There is no denying it when it comes to transport; the world is moving towards electric.

Elon Musk recently took the title as the richest man in the world. The entrepreneur’s wealth comes from several projects, the biggest being Tesla.

The electric car company is worth around £500 billion ($700 billion). With the electric car market being so profitable, investing in classic cars sounds crazy, right? Maybe not.

There was a time before electric cars when petrol-powered vehicles ruled. From American muscle cars to handcrafted, elegant British classics, our love of cars has transcended the ages.

While electric cars may be the new go-to for those looking to save the planet, classic cars are converted items for collectors.

So, from an investment point of view, is there money to be made in classic cars? In this article, we take a closer look.

The benefits of being offbeat

Alternative exotic investments can include anything from art to whisky – or in the case of this article, classic cars.

Here are some of the benefits that these unique assets offer.

Firstly, alternative options are not tied to the capital market, unlike traditional investments.

In the current climate, where the global markets are harder to predict that the lottery numbers, these offbeat investment options can provide some welcome relief.

The second benefit is, they allow you to invest in your passion. Classic cars, in particular, have seen investors turn their passion into some serious profit.

Financial planning with Holborn?

Holborn can help you make way more money than you have now.

Revving up your returns

Over the last 10 years, the value of classic cars has soared.

According to Knight Frank’s data, classic cars have increased in value by 194% in the last decade. Some models have sold for eye-watering sums of money.

In 2018, bidding started at $35 million for a 1962 Ferrari 250 GTO. After only 10 minutes the auctioneer slammed the gavel and bidding closed at $48,405,000.

The staggering sum of money made the iconic Italian car the most expensive ever sold at auction – but not the most expensive ever sold.

The same year, a 1963 model of the Ferrari 250 GTO sold for $70 million in a private sale. The landmark sale is believed to be the highest amount ever paid for a car.

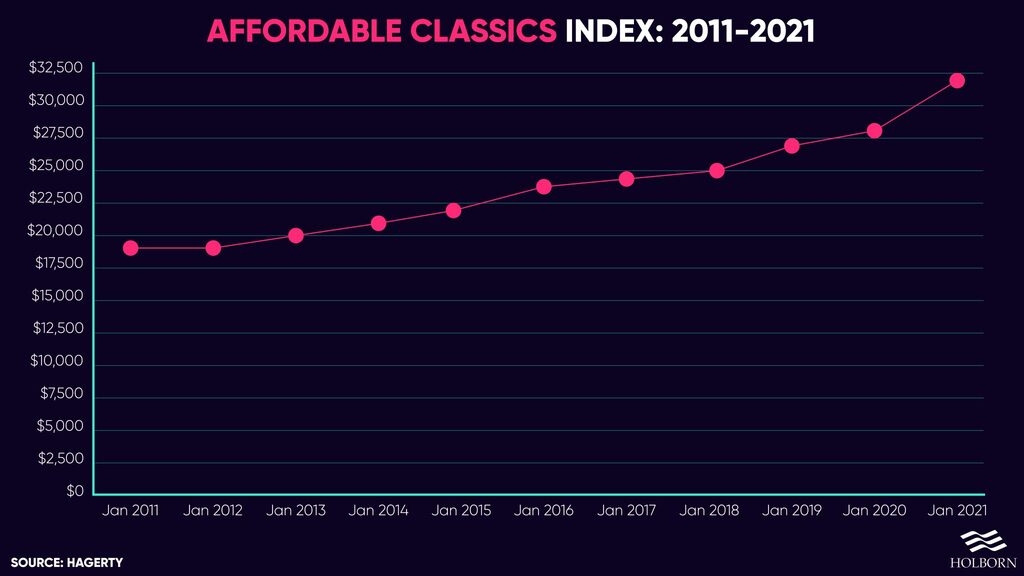

If you don’t have a spare $70m to invest in a super rare classic, don’t panic. An index of classic cars compiled by Hagerty shows that ‘affordable classics’ are performing well.

Data from the market specialists shows that affordable classics, cars priced under $30k, have seen a steady increase in value over the last 10 years.

It’s important to remember that not all cars are created equally. Some are instant classics, and others develop a cult following, making them desirable to collectors. However, in most cases, a car will devalue as soon as it leaves the showroom.

So, what makes a car a ‘classic’? More importantly, what makes them valuable?

Understanding the value of classic cars

In some ways, cars are similar to art. Their value can depend on the demand and how much someone is willing to pay to acquire something hard to come by.

Generally speaking, rare cars or those which have some kind of historical value will demand a higher price.

In the case of the 1963 Ferrari 250 GTO which sold for $70m, it had a racing pedigree. The car won the Tour de France race and came fourth at Le Mans. Another big factor was that it was in perfect condition, something rare for a car used in such races.

Nostalgia also plays a big part in a car’s value. Investopedia explains that cars which teenagers had pictures of on their walls will give a good indication that you’re looking in the right direction.

When they grow up and afford those cars, they want to buy them as they tap into that nostalgia.

If you have the knowledge and resources, picking up a classic car and restoring it to its former glory can also prove profitable.

Before you go rushing out to a classic car auction, read on. Investing in classic cars does have it’s cons.

The cons with classics

The first major issue you may run into is space.

Unlike some other alternate assets such as stamps, cars take up a lot of space. If you don’t have room to store the car, you will need to pay for storage. That brings us to our next point – costs.

Any maintenance to the car and insurance costs all add up. Even the sale of the car will likely incur commission and transaction fees. You can also be responsible for transportation costs.

Unlike investing in other passion projects, classic cars are expensive, even on the ‘affordable’ end.

Emphasis on ‘alternatives’

When it comes to building a diverse portfolio, classic cars are certainly a great, offbeat alternative.

Still, it’s unlikely that these types of investments will be the main focus of investment strategies any time soon.

If you are looking to re-evaluate your investment strategy, or start building a portfolio, speak to one of our experts.

We have been working with clients for more than 20 years to build successful portfolios. To find out how we can help you, contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences