With the introduction of the British National Overseas (BNO) visa system, understanding UK tax residency will be essential for those looking to move to the UK.

If you are one of the estimated 5.4 million Hong Kong residents eligible for the scheme, you will want to have a good knowledge of the country’s tax system.

This article looks at how tax in the UK works and the methods used to determine where you should be paying tax.

Before we look at how tax in the UK works, let’s have a quick overview of the BNO visa scheme.

If you would like more information on the BNO visa, our guide provides a detailed breakdown of the scheme. You will also find additional helpful advice tailored to those arriving in the UK.

BNO visa explained

British National Overseas (BNO) citizenship is a type of British nationality introduced in 1985. Those from Hong Kong could apply for BNO citizenship before the 1997 handover to China.

On January 31st 2021, the UK government introduced the BNO visa. Hong Kong citizens who are also British overseas nationals can apply for a BNO visa.

The BNO scheme allows you to stay in the UK for either two years and six months or five years. If you choose to stay longer, you can extend your visa as many times as you want.

Once you have lived in the UK for five years, you have the option to apply for permanent residence.

If you are granted a BNO visa, you and your close family members can live, work and study in the UK. The visa also provides several other key benefits, including access to healthcare and schools.

For those looking at taking advantage of the BNO visa, familiarising yourself with the UK tax system is essential. Failure to do so could result in you paying too much tax or paying tax in the wrong place.

How UK tax works

To explain the topic of tax to the fullest is beyond the scope of this article. The idea here is to give you a good overview of the main UK taxes and how they work.

The two main types of tax in the UK are Income Tax and National Insurance. Tax is collected by Her Majesty’s Revenue and Customs (HMRC) in one of two ways.

If you work for a company, your tax will be deducted from your salary through the Pay as you Earn (PAYE) system. PAYE makes paying your tax and National Insurance simple as everything is automated.

If you are self-employed, you will need to complete a yearly tax return form. The tax year in the UK runs from April 6th to April 5th the following year.

The amount of tax you pay will depend on your salary. There are four tax brackets which are:

0% on earnings up to £12,570

20% on earnings between £12,571 and £50,270

40% on earnings between £50,271 and £150,000

45% on earnings over £150,001

UK tax residents are also liable for Capital Gains Tax of up to 28% on worldwide income.

Now that we know more about the country’s tax system let’s look at how to determine if you should be paying tax in the UK.

UK Statutory Residence Test

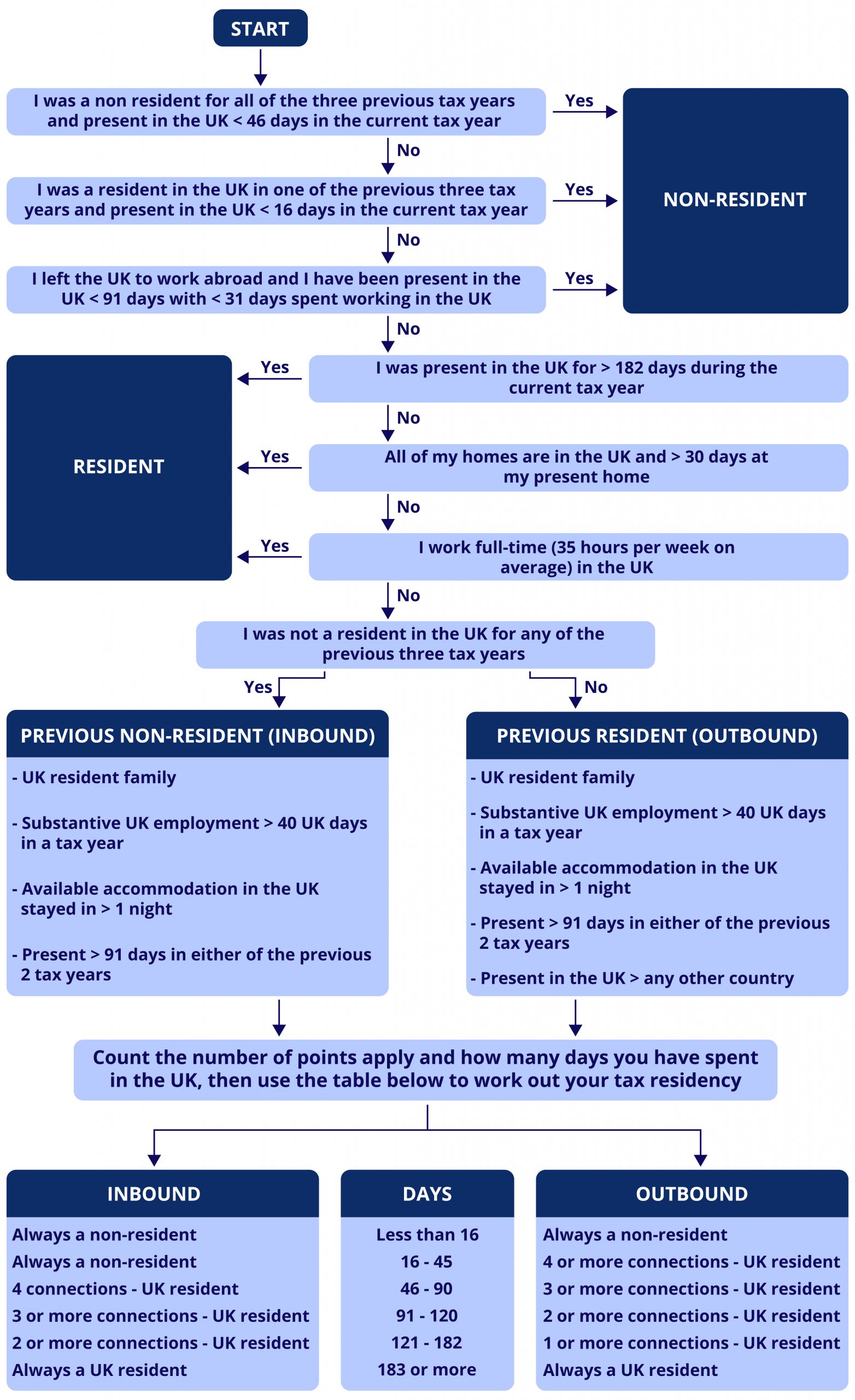

Introduced in 2013, the UK Statutory Residence Test (SRT) allows you to work out your tax residency status.

The SRT is the most effective way of working out your UK tax residency status. However, the test itself can appear complicated.

Our flowchart below illustrates how the SRT is used to determine your tax status in the UK.

In some situations, you may be considered a resident in both the UK and Hong Kong.

To protect people in these situations, the UK has double tax treaties in place with countries around the world.

These treaties protect income and assets from being taxed in both countries. In some cases, you will be taxed in the UK and Hong Kong. However, the tax you pay in one country can be offset against the tax paid in the other country.

You should note that the UK does have one in place with Hong Kong. The UK government website has more information on the agreement that is in place between the UK and Hong Kong.

Ask an expert

If you plan to take advantage of the BNO visa and move to the UK, Holborn Assets can help.

Determining your UK tax residency and making sure you are as tax efficient as possible is crucial for expats moving to the UK.

Our team of highly qualified experts specialise in the expat market. With our knowledge and experience, we are perfectly placed to advise you on both UK taxes and the BNO visa application.

To make your move to the UK as stress-free as possible, speak to our team and let us do the heavy lifting.

To find out how we can help you, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences