Some information in the article may be out of date. You can find a more recent version here .

Got your NICs in a twist?

Updated May 2019: Check your NICs online! Your National Insurance Contributions (NICs) record decides whether you get a UK State Pension. Head to the UK Government NICs website to access details of your own NI credits – but, first, discover below what you’ll need to use the official NICs site easily (including what ID you will need to register online). Here’s the opening page: Check your National Insurance Record .

What’s the big deal about NICs?

National Insurance Contributions are important because they relate to how much UK State pension people receive. Currently, the rules state that: “To get the full basic State Pension you need a total of 35 qualifying years of National Insurance contributions or credits … … If you have fewer than 35 qualifying years, your basic State Pension will be less than £175.20 per week but you might be able to top up by paying voluntary National Insurance contributions .”

What’s the big deal about the HMRC website?

The HMRC website allows you to:

Check which years in the past you haven’t paid enough NICs.

See exactly how much is owed.

Rules state that years from the past may be paid off now – but only going back six years from the present tax year.

(Note that, as with all tax affairs, variations are likely to apply depending on personal circumstances when it comes to any of these calculations.)

What will I need to login and check my NICs?

This login security set-up is quite stringent and may take some time. The one thing you cannot do without is your National Insurance number. If you have lost it, speak to the HMRC online or on the phone and read their advice on how to find it.

You will need a “Government Gateway” online account If you have an online account with the HMRC, use this User ID and Password to sign in. If you do not have a Government Gateway account, you can

– note that it may take a while to get the account properly set up, depending on whether your activation code is delivered by post or email. You will need your National Insurance number.

You might also need your backup HMRC security credentials When you supply your Government Gateway/HMRC login successfully, you may face a second security check. This may ask for backup security credentials. Don’t worry, you’ve got them somewhere – as part of the process of signing up, you will have supplied them. They might include, for example, passport details.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

And after the NIC site login process…?

Assuming you get through security, you’re into the easy bit. Choose now whether you want to:

Go straight to checking your NICs.

Print proof of your National Insurance number.

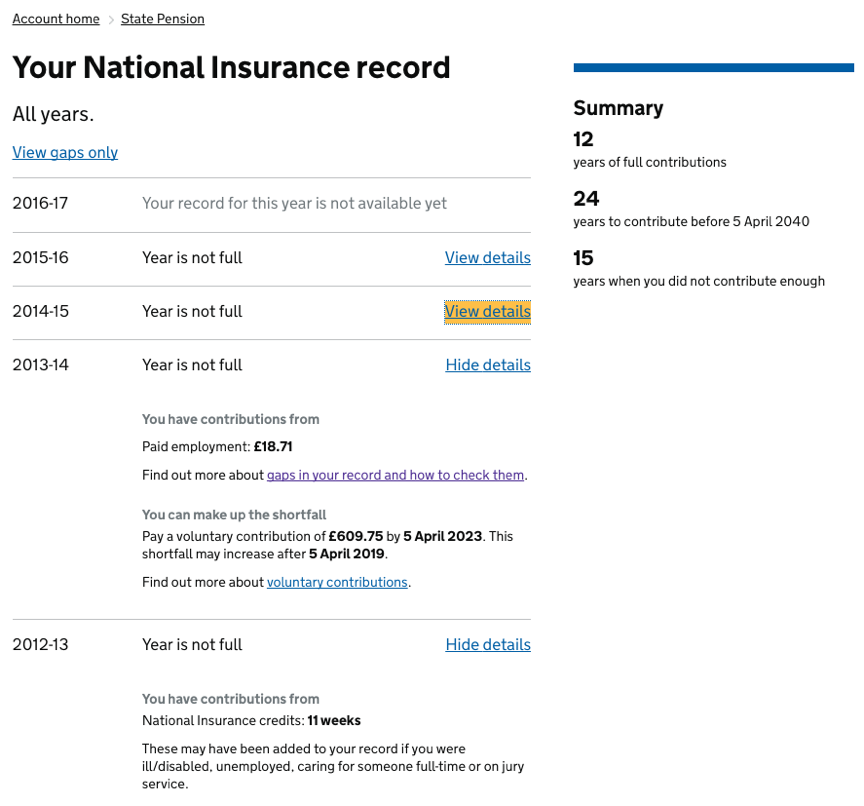

Here you can:

Click on a particular year (“

view details”

) and see exactly how much you paid that year in contributions.

See whether the HMRC deems a particular year to be “full”, i.e. enough contributions made in that tax year for the year to qualify in the pension calculations that require a certain amount of years to be paid to receive either a basic or full state pension.

See exactly how much voluntary contribution you can make to bring the balance up to “full.”

If you are behind with your National Insurance Contributions, the new HMRC website can prove something of a wake-up call. If you have gaps in your NIC record, check for yourself what happened that year:

When you’ve had a look yourself, get in touch with an IFA to see how NICs and your UK State Pension eligibility feature in your whole financial picture. Take this opportunity to firm up your retirement planning. And, if you’re a UK expat working outside of Britain in 2018, you might want to have a quick look at the key NIC issue of Should you be paying National Insurance as a UK expat?

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences