How does critical illness insurance work?

Posted on: 4th September 2018 in

Insurance

Critical illness insurance gives you financial options when you need them most. And stats show that the policies DO pay out.

Although there’s sometimes stories about insurance companies being picky when it comes to payouts, the fact is that 92% of critical illness policies did pay out in the UK in 2016 with an average award of £68k – according to the prestigious Association of British Insurers.

In the Middle East, the story is the same: insurance giant Zurich International Life paid out 91% of critical illness claims between 2014 and 2016.

Critical illness strikes earlier than you think.

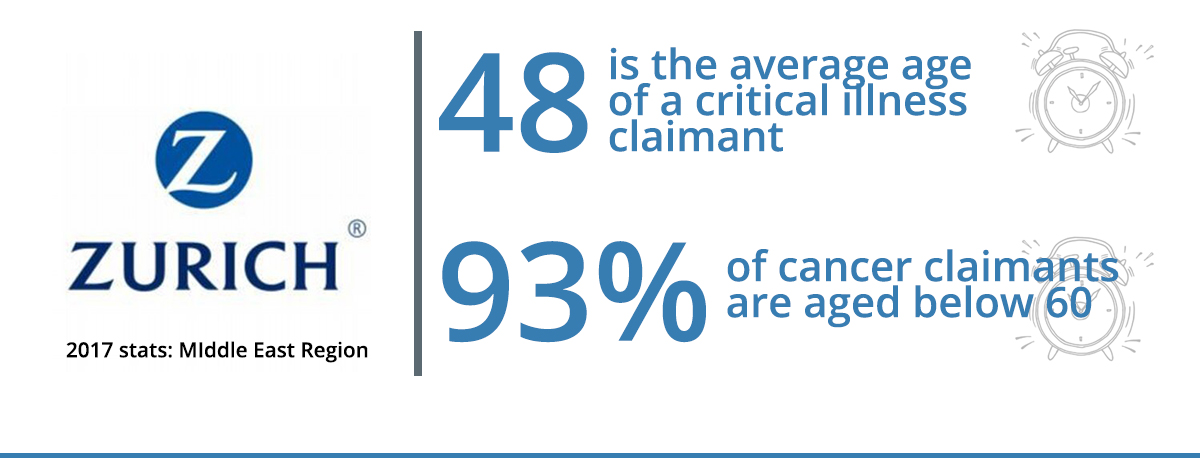

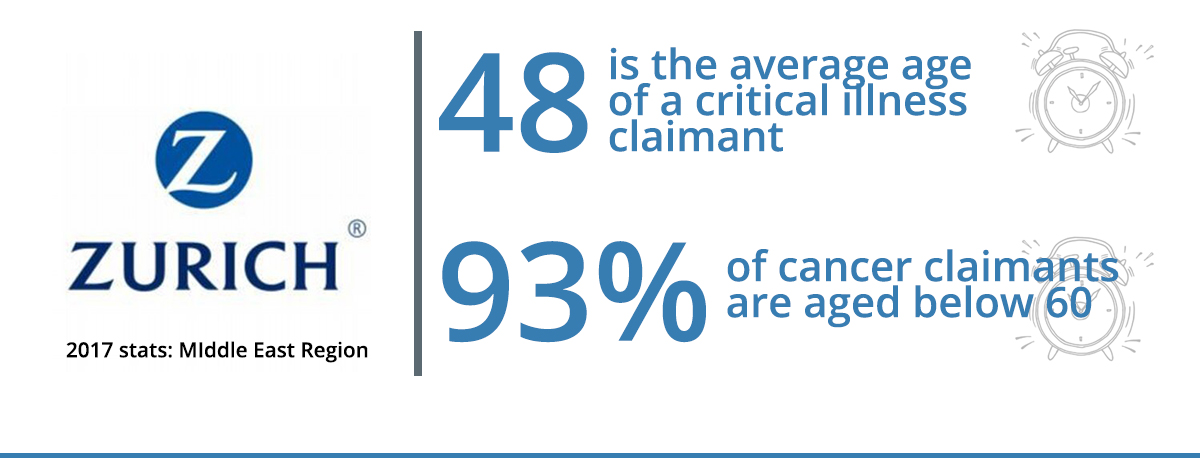

Researchers from Zurich found that the average age of a claimant in the Middle East region for a critical illness payout was 48 years old. That’s very young. And, what’s more, it was found that the vast majority (93%) of claimants for cancer

payouts were aged under 60 years old – as were sufferers with heart problems (87%).

How does Critical Illness Insurance work?

Critical illness policies give you a one-off lump sum in the event of you presenting with one of a list of 30-60 specified medical conditions. Here, for example, is insurance company Aviva’s list.

And here is Zurich’s detailed list. Between 2014 and 2016, Zurich reports that “over two-thirds (68 percent) of claims for men were paid

out due to cardiovascular disease while four out of five (81 percent) claims paid out to women were for breast and cervical cancer.”

Critical Illness vs. Medical Insurance

Medical insurance is compulsory in the UAE, and many packages are likely to cover you for some costs should you acquire a critical medical condition. In the UAE, for example, the treatment of breast cancer is now provided free (courtesy of the government)

as part of standard medical insurance. So medical insurance helps in a variety of critical health situations. But, by giving you a lump sum to spend as you wish, a critical illness policy will give you the financial flexibility you need to deal with

your whole – radically-changed – life situation. Medical insurance deals with some bills; critical illness cover manages the impact on your whole life.

Critical Illness vs. Life Insurance

Life Insurance gives you a lump sum to look after your family when you have passed on (however you have done so). Critical illness insurance gives you a lump sum whilst you are still alive but suffering from one of the pre-specified medical conditions.

Critical illness policies often come as part of life insurance policies.

Critical Illness vs. Income Protection

There’s sometimes confusion between critical illness and income protection policies. How are the policies different? Critical illness cover gives you a one-off windfall in the event of getting one of a limited range of life-threatening conditions (serious

illness or injury), whereas income protection gives you a steady financial trickle in the event of you having to take time off work for any sort of illness or injury (whether serious, life-threatening or simply a temporary inconvenience). What distinguishes

income protection, in particular, is that it is work-related. Policies centre on your ability to work, and payout monthly usually 65% of your gross income. Critical illness cover, on the other hand, has nothing to do with employment and pays out as

a lump sum if you present with a specified medical condition. Both policies – and, indeed, most health-related insurance policies – overlap. Depending on the situation, both types of cover could apply, neither, nor just one! All combinations are possible.

For example, 23% of income protection payouts made by reputable UK insurers Drewberry Insurance (2011) involved heart/cancer/stroke – which are key targets for critical illness cover. What about payouts? Income protection awards are likely

to come your way more often than critical illness awards. And that’s because income protection covers a far broader spectrum of possibility; critical illness is tied to having a specific medical condition after all, whereas income protection centres

on whether you can work or not. Statisticians from Which? the consumer group found that only about half of those having to be off work for 6 months or more would qualify for a critical illness award. That’s not surprising.

SIMILARITIES – critical illness & income protection

- Cover for injuries and illness

- Payout is free to spend as you wish

- Guaranteed/fixed premiums available

DIFFERENCES – critical illness & income protection

- Income protection is tied to earnings; critical illness is not

- You can only claim once with critical illness cover; with income protection, you can make multiple claims

- Critical illness is tied to specific medical conditions; income protection is not

Critically confused?

So critical illness cover has nothing to do with dying? What? Well, that’s the truth of it. Usually, critical

illness policies demand that you outlive your definitive diagnosis by ten days or similar – but, other than that, whether you live or die does not influence the operation of a policy. As moneysupermarket.com points out, there’s a whole other

type of cover called Terminal Illness Cover. Confusing, isn’t it?

So critical illness cover has nothing to do with dying? What? Well, that’s the truth of it. Usually, critical

illness policies demand that you outlive your definitive diagnosis by ten days or similar – but, other than that, whether you live or die does not influence the operation of a policy. As moneysupermarket.com points out, there’s a whole other

type of cover called Terminal Illness Cover. Confusing, isn’t it?

Ask somebody who knows

Insurance can be confusing because policies overlap. Policies tend to have misleading names too. Policies also have a bewildering range of strengths and weaknesses – but this is a factor for you to use to your advantage. Get an expert in to make the best

of what’s out there. Generally, IFAs are not tied to any one product or provider – but they may be able to get you a special deal. And they’ll certainly know what policies work together and which don’t. Expert assistance generally works out saving you a lot of money – despite insurance policies being relatively cheap. It’s better to “invest in the best” guidance you can get, and build a system of insurance that makes sense.

So critical illness cover has nothing to do with dying? What? Well, that’s the truth of it. Usually, critical

illness policies demand that you outlive your definitive diagnosis by ten days or similar – but, other than that, whether you live or die does not influence the operation of a policy. As moneysupermarket.com points out, there’s a whole other

type of cover called Terminal Illness Cover. Confusing, isn’t it?

So critical illness cover has nothing to do with dying? What? Well, that’s the truth of it. Usually, critical

illness policies demand that you outlive your definitive diagnosis by ten days or similar – but, other than that, whether you live or die does not influence the operation of a policy. As moneysupermarket.com points out, there’s a whole other

type of cover called Terminal Illness Cover. Confusing, isn’t it?