Posted on: 18th September 2017 in Finance

UK expats in the UAE have not been surprised to learn this week that qualifying for State aid with UK care home fees remains a patchy old business – not only because care home fees vary so widely depending on geography, but also because tricksters are generally getting away with hiding their assets to get funding. That’s the murky picture from 8 Freedom of Information requests published by the Telegraph – which shows some UK councils failing to prosecute a single relevant case over the last five years.

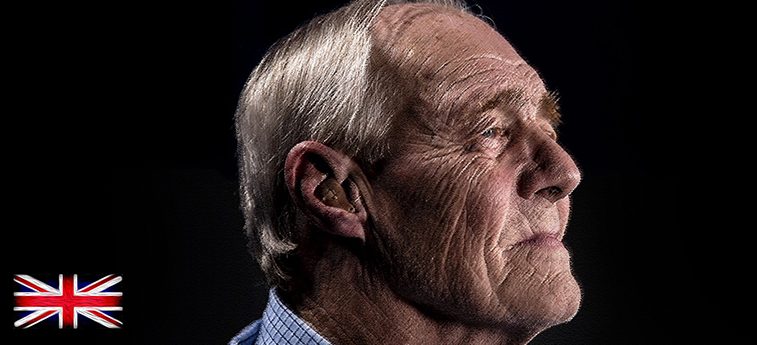

If you have assets over £23,250 as a UK citizen, you are expected to fund your own long term care. Below this figure, and your net value entitles you to local authority funding (there are different types). Nobody likes the prospect of going into a care home. But, if you get seriously ill in your old age, it is often the only sensible option. You need to start thinking about funding now, because it can be a huge expense.

It is illegal to hand assets and cash onto children, for example, with the specific intention of hiding money in order to cheat eligibility for the £23,250 funding cut-off point. In council/legal jargon, this activity is called “deliberate deprivation of assets” and is prosecutable. (Of course, it is entirely legal to hand assets on to children for other reasons). The Telegraph confirms that, “councils have powers to claw back money from people it can prove to have ‘deliberately deprived’ themselves of assets to claim state aid.”

Not very much. A snapshot of 8 councils’ efforts to put enforcement into action over the last 5 years reveals a geographical lottery of enforcement; whether prosecutions are made at all totally depends on which UK council is in charge and, even then, the numbers do not inspire confidence – which is a shame, because people successfully making fraudulent claims for UK state aid forces the Government to be more stringent with eligibility – which means that everybody suffers in the long run. Freedom of Information requests made by The Telegraph shows that Westminister council, for example, has not taken a single claimant to court for deliberate deprivation of assets since 2012; but North Somerset Council, on the other hand, has prosecuted 64 individuals to the tune of £1.3m.

Steven Cameron from care specialists Aegon warns that, “with the care crisis getting worse daily and with more public interest in getting out of paying for care by giving away assets, the attention councils will pay is certain to increase considerably.”

Care home fees can cost anything from £500 to a week (in the North of England) to as much as £1500 (in the South). Just as with council enforcement of funding fraud, care home fees depend on entirely on geography.

Read more with Holborn Assets about the two giant care home issues we all face as UK citizens going into 2018: The Big Dilemma – when it comes to it, do we go into a care home or pay for care at home? The Big Problem – where’s the money going to come from? Speak to your IFA about how you can structure your investments to secure long term care funding for the future. In the meantime, read our Care Home FAQs.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more