If you’re an expat who plans to return to the UK one day, have you considered your credit score? If you haven�’t, now is the time to. Depending on how long you have spent outside the UK, you might have a limited credit history. In some cases, you might have a completely blank credit history if you have spent an extended period living outside of the UK.

What is a credit report?

When you apply for a job, potential employers will make the decision to bring you in for an interview based on your CV. The way lenders use your credit report is similar. A credit report is a way for lenders to decide if you are a responsible borrower. Your credit report is essentially your financial history. It includes all credit accounts you have held, whether or not payments have been missed and more. Your credit report is generated by credit reference agencies (CRAs). CRAs use all of the information in your credit report to give you an overall credit score. Your credit score is simply an indicator to lenders of your credit worthiness. There are three main CRAs in the UK – Experian, TransUnion, and Equifax – and each may have a slightly different score for you. Ideally, lenders would share the same information with all three CRAs so that each report was consistent. This isn’t always the case, which is why your credit score is not a universal number.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Why is your credit score important?

As we said, lenders don’t know you personally, so they have to base their decision on the information they have to hand – your credit report. Just like having a poor CV won’t land you a job, having a poor credit score could make borrowing difficult. If you do get credit, lenders may give less favourable interest rates if you have a low credit rating. This can be an issue if you are an expat returning to the UK. Your credit report doesn’t follow you around the world. If CRAs have no information on you, they have no choice but to lower your credit score. Living outside of the UK for a year probably won’t affect your credit score too much. If you have been away from the UK for an extended period, you most likely have gaps in your credit report.

Rebuilding your credit score

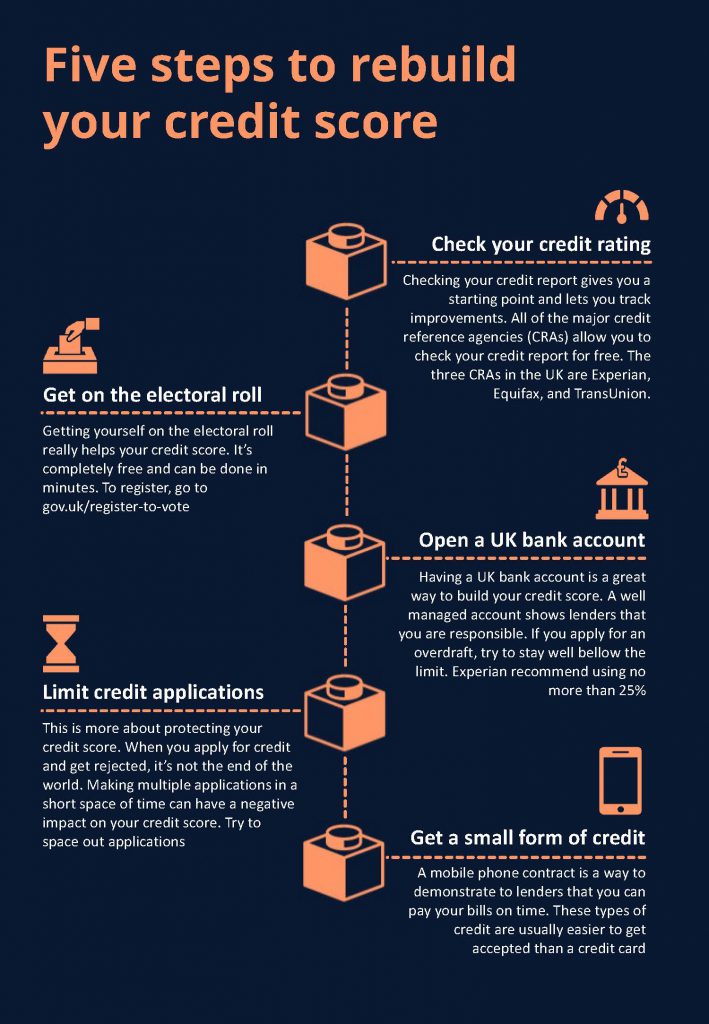

Rebuilding your credit score means re-establishing a presence in the UK. This means getting back on the CRAs radar.

Next steps

You should check credit score regularly, making sure it’s correct and that it’s going in the right direction. If you would like more information, or to discuss the best financial options when you return to the UK, contact us using the form.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences