ESG investing allows you to invest in companies that aim to make the world a better place.

Their popularity is rising, and it couldn’t come soon enough.

A recent climate report by the UN revealed the devastating impact of climate change. The findings gave a stark warning, calling the situation a ‘code red for humanity’.

It’s clear that we all need to do our part. ESG investing is one way for investors to do theirs.

However, in the past, investors faced a problem; Balancing their values and returning a profit at the same time. However, times have changed. You no longer have to sacrifice your values for profit.

In this article, we look at ESG investing and how going green could benefit your portfolio and the planet.

What is ESG investing?

So, you want to invest in a company that is doing its bit for the planet. The trouble is, how do you decide which ones meet that criteria?

This is where ESG investing comes in.

ESG stands for Environmental, Social and Governance. These are the three key areas used to measure the sustainability and wider impact of a company.

Here is a quick breakdown of those three areas:

Environment

The impact (positive and negative) that a company is having on the environment.

Social

Social focuses more on how a company manages relationships. For example, how they treat their employees and customers etc.

Governance

How those in senior roles lead and audit the company. Governance also focuses on other areas, such as shareholder rights.

These socially responsible investments are gaining interest, and demand for them continues to grow.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

ESG investing trends

Consumer habits are changing when it comes to investing.

Research carried out by Aviva concluded that interest in ESG investing had increased due to the pandemic.

Data from the insurer found that of those who already consider ESG, 81% said the pandemic made it even more important. Covid-19 was also why 55% of all investors they asked said they would consider ESG factors before investing their money.

Separate research by Aviva Investors also shows a shift towards greener options.

Their research showed 43% of financial advisers saw an increase in demand for ESG bonds. A further 56% said the demand was constant, indicating that ESG investing isn’t just a fad.

So, with the demand for ESG investing increasing, there is one big question. How do these types of investments perform?

ESG performance

There is an estimated £31 trillion invested in ESG funds globally.

The obvious benefit of ESG investing is the positive impact it can have on the planet. Still, being ethical and getting decent returns has been elusive in the past.

Data from S&P Global showed that ESG funds outperformed the S&P 500 in the first year of Covid.

Analysis was carried out on 26 ESG ETFs and mutual funds with over $250m (£180m) in assets under management.

Between March 2020, when a pandemic was officially declared, and March 2021, 19 ESG funds outperformed the S&P 500. Of those 19 ESG funds, their market performance increased by 27.3%-55%. In contrast, the S&P 500 saw an increase of 27.1%.

On this side of the Atlantic, it seems to be a similar story.

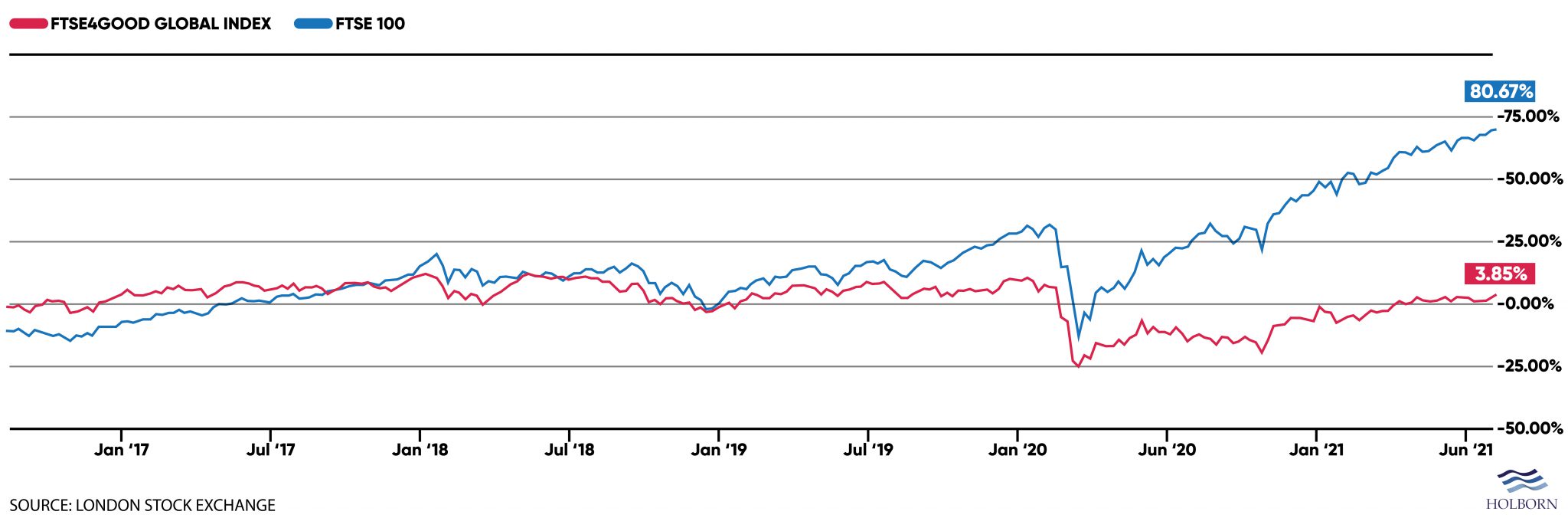

FTSE4Good, an index that allows people to invest in ESG stocks, has consistently tracked or outperformed the FTSE 100 for the last five years.

On the surface, ESG investing seems like the logical choice. Performance matches and, in some cases, beats non-ESG investments, and you get to do your bit for the planet.

Before rushing out and sinking all of your money into ESG stocks, we need to scratch beneath the surface.

Balance and transparency

When it comes to investing, there is no one perfect strategy that guarantees maximum returns.

However, most experts will agree that having a diverse portfolio is essential in most cases.

A portfolio that is heavily weighted towards ESG funds could create an imbalance in your portfolio. It’s also worth noting that ESG funds can carry slightly higher fees in some cases.

Another issue with ESG investing is so-called ‘greenwashing’.

Greenwashing is where investments are considered green but, on closer inspection, may not be what they seem.

For example, some ESG indexes hold shares in some of the biggest companies, such as Amazon and Google.

These companies are often heavily focused on reducing carbon emissions, allowing them to score highly in certain areas ESG uses to measure. However, some would argue that their performances in other areas should exclude them from ESG investments.

Research by Schroders highlighted greenwashing as the biggest challenge for investors for the second year in a row.

The data revealed that 59% said greenwashing was the biggest challenge. In comparison, only 38% were concerned with performance.

Strategies for success

The UN’s report on climate change should come as a wake-up call. Act now to save tomorrow was the message.

The large companies we invest in have a significant impact on the world. As an investor, that gives you the power to affect change.

Of course, ESG investing is not going to save the planet alone. Still, the data does suggest that balancing your beliefs and profits is now possible.

However you choose to invest, having the right strategy is essential to give you the best possible chance at success.

At Holborn, we are investment specialists. For more than 20 years, we have helped clients build and manage successful portfolios based on their needs.

To find out how we can help you, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences