Posted on: 8th November 2021 in Investments

While the term may sound like only environmental jargon, it actually spills over in the investment world.

In this article, we look at greenwashing and the potential impact it can have on your investments.

At its core, greenwashing is misrepresentation, but let’s dive a little deeper.

The term isn’t new. In 1986, environmentalist Jay Westerveld wrote an essay focusing on the hotel industry. He noticed that rooms promoted reusing towels. The reason? To save the environment.

However, Westerveld realised that these hotels made minimal effort at best to reduce energy usage. If they did, savings made by the hotel would be passed onto the customer, but this wasn’t the case.

The hotels were not concerned about the environment; they were concerned about profit. Lower laundry costs meant bigger profits, with the environment used to mask the true intentions.

It’s a similar story with oil companies. They have policies in place that are considered green, but other actions are anything but green.

So, what is greenwashing? It’s a clever marketing spin that aims to make products, policies, or companies appear more environmentally conscious than they are.

At its best, greenwashing can contain misinformation that is ‘just true enough’. At its worst, it can contain information that is an outright lie.

Let’s look at how this ties in with investments.

The demand for green, or ESG investments, is increasing.

Research from Aviva found that the demand for ESG funds had increased due to the pandemic. Data from Natixis showed that by the end of the final quarter of 2020, ESG assets reached a record £1.2tn worldwide.

If you thought that demand for such funds was coming from younger generations, think again.

A separate report from One Planet Capital revealed that 77% of 18 to 55-year-olds said that ESG factors play a key role in their investment decisions. There was only a slight drop off in over 55s where it dropped to 71%.

Demand for sustainable investments is good news for the planet. However, with the rise in demand comes the increase in greenwashing.

In the past, investors had to make a choice; profits or protect the planet. However, that is no longer the case.

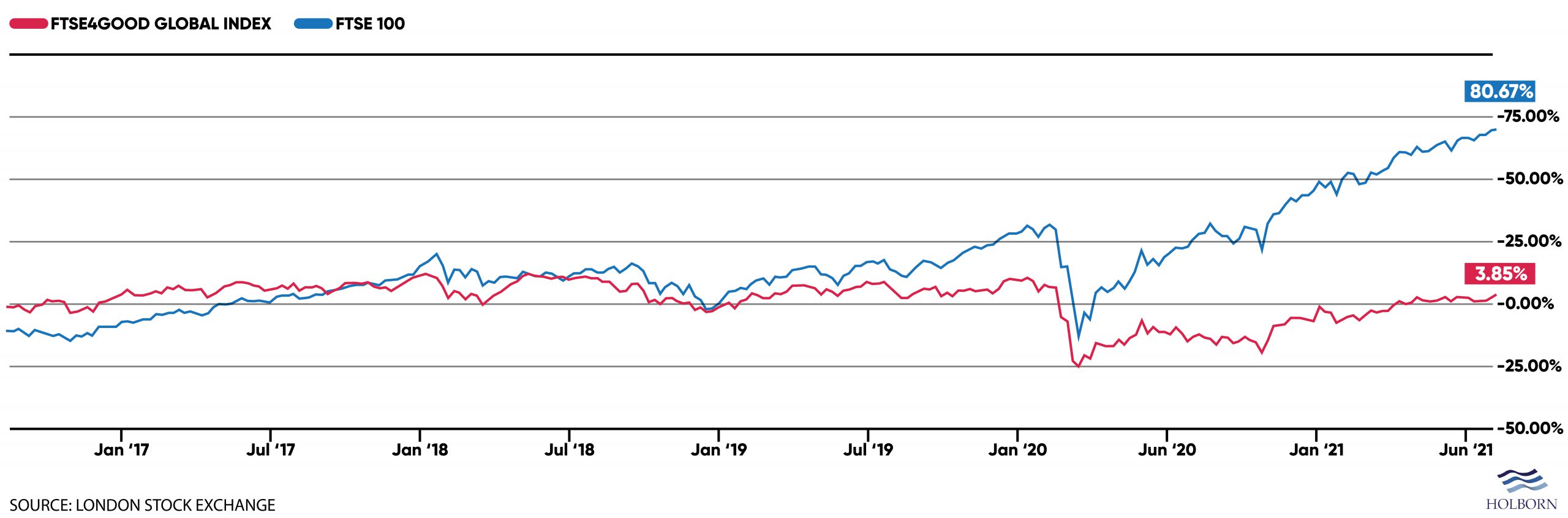

For the last five years, the FTSE4Good, an index for ESG stocks, has consistently tracked or outperformed the FTSE100.

Despite investors now being able to align their investments with their values and see good returns, there are concerns.

A study by Schroders found that greenwashing is the biggest concern for investors.

In 2021, 59% of investors stated greenwashing as their primary concern, compared to only 38% who listed performance as the biggest worry.

It’s easy to see why greenwashing is a top concern, as some funds can become polluted by companies looking to cash in on the growing popularity of ESG funds.

For example, a company could have certain policies such as using environmentally friendly materials but then use less than ethical processes to manufacture their product. Ultimately, this ends up creating distrust for investors.

All of this has made ethical investing a tricky task. Still, there are steps you can take to ensure your investments are aligned with your values.

Eventually, we will reach a point where industry-wide standards are implemented. This will give investors the transparency needed to make informed decisions.

That could be a way off, so what can you do in the meantime?

Unfortunately, doing more work may be the trade-off for now.

It’s easy for companies to use keywords such as ‘green’ or ‘sustainable’. Digging a little deeper into the company can help to determine any potential greenwashing.

Some ESG funds publish impact reports. These reports give a detailed breakdown of a company’s goals and statistics to show how they are making a difference.

Investing in a fund often means you’re investing in a group of companies. The fund’s prospectus will give you more information about the fund’s aims and the companies it invests in, so this is a good place to start.

You can usually find a prospectus with a simple Google search or by visiting the fund’s website. Doing this may mean extra leg work, but it will help you invest in companies that genuinely align with your values.

At the start of this article, we asked the question, ‘what is greenwashing?’.

The answer differs slightly depending on the context. However, for investors, it acts as a barrier. The lack of transparency can make it challenging to invest in companies that align with your values.

Regardless of how you choose to invest, having a robust strategy in place is essential.

For more than 20 years, we have worked with clients to build successful investment portfolios based on their needs and goals. With our award-winning client service and experienced team of specialists, you can be sure that you are in safe hands.

To find out how we can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Living abroad as an expat can be one of life’s most rewarding adventures—but it also comes with its fair share of financial surprises. Whether you’ve relocated for work, lifestyle, or...

Read more

Life doesn’t stand still—and neither should your financial plan. Whether you’re moving abroad for work, starting a family, or navigating unexpected events, having a plan that adapts to life’s twists...

Read more

Let’s face it—2025 has already thrown a few curveballs. From changes in global trade to market ups and downs, it’s been a bumpy ride for businesses, investors, and everyday savers...

Read more

When you’re living and working abroad, managing your wealth can feel like navigating a maze. Different tax laws, inheritance rules, and privacy concerns can all make it tricky to protect...

Read more