Posted on: 20th January 2022 in UK

Changes to UK tax in 2022 will see most people paying more this year.

For most, when Rishi Sunak announced the 2021 Autumn Budget, it meant one thing – a higher tax bill.

National Insurance and dividend income increases will come into effect in April, the former creating an uproar when it was announced. There are also changes to capital gains and inheritance tax planned.

With these changes just a few short months away, it’s essential to understand them and plan ahead to avoid any surprises.

In this article, we look at the key UK tax changes coming in 2022 and how they will affect you.

National Insurance rates will increase by 1.25% from 6th April 2022.

According to the government, the tax increase is intended to generate revenue for the NHS and social care.

From 2023, the rate of National Insurance will return to 2021/22 levels. However, it will be replaced with a 1.25% Heath and Social Care Levy.

Starting from 6th April 2022, the lower earnings limit will rise by 3.1%. The rate increase will apply to both the middle and upper earnings thresholds. However, the upper earnings threshold will stay frozen at £50,270.

The amount at which you start paying National Insurance is also set to increase.

Following the mini-budget in March 2022, the threshold for National Insurance will start at £12,570 from July 2022.

The sections below break down the changes to National Insurance contributions (NICs) for both employed and self-employed individuals.

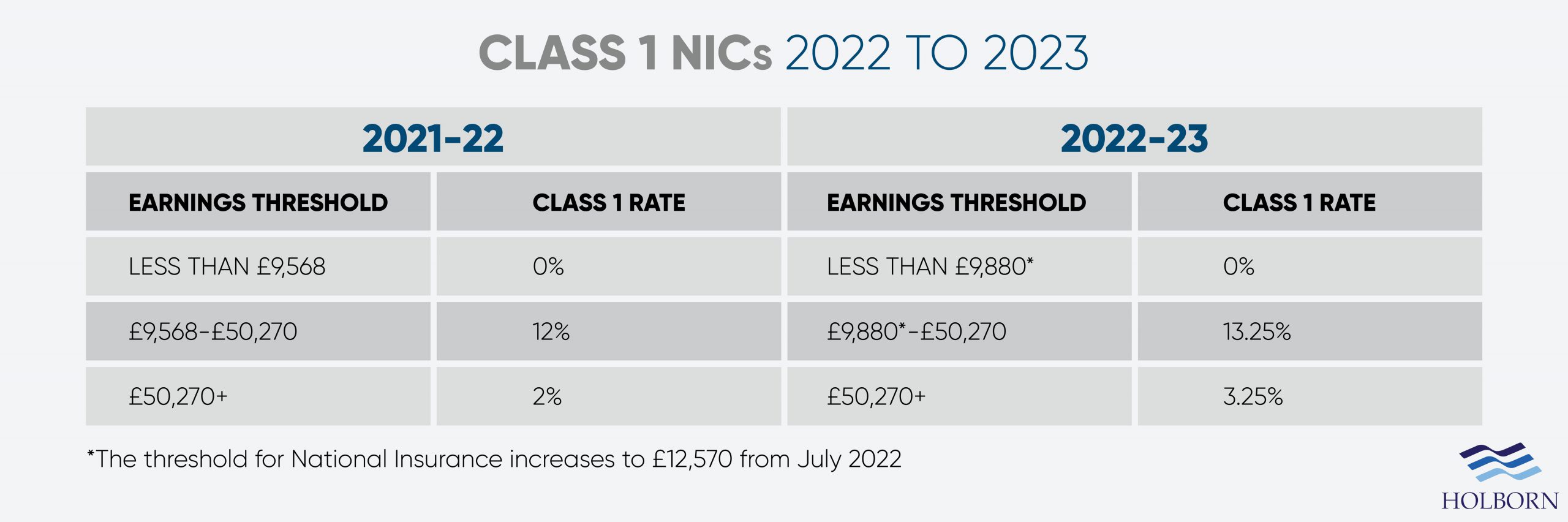

Class 1 National Insurance is paid by employees. Your earnings determine the amount you pay, as detailed in the table below.

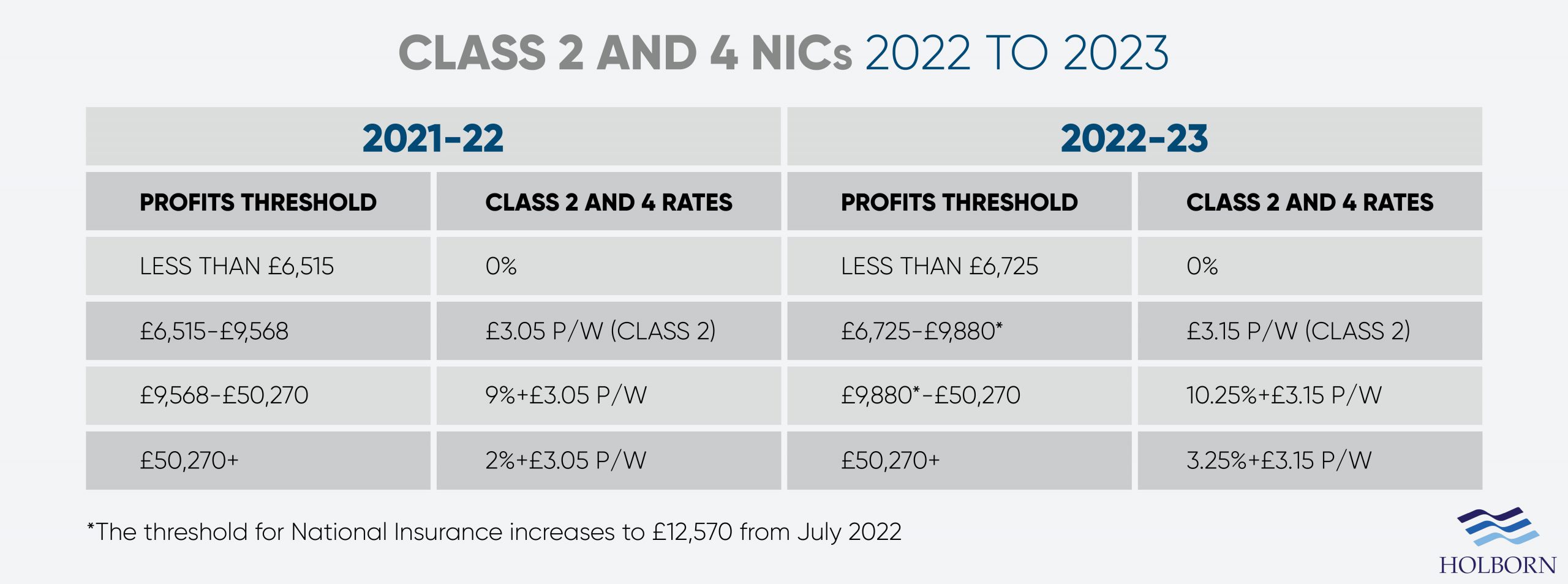

You will likely pay Class 2 or Class 4 NICs if you are self-employed, depending on your earnings. The table below shows how the increases will affect both classes.

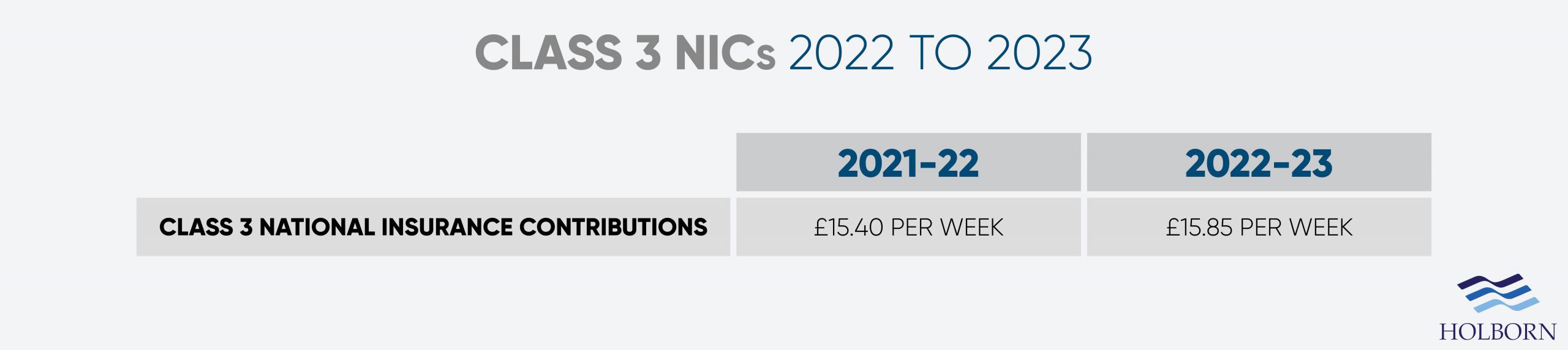

Class 3 applies to voluntary contributions. For example, if you have gaps in your National Insurance record, you may wish to make voluntary contributions. Gaps can affect your eligibility for the State Pension and other benefits.

This is especially true for expats or those who have been non-residents in the UK for an extended period.

The table below shows the increase in Class 3 contributions for 2022/23.

Our article on checking your National Insurance record tells you everything you need to know to check for gaps.

You should note that the increase in National Insurance does not apply if you are over the State Pension age.

The change to capital gains tax went live when the budget was announced on 27th October 2021 and relates to property sales.

You previously had 30 days to report any gains made from the sale and pay the tax you owed to HMRC.

Now, that window has increased to 60 days. The rate of capital gains tax you pay remains the same, but the extended window gives you more time.

Unlike the other changes, this one came into effect at the start of the year.

Starting on 1st January 2022, the number of forms required by HMRC has been reduced. The increase to current limits will significantly impact more estates as they will qualify as ‘excepted estates’.

According to the UK government website, an estate is typically excepted if any of the following apply:

Many welcomed the changes as they are expected to save people a lot of time and reduce the cost of dealing with the deceased’s estate.

From 6th April, the tax on money earned from dividends will see a 1.25% increase.

The rise in dividends tax will impact the profits of those invested in companies and earn money from their shares.

The dividend allowance for the 2022/23 tax year is £2,000. Anything you earn above the rate threshold is subject to dividend tax.

The amount of tax you pay will depend on your income tax band. Basic rate taxpayers pay less, while additional rate taxpayers pay the most. The table below gives a breakdown.

Investments held in a wrapper such as an ISA are not subject to dividend tax.

The main Corporation Tax rate will be set to 19% from the 1st April 2022 and for that financial year.

According to the government website, that rate of tax is set to increase from 1st April 2023. A 25% tax will apply to Non-ring fenced profits over £250,000.

A small profits rate (SPR) will be introduced for companies with profits of £50,000 or less to protect smaller business owners. Companies that qualify will continue to pay Corporation Tax at 19%.

Despite the sweeping changes to tax in 2022, some things have not changed.

The personal allowance, or how much you can earn before income tax applies, remains the same as the previous tax year. The rate of tax you pay at each bracket also remains the same.

Here is a breakdown of the income tax brackets on earnings for 2022:

With tax rises and changes just a few short months away, it’s essential that you understand how they could impact you.

Now is also the perfect time to take care of your finances and start planning for 2022 and beyond.

At Holborn, we work closely with clients to develop strategies tailored to their needs and circumstance.

For over 20 years, we have successfully helped our clients build wealth and create a strong financial future.

To find out how we can help you, contact us using the form below.

We have 18 offices across the globe and we manage over $2billion for our 20,000+ clients

Get started

Digital Assets: From Fringe to Framework A Responsible View for Internationally Mobile Investors Executive Summary Digital assets have moved from the fringes of finance into mainstream discussion. The arrival of...

Read more

Across the global expatriate market, one product category is showing unprecedented momentum in 2025: Indexed Universal Life (IUL). As client expectations move toward solutions that combine long-term protection, tax-efficient wealth...

Read more

Chancellor Rachel Reeves delivered her second Autumn Budget in dramatic circumstances, after the Office for Budget Responsibility (OBR) accidentally released its full economic outlook online 45 minutes before her speech....

Read more

In today’s world, much of our lives are lived online. From email accounts and social media profiles to digital wallets and online businesses, we’re building a digital legacy—often without realising...

Read more