When you think of the term ‘debt snowball’, you probably think of debts increasing rapidly in size. For many people, debt is becoming all too common. Being in debt seems to be an almost unavoidable by-product of modern living. The latest research carried out by the Trade Union Congress (TUC) revealed the average household debt is now 31% more than its peak before the financial crisis. TUC analysis found that the average unsecured debt for UK households stands at £14,540. Data collected by the TUC did not include mortgages, an outgoing which causes this figure to skyrocket. The Money Charity reported in December 2019 that the average household debt, including mortgages, is an eye-watering £59,840. Managing debt can seem overwhelming, but there are solutions. Before we look at one that is growing in popularity, let’s get a better understanding of what we mean by ‘debt’.

Good vs bad

Debt can be broken down into two basic categories. Bad debt and good debt (that’s right, there is such a thing as good debt). Good debt is one that is seen as an investment that will benefit you financially in the future. Examples of good debt include a student loan, a mortgage, and investing capital into your own business. It goes without saying that bad debt is the one you should avoid. Bad debts are usually those that make your financial situation worse and offer no benefits to your financial situation in the future. Examples of bad debt could include money borrowed to pay bills or other credit you might have. Buying expensive items that you don’t need, such as a car would also be considered bad debt. When it comes to clearing debt, it’s a good idea to have a clear strategy to do so. One strategy that stands out is the debt snowball method. There is even academic research to support its effectiveness.

What is the debt snowball method?

The debt snowball method is the brainchild of Dave Ramsey, a radio host, author, and highly regarded expert on finance. Using a snowball as an analogy, the concept is simple. Ask yourself, what is the easiest way to make a big snowball? The answer is to start with a small snowball and roll it. As it gains momentum, the small snowball you started out with keeps growing. The same process can be applied to debt management. The debt management strategy encourages you to pay off your smallest debts first. Once the first debt is settled, the money you were using to clear that balance is rolled into the next one. This creates momentum, not just financially but also mentally. Seeing your debts being cleared will give you a psychological boost. Here are five essential steps to making the debt snowball method work.

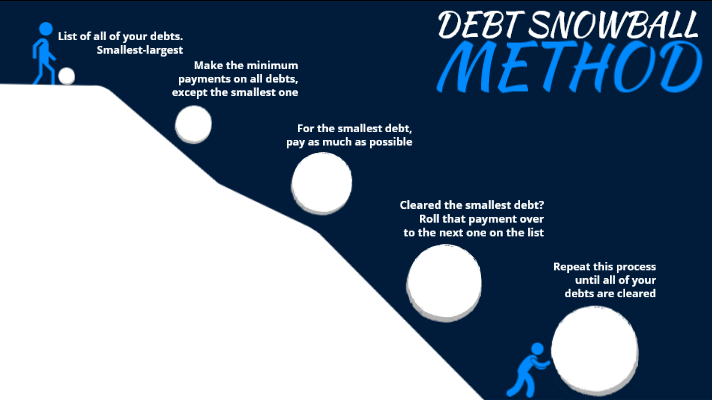

1. Make a list of all of your debts, from smallest to largest.

2. Make the minimum payments on all of your debts, except the smallest one.

3. For the smallest debt, pay as much as possible.

4. When the smallest debt is cleared, roll that payment over to the next one on the list.

5. Repeat this process until all of your debts are cleared.

Five essential steps of the debt snowball method

Does this method really work?

There are several methods for clearing debts. The debt snowball method stands out because it has academic research from Harvard University to support its effectiveness. Researchers used an extensive proprietary dataset to carry out three experiments. Their results revealed that people who concentrated on one or a few payments at a time repaid their debt 15% quicker. More importantly, participants using the debt snowball method saw better progress which motivated them to succeed. You can find a full breakdown of the research by checking out the Harvard Business Review.

Next steps

Managing debt can seem overwhelming. With the right strategies in place, reducing debt doesn’t need to feel like a daunting task. For more information about debt management and financial planning, you can speak with one of our experts. Contact us using the form below.

All information contained in this article was correct at the time of publication. This article is for informational purposes only and is not financial advice. For personal financial advice, always speak to a regulated professional.

Don’t just take our word for it...

We’re rated ‘Excellent’ on Trustpilot, based on thousands of verified reviews from real client experiences