Property vs shares: where should you invest your money?

Posted on: 4th April 2022 in

Investments

Property vs shares – which is the better option for investors?

With house prices continuing to soar, that’s a question more people are starting to ask.

In this article, we look at how real estate investments compare with stock market investments.

Let’s start by looking at both types of investments in more detail.

Property investments

A brick and mortar investment property will usually fall into one of two categories – residential and commercial.

Commercial property will include things like office buildings or real estate funds. Residential property investment is normally one that you intend to use to create a steady income stream. This is usually a regular income from rent payments.

Your return on investment (ROI) is often based on rental yield and capital growth. Of course, these will be offset by outgoings such as mortgage costs.

The stock market

With the stock market, you generally either invest in individual shares or funds. Funds are pre-made baskets of investments.

Returns are based on share prices either going up or down. Investments are typically a long-term strategy for building wealth. Most experts suggest that you remain invested for five years at the very least.

Your risk tolerance and goals play a major role in picking your investments.

Each asset class has a different level of risk. For example, equities have the highest risk levels but generate the biggest returns. The idea is to invest in a way that you are comfortable with, and that helps you reach your financial goals.

Doing this can be tricky, so people often turn to portfolio management services to take care of everything for them.

Property vs shares

Research carried out by The Telegraph looked at how a £50,000 investment would perform over a 10-year period in both real estate and the stock market.

Their analysis showed that a buy-to-let landlord would make a profit of £54,106 from rental yield alone. There would be a further £39,079 profit from capital growth, bringing the total profit to £93,185 before tax.

On the other hand, the total profit in the stock market scenario returned £31,833.

So, property is the clear winner based on the numbers alone, right? Well, it’s not that simple.

The first thing to consider is the investment amount. The mortgage deposit for a buy-to-let property is around 25%. According to the ONS, the average property in the UK is £274,000, meaning you would need a deposit of roughly £69,000.

This highlights how high the initial costs are to invest in property. In contrast, the stock market is far more accessible for most investors.

Other points to consider are tax and additional costs.

Both will likely incur capital gains tax. However, landlords who own another home will pay stamp duty. On top of this, there is the cost and time investment of maintaining rental properties. All of these added costs will reduce the overall profits for a private landlord.

Investments in shares can be held in an ISA. This gives them tax advantages over real estate investments. There is an annual tax-free allowance for ISAs, so anything over that amount would be subject to tax.

It’s important to remember that the scenarios mentioned above are hypothetical. To better compare the two types of investment, we need to look at some real-world data.

Real-world data: property vs shares

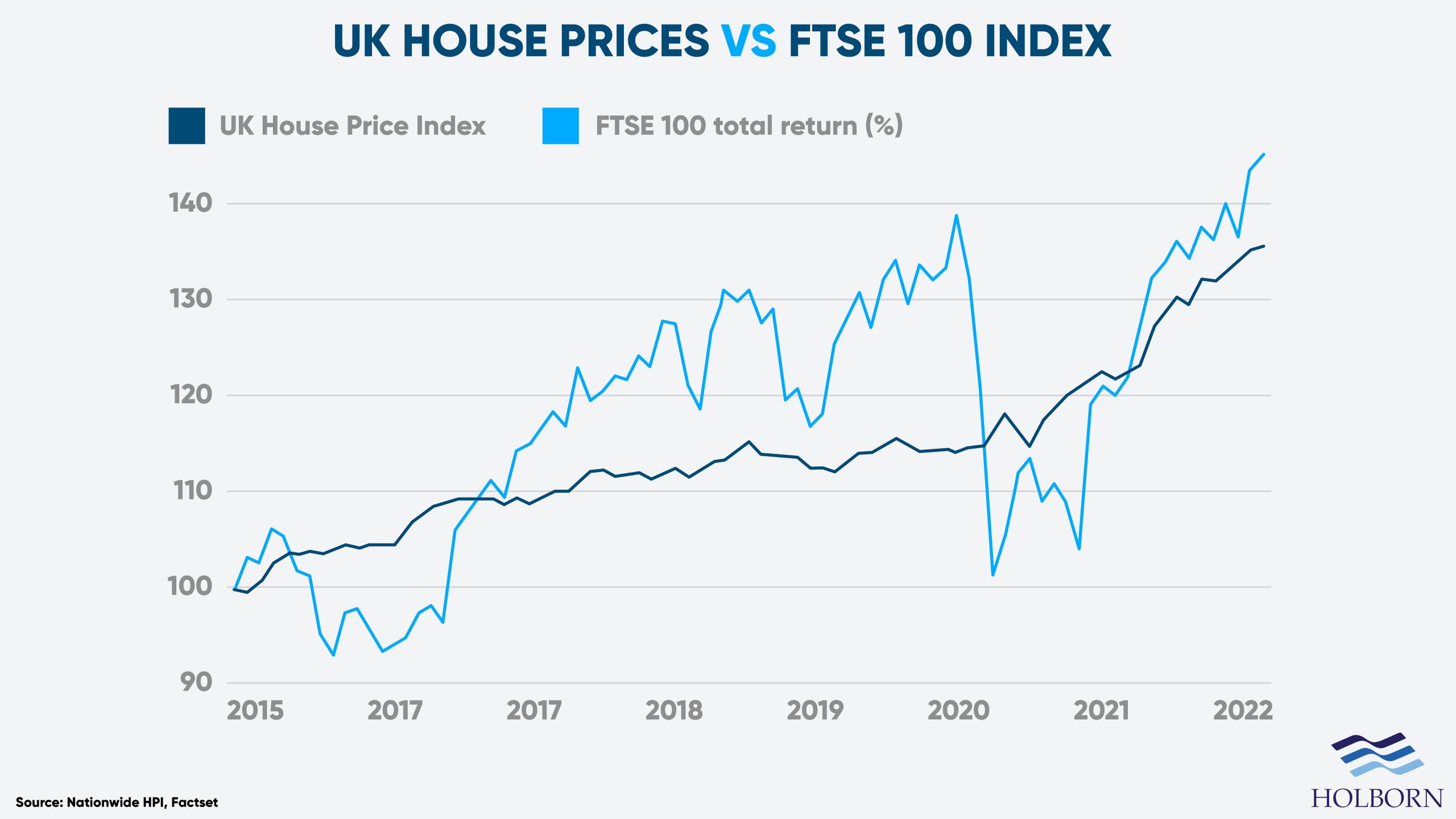

One of the advantages of property investment is its consistency, even during times of uncertainty.

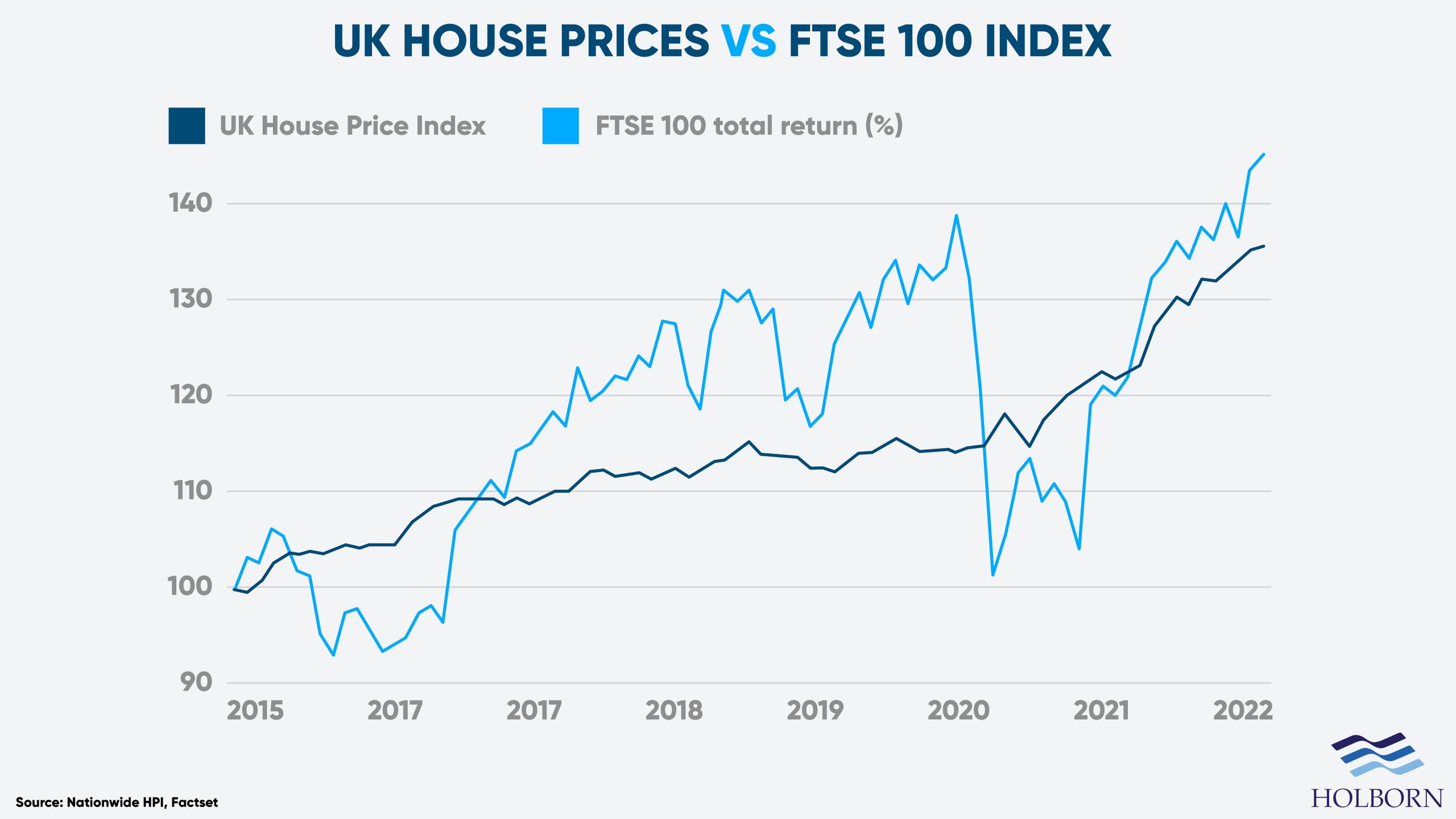

There are times when stock market returns have been significantly higher than the appreciation of property prices. However, comparing the property market to the FTSE 100 shows how much the stock market can fluctuate.

As the graph illustrates, the FTSE 100, along with other global markets, dropped dramatically going into 2020 due to the pandemic. On the other hand, property value saw a small, brief drop before it continued to trend up.

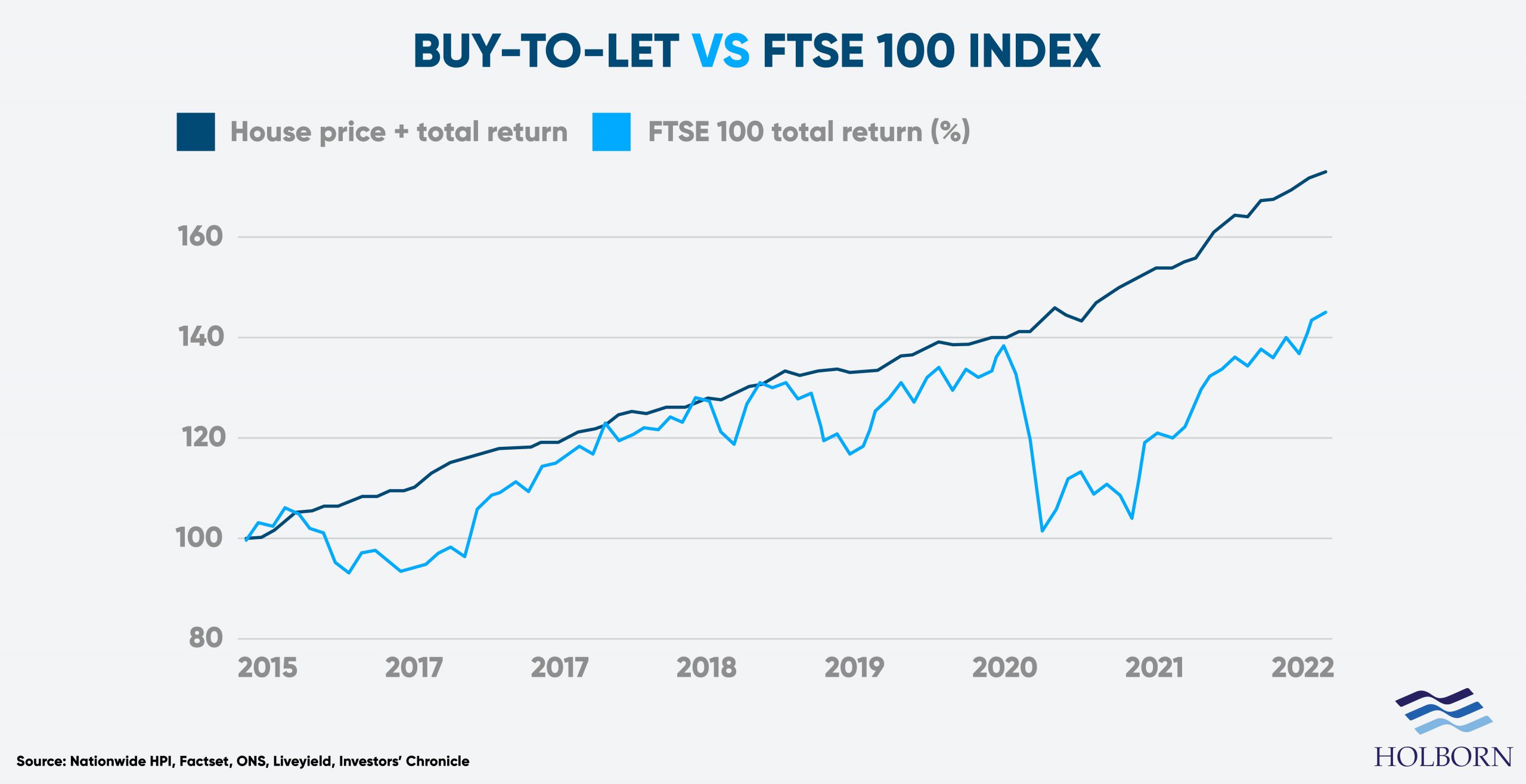

This gives us a good idea of overall property value vs investment returns in the stock market. However, if we compare the FTSE 100 against a buy-to-let investment, we see a clear separation between the two.

This gives us a good idea of overall property value vs investment returns in the stock market. However, if we compare the FTSE 100 against a buy-to-let investment, we see a clear separation between the two.

We can see buy-to-let consistently outperforming the FTSE 100 between 2015 and 2022. At this point, choosing where to invest your money probably seems like a no brainer. But don’t write off the stock market just yet.

The problem with property

Most experts agree that a well-diversified portfolio is essential for long-term success with investing.

That means thinking about your asset allocation and spreading your investments across different sectors and asset classes.

The problem with real estate, especially buy-to-let, is the high costs involved. For that reason, owning more than one is likely beyond most investors.

Of course, you could point to the charts above and say that owning one property is enough. However, you need to consider that not all buy-to-lets are created equally.

For example, the average rental yields and capital growth differ depending on location. There may also be points where you don’t have tenants, thus no rental income to cover the mortgage payments.

Buying shares on the stock market is a lot cheaper than stumping up 25% for a deposit – especially as the average house prices continue to rise.

You can also benefit from buying shares in different companies, allowing you to spread the risk. In other words, you don’t need to put all of your eggs into one basket.

You can probably tell by now that the stock market and a buy-to-let property are very different types of investment. For one, property is a tangible asset, unlike shares in Apple.

So, is there a middle ground between the two?

The best of both worlds

Real estate investment trusts (REITs) allow people to buy fractions of a property. Think of these like shares on the stock market.

Shares are units of stock. You can’t buy Amazon, but buying shares allows you to buy a small part of the company. REITs work similarly.

Like shares, you can hold REITs in an ISA, making them more tax-efficient. This is not an option with brick and mortar real estate.

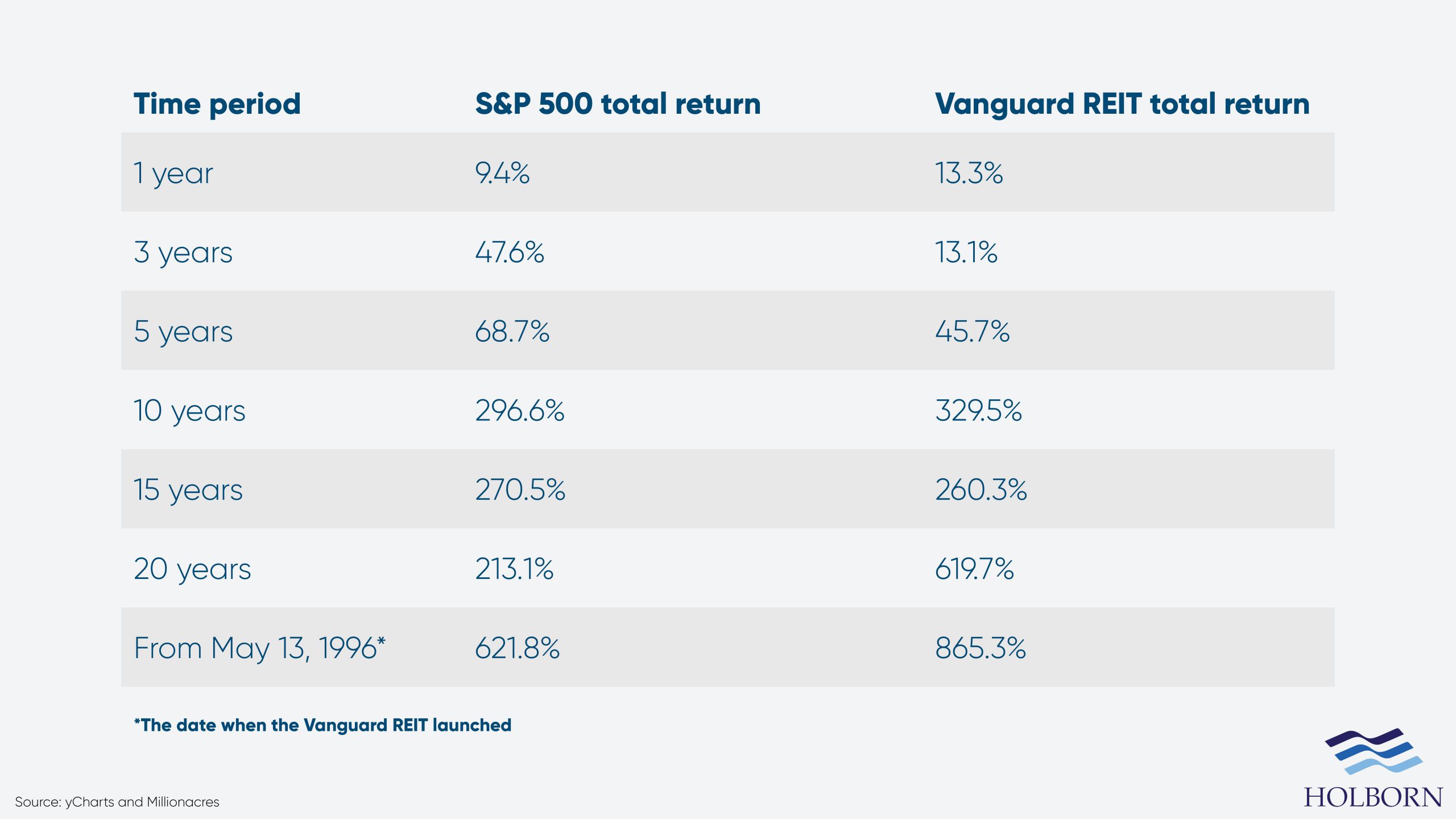

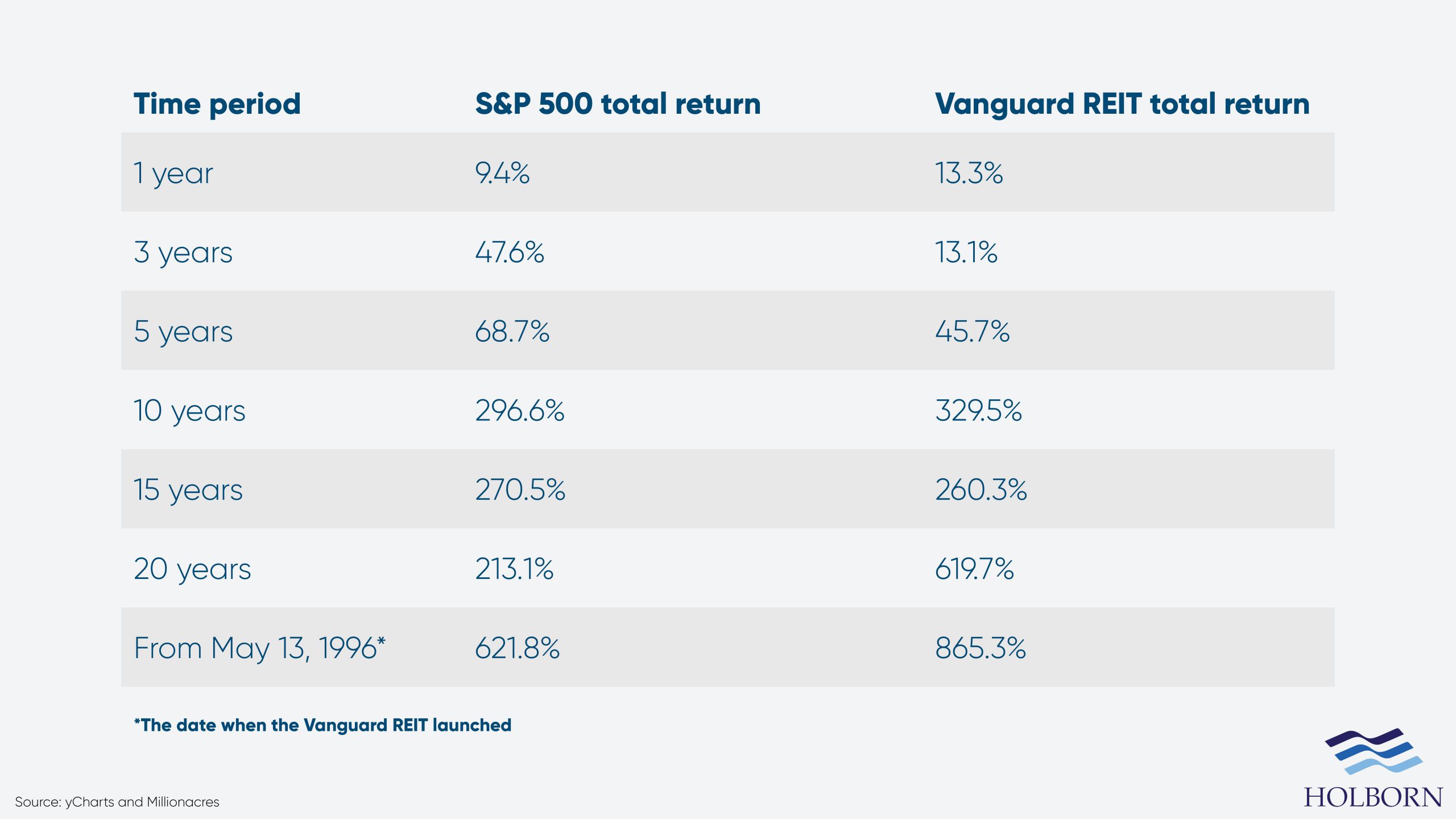

The big question is, how do REITs compare to stock investments over an extended period of time?

The table below compares the S&P 500 and one of the most popular REITs; the Vanguard Real Estate mutual fund.

Investing with Holborn

We started this article by asking when it comes to real estate vs. stocks, where should you invest your money?

The truth is, both are very different. Comparing the two apples-to-apples is difficult. REITs act as that middle group between the two but may not be suitable for everyone.

Ultimately, the best investment choice is the one that fits your needs, goals and financial situation. If you are unsure what the best strategy is for you, seeking professional advice can help.

For more than 20 years, we have worked with clients to build portfolios that meet their needs and financial goals.

At the heart of what we do is the client experience. That means always putting your best interests first by providing transparent financial advice at all times.

It’s that client-first approach that has won us multiple industry awards and makes us one of the most trusted financial institutions in the market.

So, with Holborn Assets, you can be sure that you are in safe hands. To find out how we can help you, contact us using the form below.

This gives us a good idea of overall property value vs investment returns in the stock market. However, if we compare the FTSE 100 against a buy-to-let investment, we see a clear separation between the two.

This gives us a good idea of overall property value vs investment returns in the stock market. However, if we compare the FTSE 100 against a buy-to-let investment, we see a clear separation between the two.