If you've recently lost a loved one or started thinking about estate planning, you've heard about probate.

But what exactly does it mean?

Probate is often a lengthy and sometimes complicated legal process for managing someone's estate after they die. It's important to know what probate involves and how you can avoid it.

This article explains what probate is, how it works, and how you can avoid it with proper planning.

What is probate?

In simple terms, probate is the legal process of sorting out someone's estate after they die. It includes confirming that the will is valid (if there is one), paying any debts or taxes, and then distributing what remains to the rightful heirs.

If someone dies without a will, the process still takes place. But if this happens, the rules of intestacy apply. This means the court decides how the estate is distributed.

Every country, and sometimes each region, has its own probate rules. Because of this, estate planning for expats and people with assets abroad can be different.

What is a grant of probate?

If the person has left a will, the executor must apply for a grant of probate.

A grant of probate is a legal document that lets the executor manage a person's money, property, and possessions after they die. It's essentially an official court order granting permission to handle the estate.

If there is no will, a letter of administration is needed instead. This document works the same way as a grant of probate. Both give legal permission for a named person to manage the estate.

When is probate required?

Not every death requires probate. Whether probate is needed depends on the type and value of a person's assets and the complexity of their estate.

Probate is usually required if:

The deceased owned property solely in their name

There's no valid will (known as dying intestate)

The person had any accounts solely in their name

There are significant assets not jointly owned or placed in a trust

Check with the financial institutions the person used to find out if probate is required. Each institution has its own rules for accessing a deceased person's assets.

Probate is often not needed for:

Jointly owned assets (which pass to the surviving owner)

Low-value estates

Assets held in a trust

Life insurance usually forms part of your estate, so it often goes through probate. However, if a policy is placed in the right kind of trust, it can avoid probate because it is no longer part of your estate.

How long does probate take?

In the UK, probate usually takes about 12 months. The time can be shorter or longer depending on the size and complexity of the estate.

Certain factors can delay probate, such as:

Mistakes made on the application form when applying for probate

Will disputes

Invalid wills

Whether you submit a paper application or apply for probate online

Probate is also a public record, so your estate details are not kept private. A probate solicitor can help make the process smoother and prevent some delays.

How does probate work?

Below is a simple overview of how probate works:

Register the death and report it to the government.

Make a list of the deceased's assets to determine the estate's value.

Pay inheritance tax (IHT) if necessary.

Apply for probate (or a letter of administration if there is no will).

Once probate is granted, settle any debts or taxes due.

Distribute the remaining assets to beneficiaries.

To apply for probate online or learn about postal applications, visit GOV.UK.

Can you avoid probate?

If you want to spare your loved ones the stress of probate, there are ways to avoid it:

Joint ownership: Joint accounts and joint property ownership often avoid probate.

Gifts: Gifts given while you are still alive avoid probate and reduce the value of your estate.

Naming beneficiaries: Naming certain beneficiaries on a life insurance policy can help it avoid probate.

Trusts: Adding a trust to your estate plan can help you avoid probate completely.

Wills and trusts VS probate

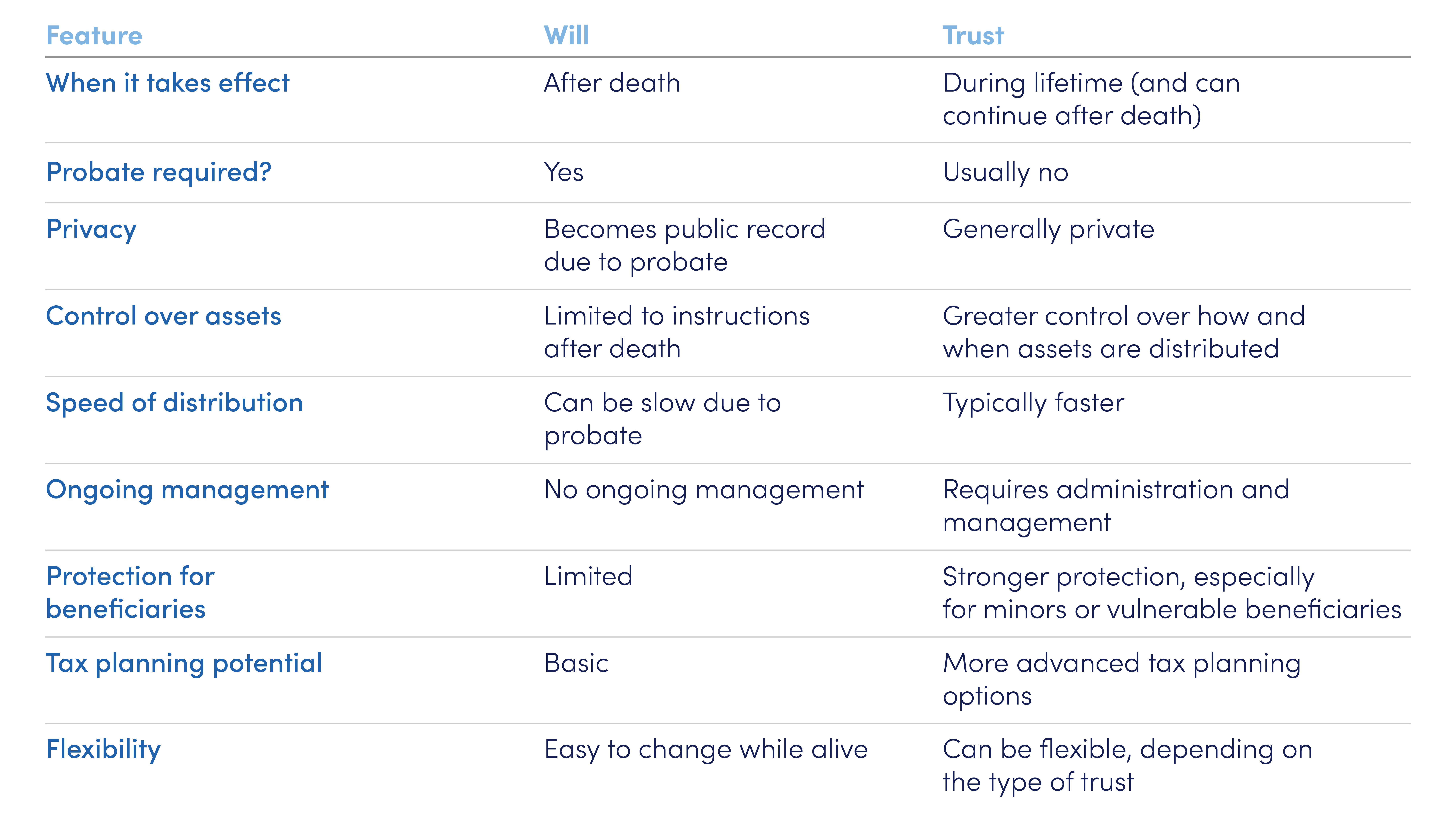

Many people ask about the difference between a will and a trust when planning their estate.

In short:

A will states your wishes after you die, but it must go through probate.

A trust lets you manage your estate privately and can help your heirs avoid probate.

The table below outlines key differences between the two.

A will and a trust have different roles. Many people include both in their estate plans.

How much does probate cost?

Probate is not free, and the costs can vary. Usually, the bigger and more complicated the estate, the higher the cost.

Typical costs include:

Probate application fee: In the UK, the application fee is £300 for estates over £5,000.

Legal fees: If you use a solicitor, fees can vary.

Inheritance tax: If the estate is subject to inheritance tax (IHT).

Asset valuation fees: These depend on the size of the estate and the types of assets.

Final thoughts: plan now for peace of mind

Thinking about death is never easy, but having a clear plan can make things much easier for your loved ones.

If you want to avoid probate headaches, get your estate in order by doing the following:

Write a will

Consider setting up a trust

Name beneficiaries on your accounts

Keep your documents up to date

For expert advice, contact Holborn Assets and start planning today. Your future self and your loved ones will thank you.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences