Posted on: 1st November 2024 in Finance

When Chancellor Rachel Reeves stood up to deliver Labour’s first Budget in 14 years, she promised to “rebuild Britain” — but at what cost?

£40 billion a year in extra taxes, to be exact.

This will bring taxes to their highest levels since 1993, with some paying much more than others.

Prime Minister Keir Starmer warned ahead of the Budget that “those with the broadest shoulders should bear the heavier burden”. Now we know he meant what he said.

So, how will the 2024 Autumn Budget affect high-net-worth individuals (HNWIs) and expats?

Now that the dust has settled, we will delve deeper into the Budget and look at what the announcements mean for you and your money.

Chancellor Rachel Reeves has committed to scrapping the non-dom tax regime, a system she called an “outdated concept”.

The current UK’s non-domiciled (non-dom) tax regime allows people who live in the UK but have their “domicile” elsewhere to benefit from significant tax advantages.

The regime is popular among high-net-worth individuals (HNWIs). It allows them to avoid being taxed on their global income and gains while they live in the UK.

Starting in April 2025, a new, more straightforward residence-based system is set to be introduced.

Ms Reeves claims closing the current scheme’s loopholes will generate £12.7 billion over the next five years. However, this could lead to HNWIs leaving.

According to the UBS Global Wealth Report for 2024, Britain is on course to lose nearly one in six (17%) HNWIs by 2028.

Paul Donovan, Chief Economist of UBS Global Wealth Management, admits that the UK’s decision to scrap the non-dom status has had a “small effect” on the wealthy leaving the country.

There were some significant changes to pensions, especially for expats living overseas.

From April 2027, inherited pension pots will count as part of your estate for the purpose of inheritance tax (IHT). This change will affect UK pensions and qualifying non-UK pension schemes (QNUPS).

The second notable change will impact UK and EEA expats, specifically qualifying recognised overseas pension schemes (QROPS).

A QROPS is not always the best option for expats looking to transfer their pension overseas. This is because there is often an Overseas Transfer Charge (OTC) of 25% when transferring to a QROPS.

However, the OTC did not apply to transfers to QROPS established in the EEA and Gibraltar. This allowed UK residents to benefit from double the amount of tax-free cash.

Buried deep in the Budget was the announcement that the government would remove the OTC exclusion for QROPS established in the EEA and Gibraltar. This will most likely prevent UK residents from transferring to a QROPS in those locations.

If you are unsure how these changes will affect you and your retirement planning strategy, speak to one of our experts. Alternatively, read the UK government’s policy paper to learn more about the changes.

Private schools in the UK are exempt from Value Added Tax (VAT), but this is set to change.

From 1 January 2025, VAT will be added to private school fees at the standard rate of 20%. This will result in higher costs for parents to send their children to fee-paying schools.

How much private school fees will increase remains to be seen. Based on government predictions, private school fees are expected to rise by 10% on average.

According to the Office for Budget Responsibility (OBR), the number of private school students is forecast to fall by 35,000 due to the new policy.

With an increase in private school fees on the horizon, now is the time to consider your education planning strategy to secure your children’s future.

Landlords, property investors and anyone buying second homes will be out of pocket following the Budget with increases to Stamp Duty. Before we cover the changes, let’s look at how Stamp Duty works.

UK Stamp Duty, also known as Stamp Duty Land Tax (SDLT), is a tax paid when purchasing property or land in England and Northern Ireland.

It applies to residential and non-residential properties, with rates and thresholds depending on the property’s value and whether the buyer is a first-time homeowner or a property investor.

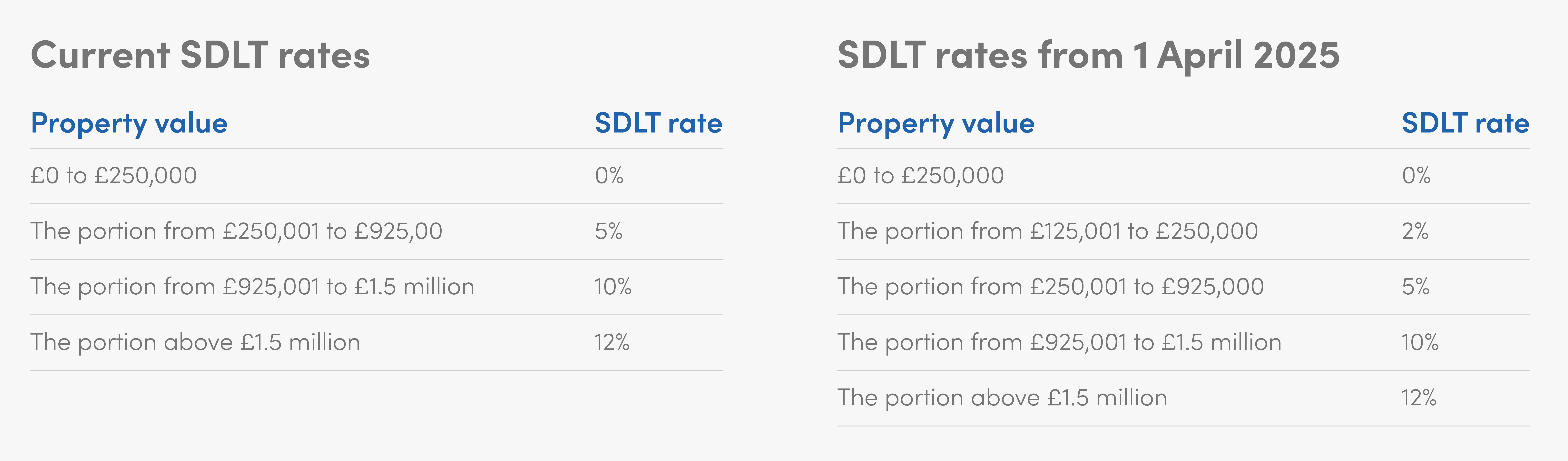

The current SDLT rates are as follows:

For example, at the current rates, SDLT on a property costing £1 million would be calculated as follows:

Total SDLT = £41,250

From April 2025, the same £1 million property would be calculated as follows:

Total SDLT = £43,750

You can visit the UK government website to calculate how much SDLT you will pay.

For those buying a second property, such as a buy-to-let investment, there is an additional SDLT rate to pay.

From 31 October, this has increased from 3% to 5%. The single rate of SDLT has also increased from 15% to 17%. This applies to companies that buy residential properties valued at £500,000 or more.

The Budget brought bad news for investors when it was announced that capital gains tax (CGT) would increase.

CGT is a tax charged on the profit from selling assets that have increased in value. This applies to real estate, stocks, bonds, and other types of investments.

The increase will depend on your income tax bracket:

The existing rate for properties is 18% (basic rate) to 24% (higher rate). This will stay the same, meaning the amount of CGT you pay on property or any other asset will be consistent.

The increase in CGT will impact wealthy individuals as they could lose nearly a quarter of their profits when selling assets. This puts a greater emphasis on structuring assets correctly to remain as tax-efficient as possible.

It’s businesses that will bear the brunt of the Autumn Budget.

The government aims to raise £40 billion a year through tax increases. More than 60% (£25 billion) of that will be raised by increasing the National Insurance Contributions (NICs) for businesses.

Employers will see NICs increase by 1.2% to 15% from April 2025. According to the Institute for Fiscal Studies (IFS), this will lead to employers paying an additional £900 for each employee on median average earnings (£33,000).

The threshold for paying them is also reduced from £9,100 to £5,000. As a result, more employers will be pulled into that bracket of paying NICs on their employee’s salaries.

With the cost of employment increasing, the ripple effects of this tax hike could be felt across several areas.

The Autumn Budget was eventful, and there is a lot to unpack.

One of the most significant announcements affecting HNWIs is scrapping the non-dom tax system. We will need to wait for more information about the new residence-based system and how it will work.

While the Budget will impact British citizens and residents, there are options available that could help alleviate some of the potential tax burdens.

Citizenship by investment allows you to become a second or dual citizen in another country by investing in the local economy, providing several benefits.

These programmes are beyond the scope of this article. Speak to our investment visa specialists for more details. Alternatively, contact Holborn Assets to learn how we can help you manage your money better.

We offer a wide range of financial services and wealth management solutions to help put your money in the right place, at the right time.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more

When it comes to growing your wealth, choosing the right investment path can make all the difference—especially if you’re an expat managing finances across borders. Two of the most talked-about...

Read more

Building wealth is one thing—but building a legacy that lasts for generations? That’s something else entirely. For families, especially those living and working abroad, creating multi-generational wealth means more than...

Read more