Have you ever tried to bake a cake without following a recipe?

Even if you know which ingredients to use, the whole thing can fall apart if you don’t know the right ratio.

It’s not just baking where ratios are useful; they can also help simplify your approach to personal finance and save more money.

The ability to save can be one of the biggest obstacles when it comes to achieving financial freedom . Thankfully, there are countless strategies to help you budget and manage your money.

In this article, we will focus on a simple but effective strategy – the 50/30/20 rule.

50/30/20 explained

The 50/30/20 rule was popularised by Elizabeth Warren, a senior US senator and former Harvard law professor. If that wasn’t enough, in 2010 Time magazine included her in its list of the 100 Most Influential People in the World.

She also knows a thing or two about finance.

Before she launched her political career, Ms Warren worked as a bankruptcy and personal finance lawyer. In 2006, she co-authored the book, All Your Worth: The Ultimate Lifetime Money Plan, a straightforward guide to budgeting.

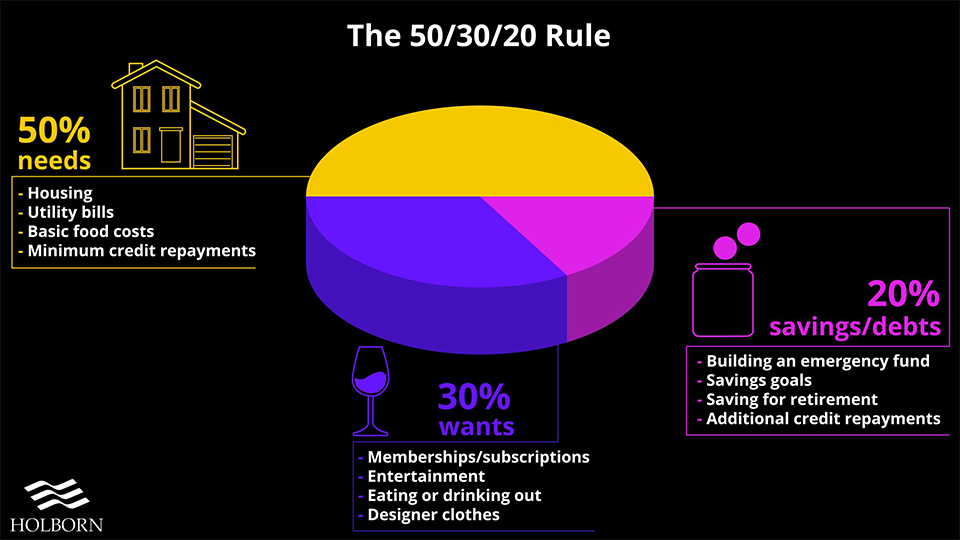

The idea of the 50/30/20 is to allocate a portion of your income to three areas which are:

50% – needs

30% – wants

20% – savings/debt repayments

The strategy can be used as a template to help you effectively manage your money, reach long-term and short-term savings goals, as well as keep on top of debt. Best of all, it’s simple.

So, how does it work?

The 50/30/20 rule in four easy steps

You can break down the 50/30/20 method into four simple steps.

Step 1 – know your net

Before you begin, you need to know how much money you have coming each month. This will be your income after tax, otherwise known as your net income.

Step 2 – sorting the ‘needs’ (50%)

Now you know how much money you have each month, it’s time to start dividing it up.

Start by writing a list of essential expenses. These are bills that you absolutely must pay every month, and failure to do so will have a negative impact.

Some examples include:

Housing – rent, mortgage and council tax

Utility bills – gas, electric and water

Food costs – think essential items rather than luxury items

Minimum payments on credit cards – these are important as failure to pay could harm your credit score

Only minimum repayments should be included here.

Let’s say you have a credit card and the minimum monthly payment is £50 but you pay £150 to clear the debt faster. Deciding to pay more is great, but that extra £100 isn’t classed as essential, it’s not even classed as a ‘want’. Stick with us; we’ll come back to this later.

The line between a ‘need’ and a ‘want’ can get blurred if you’re not careful. For example, making payments on a car would be considered a ‘need’ depending on the vehicle. There is a big difference between a car to get you from A to B and an Italian sports car.

Now you know how much your needs come to, make sure that 50% of your income covers the costs.

Step 3 – listing the ‘wants’ (30%)

Your ‘wants’ include non-essential expenses. These will vary from person to person, but here are some examples:

Memberships – these include the gym and subscription services such as Netflix

Entertainment – this might include video games, going out to the movies or concert tickets

Designer clothes – not to be confused with essential clothing

Food and drink – this might include eating out or going for drinks with friends

Now you do the same thing as you did previously. Make sure that 30% of your income covers the things you have added to your ‘wants’ list.

Having nearly a third of your income to spend on things you want sounds like a lot, but don’t splurge just yet.

Figures from the Office for National Statistics (ONS) revealed the average household income after tax in the UK is £30,800 per year. Per month, that works out to roughly £2,566.

Based on the UK average, 30% would leave you with around £770 each month to cover the items in your wants list. You might be surprised how quickly that money goes when you start adding up the costs.

Step 4 – Savings and debt repayments (20%)

The remaining 20% of your income is used to clear debts and build up some savings.

Some examples here might include:

An emergency fund – money saved specifically for a rainy day

Savings goals – for example, money for a house deposit

Retirement – retirement savings or a private pension scheme

Credit repaymenz – repayments over the minimum amount

The last point here is important. Remember the extra £100 in credit repayments we spoke about earlier? Let’s get back to that.

The minimum credit repayment is a ‘need’ because of the negatives associated with not paying it. You include anything over the minimum repayment amount in this bucket. The idea is to reduce and ultimately eliminate your debts, freeing up more money for savings.

So using our example, the minimum repayment is £50, and you decide to pay £150. The £50 is added to your needs bucket, and the other £100 goes in your savings and debt repayments bucket.

Paying over the minimum amount is advantageous and encouraged in some cases. Just remember, some debts can have an early repayment fee, so you could be penalised for paying over the minimum amount. Make sure you check the terms and conditions first.

Experiment and adapt

To call it the 50/30/20 rule might be a little misleading.

Just like other budgeting strategies, the 50/30/20 ‘rule’ is more of a template to help you work towards financial goals.

Everyone’s situation is different, so feel free to adapt the strategy to fit yours.

For example, you might be more focused on saving than non-essential spending. In that case, you could switch things around and save 30% and allocate 20% to your ‘wants’.

There are countless ways you can play with the ratios to fit your situation and your goals.

Whichever strategy you adopt, budgeting is an essential tool for managing and controlling your finances. But remember, budgeting alone might not be enough to reach your financial goals or milestones.

To find out how we can help you improve your financial situation, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences