000.

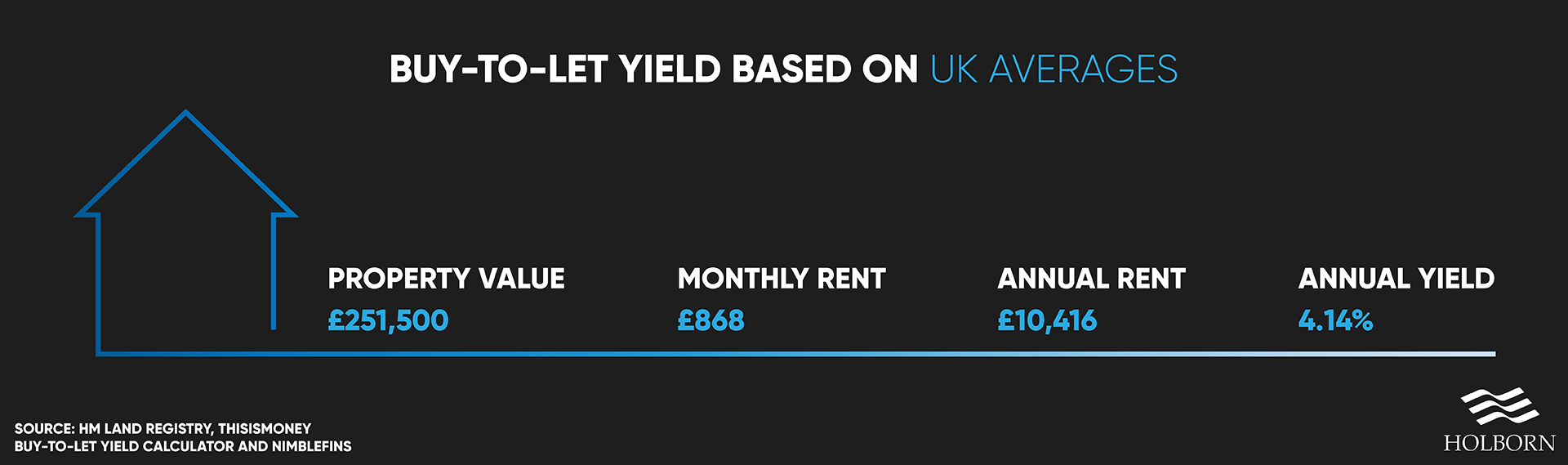

Here is how the annual yield would look based on the average UK property value and the average rent.

Here is how the annual yield would look based on the average UK property value and the average rent.

However, the number of buy-to-let mortgages has dropped in recent years. Data from UK Finance found 64,500 buy-to-let mortgages were taken out in 2020. The figure represents a big drop off in buy-to-let mortgages from 2019 and 2018, which saw 72,300 and 73,300, respectively.

However, the number of buy-to-let mortgages has dropped in recent years. Data from UK Finance found 64,500 buy-to-let mortgages were taken out in 2020. The figure represents a big drop off in buy-to-let mortgages from 2019 and 2018, which saw 72,300 and 73,300, respectively.

One of the reasons for the dip could be the current tax climate and its impact on returns.

In 2016, the UK government introduced a surcharge on buy-to-let investment properties. Depending on the cost of the property, the surcharge can range from 3% to 15% of its total value.

When you account for these additional costs and taxes, there is a large gap between gross and net returns.

Research carried out by Hamptons found the average landlord paying higher-rate tax saw a 14% drop in net yield between 2016/17 and 2020/21.

Of course, income from rent is only one of the factors which make property an appealing asset. Capital growth will increase the total return for investors in the long term.

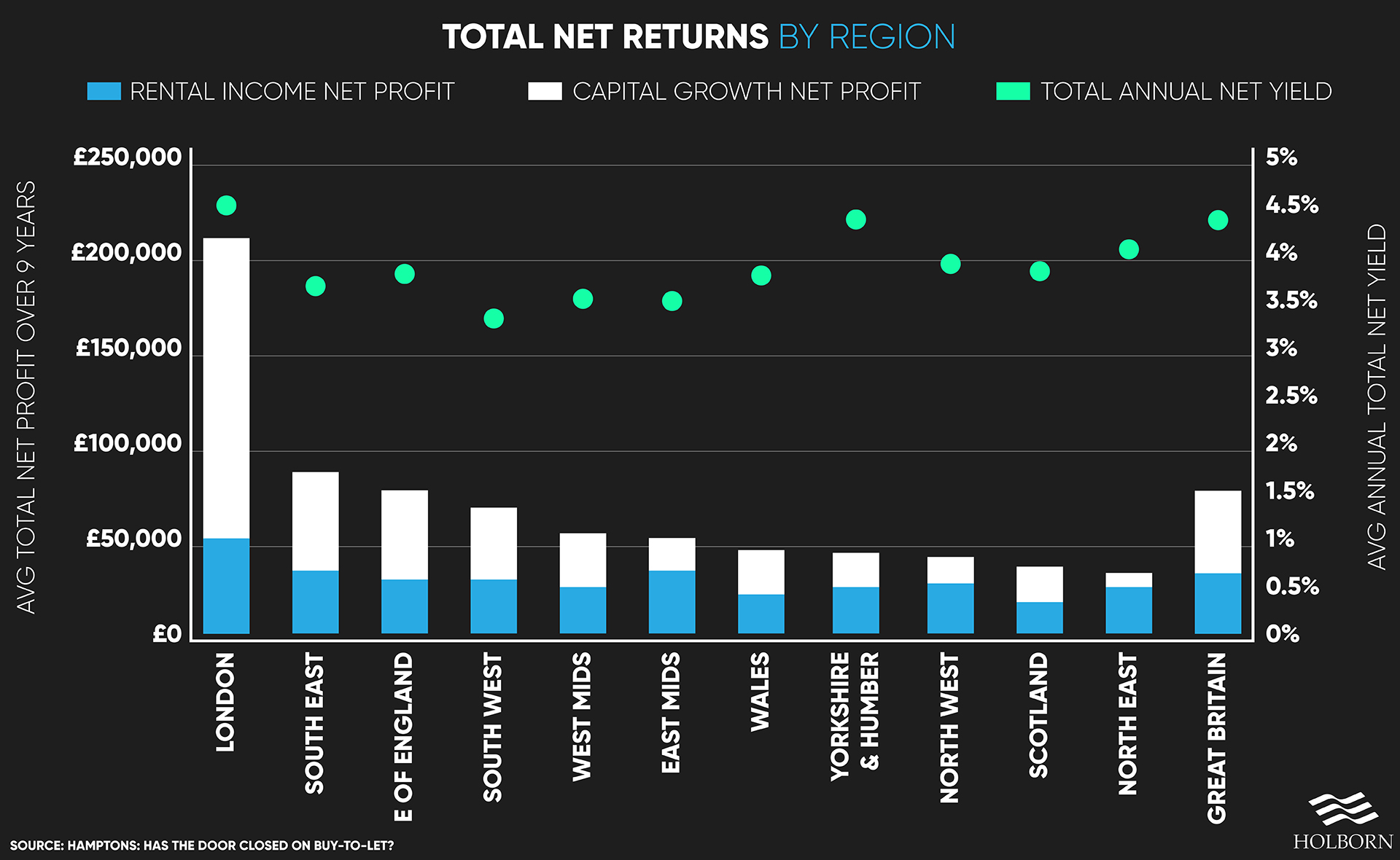

In 2020, the average landlord sold their property for £78,010 more than they paid for it, having owned it for 9.2 years. According to Hamptons, accounting for costs, Stamp Duty, and capital gains tax, the net profit on the sale came to £43,340.

Adding rental income and capital growth together over that period, the average landlord in the UK made a total net profit of £76,820. The net profit represents a 39% return on investment and an annual net yield of 4.3%.

Here is a look at the total net profit over nine years in each region based on a higher-rate taxpayer.

So what does all of this mean? Ultimately, net yields have dropped, but a buy-to-let investment still remains profitable in most cases.

So what does all of this mean? Ultimately, net yields have dropped, but a buy-to-let investment still remains profitable in most cases.

The current climate has certainly made people rethink their investment strategies.

There is no doubt that a buy-to-let investment remains a viable option. The landscape may have changed, but property as an asset still provides excellent long-term growth for investors.

Other external factors such as negative interest rates may push people towards buy-to-let investments.

With rates already at a historic low, savings accounts look less favourable than they have in recent years. On the other hand, lower rates have made borrowing more appealing. The two could be the perfect recipe for potential investors to look at putting their money into property.

Are you looking for the most effective way to grow your wealth in 2021 and beyond? If so, speak to our team of specialists.

Our expert wealth managers are on hand to provide you with the information you need to build a profitable portfolio in any climate.

To find out how we can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more