Posted on: 20th November 2024 in Investments

Investing globally has never been more critical.

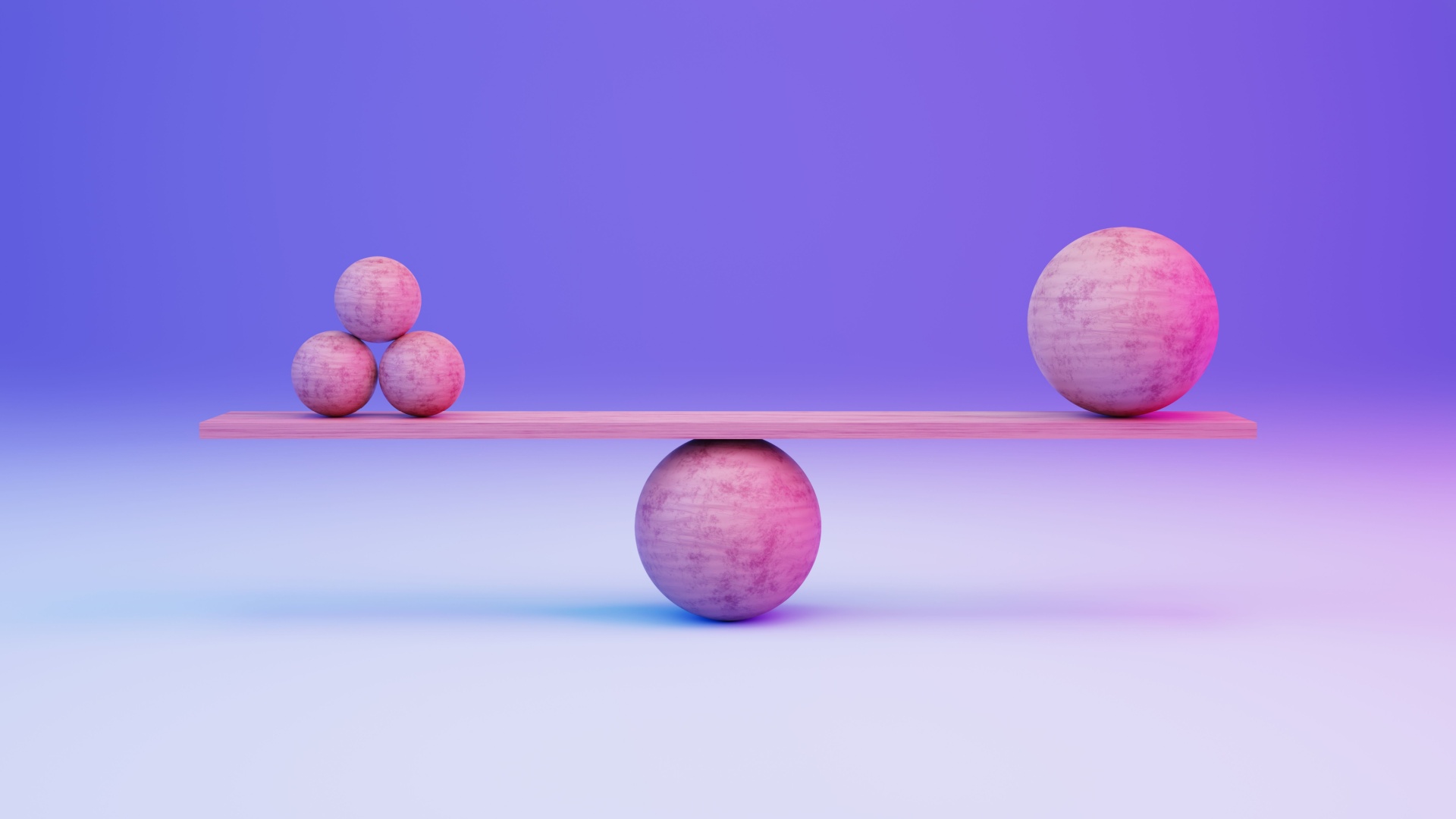

As the world becomes increasingly interconnected, diversifying your investment portfolio across multiple countries can reduce risk and boost potential returns.

But how do you build an effective international portfolio?

This guide will cover everything you need to know to start investing across borders and create a well-balanced portfolio.

First things first: understanding asset classes is critical to diversifying your investments.

Asset classes include equities (stocks), fixed income (bonds), real estate, and commodities. Each reacts differently to market conditions. Equities may do well during economic growth, while bonds tend to perform better during economic downturns.

When investing globally, aim to spread your investments across different asset classes and countries. This approach helps reduce the impact of any single market downturn.

For instance, while US stocks have performed strongly in recent years, European or Asian markets might provide growth opportunities at other times.

Home bias is the tendency to invest most of your money in your home country. This is common but limiting.

Investing only in domestic assets can leave you vulnerable if your country’s economy hits a rough patch.

To overcome home bias, make a conscious effort to include international assets in your portfolio. This could mean buying stocks from different countries or investing in funds that include a mix of global equities.

By doing so, you spread your risk and tap into growth potential outside your borders.

One of the unique challenges of investing internationally is dealing with currency risk.

Changes in exchange rates can affect your returns. For example, if you invest in European stocks while the British pound is strong, any weakening of the euro could mean smaller returns when converted back into pounds.

To manage this risk, consider investing in currency-hedged funds. These are designed to limit the impact of exchange rate fluctuations.

Another strategy is to invest in countries with stable currencies or a basket of currencies to balance potential shifts.

Not all countries are created equal when it comes to political and economic stability.

A country’s policies, government, and economic health can significantly affect your investments. For example, investing in a country facing political unrest or an economic crisis could lead to significant losses.

To avoid such pitfalls, do your research. Before investing, consider a country’s stability, regulatory environment, and growth outlook.

Diversifying your portfolio across multiple regions can help reduce the risk that comes from political or economic turmoil in any one area.

Investing internationally doesn’t have to mean buying individual stocks from foreign exchanges. There are plenty of investment vehicles that offer easy access to global markets.

Mutual funds, exchange-traded funds (ETFs), and index funds can provide exposure to different countries and regions in a cost-effective way.

For example, global ETFs or mutual funds are managed by professionals who understand the nuances of international investing. They handle the complexity while you benefit from a diversified basket of assets.

The world changes quickly, and staying on top of global market trends is essential for successful international investing. Economic indicators, geopolitical events, and market shifts can all influence the performance of your portfolio.

Keep an eye on major news sources, economic reports, and analysis from trusted financial institutions. This will help you stay informed and ready to adjust your investments when needed.

Even changes in major policies or unexpected geopolitical events can shift markets, so being aware can make a big difference.

Investing in multiple countries can feel overwhelming. This is where a financial adviser with global expertise can be a huge asset.

An experienced adviser can guide you through the maze of international investing, help you craft a strategy tailored to your goals, and keep you up-to-date with market developments.

Make sure to choose an adviser who understands the international landscape and has experience building globally diversified portfolios. The right guidance can help you identify opportunities in emerging markets or sectors poised for growth.

Building a balanced investment portfolio across multiple countries is an excellent way to reduce risk and maximise returns.

By diversifying globally, you’re better prepared for whatever the market throws your way. While it may seem complex initially, you can make the most of worldwide opportunities with the right strategy.

Speak to one of our investment experts to learn how we can help you build a balanced portfolio and achieve your financial goals.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more

When it comes to growing your wealth, choosing the right investment path can make all the difference—especially if you’re an expat managing finances across borders. Two of the most talked-about...

Read more

Building wealth is one thing—but building a legacy that lasts for generations? That’s something else entirely. For families, especially those living and working abroad, creating multi-generational wealth means more than...

Read more