No doubt the term ‘don’t put all of your eggs in one basket’ is one you’ve heard many times.

The same goes for investments. Asset allocation is a crucial component when it comes to building a successful and profitable investment strategy.

The trouble is, knowing which assets to pick and how much to allocate to each one can be difficult.

In this article, we take a look at asset allocation to help you balance your portfolio. To start with, let’s look at what asset allocation is and how you can benefit from it.

What is asset allocation, and why is it important?

You may have heard of portfolio diversification before. Investors use the strategy to offset one of the biggest pitfalls of investing – risk.

The aim of the strategy is to bring harmony to a portfolio by balancing the risk and reward. Think of it like evening the odds at a roulette table.

If you put all of your chips on 18 red, that is a high risk, high reward bet. The reward may not be as high by spreading your chips across the table, but the risk is considerably lower and your chance of winning increases.

In its most basic form, this is how the strategy applies to investments.

Research by Vanguard revealed how important asset allocation is when it comes to generating returns. Their data showed that asset allocation is key to the returns of a portfolio over time.

So, unlike roulette, investing is not a guessing game, but how do you pick the right assets? First, you need to know a bit more about each of the main asset classes.

Assets explained

Each asset class has different subclasses. For this article, let’s take a look at the five main asset classes and their characteristics.

Equities

You may know these as stocks and shares. When you invest in equities, you are buying a stake in the company.

Pros

Equities often have the best growth potential compared to other assets

You could receive dividends which can provide a regular income from your investment

Cons

Equities may provide great return potential, but they also tend to carry the most risk

The asset class can be volatile in the short-term

Commodities

This asset class includes raw goods and goods for production. An example of a commodity is oil or gold. You can either invest in a specific commodity or a commodity fund that will focus more on a company.

Pros

Unlike other asset classes, commodities can benefit from inflation increases

A good asset to diversify – the performance of a commodity often moves in a different direction to equities

Cons

They can be high-risk assets

In the short term, their performance can be hard to predict

Bonds

These are essentially a loan to the government or a company. Like a bank, when you lend them money, you receive interest payments over time.

Pros

Bonds are usually a low-risk asset as companies will prioritise paying interest on bonds over paying dividends

Bonds are more secure as interest is fixed and paid regularly

Cons

The returns are usually lower than other asset classes

Corporate bonds provide less security than government bonds

Cash as an asset

Cash has the lowest risk compared to the other assets. Because of its low risk, it can help to offset the risk of different investments in your portfolio.

Pros

Cash is a liquid asset, meaning your money is easy to access

Its low risk means it pairs well with other assets such as equities which carry a higher risk

Cons

Cash can be affected by inflation, reducing its value

With cash investments, you could get back less than you put in as their value can go down as well as up

Property

These include the commercial and residential property market. You can also invest in funds, meaning you can put in smaller amounts instead of buying the whole property.

Pros

Funds can make investing more flexible and offer a wider range of opportunities

Funds take away the responsibilities associated with being a landlord, such as finding tenants etc.

Cons

Property prices are volatile at times, and you could get back less than you invested

If you decide to go down the buy-to-let route, tax changes could make it a less viable investment than in previous years

The next thing you need to do is establish your risk profile.

Profiling

There is no single right way to invest. How you allocate your assets will depend on several factors.

Your financial goals, age and appetite for risk all play a part in asset allocation and building your investment strategy.

The amount of risk you are willing to take is probably one of the biggest factors that will influence how you will split your assets.

Remember, bonds are typically considered low risk, but the downside will be lower returns. On the other side of that, we have equities. Equity-based assets, by nature, are high risk, but they deliver higher returns.

If we were to generalise a portfolio, the higher the tolerance to risk, the more it will be weighted towards equity-based assets.

Of course, going all-in on equity-based assets wouldn’t be the best idea if the goal is to create a diverse investment portfolio. Let’s take a look at what makes a portfolio truly diverse.

How diverse?

Now we know about the main asset classes and the role that risk plays, it’s time to look at what we mean by ‘diverse’.

You should note, the diversity of a portfolio will come down to your goals, the timeframe of those goals and your tolerance to risk.

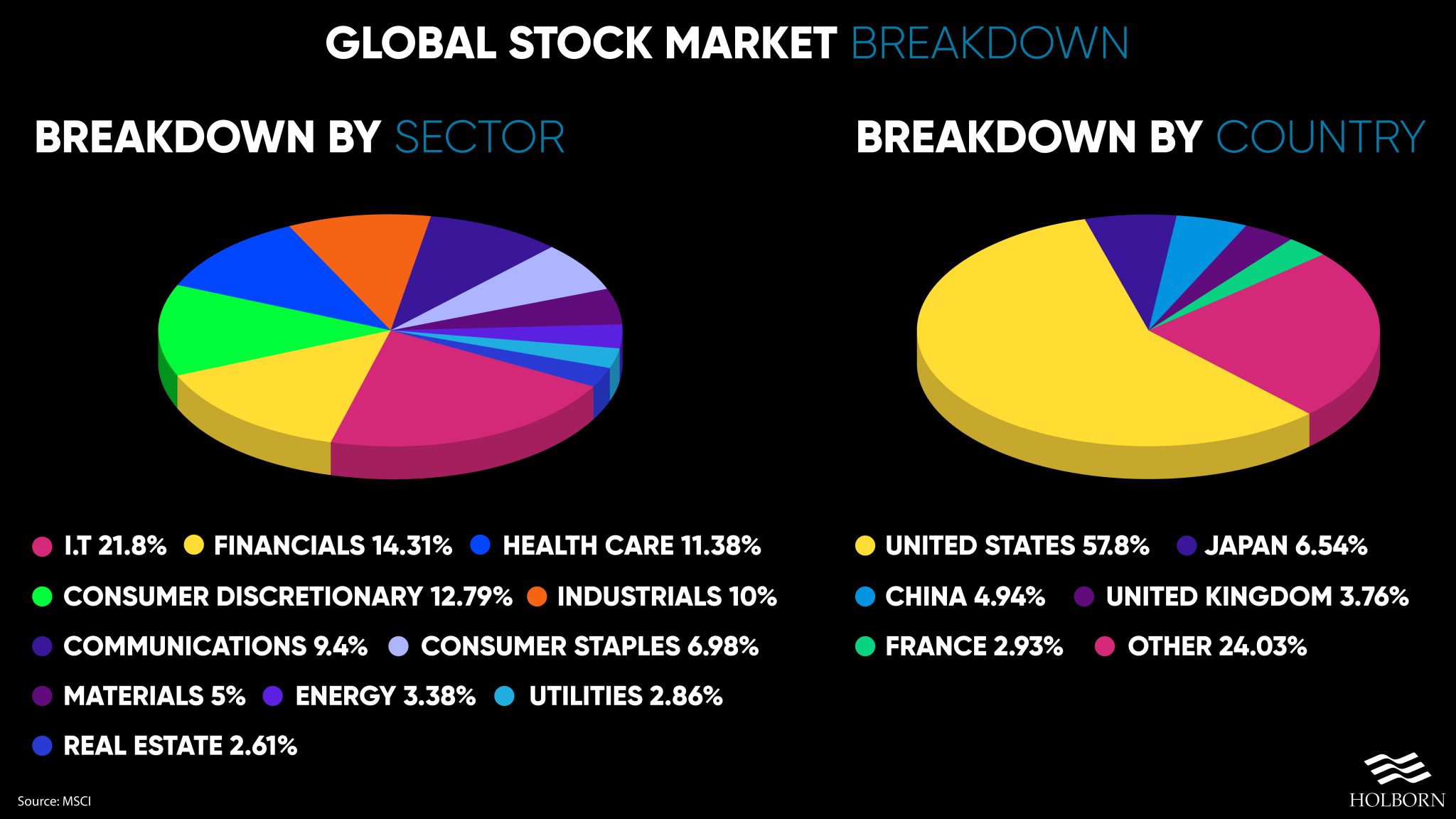

The characteristics of a truly diverse portfolio will usually be a mix of assets and investments in different sectors within each asset. Location is also important. You may choose to invest in equities from other countries to spread the risk.

Drilling down further, you could invest in assets with little relation to one another. For example, let’s say you invest in gold and health care. There is little to no correlation between the two, so it won’t impact the other if one performs poorly.

Seeking advice

Investments are a long-term strategy for building wealth. With that in mind, try to avoid hitting the panic button at the first sign of market volatility.

Although investments are all about the long game, that doesn’t mean you shouldn’t change things. Your goals, situation and tolerance towards risk may change, and your investment strategy should reflect those changes.

This article intends to give you the information you need to get started. However, it can not replace expert advice.

When it comes to asset allocation, there is no single perfect strategy. Without a blueprint to follow, knowing what the right choices are based on your situation can be difficult.

An experienced professional can give you the advice you need and help build an investment strategy based on your goals and needs. Not sure how to find the right financial adviser? Read our guide on how to choose the right adviser for you and your needs.

For over 20 years, we have been successfully managing and building diverse investment portfolios for clients.

To find out how we can help you and support your investment goals, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences