Posted on: 29th November 2019 in Expats

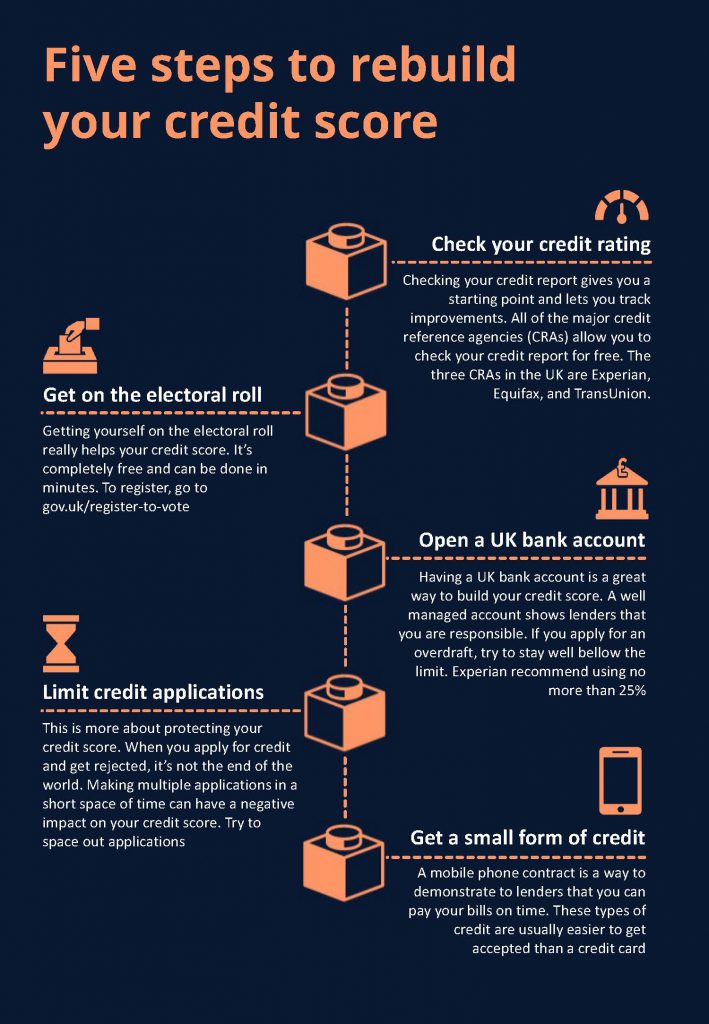

If you’re an expat who plans to return to the UK one day, have you considered your credit score? If you haven’t, now is the time to. Depending on how long you have spent outside the UK, you might have a limited credit history. In some cases, you might have a completely blank credit history if you have spent an extended period living outside of the UK.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more

When it comes to growing your wealth, choosing the right investment path can make all the difference—especially if you’re an expat managing finances across borders. Two of the most talked-about...

Read more

Building wealth is one thing—but building a legacy that lasts for generations? That’s something else entirely. For families, especially those living and working abroad, creating multi-generational wealth means more than...

Read more

Living abroad as an expat can be one of life’s most rewarding adventures—but it also comes with its fair share of financial surprises. Whether you’ve relocated for work, lifestyle, or...

Read more