Commodity investments: a market overview

Posted on: 18th July 2022 in

Investments

Commodity investments offer a range of benefits.

With the right strategy, the asset class can help you to hedge against inflation. They are also an effective way to build a diverse investment portfolio, thanks to their relationship with other assets on the stock market, such as shares and bonds.

While commodity prices are known for their volatility, they have been one of the best-performing in 2022. So, as an investor, is now the right time to add the asset class to your portfolio, and what are the areas to watch?

In this article, we look at the current state of the commodities market and how it is performing versus other asset classes.

The commodity market in 2022

While other asset classes have struggled, commodities have shone in 2022.

The Bloomberg Commodity Index, which tracks the futures price of 22 commodities, climbed nearly 30% during the first half of the year. The S&P GSCI Index, a major commodity index, also saw a 30% increase during Q1, holding steady during Q2.

In the 12 months to February 2022, we also saw the Dow Jones Commodity Index outperform the stock market, with a return of 33.3% compared with 17.1% for the S&P 500.

Individual commodity prices also soared due to geopolitical factors. The demand for oil and its short supply saw its value leap by 60%. Of course, people don’t always want to go all in on a single commodity. That is where mutual funds and ETFs come in.

Should you consider commodity ETFs?

Commodity exchange-traded funds and mutual funds can give individual investors exposure to one or more commodities.

ETFs allow you to invest in raw materials such as agricultural products, natural resources, precious metals and industrial metals. Some of these will track a ready-made basket of commodities, while others focus on a specific one.

Generally, ETFs invest in commodities in one of two ways. The first is through a physical commodity. With these, you are investing in physical assets, such as gold or silver.

The second way ETFs are structured is through futures contracts. A commodity futures contract often means investing in the commodity-producing companies rather than the physical asset.

What separates an ETF from mutual funds is, like equities (stocks and shares), they can be bought and sold on a stock exchange. This gives them high liquidity, making them a popular choice for investors.

It would also seem that gaining a broad exposure to the asset class has been a wise investment decision looking at their performance.

The golden child of ETFs in 2022 has been the Energy Select Sector EFT, up 40% by the end of the first half of the year.

The fund is made up of some of the big players in the natural resources field, such as Exxon Mobil and Chevron Corp. 91% of the fund allocation is in consumable fuels, oil and gas, all of which have performed well in the first half of the year.

Commodity investments vs other asset classes

There is no ‘one asset class to rule them all’. Each has its pros and cons and its place within a given strategy.

Still, the data does suggest that exposure to commodities is beneficial in terms of raw performance.

Research by Quilter Cheviot found that only 6% of investment funds produced positive returns in the first half of 2022. However, eight of the ten best-performing funds were from the commodity sector.

Topping the list was BGF World Energy D2, with a total return of 39.47% between June 2021-2022. That should probably come as no surprise as crude oil prices and energy prices continue to soar.

When we pit the asset class against others, it’s clear why commodity funds are showing strong returns.

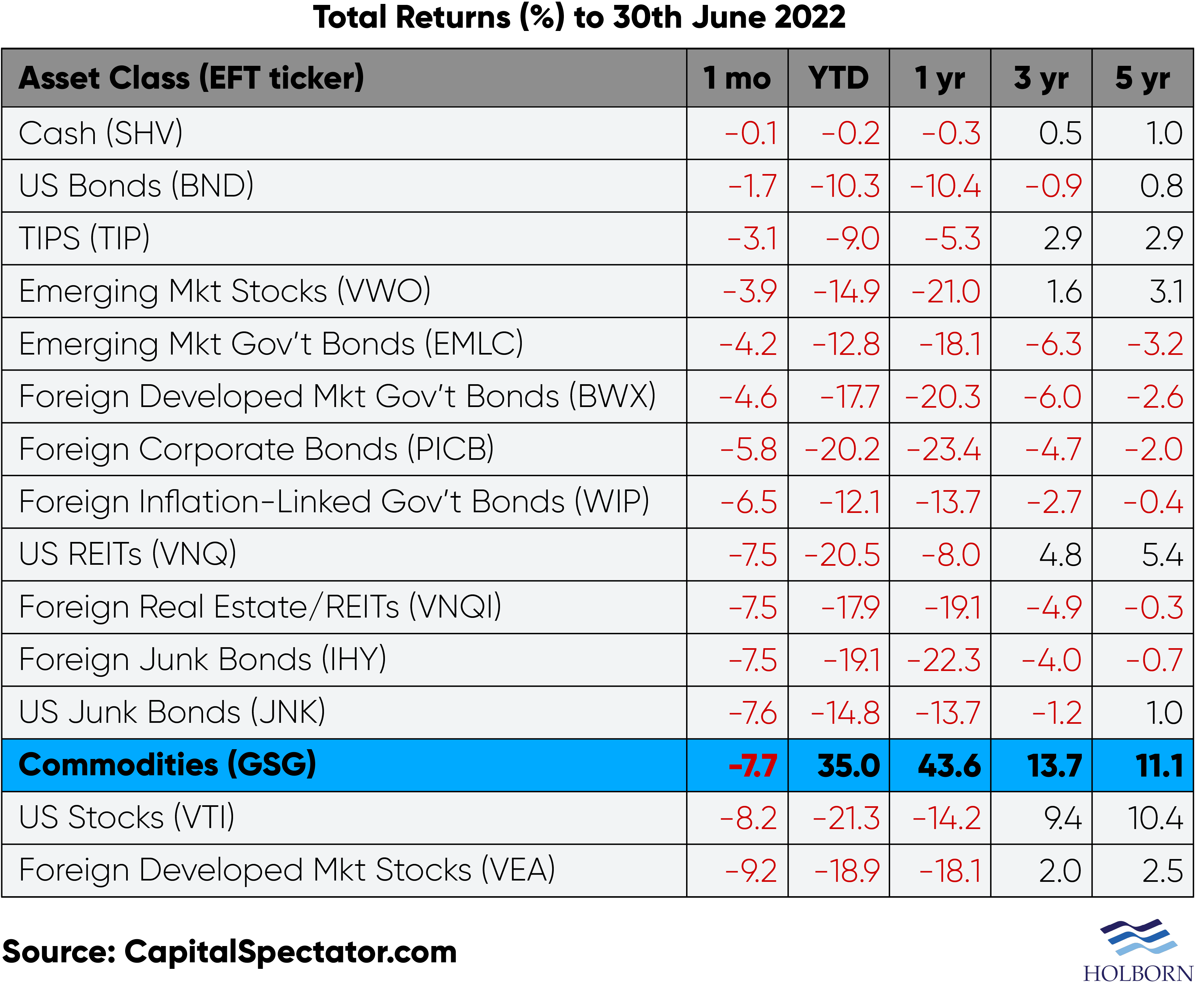

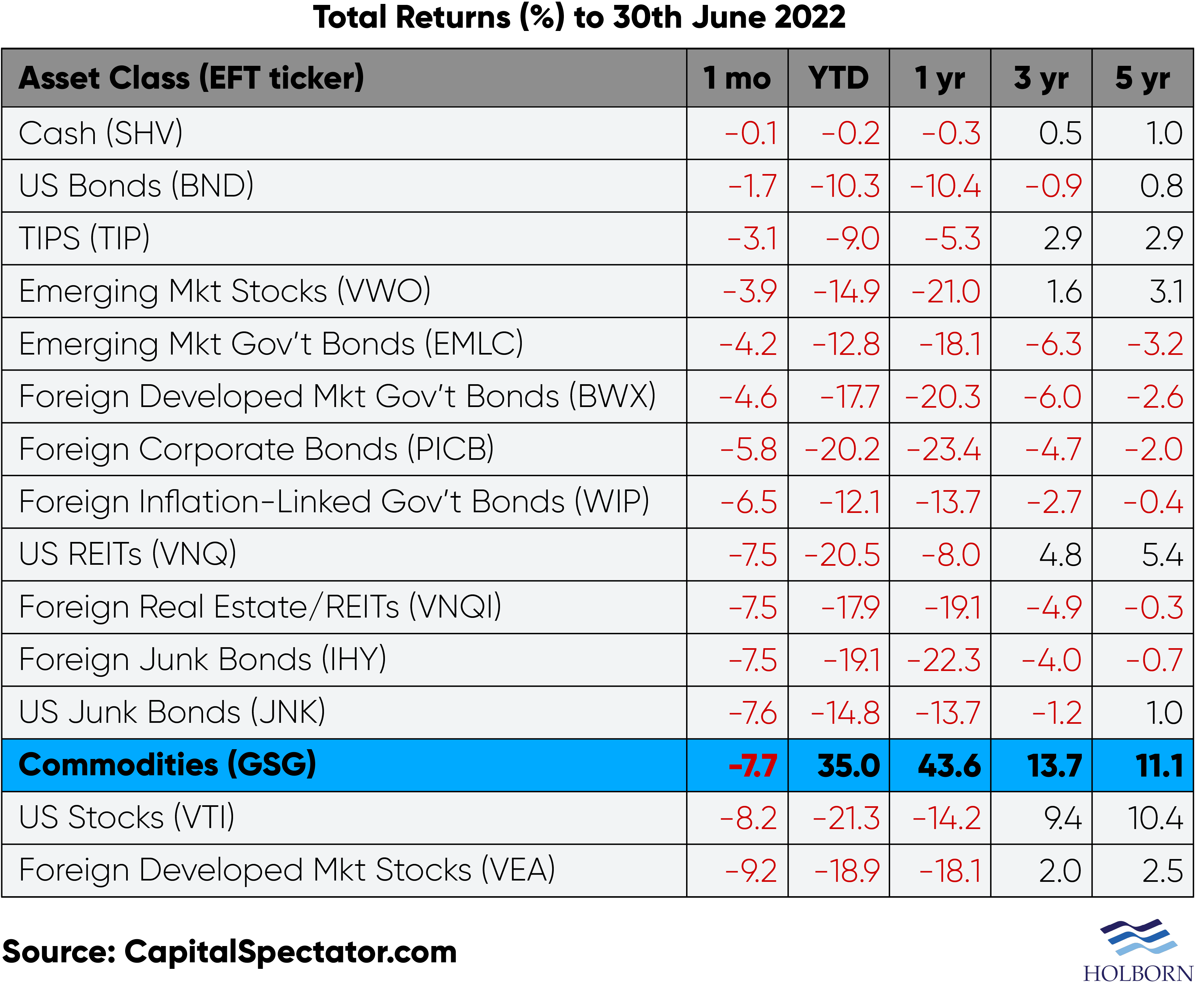

Seeking Alpha’s latest performance review for North America looks at the total returns for each major asset class across different timeframes. Here, we can see that commodity investments have consistently outperformed other asset classes.

How Holborn Assets can help

How you invest in the asset class depends on your overall investment objectives.

Whether you invest in commodity stocks directly or via a fund, the asset class provides investors with a great way to build a balanced portfolio.

Their current performance is strong, but as with any asset, things can change. Remember, past performance is not always an indication of future results.

In the fast-paced world of investing, you need an investment strategy that keeps up with the market, fits your risk tolerance and helps you reach your goals. That’s where we can help.

At Holborn Assets, we have worked with clients for over 20 years to reach their investment goals. We understand that a one-size-fits-all approach doesn’t work. We provide investment solutions tailored to your needs and goals.

With our transparent, client-first approach and award-winning customer service, you can be sure that you are in safe hands.

Contact us using the form below to find out how we can help you.