Trusts play a central role in modern estate planning. While there are various types of trusts, most fall into one of two categories: revocable or irrevocable.

Both types of trusts can help protect your assets and make inheritance easier, but they work in different ways. Here, we explain what revocable and irrevocable trusts are, how they differ and when each might be a good fit.

What is a trust in estate planning?

A trust is a legal arrangement where assets are held and managed by one party for the benefit of another. In estate planning, people often use trusts to manage their wealth while they are alive and to pass on assets after they die.

Every trust involves three key roles:

Grantor: Also called the settlor, this is the person who sets up the trust and puts assets into it.

Trustee: The person or organisation that manages the trust.

Beneficiaries: The individuals or organisations who benefit from the trust.

What is a revocable trust?

Definition and overview

A revocable trust, sometimes called a living trust, lets the grantor change, update, or cancel it at any time while they are alive.

In most cases, the grantor retains full control over their assets while they are alive. Revocable trusts also avoid probate, meaning your estate does not become public record and can speed up the transfer of assets.

Key features of a revocable trust

The grantor keeps control of the assets

Terms and beneficiaries can be changed at any time

Assets typically pass to beneficiaries without probate

The trust usually becomes irrevocable upon the grantor’s death

Pros and cons of a revocable trust

Pros

High level of flexibility and control over assets in the trust

Easy to update as circumstances change

Maintains privacy compared to a will

Cons

No protection from creditors

Limited tax advantages during the grantor’s lifetime

Assets remain part of the taxable estate

People often choose a revocable trust for convenience and control, not for asset protection.

What is an irrevocable trust?

Definition and overview

An irrevocable trust usually cannot be changed or cancelled after it is set up and funded. The grantor gives up ownership of the assets for good.

Since the assets no longer belong to the grantor, they are legally taken out of the estate. The main benefit is that this can help minimise estate taxes.

Key features of an irrevocable trust

The grantor gives up control over the assets

Assets held in the trust no longer form part of the grantor’s estate

Managed by an independent trustee

Designed for long-term planning and to protect your assets

Pros and cons of an irrevocable trust

Pros

Can provide strong asset protection from creditors and legal claims

Potential estate and inheritance tax benefits

Useful for long-term wealth preservation and succession planning

Cons

Very limited flexibility

More complex to establish and manage

Changes often require legal approval or beneficiary consent

People with significant assets or complex estate plans often use irrevocable trusts.

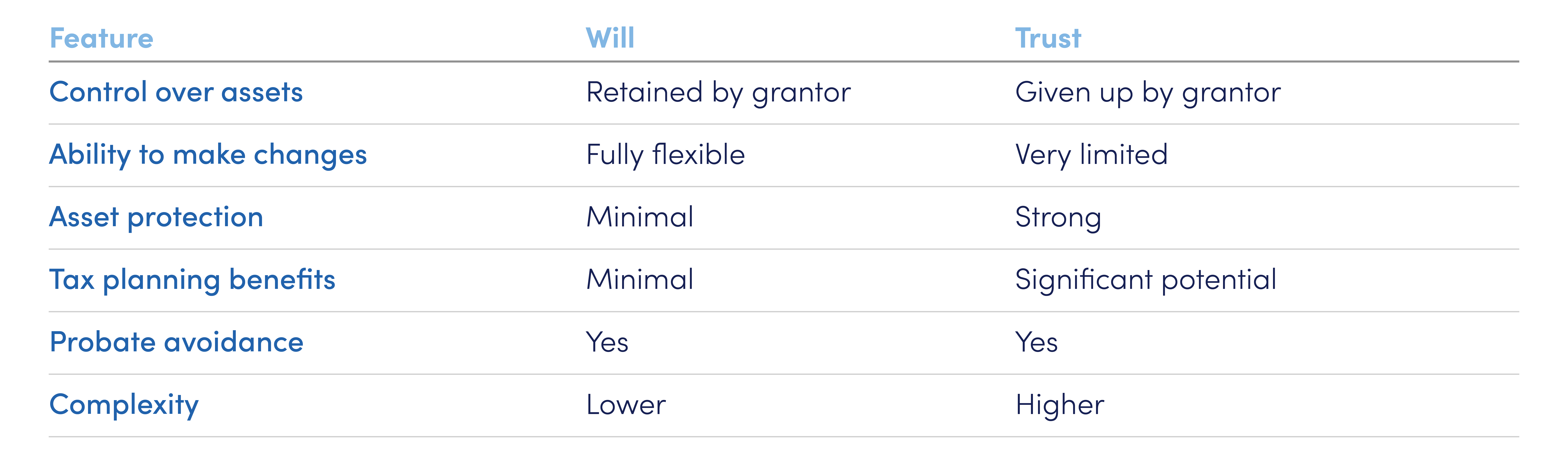

Revocable vs irrevocable trust: key differences

The main difference between a revocable trust and an irrevocable trust is control versus protection.

A revocable trust is best for flexibility, while an irrevocable trust is better for protection and tax savings.

Tax and asset protection considerations

From a tax perspective, revocable trusts offer little benefit while the grantor is alive because the assets are still part of their estate. Any income the trust earns is also subject to income tax.

In contrast, assets in an irrevocable trust no longer belong to the grantor. This can lower the estate’s value for inheritance tax purposes and may protect assets from creditors.

Because of these benefits, irrevocable trusts are especially helpful for people with high-value estates, business owners, or those worried about future legal or care costs.

Which trust is right for you?

A revocable trust may be right for you if you:

Want to maintain full control over your assets

Expect your estate plan to change over time

Value simplicity and flexibility

An irrevocable trust may be a better choice if you:

Have a high-value or complex estate

Want to protect assets from future claims

Are focused on long-term tax and succession planning

Your decision usually comes down to balancing personal control with long-term protection.

You can include a revocable and an irrevocable trust in your estate plan. To find what strategy is best for you, it’s always best to speak to an expert and get tailored advice.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Common mistakes to avoid when choosing a trust

Estate planning mistakes can be costly. Remember, trusts are powerful tools, but only when set up correctly.

Some common pitfalls to watch out for are:

Assuming one trust type suits everyone

Focusing only on tax savings and ignoring control issues

Failing to review trusts as circumstances change

Creating trusts without professional estate planning advice

Final thoughts

There is no single 'better' choice between a revocable and an irrevocable trust. Each one serves a different purpose in estate planning.

Revocable trusts give you flexibility and simplicity. Irrevocable trusts offer asset protection and possible tax benefits. The best choice depends on your financial situation and long-term goals.

Getting professional advice is important to make sure your trust meets your needs now and in the future.

Speak to our estate planning specialists to learn how we can help you.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences