Posted on: 26th July 2019 in Financial Planning

None of us likes to think about our own mortality, but we all want to make sure our loved ones are taken care of when we’re gone. Life insurance provides financial security for your loved ones when you pass away. However, if your policy isn’t set up in the right way, your family may never reap the full financial benefits that you had intended.

Life insurance is not usually subject to income and capital gains tax. Under normal circumstances, life insurance will be included in your estate and could be subject to inheritance tax (IHT). The standard rate of IHT is 40% of anything in your estate over the value of £325,000. This means that if your estate is worth £600,000 then £275,000 is subject to 40% tax, or £110,000. This might seem like a lot of money but remember, your estate is basically anything you own. This includes your home, cars, money and your life insurance policy. In the UK as of July 2019, the average property price stood at £312,681 – just over £12,000 shy of the IHT threshold. It’s not just IHT that should be considered when you take out life insurance, probate can potentially reduce the amount your beneficiaries receive significantly.

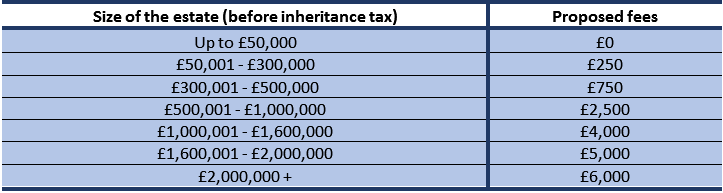

Probate is the legal process of dealing with someone’s estate when they die. The person who applies for probate (the executor) will clear any outstanding debts and distributing assets. In some situations, life insurance can be included as part of your estate. This means it would need to go through probate before any funds can be distributed. Probate can be a lengthy process, and proposed changes to fees could be costly. Currently, probate fees are charged at a flat rate of £215 for individuals or £155 for solicitor applicants. This fee is waived if the total value of the estate is worth less than £5,000. The government plans to introduce a tied system, with fees dependent on the value of the estate. Here is the full list of proposed fees.  These changes only apply to England and Wales, and it’s still not clear when, or if these fees will kick in. Not only do you want your loved ones to receive as much as possible, but you also want to make sure they receive the payment as quickly as possible. Writing your life insurance in trust is one way to protect the policy payout.

These changes only apply to England and Wales, and it’s still not clear when, or if these fees will kick in. Not only do you want your loved ones to receive as much as possible, but you also want to make sure they receive the payment as quickly as possible. Writing your life insurance in trust is one way to protect the policy payout.

Trusts are nothing new, in fact, they have been around for centuries. Knights would put their worldly good into the hands of trusted people to look after until they got back. Trusts have evolved since they but the purpose they serve has remained largely unchanged. Essentially, a trust lets you put assets aside and elect a person (or people) to benefit from those assets at a time you decide. You (the settlor), place your assets in the hands of others (the trustees) who look after them until the time comes for your loved ones (the beneficiaries) to benefit from those assets. A life insurance policy is one of the many assets that you can put into a trust. Research carried out by insurer Aegon found only 6% of life insurance policies in the UK are written in trust. Although they won’t be the best option for everyone, trusts do offer some notable advantages.

For those with a large estate, writing life insurance in trust can help you sidestep inheritance tax (IHT). In some cases, a life insurance policy can be included in your estate if it is not written in trust. If your estate is over the £325,000 threshold, it is subject to 40% IHT. If a policy is written in trust, it will no longer legally be part of your estate. This means that any proceeds will go directly to the beneficiaries and bypass IHT in most cases. Writing life insurance in trust isn’t a guaranteed way of protecting the policy against IHT. For policies worth large sums, a more bespoke approach is needed to reduce the impact of IHT and other charges. It is estimated that only 5% of the UK population actually pay IHT. For those with an estate value below the IHT threshold, the real benefit to a trust is avoiding probate. As we mentioned earlier, probate can be a lengthy process. Bypassing this process could be crucial, especially if your loved ones rely on a second income for mortgage repayments or other expenses. When a policy is written in trust, the insurance provider would only require a death certificate for a payout to be made.

Writing a policy in trust is very simple, and most insurers will offer it as an option when you take out the policy. A policy can be written in trust at any time. You can do it when you first take the policy out, or if you change your mind it can be transferred at a later date. Although it is usually free to write a policy in trust, transferring an existing policy may incur changes. This is because you may need assistance from a solicitor or financial advisor. If you are thinking of writing a policy in trust, we recommend that you seek advice from a financial advisor first. This is especially true if you are looking to set up a bespoke trust for larger amounts. If you would like to find out if a trust is right for you or for assistance with life insurance, contact one of our experts using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more