How to Plan for Retirement

Retirement is one of life’s significant milestones. It marks the transition from the workplace to a new stage of your life.

But to enjoy a secure and comfortable retirement, it is essential to plan ahead.

However, research shows that a large number of people are not prepared financially for what is to come.

A staggering 69% of unretired people over 50 have done little to no planning around their retirement finances. Meanwhile, only 7% feel fully prepared financially.

The truth is, having a plan in place could be the difference between the future you want and the future you get.

In this article, we look at the process of planning for retirement and other key information to help you prepare for what lies ahead.

The importance of planning for retirement

While we can’t predict the future, we can prepare for it.

Retirement planning allows us to do just that.

It is an essential process component of financial planning that allows us to work towards the lifestyle we want when we stop working. Think of a retirement plan as a roadmap that takes us from point A to point B.

Point A is where we are now, and point B is where we want to be financially to enjoy our golden years the way we intended. In other words, achieving financial freedom.

So, by putting plans in place now, we give ourselves the best chance of reaching our retirement goals.

Retirement planning checklist

There is a lot to think about when planning for retirement, and there is no one-size-fits-all approach.

To put yourself in the best position and better prepare for the future, use our checklist highlighting some important points to consider.

Decide when you want to retire

When planning for retirement, your age of retirement is a crucial factor to consider.

In the UK, there is no set age for retirement. However, you have to wait until the age of 55 to access a defined contribution pension. And while there is no set age, the dream for many people is to retire early.

But with life expectancy increasing, we are now spending longer in retirement. As a result, we need to make our pension pots last longer. And the earlier you decide to retire, the longer you need to make your savings last.

Understand how much you need to retire

There is no magic number when we talk about building a retirement nest egg. That is because the cost of retirement will be different for everyone.

To determine how much you will need, you must consider factors such as:

- Your desired retirement lifestyle

- Your retirement age/average life expectancy

- Medical expenses

- Inflation

As a general rule of thumb, for those looking to maintain their current lifestyle, their annual retirement income should be around 80% of their pre-retirement income.

Let’s say your annual income is £200,000 by the time you reach retirement age. That means you would need roughly £160,000 annually to maintain your current lifestyle.

Financial planners use 80% as a guide because you typically have fewer expenses in retirement. For example:

- You have lower housing costs if your mortgage is paid off

- You no longer have to cover costs associated with going to work

- You no longer have to think about saving for retirement

To get an idea of how much you should save, you can use the 4% rule.

The 4% rule is used to determine how much you should withdraw from your retirement fund per year. It is also used to help ensure a steady income that lasts throughout your retirement.

Using the 4% rule, you take your desired yearly retirement income and divide that number by 4%.

Alternatively, you can use our pension calculator below to check you are on track with your retirement savings.

What will your pension be worth when you retire?

Knowing what your pension might be worth when you retire is critical to planning ahead for your retirement.

If you know where you are now, and where you want to be, the journey will be easier. Use our calculator to work out what your pension will be worth when you come to retirement age. You can also see how small differences today can have a huge impact on your financial future.

Calculate pension value

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Determine your sources of income in retirement

The next step is to predict your likely income after retirement to better understand if it will be enough to meet your needs.

Pension plans are typically the primary source of income. The two types of pensions are:

- Defined benefit pensions

- Defined contribution pensions

Statements from your pension provider should give a full breakdown of your current pension pot and future projections.

However, there is more than just pension income to consider. Other sources of income may include:

- Investments or additional savings accounts

- Part-time work

- Equity release from your home

- Rental income from real estate investments

Assess your income options

When it comes to accessing your pension, you have several options. Some of the most common include:

- Pension drawdown – This allows you to draw a regular income from your pension

- Lump sum – This allows you to take a portion of your pension as a tax-free lump sum

- Retirement annuity plan – Purchasing an annuity product can provide a guaranteed income for life

Be aware that some of these options provide greater flexibility at the expense of risk. It is always best to speak to an expert to help determine the best strategy for you and your needs.

Review your plans

Planning for retirement is not a one-time thing. It is an ongoing process that requires careful thought and consideration.

For example, reviewing pension choices regularly can help ensure they are performing well and you are on track to reach your retirement goals.

And while you can take the DIY approach to creating a retirement plan, seeking professional financial advice can help you make the most of your money and identify strategies you may have missed.

A financial adviser can also provide the professional guidance and support needed to help you make more informed decisions and overcome complex financial situations surrounding your retirement.

How to plan for retirement at different ages

Knowing how to plan for retirement at different life stages can be helpful to ensure you are on track and taking the right steps towards your destination.

And while there is no one-size-fits-all approach when it comes to planning for retirement, there are some useful formulas that serve as a good starting point.

As a guideline, Fidelity recommends setting 15% of your annual income aside for retirement, starting at age 25.

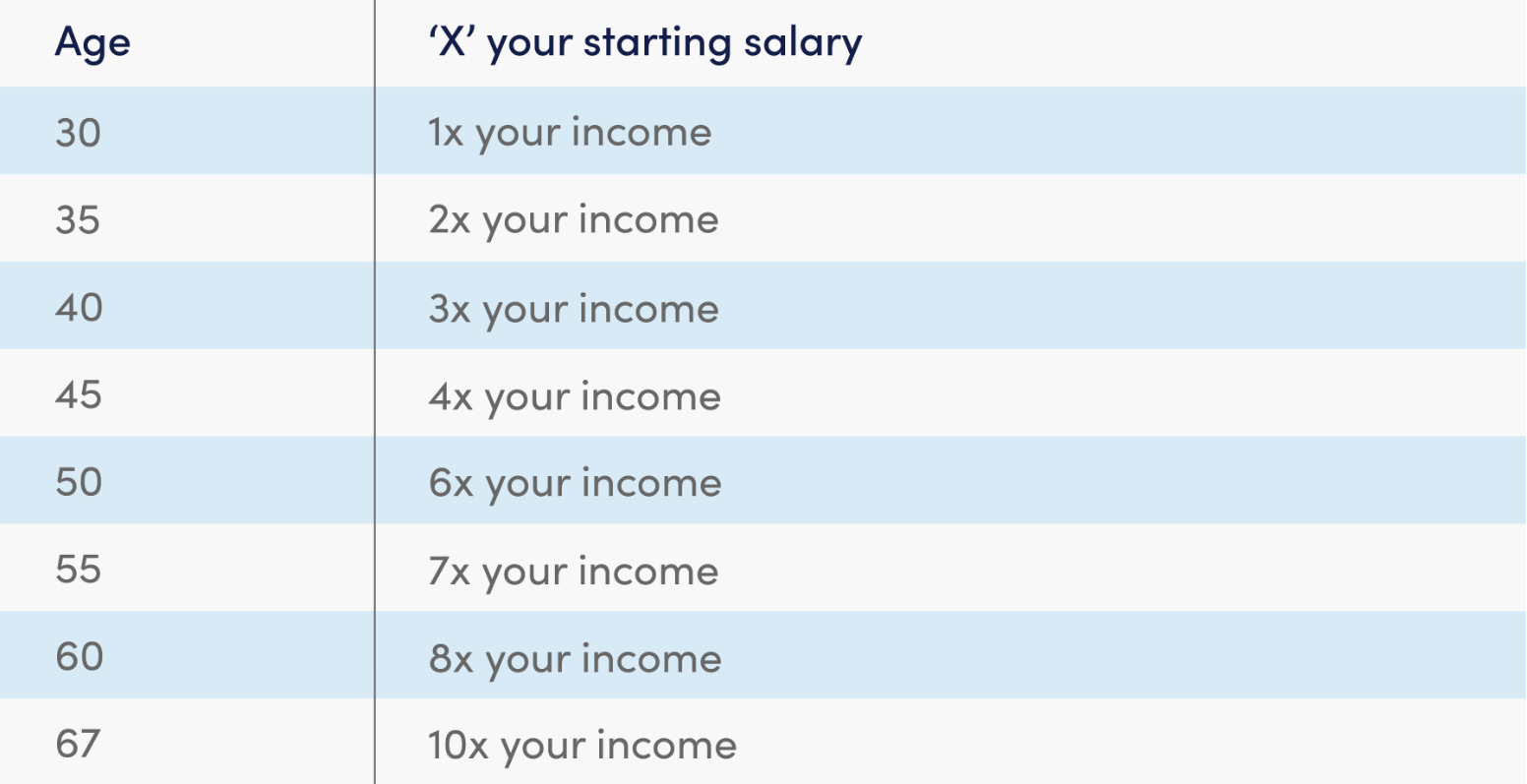

To help you stay on track, they also suggest the following age-based milestones:

Your investment strategy and risk tolerance will also likely change depending on your age.

For example, a common strategy is to build an investment portfolio more weighted towards higher-risk asset classes, such as equities, while you are young. This is because equities typically produce stronger returns than other asset classes, but they also have a higher risk profile.

This allows you to benefit from a higher rate of return and build wealth, and because retirement is a long way off, you have time to make up for any losses.

However, as you approach retirement, you want to limit your losses. To do this, you could restrict your equity exposure and shift to lower-risk options such as bonds.

Planning for retirement with Holborn Assets

As we said at the top of this article, planning for retirement could be the difference between the future you want and the future you get.

Remember, the earlier you start, the better prepared you will be. If you are ready to start building towards the future you want, we can help.

At Holborn Assets, we work closely with clients, providing expert advice and support to help them reach their retirement goals.

Remember, retirement is not the final chapter; it’s simply the start of a new one. Start planning today and make sure you are prepared for tomorrow.

Book a free, no-obligation meeting today and learn how we can help you plan for retirement.