Changes to UK tax in 2022 will see most people paying more this year.

For most, when Rishi Sunak announced the 2021 Autumn Budget, it meant one thing – a higher tax bill.

National Insurance and dividend income increases will come into effect in April, the former creating an uproar when it was announced. There are also changes to capital gains and inheritance tax planned.

With these changes just a few short months away, it’s essential to understand them and plan ahead to avoid any surprises.

In this article, we look at the key UK tax changes coming in 2022 and how they will affect you.

Changes to National Insurance

National Insurance rates will increase by 1.25% from 6th April 2022.

According to the government, the tax increase is intended to generate revenue for the NHS and social care.

From 2023, the rate of National Insurance will return to 2021/22 levels. However, it will be replaced with a 1.25% Heath and Social Care Levy.

Starting from 6th April 2022, the lower earnings limit will rise by 3.1%. The rate increase will apply to both the middle and upper earnings thresholds. However, the upper earnings threshold will stay frozen at £50,270.

The amount at which you start paying National Insurance is also set to increase.

Following the mini-budget in March 2022, the threshold for National Insurance will start at £12,570 from July 2022.

The sections below break down the changes to National Insurance contributions (NICs) for both employed and self-employed individuals.

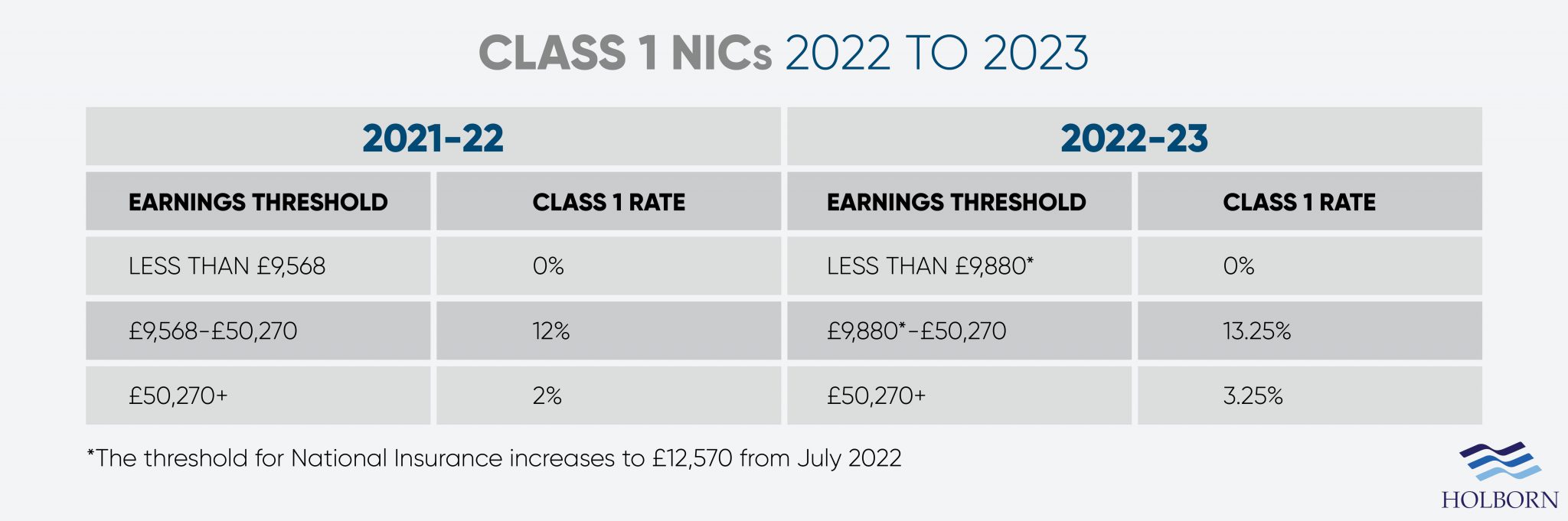

Class 1 NICs

Class 1 National Insurance is paid by employees. Your earnings determine the amount you pay, as detailed in the table below.

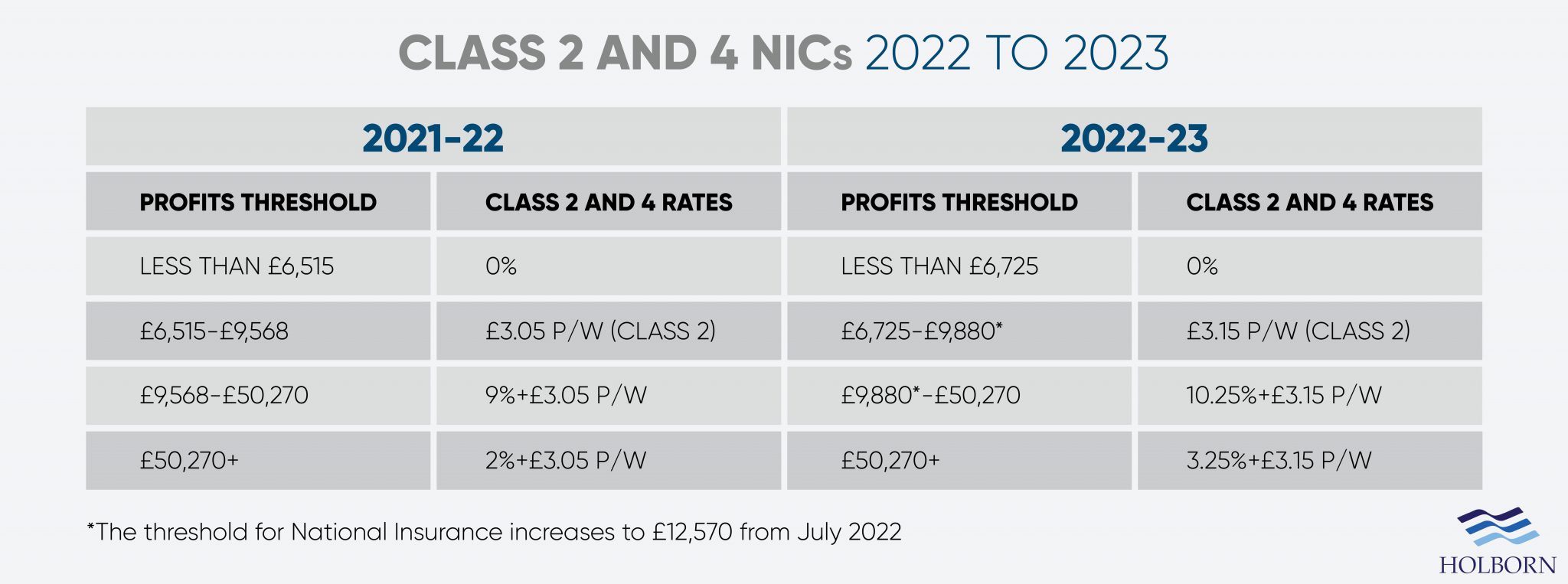

Class 2 and 4 NICs

You will likely pay Class 2 or Class 4 NICs if you are self-employed, depending on your earnings. The table below shows how the increases will affect both classes.

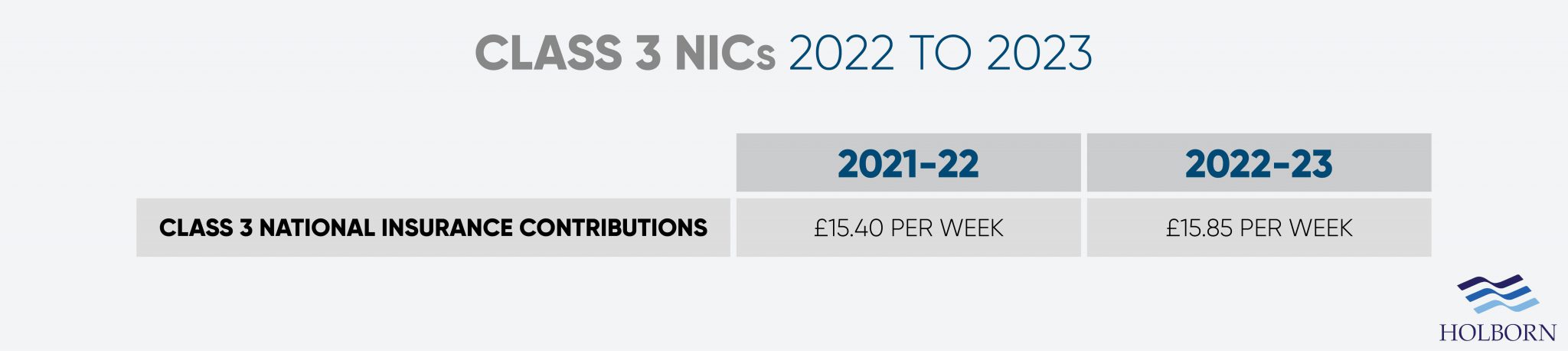

Class 3 NICs

Class 3 applies to voluntary contributions. For example, if you have gaps in your National Insurance record, you may wish to make voluntary contributions. Gaps can affect your eligibility for the State Pension and other benefits.

This is especially true for expats or those who have been non-residents in the UK for an extended period.

The table below shows the increase in Class 3 contributions for 2022/23.

Our article on checking your National Insurance record tells you everything you need to know to check for gaps.

You should note that the increase in National Insurance does not apply if you are over the State Pension age.

Changes to capital gains tax

The change to capital gains tax went live when the budget was announced on 27th October 2021 and relates to property sales.

You previously had 30 days to report any gains made from the sale and pay the tax you owed to HMRC.

Now, that window has increased to 60 days. The rate of capital gains tax you pay remains the same, but the extended window gives you more time.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Inheritance tax

Unlike the other changes, this one came into effect at the start of the year.

Starting on 1st January 2022, the number of forms required by HMRC has been reduced. The increase to current limits will significantly impact more estates as they will qualify as ‘excepted estates’.

According to the UK government website, an estate is typically excepted if any of the following apply:

Its value is below the current IHT threshold (£350,000)

The estate is worth £650,000 or less, and any unused threshold is being transferred from a spouse or civil partner who died first

The deceased left everything to a spouse or civil partner living in the UK or to a qualifying charity, and the estate is worth less than £3 million. You can

search for registered charities

for more information

They were living outside of the UK permanently when they died, and the value of their UK assets is under £150,000

Many welcomed the changes as they are expected to save people a lot of time and reduce the cost of dealing with the deceased’s estate.

Dividend tax rates

From 6th April, the tax on money earned from dividends will see a 1.25% increase.

The rise in dividends tax will impact the profits of those invested in companies and earn money from their shares.

The dividend allowance for the 2022/23 tax year is £2,000. Anything you earn above the rate threshold is subject to dividend tax.

The amount of tax you pay will depend on your income tax band. Basic rate taxpayers pay less, while additional rate taxpayers pay the most. The table below gives a breakdown.

Investments held in a wrapper such as an ISA are not subject to dividend tax.

The cost to companies – Corporation Tax

The main Corporation Tax rate will be set to 19% from the 1st April 2022 and for that financial year.

According to the government website, that rate of tax is set to increase from 1st April 2023. A 25% tax will apply to Non-ring fenced profits over £250,000.

A small profits rate (SPR) will be introduced for companies with profits of £50,000 or less to protect smaller business owners. Companies that qualify will continue to pay Corporation Tax at 19%.

Rates of income tax in 2022

Despite the sweeping changes to tax in 2022, some things have not changed.

The personal allowance, or how much you can earn before income tax applies, remains the same as the previous tax year. The rate of tax you pay at each bracket also remains the same.

Here is a breakdown of the income tax brackets on earnings for 2022:

£0 to £12,570 – Tax-free

£12,571 to £50,270 – Basic rate income tax of 20%

£50,271 to £150,000 – Higher rate taxed at 40%

£150,000+ – Taxed at 45%

Looking ahead – 2022 and beyond

With tax rises and changes just a few short months away, it’s essential that you understand how they could impact you.

Now is also the perfect time to take care of your finances and start planning for 2022 and beyond.

At Holborn, we work closely with clients to develop strategies tailored to their needs and circumstance.

For over 20 years, we have successfully helped our clients build wealth and create a strong financial future.

To find out how we can help you, contact us using the form.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences