Posted on: 11th April 2022 in Investments

Technology has become a fundamental part of our personal and professional lives.

Following the COVID-19 pandemic, remote working has become a way of life for many people. A report by Accenture found that 100% of companies rely on the internet to operate. Just a decade ago, that figure was one in four.

We are now more connected than ever before. However, that comes at a cost.

As technology advances, so do the opportunities for criminals to exploit it for personal gain. What is helping to stop them is cybersecurity. And this provides opportunities for investors.

In this article, we look at how the reliance on cybersecurity is increasing and why you might want to consider investing in the sector.

But first, you need to understand one of the main things it is protecting against and how big of a threat it poses – cyber crime.

Data is now considered one of the world’s most valuable resources. There is a reason giant companies such as Meta (previously Facebook) and Google collect so much data on their users.

Because data is such a valuable resource, it has also become one of the most vulnerable. As a result, cyber attacks have become a go-to for criminals.

In recent years, high-profile attacks have seen hundreds of millions of people’s data fall into the hand of criminals.

In 2013, Adobe saw around 38 million accounts breached. Last year, a significant breach saw the personal data of 533 million Facebook users published on a hacking forum.

A press release from Which? further highlights the issue. Their investigation found that cyber criminals were selling stolen data for just a few pounds on the dark web.

However, cyber crime goes beyond data. Criminals also look to steal money from individuals and cause outages on major networks, costing companies millions.

According to the National Crime Agency (NCA), some of the most common cyber threats include:

So, how big of a problem is cyber crime on a global scale?

Cyber crime has cost the UK economy roughly £27 billion. On a global scale, that cost is much higher.

The total cost worldwide for 2021 is not known just yet. Still, experts forecast that cyber crime will cause damages upward of $6 trillion by the end of 2021.

To put that into perspective, if cyber crime were a global economy, it would replace Japan as the third-largest in the world.

Things are also predicted to get worse. By 2025, that cost is expected to grow by 15% to $10.5 trillion.

As the threat of cyber crime increases, so does the need for tools to protect against it.

From the computers in use for work to the mobile phones we carry in our pockets, we are more connected now than at any time in our history.

With our devices now a fundamental part of our lives, there is an increasing need to protect our digital assets.

Cybersecurity protects computers, networks and data from attacks. In other words, it’s a way for both individuals and companies to help reduce the risk of a cyber attack.

For companies, governments and critical infrastructure, network security is crucial. A major cybersecurity breach could have catastrophic consequences.

In 2020 spending on information technology fell due to the coronavirus pandemic. With people now working from home, companies had fewer overheads.

However, cybersecurity spending was the exception. The sector has grown significantly in recent years, which is expected to continue.

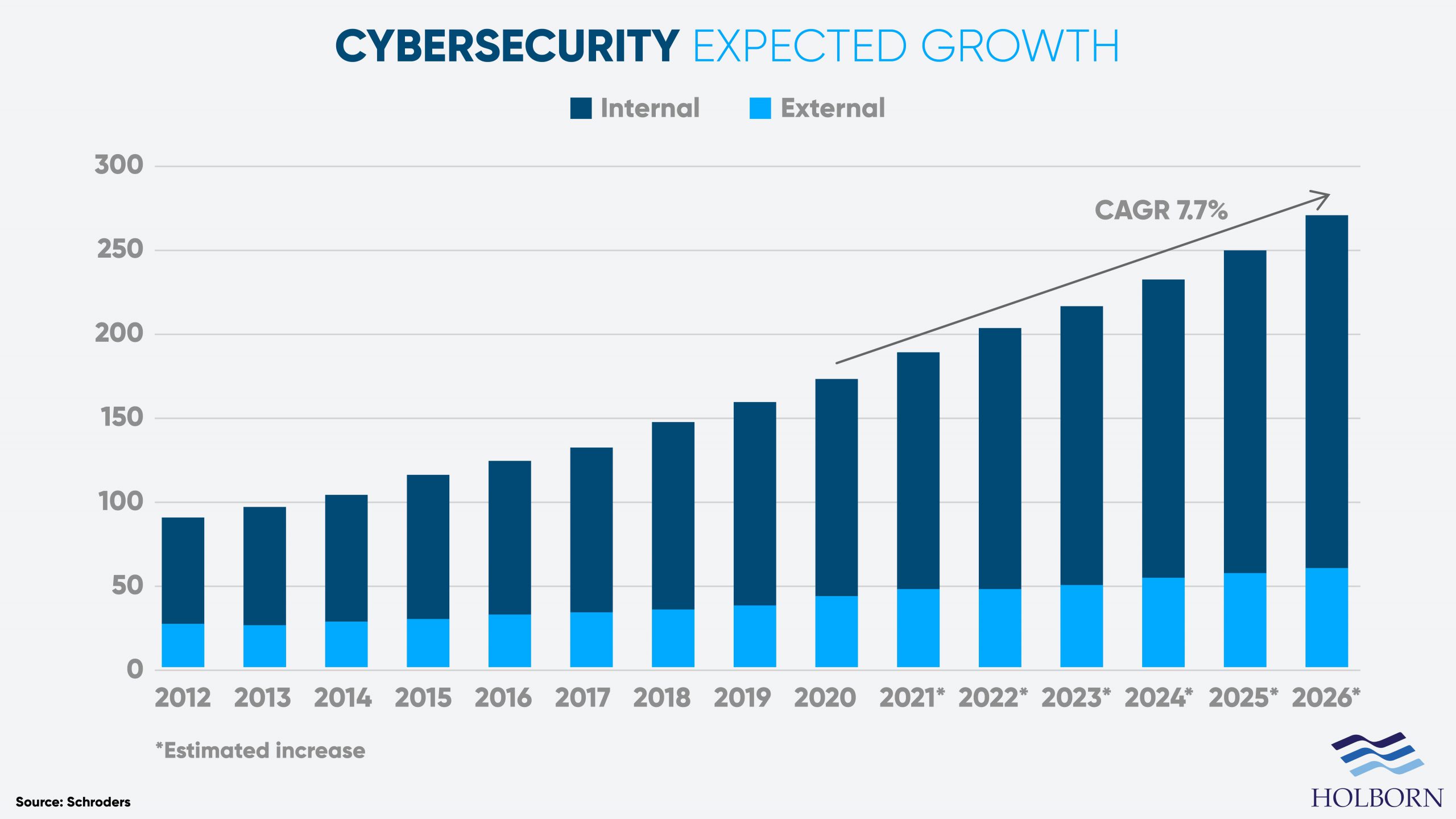

Between 2020 and 2026, the sector’s compounding growth rate (CAGR) is expected to increase between 7.7% and 14.5%.

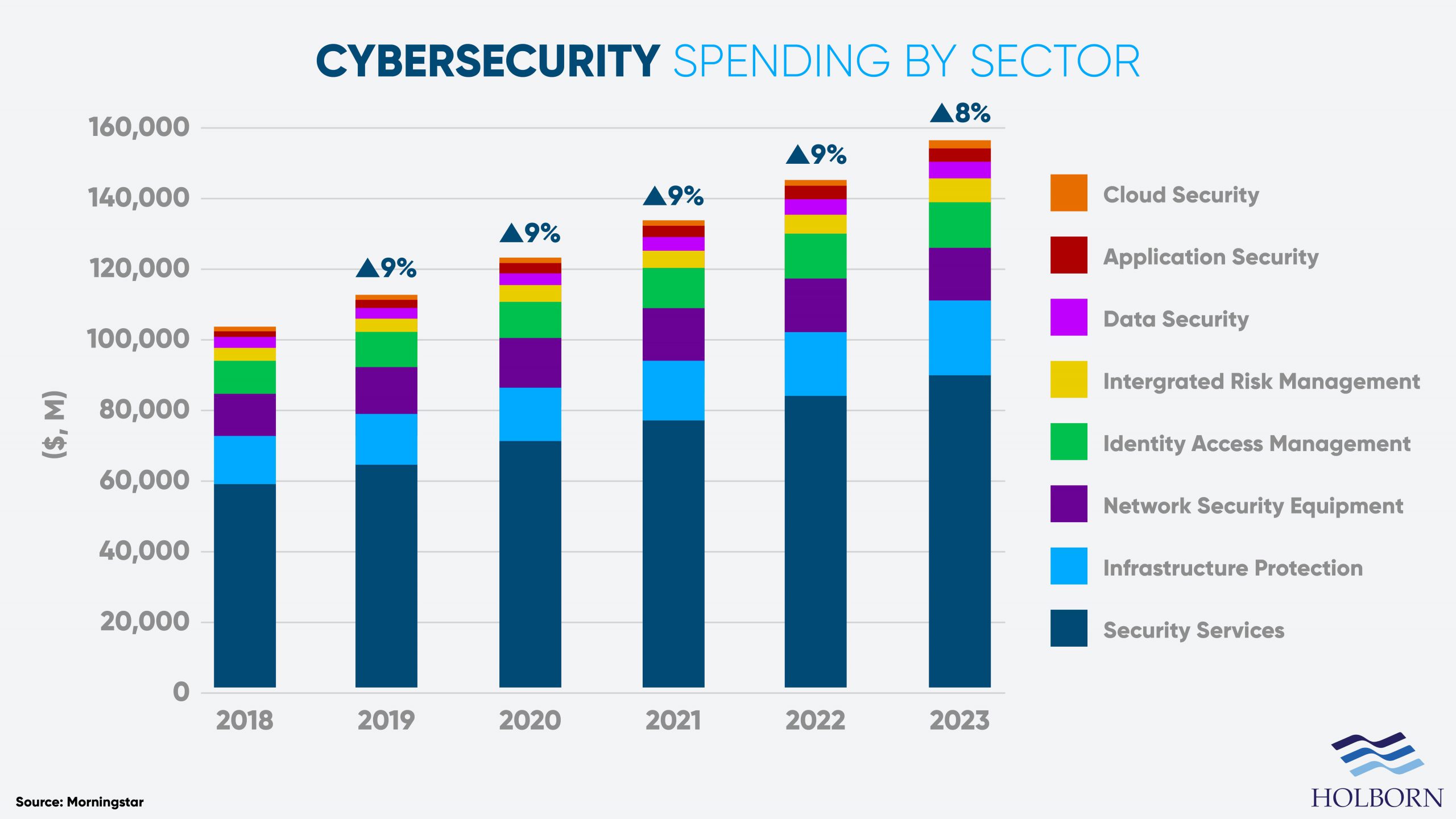

As an investor, it’s essential to know where spending is happening. This allows you to make an informed investment decision by identifying key areas within the sector.

The graph below gives a breakdown of cybersecurity spending by service.

Cybersecurity looks likely to continue to be a high-growth industry, with spending in the sector only set to increase. This is good news for investors looking to diversify their portfolios with tech shares.

However, it’s important to understand how to invest in the cybersecurity space and the available options.

Cybersecurity stocks are listed on stock exchanges around the world. Investors can buy shares in individual companies or invest in funds.

The issue with investing in specific companies is that the cyber landscape is continually changing.

As new threats emerge, the demand for specific services can increase or decrease. Ultimately, this can impact the overall stock value of a company.

However, exchange-traded funds (ETFs) can provide a solution. Cybersecurity ETFs give you exposure to different cybersecurity companies.

One of the key benefits of investing in an EFT is it helps spread the risk, rather than putting all of your eggs in one basket.

Having the right strategy is the key to long-term success, as with any investment. That means knowing how to invest in a way that suits you while also reaching your financial goals.

Finding the right balance can be tricky, but speaking with an expert can help.

For more than 20 years, Holborn Assets have worked with clients to build and manage investment portfolios.

Our client-first approach has won us multiple industry awards, making us one of the most trusted financial institutions.

To find out how we can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more