Posted on: 23rd September 2022 in Mortgage & Property

Liz Truss’s newly appointed chancellor, Kwasi Kwarteng, announced a stamp duty cut on Friday as part of his mini-budget.

The cuts will reduce the overall stamp duty bill for buyers and investors. But by how much?

In this article, we look at stamp duty and what today’s announcement means for those looking to take advantage of the strong UK housing market.

Stamp Duty Land Tax (SDLT) is a tax tied to property and land.

You may have to pay SDLT if you buy residential property or land in England or Northern Ireland. The tax is slightly different when purchasing property in other parts of the UK.

As stated on the UK government website, stamp duty applies to the following:

You will pay SDLT if you buy a property over the threshold.

The threshold for residential properties was £125,000, otherwise known as the nil-rate band. However, this has now been increased to £250,000. So, any property below the threshold is not subject to SDLT. Based on the price of a property in the UK, you will unlikely avoid paying SDLT.

According to the latest ONS figures, the average price of a property in the UK is £292,000.

However, not everyone will need to pay stamp duty. Those looking to buy their first house can take advantage of reliefs and exemptions.

First-time buyers did not pay stamp duty on the first £300,000 of the property’s value. This has now increased to £425,000.

After that, a first-time buyer will now pay SDLT at a reduced rate of 5% on the value between £425,000 – £625,000.

SDLT also applies when purchasing a second home that costs more than £40,000 in England or Northern Ireland.

Examples of second homes include:

The big takeaway from the chancellor’s announcement is the increase in the SDLT threshold.

Previously, the nil-rate band was £125,000. That has doubled to £250,000. Here’s how your bill is worked out.

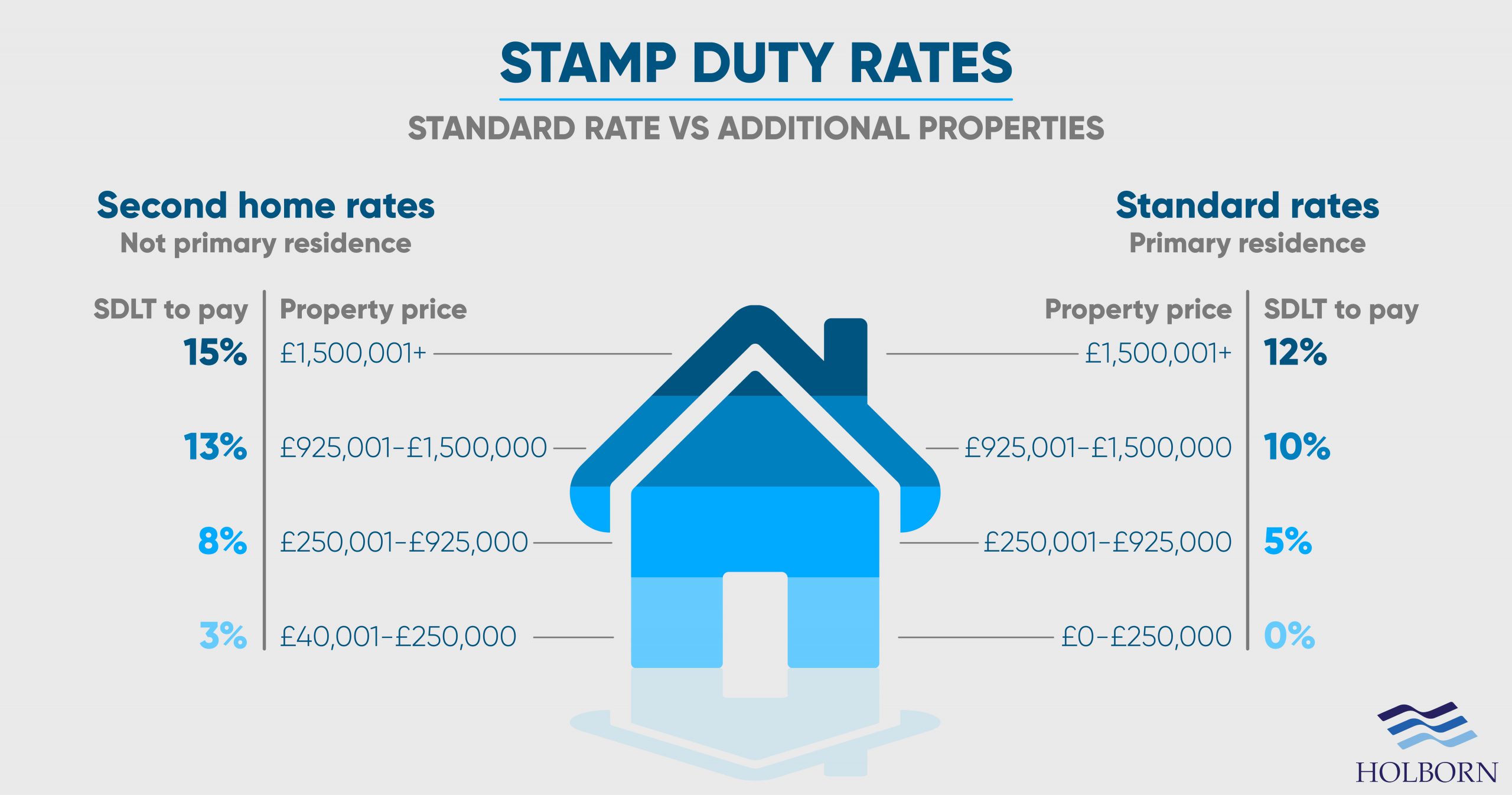

SDLT is paid on a sliding scale. In other words, the higher the property price, the more you will pay. Stamp duty bands are used to calculate the total amount due. The current stamp duty rates range from 0-12%.

You will pay an extra 3% on top of the standard stamp duty rates if you buy a home over £40,000 that will not be your primary residence. This includes additional properties or a buy-to-let rental property.

Each portion of the property value is taxed based on the corresponding stamp duty band.

So, buying a property for over £1,500,000 doesn’t mean you pay 12% of the total value. Only the portion of the value that falls within that band is taxed at 12%, not all of it.

Here’s an example:

Be aware that overseas buyers face paying an additional 2% on top of the existing surcharge rates. This could result in foreign investors paying up to 17%.

For more information on the rates of stamp duty for non-UK residents, please visit the UK government’s website.

If you are required to pay SDLT, you will have to do so within a short time frame.

You will need to pay any stamp duty owed within 14 days of completion. Your solicitor will take care of the payment to HMRC as part of their process.

Once they have filed and completed your stamp duty payment, they will add it to your fees.

Interest rates in the UK are the highest since 2008, following the Bank of England’s decision to raise them by half a point to 2.25%.

Ultimately, this means real estate investors looking to secure a buy-to-let mortgage will see an increase in their monthly repayments. However, the stamp duty cuts announced on Friday may help offset the inevitable rise in mortgage rates.

For investors looking to take advantage of the soaring UK housing market, now could be the time, and Holborn can help.

At Holborn, we work with some of the world’s leading developers, allowing us to offer clients an exclusive range of properties in sought-after locations.

With a wide range of investment options, we can help you secure the right investment property based on your needs and goals.

Contact us using the form below to find out how we can help you.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more