Posted on: 27th March 2020 in News

As we are in the fifth week of the global markets’ panic over the COVID 19 virus outbreak, there seems to be no let-up. As a result, stocks have slumped across the world, while major currencies have also suffered losses. On Friday March 20th the British Pound was trading at $1.15, very close to the 35-year currency pair low of $1.14. The plans of the UK government to support the economy don’t seem to boost Sterling’s value against the US Dollar yet.

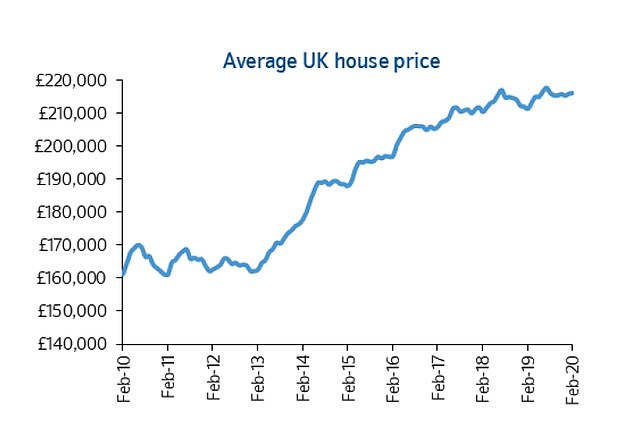

Although significant events such as Brexit seemed to affect property prices in the UK, the price crash that some

people were waiting for never materialised. According to market analysts, the UK property market remains a resilient

investment consideration. In Schroders’ latest Global Cities 30

index in Europe, London is listed as the second-best city in the world to invest in property. While there

isn’t a set formula for achieving a perfect investment portfolio, the reality is that the UK real estate market has

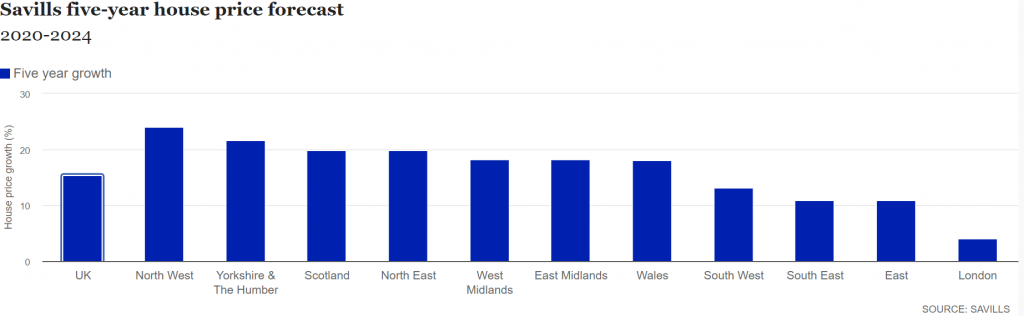

consistently performed despite the uncertainty deriving from Brexit.  Savills five-year house price forecast Whether you are planning

to stay in the UK long-term, buy to let, or you are certain on a particular area, buying an apartment, or a house in

Great Britain can be the right solution for you and your investment planning, taking into consideration the very

low-interest rates on mortgages in the last few years.

Savills five-year house price forecast Whether you are planning

to stay in the UK long-term, buy to let, or you are certain on a particular area, buying an apartment, or a house in

Great Britain can be the right solution for you and your investment planning, taking into consideration the very

low-interest rates on mortgages in the last few years.

At Holborn Assets Property, we offer comprehensive, fully managed solutions to property investment, giving you peace of mind in every step of the process. If you’re considering investing in property in the UK, whether that’s off-plan property or completed property developments, our property experts are here for you every step of the way and we are more than happy to discuss investment options tailored just for you. All of our experts have years of experience in UK property investments for both on and offshore clients, aiming to help you achieve your investment goals, thus providing a better future for you and your loved ones.

Finding the right property means solving only half of your problem. Choosing the best type of mortgage is the other half. Since borrowing is all about adjusting your budget, you should find a mortgage suitable for your needs. The majority of potential buyers may get overwhelmed by the available options. At this stage, Holborn Assets Property is always ready to help you. As part of Holborn’s Complete Property Solution package, we offer several different tiers when it comes to sourcing and securing a mortgage for you. Our team of experts is able to answer all your questions and provide the right solutions, depending on your needs. Contact us by filling in this form or give us a call at +971 44 57 3800 (International) or +0203 519 77 98 (UK). Note: On the day of publication the GBP/USD exchange rate stood at $1.22. Market analysts suggest that the currency pair may suffer fluctuations due to the global market turmoil.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more