We all know the importance of saving. However, it doesn’t stop us from wasting a lot of money on things we don’t need.

According to research carried out in 2019, the average UK household wastes £9,051 per year on things they will never use.

The data revealed that respondents spent £733 on clothes that have never been worn. A further £628 was wasted per year on TV packages that were rarely, and in some cases, never used.

We are all guilty of buying things that seem like a good idea at the time, only for them to end up in the darkest recesses of our cupboards. But what if we were to tell you that you could turn that wasted money into a lot more money?

No, this isn’t a dodgy get rich quick scheme. But thanks to the power of compound interest, £9,051 could go a lot further than you might think.

In this article, we look at how compound interest works and how it has the power to turn a little into a lot.

How compound interest works

Compound interest is a term you usually hear associated with savings and investments. Here’s how it works.

When you save money, you receive interest on that amount. With compound interest, you also receive interest on your interest. What this does is create a snowball effect for your savings.

Benjamin Franklin probably had the most simple explanation: “Money makes money. And the money that money makes, makes money.”

The rate at which your money ‘compounds’ is an important factor.

Interest can be paid either annually, bi-annually, monthly or even daily. The more regular interest is paid, the more beneficial it is for you, the saver.

Remember, the magic of compound interest is the fact that you receive interest on your interest. The more regular that happens, the quicker your money can grow.

This is important to understand because more frequent payments can result in more interest across the year.

If you want to calculate compound interest for yourself, here is the formula:

A = P(1+r/n)nt

Don’t worry; there is a much simpler way of working out compound interest. Our calculator below lets you put in your numbers and does all the hard work.

The power of compound interest

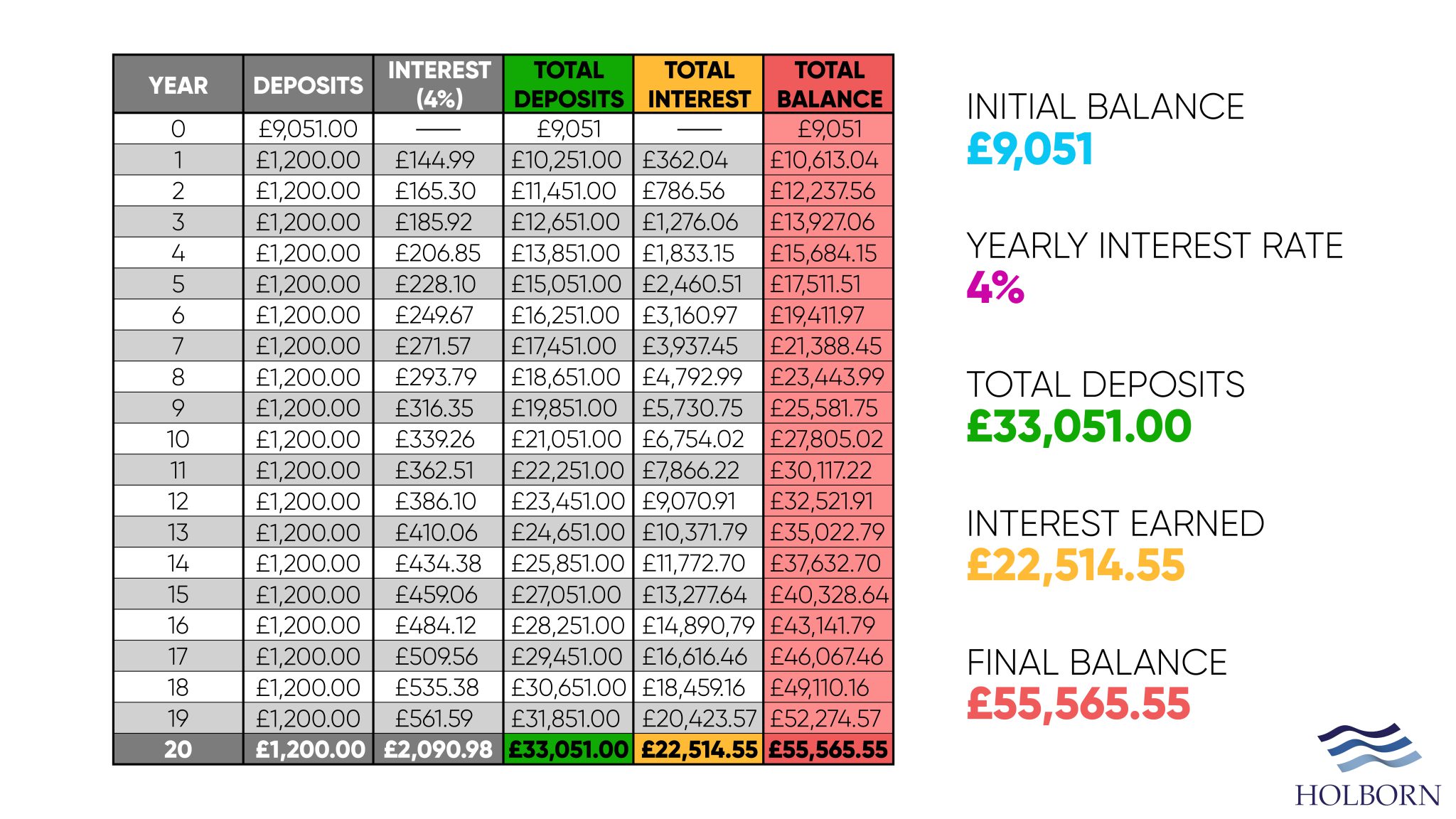

Let’s go back to how much the average UK household wastes per year on things they don’t need or never use – £9,051.

If that £9,051 had compound interest applied to it at a rate of 4% in 20 years, you would have a balance of £20,116. That may not sound like much but remember, this is without even adding to your savings.

It’s once you start adding to your starting amount that your savings really begin to soar.

Here is how your savings would look over the same period if you contributed just £100 per month.

Of course, these are hypothetical situations, but they illustrate how compound interest works over a long time and the impact it can have on your savings.

Hard to predict

Now is a tough time for savers with less than favourable interest rates.

Compound interest is most effective when you save over a long period, allowing your money to grow continuously.

In the current climate, predicting the interest rates you will get next year can be difficult. Predicting what rates you will get over 20 years or more is even more of a challenge.

For this reason, the long term outcome of your savings will vary as the rates change over time.

The sooner, the better

There is one key ingredient that is needed to make the most of compound interest – time.

The longer your savings have to ‘compound’, the more they will grow. Ultimately, the sooner you start saving, the better.

However, with so many products in the market, finding the best one to suit you can be difficult. Speaking with a specialist can help you find the right product based on your situation.

At Holborn, we have a wealth of experience, successfully working with clients for over two decades to reach their financial goals.

To find out how we can help you, contact us.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences