Posted on: 25th November 2020 in Investments

‘Eat your greens; they will make you big and strong’.

We are sure this was something every child heard as they faced a plateful of broccoli.

As adults, we all know the benefits of eating more vegetables. But did you know that greens can also net you some healthy returns on your investments?

Of course, we are not talking about vegetables here. By adding greens to your portfolio, we are talking about sustainable, environmentally friendly investments.

We have previously discussed the benefits of ethical investing. However, now might be the perfect time to do your bit for the planet and net some healthy returns in the process.

Before we look at potential green stocks to invest in, let’s start by looking at why they now might be a good time to rethink your investment strategy.

Time to save the planet is running out, and countries are responding. The world is going green.

The UK has recently joined other countries, committing to do their part to support and protect the environment.

Prime Minister Boris Johnson’s ‘green industrial revolution‘ aims to reduce the UK’s net carbon emissions to zero by 2050.

The Government has put their money where their mouth is, committing to a £12 billion investment to support the initiative. The ambitious ten-point plan includes petrol and diesel car sales banned from 2030.

So, how does this tie into your investment strategy?

Put simply, achieving such an ambitious goal requires an infrastructure to support it. That’s where opportunities for investors come in.

Here are some of the key investment areas to consider adding to your portfolio.

Part of the UK’s commitment to net-zero carbon emissions by 2050 includes green alternatives to power homes.

To tackle this, Prime Minister Johnson wants every home to be powered by offshore wind turbines by 2030. To get there, the UK has a lot of work to do.

Currently, the UK’s offshore wind capacity stands at around 10.5 gigawatts (GW). Experts predict that to power all homes across the UK by 2030, that capacity needs to increase to 40GW.

Wind is already one of the fastest-growing renewable energy sources. For the UK to quadruple wind capacity, more wind farms are needed.

The increase in demand could see substantial growth in the sector. Ultimately, this could present more investment opportunities.

The news that Boris Johnson plans to ban the sale of new petrol and diesel cars by 2030 creates opportunities for electric vehicle manufacturers.

Hold on; don’t rush to invest in Tesla just yet.

When we think of electric cars, we think of Tesla and for good reason. The company has gone from strength to strength and is by no means a bad investment.

However, there is more going on behind the scenes that investors need to consider.

For electric cars to become the norm, they need to overcome two hurdles – range and charging point accessibility. Let’s start by looking at range.

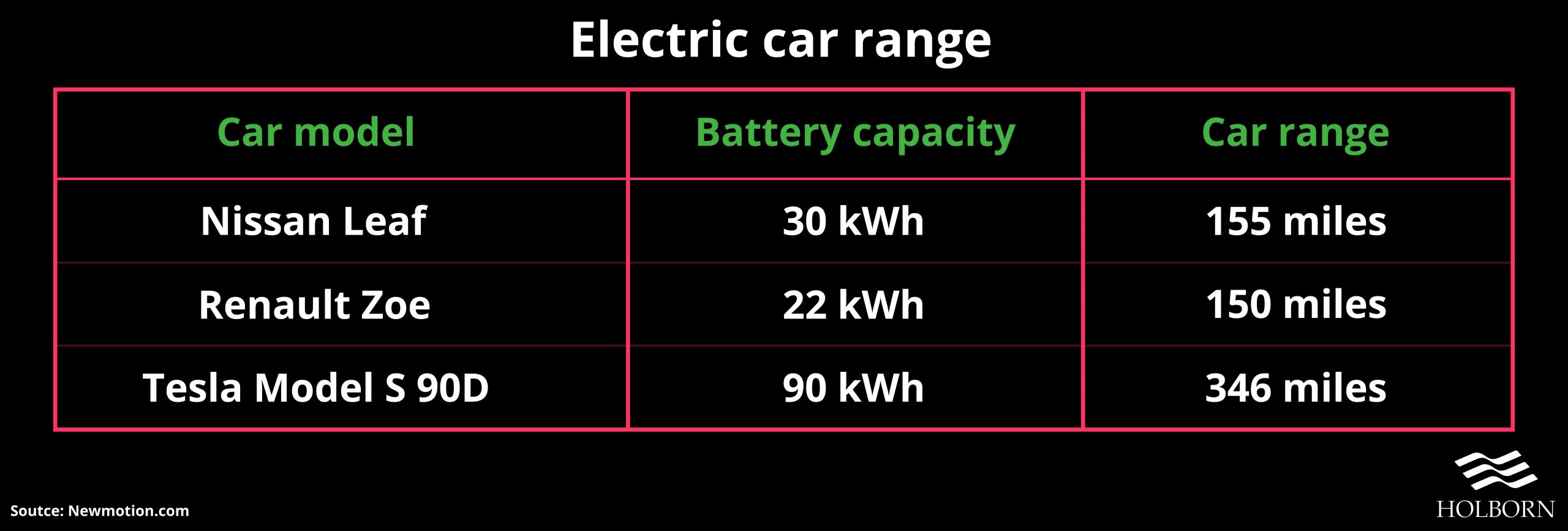

The average range of an electric car is 181 miles. That means driving cross country is difficult without needing to recharge the battery. Tesla solves this problem with their Model S being able to stretch to around 346 miles.

Unfortunately, the price of a Tesla is what is currently preventing them from being more mainstream.

Thankfully, there is a lot of work going on behind the scenes to advance the battery technology. Investors may want to consider gaining exposure to the technology behind electric cars.

Now let’s look at the second issue; charging points.

There are currently just over 35,000 charging points across the UK. That may sound like a lot, but with a switch to electric, the infrastructure needs to improve.

The Government has pledged a £1.3 billion investment in charging points as part of their ten-point plan.

With a push to improve the infrastructure that supports electric cars, this could provide investment opportunities.

We have already looked at one source of energy provided with the help of mother nature, but there is another – the sun.

For the UK to reach net-zero carbon emissions by 2050, solar energy will no doubt play a crucial role.

The stock value of companies which produce solar panels will likely increase. Of course, there is more to solar energy than just the panels, especially in countries such as the UK.

The UK is known across the world for several things. One of them is the notoriously gloomy weather. So, when the sun is shining, your need to make the most of it. That is where battery storage comes into play.

Just like the scenario we previously mentioned with electric cars, companies will be looking to advance battery technology to support the infrastructure.

Of course, there is more to consider. Other components used for solar energy could also open up investment opportunities.

2020 has certainly been a strange year. The markets have been hard to predict, and finding the right investment strategy has been challenging.

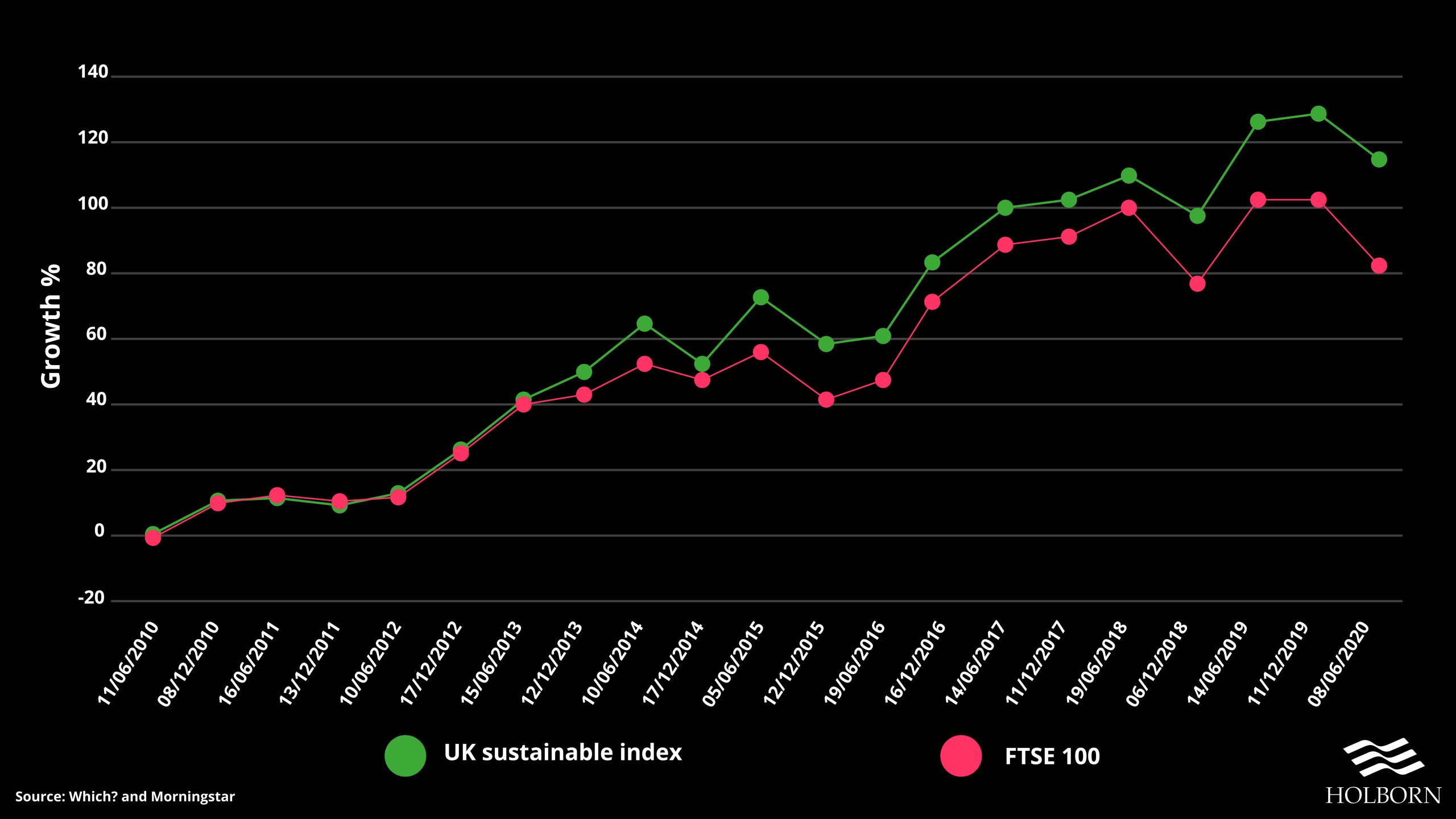

However, it’s worth noting that the UK sustainable index has consistently outperformed the FTSE 100.

This isn’t something new or another twist in the madness that is 2020. Sustainable investments have matched or outperformed FTSE 100 for over a decade.

Whatever your investment goals, we have the knowledge and experience to help you build a profitable portfolio.

To find out how our experts can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more